Jerome K Wiley?

We do think Powell is running off a cliff, just not the one the market assumes. As we endured the wettest February since (at least) 1836, when William Lamb was prime minister, and the wettest Tory government since records began, is there any chance of dryer times?

But first the tiresome tango of rate rises, the market swept to and fro, nation by nation, until the firm stamp of a well-heeled bond whips the whole mass back round again.

Bailey of the BoE, and Powell of the Fed

So, this week it is to be Bailey first out the gate, FTSE up, bond yields down, next week who knows? That rates will fall this year is the only certainty and the big US markets have built a near vertical climb out of that snippet. But you will note, not in rate sensitive stocks, the Russell (small cap) is still pretty flat, weighed down by the regional banks that dominate it.

And Powell, he’s guessing or as he calls it is “data dependent”, but for all that he is pretty happy projecting those guesses forward. So, he has moved from three rate cuts this year, to a new position of ? Well - three rate cuts this year. Not much data dependency there.

Before long he will run out of “this year”, because the inflation numbers are not behaving, nor critically is the oil price. Like Bailey in the UK, he is desperate to cut and under heavy political pressure to do so, both have said 2% inflation is not now needed, just moves in the right direction.

I feel the only thing that can get us there is a sudden (and indeed overdue) drop in the energy price, which we do expect in the summer, but who knows? It has held up rather well so far.

So, at the moment, Powell is perhaps running on thin air. Protectionism and vote buying fiscal measures mean he can’t get there without some other help.

Markets are supercharged – is it sustainable though?

And if rate cuts are what has supercharged markets in the US, I don’t see that as sustainable right through the year. It might instead be the possibility of a more market friendly, fiscally prudent, Trump, which would be more logical, in some ways; but that still feels implausible.

Nor do I see, as yet, many other markets joining in. Partly, why own anything else but the NASDAQ? Some markets have moved (Germany, Japan) but you could also argue that was after being oversold for too long. While the Swiss have cut rates, it is in part (as ever) to restrain their currency, I am less sure others will want to move ahead of the US.

They may be forced to, but there again their scope before European and UK elections looks limited. And some parts of the market, like UK smaller companies and many REITs (and some renewables) are not signalling anything but yet more damage and destruction, from suspect refinancing at high rates and over optimism on revenue.

Air Cushions

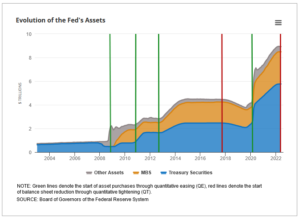

It was notable too how keen Powell is to slow the tightening imposed by reducing the Federal Reserve bond holdings, which has to date been done at a fairly brisk pace. He now talks of stabilising holdings, (in other words resuming bond buying, stopping the runoff of expired holdings) at what seems a high level, for fear of taking too much liquidity out of the system.

From this explanatory article on the process by the Richmond Fed.

For a while rates and reserve sales were working as one against inflation, but not for much longer it seems. Which should be good for bitcoin and other liquidity consuming monsters, if nothing else.

Who is Next in the UK?

The interesting Tory battle is between the Official wing, now entrenched in power, and showing no sign of intelligent life, beyond wanting to “make a good fist of it” in the inevitable electoral defeat. Then there is the Rebel wing, keen to cause trouble, break things, get popular support, or be nasty, if it gets them attention. Although the Official wing regards this as disloyal, it follows an old pattern. It is not just about this particular bunch: see this paper.

Faced with a like quandary under Blair, the Tory party swung left, towards the centre and power, just as Gordon Brown started the decade long Labour march to irrelevance. The Official assumption is that will work again, although the alternative scenario is that Starmer settles down in the centre for the long haul, and the Rebel wing, kept securely away from power, withers for lack of a structure.

But all ruling parties were, by definition, rebels once.

Back in 1836, William Lamb was an unsuccessful politician, wrapped around by Peel, sent to the House of Lords, then brought back as a centrist Prime Minister, and being generally useless, was turfed out again, after naming an Australian city, en route. One must hope for no repeats from history.

William Lamb, Lord Melbourne – from this site

It does not feel time for compromise candidates, nor will a ‘safe pair of hands’ do. Rishi is in a fight.

Meanwhile the fields here feel like salt marshes, dark water lurking in deep cracks, the lips of which slide into clay and suck at the soles of your feet. We certainly could do with some heat.

I do expect this run in markets to go on, but the upside in the big US indices looks more limited and broader participation elsewhere will await those rate cuts. Both their size and speed have a capacity to disappoint, especially when they are so hotly anticipated.

The politics, a long time coming, may become more influential. It could get choppy.

We will take an Easter break, after what feels like a long spring.

And return with the sun (we hope) on 14th April.

Sweet Dreams

Here we talk about the delights of the Conservative Party Conference in rainy Manchester, the failure of the in-built two-year time horizon in inflation models, and what may happen to interest rates.

FANTASY IN BLUE

At times in Manchester, it felt like everyone was looking for something. As government steps up spending initiatives, and empowers regional governance, and drives big spending on not achieving net zero, the chorus of demands for more taxpayers’ cash grew deafening.

There was utter silence on efficiency or capital allocation; it was all just “a good thing” to spend more.

And oddly too, with so much lip service to the long term and reducing debt and halving inflation, the ‘how’ of those was also ignored. Surely halving inflation is not even a government task? It was devolved to Bailey of the Bank - yet we heard not a word of criticism. If ever an eight-year commitment to a disastrously run project needed cancelling, his appointment looks to be just that.

This would spare him (and us) those endless letters on why he’s failing to control inflation.

For all that Conference was oddly cheerful - quite a bit of steel on show, from Suella of course, the only natural politician involved - some guts from Steve Barclay at Health, and Stride, a little less convincingly, at work and pensions - else, all rather wooden and on autocue. Although you could not help but notice that Farage still charms the fringe crowds.

COMPETENT DELIVERY?

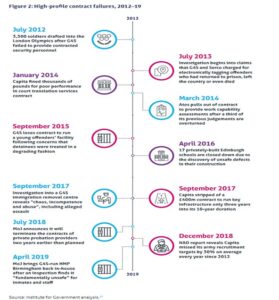

The abiding issue remains competent delivery. It was odd to hear the government on HS2 arguing for accountability by sacking their own Euston delivery team. As if the failure of HS2 is not theirs, and theirs alone.

Instead of penny packet incrementalism, government needs a holistic delivery view - perhaps why France can build a TGV, and we simply cannot.

From this report of the Institute for Government

From this report of the Institute for Government

The Maude/Osborne “reforms” destroyed half our domestic contractors, by a short-term focus and ceaselessly moving the goalposts. As a result, home grown firms are in the minority on the HS2 contractor list, and giant multinationals with more lawyers than bulldozers were the main bidders.

They want top dollar to take on the risk of a lazy, indecisive government machine - no wonder.

THE CHANGE PRIME MINISTER?

We have been very clear since 2019, that the Tories can’t win another term, none of that changes, but the scale and composition of the anti-Tory majority next year is rather less clear.

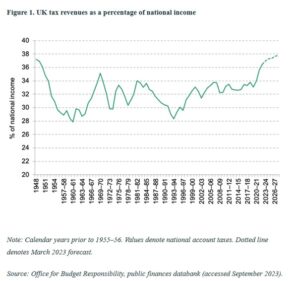

In many ways, the best case for a Labour defeat, at the next election, is that the Tories have done it all already. They have blown the bank on out-of-control spending, splurged on unaffordable welfare, and raised taxes to unsustainable levels.

From this website

From this website

This government also crashed the pound, let inflation loose, let rhetoric overtake sense and has gone in hock to foreign debtors. I suppose they have yet to invade a sovereign country without a UN mandate, but they are working on that too.

So? Well oddly Starmer is still slightly boxed in, and in terms of polling data, not really getting much help from the weak Lib Dems, in those critical three-way marginals in the South. While Scotland clearly has had enough of the SNP running Scotland, it is less clear that they don’t want the cause of independence to be heard in London. The Rutherglen by-election could be sending both messages, but in a general election voters only send one. I would not assume that genie is back in the bottle just yet.

JITTERBUG BLUES

We continue to see US rates above inflation, which is very different from UK rates which are still below.

So exactly what Powell (and Bailey) are doing with selling down the Central Banks balance sheets at a time of maximum new issuance, is not clear; it solidifies vast paper losses, creates new losses on the rest, so seems to be quite a pricey warning shot to politicians. But it is a plausible reason (along with super high levels of new issuance) for current bond market nerves.

We have always felt the Central Bank models, where whatever the question the answer is “it will be fine in two years” are a fiction. The awareness that rates and inflation are staying high, is long overdue. But we have been in no doubt about it, for two years, nor have we ever flinched in our aversion to bonds, we were never being paid enough for the risk.

The jitters in the bond market feel more like a turning point, the sudden chop as the tide turns. The dollar has risen; people want to be there; if there is enough demand, that will lower bond yields again. So, I am not looking at US rates rising, so much as at the battle switching back to fiscal policy. Although in the end if Biden really wants 7% rates, I guess he can try to have them.

The UK and Europe are less contested, the labour market in Europe at least is not that tight, although still at record low unemployment levels, but with a lot of surplus workers in France, Spain, and Italy, and especially amongst the young. Euro interest rates are also really quite low still and are not yet looking restrictive.

So, it looks like another round of softening currencies, stagnant inflation and rate rise pressure. Central Banks still hope they have done enough. Even so it is quite odd that UK long rates are only just touching the level of a year ago, logically they should be two points higher. As for oil, we have seen this autumnal spike as a little surprising but transient, and as ever at this time of year, the short-term path is weather related.

Overall if the start is any guide, October yet again could be rough for markets, but longer term still looks brighter.

Skipping along

Skipping is the week’s theme, following the inadvertent use of the term by the Fed Chairman, along with the rather weird behaviour of Jeremy Hunt.

Although any skipping seems unlikely soon, on this side of the Atlantic.

The dear old ‘recession’ still lingers, unseen but feared, like an ex Prime Minister. We are convinced it will arrive, but as a ‘technical’ recession only. It should be hard for anyone to be surprised. Labour markets are much stickier and far more fragmented. Supply is short, so any systemic shock feels unlikely. While as old hands keep noting, single figure mortgage rates, well below inflation rates, are hardly restrictive.

Chair Powell (almost) mentions ‘skipping’.

Jerome Powell was bowling along contentedly, when he suddenly described the Reserve Board’s June inactivity as ‘skipping’. Although it actually was just a ‘skip’, before he realised the error and with a guilty look speedily reverted to the far more passive ‘pausing’. But we knew how he was thinking. He was going to keep his foot on the neck of borrowers for a bit longer – interestingly, he refers to real rates of interest, as somehow unjust and injurious. Odd that when asked anything about fiscal policy he instantly plays the neutral, technical banker, no good and evil there.

Moves in the real economy.

So, what has really happened?

Not a lot, energy prices have climbed all the way up, and now slid all the way down. Aggressive fiscal stimulus continues, any chance Biden has to bribe the electorate with their own money, he still takes. Employment remains strong, although there is some tightening in hours worked, but it is still pretty hard to see how the Fed gets down to 2% inflation for a year or two.

And yet, markets by a mix of that unseen recession and faith in so called base effects, do think inflation by the autumn, will justify a real pause. No skipping.

UK Chancellor’s odd statements

Here in the UK Jeremy Hunt is in quite a different place. Inflation still looks high and embedded, but he has carefully outlined how he would keep going with substantial hand outs to offset inflation (aka fiscal stimulus).

However, inflation control was all for the Bank to sort out.

This is nonsense, of course. The UK Government is yet again stoking inflation while taking no responsibility for stopping it. He then gave a tortuous explanation as to why his policies have now produced exactly the same interest rates as the Truss typhoon, created by his reckless predecessor, but somehow, not at all the same.

Rate rises – a global feature.

Funny that, as we noted at the time, there was little odd about the October rate spike, and much that the Bank could have done (but refused to) by a prompt rate rise (matching the US) to stabilise the currency and inflation.

Rate rises are a global feature, with not a lot one small country could do about it.

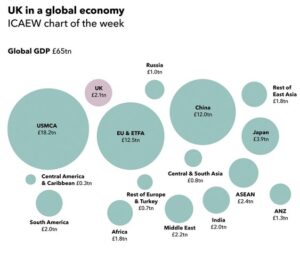

2021 chart produced by the UK Institute of Chartered Accountants

So quite where the virtue of the Truss toppling quarter point rise is now, is rather unclear.

As sterling shows, the prize for that autumnal sloth will be higher rates (and inflation) than elsewhere for longer. The thing about fire fighting is the sooner you start the less you have to do.

So how did Monogram’s methodology work?

Our in-house model switched into Japan in December 2022 and Europe in March 2023. As we only ever deal in half a dozen big global index Exchange Traded Funds, this is not a tickle, but 25% of the total equity position in (or out) at once.

Brutal and scary, but effective.

We look at the signal, kick the tyres, thump the bonnet, turn it off and on again, look for reasons to ignore it, and then six months later look back in wonder and say, “oh yes, that was right”. These signals are delicate enough to very seldom feel right at the time, but after almost a decade of running the model, we have learnt to obey.

So, our Momentum performance discussion, yet again, is about how much we made, not about in which direction the money went. While the GBP version, seeing similar signals, has also never come out of the S&P 500, which for a good while also felt wrong, but it seems was right, taking a long view. The USD model was more skittish but is back in both (S&P and NASDAQ) US indices now.

So, we do know where momentum has been, and it is quite strong.

Markets in the political timeline

The rational thinkers say the market is (still) too expensive, but the trend followers don’t agree, who is right?

We tend to feel just as Central Bankers were very slow to spot inflation, they are possibly being too slow to see it has now been contained, and the US skip may be a pause and then a snooze. Which would be very convenient for the Fed during the US Primaries, allowing for cuts into the US election?

Related to that, we watch with amusement a dialogue about the attractiveness of stock exchanges, in particular in London, couched entirely in terms of what potential listing companies say they want. Not a mention of what investors want, as if they just don’t matter. Quite absurd, as what all listings need is a deep market, good liquidity, stable tax regimes, and an attractive base currency.

Is London aiming to provide these? We seem to favour founders – so, tweaks to voting rights, smaller free floats, fewer shareholder rights. But then oops! No buyers.

This is worse than nonsense, it damages what little is left of London’s reputation. In this market you start with the buyers. The price performance of many a recent IPO spells out the problem, the sellers are finding it too easy to deceive people – a call is needed for greater transparency, longer lock-ins, and less pandering to insiders and their advisers (not more).

The Long Recessional

English local elections, and US regional banks

The English local elections saw the Tories lose 1,058 seats, dropping to 2,299 in the wards contested on Thursday, Labour gained 536 rising to 2,674, while the minor parties saw the Liberal Democrats rise by 405 to 1,626, Independents dropped by 104 to 962, Greens rose by 241 to 481.

What does all that mean for next year? Well, we called the next General Election for Labour the day after the results of the last one, and nothing has changed that view. Nor do we believe talk of falling short of an absolute majority is anything but wishful thinking by bored commentators. Rishi is largely in office, but not in government: a fairly weak cipher for the mandarins behind the throne. When they tell him to abandon core Tory principles, he obeys. This divides his party even further.

So, investors really should focus on the ‘what’; not the ‘if’. The Tories as we noted last time, had most to lose, and will take some heart at the spread of their defeats amongst the opposition parties. Although given the locations contested, both official Labour, and the Corbynite rump voting Green, did well.

This was an anti-Tory vote, rather than pro anything in particular.

We will still see a solid Labour governing majority next year. The Lib Dems will likely be back over fifty seats; as ever un-representative of their larger vote share.

So, what of Starmer?

His big offer is that he will stop party infighting and provide stable competent government. It will be Blair redux. The core five aims are currently crime, education, NHS, climate change and growth. Who would have guessed. No doubt apple pie is next.

The method it seems is Blairite targeting, with a bit of management mumbo-jumbo about breaking down silos, overarching aims etc. With the one area of large-scale Soviet style planning in the energy sector, with a state-run organisation, with what sounds like loads of money, but in truth (for the task) is not. Anyway, the big issue is not power generation but transmission.

I guess we do know from Wes Streeting, (the next health minister) that Labour knows the real problem is the public sector unions, part of why Starmer was so keen not to rely on their funding or support. But while ‘silo breaking’ is neat code for curing chronic demarcation fights, again, how does he propose to tackle it? Breaking ossified crusts needs steel. We know soft soap and water won’t do it.

But to tackle that, means splitting up some giant empires and even if Labour wanted to, I doubt if it has the means. At the same time public sector reform requires exiting vast areas where mission creep has expanded a thin film of under-funded interference and sub-par delivery. True Blair did cut loose Scotland and Wales, to wreck their own patches, raise their own taxes, maybe we will see more of that?

So, we should not hope for too much, we will get another well-meaning ambitious left-wing lawyer, but he is not Blair, and Blair despite fond memories, still gave us the GFC and Iraq.

We fear that the hostility to business and enterprise shown by Sunak will persist, it is probably embedded in the Treasury and Whitehall.

The slew of rate rises, and the slow sacrifice of the US Regional Banks

Somehow Wall Street keeps looking for rate cuts, and collapsing inflation, when it is simply not visible in the data. They are so hidebound by their models, that they see inflation as a pile of bricks. You count the bricks; you know what inflation is. But it has never been that, it is like the water table, it is a level, not discrete pieces, and like water it spreads, dampness pervades all. Sure, you can remove bricks, even big pieces of wall, but the water table needs everything to dry up for it to subside.

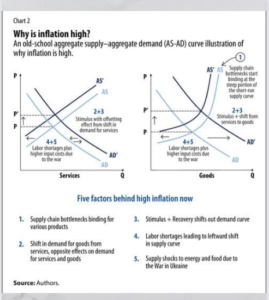

Taken from this article by IMF staff writers, Agarwal and Kimball in 2022.

You can see the flaws, factors 1, 2 and 5 look like classic bricks, or transitory bricks we should call them now. As for 4 that has been entrenched by regulations, especially on minimum wages, by tax hikes, health fears and support payments, which leaves 3 as the real solvable problem, and it endures. True they rightly noticed it, but by relying too much on the bricks falling, institutional economics just keeps getting it wrong.

You can’t lower the level, while demand remains too strong to be drained away. While the idea you can disperse inflation while piping liquidity in to offset the cost-of-living crisis, is simply daft. Until excess fiscal stimulus stops, inflation will quietly shift, steam away, reform, and then drip back on us; clammy and damp as an English spring.

It helps a bit that vacancies per job seeker are falling in the US, but it is all pretty glacial, the job market is still very tight and wage inflation still embedded. We are awfully short of swallows to be declaring summer’s arrival.

Yet, we do accept Central Banks have largely given up on rate rises, we think too soon, and their main mechanism will now be leaving rates elevated for longer. Along with quantitative tightening, which as few politicians really understand it, they can get away with. Well, it may slowly work.

Looking ahead

We (still) see inflation as higher for longer, rates likewise, and over time the big users of debt, mortgage borrowers and national Treasuries, are going to get used to paying more for it.

Although expect some other fiddle to try to stop this too, which will, naturally, embed inflation and stagnate productivity.

Markets? Well, with plenty of liquidity still and indeed (unjustified) rate cut optimism and many cash flow yields staying attractive, they remain skittish, but with no panic.

So, we are not that gloomy. Although perhaps a sideways summer is ahead.

If your base case is rapid rate cuts and mean reversion, we still have our doubts.

Charles Gillams

Monogram Capital Management Ltd

The Recessional is a great poem by Rudyard Kipling. And the Long Recessional, the title of David Gilmour’s book on RK.

While Shonibare’s trademark mannequins rely on implausible inflation to prevent disaster too.

First as Tragedy, then as Farce

This is turning into another unloved bull market, we look at why, and wonder if Chou En Lai was right about the French revolution. Lets start with inflation.

I chanced upon Paul Krugman’s The Return of Depression Economics, written in 2008. Krugman is very much an establishment man, Keynesian to his socks and seeing the great failure of late 20th Century economics being the sudden lack of demand. He has other work and more recent books, but I will focus on this one.

IMF Remedies

He has particular vitriol for the way the IMF repeatedly used austerity in its many forms, as the antidote to all and any of the chaos created by a deflating bubble. So, taxes up, spending down and crush demand to stabilise a currency, to avoid the extremes of bank collapses.

In Krugman’s world, it was more important to regulate banks, and it seems hedge funds, thereby stopping the sources of instability in the credit markets, and to then prop up demand.

Well, the echoes are there, current policy remains both IMF applauded austerity to save the currency, which is just what Hunt inflicted on the UK last year, and a desperate search for ways to pump up demand, to stop stagflation. Much as Biden is doing with the US and the amusingly called Inflation Reduction Act, and indeed the MAGA type, neo-Trumpian, protectionism now evident in the CHIPS Act. The rush to global rearmament should be just as effective.

All in the end versions of Keynesian demand creation – digging holes in highways to refill.

Echoes of Old Bubbles

Krugman is not indifferent to the bubbles this creates in the US stock market and US housing prices but would seem, like Senator Warren, to suggest whatever the question, more bank (and shadow bank) regulation is the answer.

It is odd as you piece together many establishment views, how this policy of ‘create bubbles, and then carefully regulate their deflation’, but never cut demand too hard, is now the undeclared reality of mainstream economic policy at Western Central Banks.

Krugman is blistering on some old tropes, the Schumpeterian theory of creative destruction gets short shrift, which still lingers in the financial press in complaints about ‘zombie’ companies (which I have always found weird). Likewise, that global development is all about rigging resource prices, which haunts the walls of a million coffee shops and a fair few churches and is also (sadly) tosh.

So, he is not all bad.

The New Bernanke Put

Nor when you understand how deep his influence is, does this financial market seem so strange, because the Central Banks hope inflation is external (weather, politics, madmen fighting etc) so this will “mean revert” in time. Alongside this sits a very wary take on destabilising currencies by interest rate differentials. The old guard real world elements break through occasionally (and have supporters, like the splendidly lucid El-Erian) especially with double figure inflation on the rampage, but they are not heeded for long.

Seen like that, while the stock market hates bubbles and inflation, it can’t shake the belief that in some form the “Bernanke Put” is still in play.

In which case ‘higher for longer’ on interest rates is a paper tiger, as rates don’t cause recessions, regulatory failure and hot money flows do. In that world buying an overpriced but liquid US market and buying the dollar looks, to many, like low risk. Not to us.

Inflation control?

And yes, as we have long argued, this won’t control inflation, but it seems who cares? We don’t need to fear the stock and housing bubbles deflating abruptly, as the Central Banks won’t allow that. Nor should we worry about rates, as Central Banks can’t let them rise much more, without jeopardising their over-indebted host governments.

So yes, old hands may hate a rising market into an economic slow-down, but they are it seems, just part of history.

What then to buy? Arms companies are not significant post ESG, the China trade is (we feel falsely) boosting already elevated resource prices, and travel companies are getting plenty of attention. Meanwhile areas of bountiful state subsidy (an ever-increasing list) are happy too. However, that is a fairly unattractive list. And are valuations in those areas still reasonable?

I can see why some investors just think playing around with Tesla options is the best bet (we don’t).

Then as Farce, Modern Imperial Europe

Chou En Lai when asked about the French Revolution was of the view (it is said) that it was “too early to tell”. I have been reading Michael Broers’ brilliant Europe Under Napoleon, an extended love letter to the EU, in favour of rational technocratic administration, with a deep-seated fear of the sans-culottes.

This seems to highlight so much of the French desire to see the EU as the Napoleonic Empire, without the bad bits. The terror of the rabble, the urban bias, the fetishism of one law, the desire to paint any opposition to EU autocracy as unspeakable - it all rather gels.

Well perhaps the parallels go too far, but in looking at the bizarre actions of the EU over Ulster it is tempting to see more than just childish spite. The resources thrown at half a dozen sleepy border crossings (reportedly 20% of all external border EU customs checks last year) made little rational sense. Even if not that bad, it was overkill.

So, I can half see why the DUP feel that getting rid of bureaucratic bullying is just appeasement, but looking at the litany of inconvenience to be scrapped, this does still feel like a win for all sides.

But as with markets, I suspect all the fundamental problems still remain.