The name of the game

What is the point of investing? How has that changed over time.? Do we still need so many choices? Are single stocks relevant? And we salute the prime palindrome.

We were taught that investing is an economic process for allocating capital to allow competition to seek out the best opportunities and fund the best businesses for the benefit of all. Countries with good markets have good capital allocation, grow faster as enterprises with the best return on capital, and then attract more of it.

Really? Not what it looks like now. Things change. The old gateways got knocked down, so anyone can access any investment anywhere. The paternalistic City was never sure about that, but in reality, markets followed communications, which went global.

The FCA (and to a degree the SEC) has a muscle memory of these protected times, and constantly wants to suppress innovation, keep new issues and ideas away from investors. Slow it all down, so they don’t just regulate markets, but control them. But excess capital flows are changing all that. It is instructive how the SEC, by trying to stop Bitcoin, has simply made it respectable and transacting in it safe.

And looking skyward and not understanding how this excess liquidity is created by quantitative easing is sadly no longer viable for investors; entire economies are built on it, like Japan. Nor is it transitory, it is embedded in the US and EU as much as anywhere.

Governments hoped to take control, using QE they forced the cost, to them, of debt down to zero, on the way creating such a shortage of bonds, that prices rocketed. Paradoxically as did equities, for they could keep offering a yield and had no “lower bound”, so their prices could rise for ever.

Then equity investors got back in control, they realised they could move the price, on the thin sliver of equities that are actually traded, pretty much as they wished. In particular they could signal or co-ordinate, so that everyone was on board with the price direction. Which is both the meme stock phenomenon, but also at the heart of momentum investment.

And liquid, global, interconnected exchanges were designed to let all those price signals out in an instant. Of course, co-ordinating them takes only a few seconds more.

THE POINT IS

Which brings us back to what the point of investing is. I am only interested in capital allocation, if by understanding it and dissecting the choices, I can get better returns.

I can have an altruistic angle of course, I just like old style engineering and banking outfits, I sponsored the IPO of an art gallery once. I have a soft spot for Kenya and Bulgaria. I want to avoid ‘defence’ industries, I dislike tobacco and polluters, and not sold on slave labour either. How nice, and in the investing world, how utterly useless. Never, ever, fall in love with a stock they said: quite right, sadly.

Indeed, what you and I call capital allocation is what others call hot money, and it moves faster and faster. As for those bad actors, well money always attracts crime, the faster it moves the more options for criminals exist, quite a few of whom wear suits.

But then who needs stocks and analysis when you can now buy a market cheaply? Everything says invest in multiple geographies, but really? The process I have outlined above favours one or two markets, they win, so they give a good capital return, so they win again, almost regardless of what the underlying business does.

Indeed, Bitcoin shows, it can indeed be regardless of the underlying asset. Coordination and belief matter, not reality.

So, what of all the rest, the unfashionable markets, unfashionable stocks, they just keep underperforming, keep being sold, with very little scope to recover. With rates low it was possible to pay a competitive dividend, but when money market funds are expected to offer you twice the rate of inflation, even those dividends are unattractive, and they get taxed hard.

NO COMPETITION IN COMPETITION

While the Government has also destroyed the competitive market for companies, by largely sidelining hostile takeover bids. In any event issuing poorly rated paper for poorly rated paper never sounds great. But that closes out profitable exits; sure you get insiders sweeping the Aim floor for cheap deals, but by definition those are not competitive, you can’t have two sides both inside.

The government knows that almost any deal has a loser, or someone not as well protected for life, as they had hoped. Which means media noise and MP’s getting lobbied, so far better to ‘long grass’ it, via a competition investigation. Isn’t it odd that the competitive market in asset allocation created by an active takeover market, is the one market the competition authorities simply won’t investigate. But without that cheap stocks just stay cheap, it is why buy backs are so prevalent: the companies are right, the price is wrong.

Of course, index investing has issues, you buy the bomb maker, cigarette seller and dodgy legal firm all in one bundle, but that’s the game. If it is big enough, it goes in the index, and you buy the package.

And hot stocks are likely to favour low commission markets, and low transaction costs. It may be an accident, that UK commission and tax is based on total deal value, but US commission is based on share count (and there is no stamp tax). But it does mean that you buy a share in Berkshire Hathaway for the same dealing cost as one in Game Stop, or if you prefer Nvidia and Trump Media.

Assuming sanity, you trade in the US, or in stamp free index ETF’s, not UK stocks. Although the FCA are fighting a rearguard action against both ideas, with the discrimination against holding ETFs seeming particularly bone headed and indeed against consumer interests.

But few stocks, fewer markets, more hot stock volatility, it is just the way we have set it up, don’t be surprised that is how capital is now allocated, growth funded, prosperity achieved and destroyed.

TIME FOR A BREAK

As for this market, it had to break, we have said it for a while.

Levels have dropped sharply, and money is rotating back into bonds, or at least not flowing out of bonds.

Waiting to see through the summer, when that first rate cut arrives and who wins the US Presidential election, is all impacting the hot flows and making staying in cash feel easier.

While a more sinister undertow is coming from the narrative that the terminal interest rate settles out higher.

Our core assumption is still that real interest rates are now in a steady decline, but the equity bonanza of negative real rates is not coming back anytime soon. While for now, only one Central Bank and one market is going to keep on winning the hot money race. No prizes for second anymore.

The Winner Takes It All.

Good intentions

Two quite technical topics this week, hinged on the persistence of old viewpoints on current markets: pricing in UK stock markets, and China, and how we might look into emerging market funds. Plenty of good regulatory intentions, but rather less than welcome outcomes.

FIXED ODDS

Little in the debate on UK markets has looked at the major role played by an increasingly poorly performing small UK bank, Close Bros. Even when it was doing well, it felt odd to have a vital market role being undertaken in a backwater, but as its capitalisation dwindles, the core task of equity market maker, which it provides, seems oddly misplaced.

In smaller UK stocks, we therefore still have a ring holder who, it is said aligns buyers and sellers’ interests. Not mine.

Given the fortunes at the disposal of state banks or indeed the London Stock Exchange, why is Winterflood (a part of Close Brothers) still trying to provide this vital service in the style of an old-fashioned bookie?

It matters greatly, because in many UK stocks and investment trusts, the wide bid offer spreads make dealing almost impossible. If you are eking out a high single figure return, and in these markets not doing badly to do so, Close Brothers scooping 10% off a single trade, in the bid offer spread, is pretty lethal.

With them restricting trade, liquidity disappears, without liquidity so does price discovery, and it is not a stock market any more.

Close has itself also suffered a number of hits lately. It is a hotch potch of old merchant banking activities, along with an expensively acquired asset management business, plus a shocking venture into litigation funding that might ultimately (it is itself a matter for litigation) cost almost as much as they paid for it.

While just lately the FCA has been asking (dear CEO…) about insurance premium finance, oh, and Close has a lot of motor finance too, an area of recent expansion, but also another hot spot for the FCA, after issues on commission. The latter Close has known about for a while, it was a disclosed risk in their last accounts.

All places where margins are quite high, perhaps in the view of the FCA too high.

From: Close brothers website – section on ‘who we are’ - their business model.

Given the lack of any announcements, the 40% share price decline in Close (CBG) over six months, to levels seen just after the GFC, is remarkable. Perhaps this benign graphic is not quite the whole picture?

Premium financing is ironically a good business, because the FCA’s wide and unpredictable view of its own remit makes financial services insurance premiums rather high, but that’s another story.

And market making is run as a bookie, not as a market utility. Winterflood itself can be taking a long or short position. So, investors must fathom both the share price, and which way their market maker is facing. In big stocks with lots of choices that’s all fine and pretty transparent. But in small ones, they can look (and behave) like the only game in town.

And it looks as if last year, they possibly went too short in the autumn. So, when the market turned on a dime in November, a fair bit of short covering took place, prices leapt, in places by over 20% and spreads opened out. And market size dwindled to penny packets.

It matters how? Well, you can get ripped off to deal in smaller UK stocks, where smaller is up to about £300m, and the price can be “wrong”, volatility increases, and liquidity goes. Do companies or investors like any of that? Nope.

It is notable that their trading profits in this area seem to far exceed both their gross (long and short) and net (long less short) positions.

Every big company was small once, and if you choke off the supply you get an ossified market, like the current moribund main FTSE index.

Perhaps the FCA could start to look more at best execution and market depth, and less at arcane ways to double count costs, or ‘protect’ those trying to enter the primary market from strict rules. This interview with Witan makes a reasonable case for looking after the secondary market first, not just the big IPO’s, with their juicy listing fees.

Investor protection is about investors making money, not about them losing it as cheaply as possible.

CHINESE BURNS

After our piece last time, we have been looking at Emerging Market funds ex China, because far from being the great hope of EM investors, China (and not just the PRC, but also Hong Kong) has become the rock that shatters fragile performance.

The role of benchmarking

There are several structural problems in EM funds, one is the role of benchmarking. A good idea at one time, it allows investors to compare performance to something specific. But it has become quite expensive (guess who pays?), as benchmarks don’t come cheap, if you now have to have them.

It also rather neatly points out to investors, when an index fund might do a better job than active managers, and worst of all, especially with the oddly amateur directors of most UK investment companies, leaves them ‘hugging’ or enslaved, to the benchmark. For good reasons in one sense (you don’t get fired for just about beating the benchmark) but for bad in others (all the funds are boringly similar). They just make the same mistakes together. And a beaten benchmark, that is itself falling, means the investor still suffers losses. I have yet to meet an investor that liked those.

The impact is both direct, so you can’t find India funds without Reliance Industries (the biggest stock), for example, and indirectly so as to “generate alpha” funds take bigger risks within a market, rather than have a below benchmark position in that market, even if all their analysis says they should just quit that particular town. Which is why funds find reasons to linger in bad neighbourhoods.

Another bias that hits the EM sector (which for a decade now has flattered to deceive) is that their stock analysis is focused on stocks they have held, while the investor wants to hear about stocks they should hold.

So, a fund manager typically gives a detailed list of analysts and companies followed by their firm, and it is full of what looked sensible when all those analysts were hired. So, in EM, there are stacks of China analysts, of organisations based in Singapore (the preferred offshore China centre, after Hong Kong got too hot), hundreds (if not thousands) of Chinese stocks covered, but all the buying is now into India. With quite nominal stock coverage; and hardly anyone based in the country.

Just as to a hammer, every problem is a nail, so to those EM analysts every opportunity is in China. Until outfits like Janus Henderson and Templeton stop having toolkits full of hammers, they won’t be able to stop breaking investors’ hearts with China. Nor will investors realise quite how much this infects their performance.

This will slowly correct, but small funds that can exit China totally in a week, and have a global remit, with no equity benchmark, dare I say it, have quite an edge.

It is a vast and nuanced space, Lazards provides a good overview.

And it is not just EM specialists, we looked at Ruffer of late, it has got broken China littered amongst its portfolios.

So, we worry that the Christmas rally looked broad based, because of a bear squeeze over a range of stocks, that then reversed with early January selling, based rather more on fundamentals. In which case 2024, so far, is in danger of looking more like 2023, less like the cyclical turning point many hope for. We do see earnings falling, of course and then ultimately rate cuts rescuing valuations. But ultimately may be quite a while.

Skipped - what will 2024 look like?

May I say we told you so? In "Skipping Along" before the summer break we called the end to rate rises, and by the November Fed meeting, we were well on board for a "rip your face off" rally. Feeling ripped? Anyone coming to the equity party in December, has just not been paying attention.

And our powerful MomentuM model had investors buying Japan and European Indices LAST December, so they have milked that entire rally. It also signaled buying back into the NASDAQ from May, arguably a bit late, but still very effective.

Jerome Powell said nothing new this week, and the New Year still looks bright for the beaten-up stocks, regions and sectors, as rates decline. I suspect prospects for the perennial winners to keep on winning are not too bad. Although economic growth will suffer (and so will earnings), but valuations still have some space to catch up amongst a lot of this year's losers, as discount rates keep swinging lower and bond yields dwindle.

A RED CHRISTMAS – Looking forward a year.

A year ahead, politics looks more interesting: so, what will the newly elected British House of Commons do next Christmas? What are the choices and likely outcomes?

The new Labour prime minister will care relatively little about political opponents, and quite a lot about holding party discipline.

Nor, we are told, will he seek early solutions to some of the more intractable constitutional problems (Second Chamber, Proportional Representation, Party Funding etc.), as based on his predecessor's experience, that just wastes precious time.

For all that, when it comes, his manifesto will (at last you may say) be festooned in clear deliverables, a plan to govern, at least for the next year. While Rachel Reeves is influential, the drive will be legislative, not economic. But as ever The Chancellor will have to then deliver the possible.

A DOLLOP OF BORROWING

So, more debt, extra tax, spending cuts are the options facing her, to fund that manifesto along with a cursory fig leaf for growth. The latter is needed (like the absurd Tory public spending targets) to get the Office for Budget Responsibility on side. Albeit responsibility is what you take, whereas the OBR offer simply a comptometer's sign off on specious forecasts.

For all that the Treasury thinks Gilt markets pay attention to the OBR, although I doubt it. So very early on, the rather too stringent self-imposed spending and funding restraints the Tories have adopted, will be quietly reconfigured. The rise again of a few PFI like schemes to keep stuff off the books is likely; Labour does not do fiscal hawks.

Falling interest rates and lower indexation provide small windfalls, and binning the 'irresponsible' Tory promises of tax cuts, won't hurt the numbers either. So yes, more debt, low tens of billions at least will be used.

A SPLASH OF TAX

What of tax? Can the pips be made to squeak. Yes, again, I am sure they will be, although not really on income tax, and I think for employed staff not on NI either. Labour has no love of the entrepreneur, who is too poor to hire lobbyists or to make donations. So, a bit more squeezed there off the self-employed and small business owners.

I expect a big hike in fuel tax, especially petrol and aviation fuel, under a green cloak, generating another £10 billion. Consumption taxes remain rewarding: VAT rates, thresholds, and exemptions are all likely targets. And if they are inflationary, just adjust them away in your numbers. Nothing new – claiming them to be a 'one off' (of course).

UK property taxes are low in the South East, due to a long-standing failure to re-rate, so there is some scope there. With more housing coming, this will likely be punitive. But there are other enduring loopholes, that make little sense: REITs, Limited Liability Partnerships, a lot of EIS, VCT, Freeport stuff, albeit none of that is big ticket. I guess some simple populist tariffs may arrive as well. Labour is at heart protectionist.

All in all, I expect Labour to get enough from extra debt and taxation to provide a budget to tackle (rather than just top up deficits in the funding of) some long-standing reforms. I'd also expect seizures of assets. The Treasury seems to have a taste for balancing the books illegally, and there is little judicial protection.

PRESENTS FOR SOME

I don't expect infrastructure or defense budgets to be much loved – that's some of the cuts. The undoubted green spend will likely benefit (or keep on benefiting) China's manufacturers, more than the UK, but do still expect energy prices to go on up. They are the modern sin tax.

But higher tax, debt and spending can be pretty good for the economy, as Biden has shown, it all depends on how long you can get others to fund you for, and at what price.

Much as I am sure Labour don't want to crash the pound, they normally eventually find a way to do so, and for all my glib assumptions, they will be starting far closer to the edge than most new governments, for some while.

THE HANGOVER

How useful is that analysis? Well don't expect the FTSE to collapse, this will be a spending regime, but do expect stock specific damage, although arguably a lot of that is in the price of impacted sectors, or indeed the long standing (and ongoing) flight from UK equities overall.

The FTSE is mired in a twenty-year stagnation, from 7,000 in 2000 to well, 7,000 now, although not to altogether discount the medium-term Tory inspired rally. Note what Labour, even Blairite Labour, gives you.

On the other hand, sitting, duck-like, waiting to be hit, or worse buying into vulnerable areas, feels quite high risk.

The election outcome is (and has been for a while) clear. Nor is this a safe European coalition of the sane and less sane. It will be red through and through.

Given so many other options, and that some of the pain will be direct on pensions and property, it seems a good time to start planning on the investment side.

The MP's pension fund invests only 1.7% in UK listed equity. Do they know something?

Have a magnificent Christmas and thank you for reading.

We will be back on January 14th.

Charles Gillams

17-12-2023

Stop Making Sense

The benign Powell’s fireside chat has left us all very happy, while I have been pondering the Yanis Varoufakis saga from afar. So how did Greece survive the doom and gloom after the Euro crisis?

An apposite topic, as high state debt, unproductive spending, and uncertain or burdensome credit, pretty much all over the West, apparently beckons once more.

The Song of Chairman Powell

We start with Chairman Powell in his recent Q&A: he could hardly have been nicer, the equity markets loved him, the bond markets sweetly retreated, and the dollar fell away.

It was not so much the repetition of ‘data dependent’, a seemingly meaningless phrase, or the deft swerves around repeated questions about the path of rates.

It was more the extra lengths he went to, to dismiss the data outliers, particularly on much faster GDP growth (4.9%) in the US economy, for Q3 and the sharp upward shift in longer term inflation expectations. The bond markets had found both metrics spooky.

The GDP number was dismissed, rather airily, as related to strong consumption, which in turn was linked to high employment and rising real wages on the one side, but more importantly to COVID savings balances. Although he admitted no one really knew what these were, but somehow, they were still contributing.

The inflation expectations got dissed even faster: Powell thought it an outlier, more recent data was far more consistent. Suddenly the evil portents were gone.

It would be wrong to think he knows what he is talking about (why start now?) but right, to know how he is feeling; that’s it. Sure, he keeps the rate rise out in the open, like an old dog, but the chain is lax and rusted, the beast benign.

It would take a lot to make the US raise rates again and he was happy with tighter monetary policies. Even nicer for the long end, while Powell is not sure where the “neutral” funds rate was (who is?), it was certainly a lot lower than where we are now. You might even choose to quantify a gesture; I’d say his was in the 3% area.

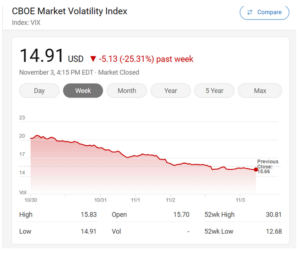

So, I feel like crisis-driven prices should not really apply. While the VIX? Down 25% in five days. Game over?

Search Results from MSN

Yanis, Right or Wrong?

Politically Yanis got lured by the old trap of supporting a party without a history, after sudden promotion, as a technocrat.

A rookie error.

But how does History see the Global Financial Crisis?

I looked at GDP from 2007 to 2022, for Bulgaria, Greece, France, Germany, UK, and the US. Here is the World Bank Chart of GDP growth rates. You can see Greece tumble out of the bundle, but it was also gathered back in, quite fast.

By 2007 the Eurozone was apparently out of control, spending was too high, it needed debt write downs, balanced budgets, selective privatisations and a war on tax evasion.

And Yanis felt Greece was being unfairly picked on to trial that medicine.

Size Counts

So, it is perhaps more instructive to look at levels, not growth rates. Here the damage is clearer, Greece has a GDP still substantially below the 2006 level. Bulgaria a neighbouring Balkan state, has doubled (and more) in the time. So Yanis has a point there.

Elsewhere France grew a shade faster than the UK, but from a slightly smaller base, so really little change.

But the US added almost twelve trillion dollars to its economy, which is like bolting on a new economy the size of the UK, France, Germany and Italy in just two decades.

We could adjust for currencies, population, different data points, calculation bases, of course and it is non-linear, inevitably. But we are looking big picture here.

Was The Left Right?

Gordon Brown was quite keen on the Yanis theory, and to some extent that adoration survived the subsequent dilettante Tory rule. Seizing big banks, attacking tax evasion at any cost, and aiming to balance budgets (Yanis was big on the primary surplus then) all crept into UK policy. The first two are oddly very non-Tory, especially when used to destroy economic growth by over-regulation. The third is quite sensible by comparison, but it was ignored.

Greece has since taken its medicine, with a steady swing to the Centre Right. Yanis finally lost his seat (for his new party) early this summer.

If the pain was indeed all inflicted to help the struggling IMF, no one told the US. If it was all done to save the Euro, I ask myself why did France go nowhere fast? It didn’t obviously hurt other Eastern European countries.

So, Greece remains an outlier, vastly reduced in wealth by the whole episode. It saved the Euro; it did not save Greece.

Where Next?

In the end, all national budgets work better with a growing economy, and in the long term that is essential. Flat or declining economies are the real crisis, especially without flat or declining state spending.

My highly selective period – (2007 being the pre-crash high) finds considerable upsides in both Trump and Biden’s expansion and in Obama’s reconstruction.

While if you need to know why the US stock market dominates in that period after the GFC, it is because GDP growth was twice that of Germany, and on course to double from 2007 quite soon.

Elephants can’t dance, they say, but when they do, the world shakes.

Insert Media here

Although Yanis, indeed has stopped making sense.

Charles Gillams

4.11.23

Sweet Dreams

Here we talk about the delights of the Conservative Party Conference in rainy Manchester, the failure of the in-built two-year time horizon in inflation models, and what may happen to interest rates.

FANTASY IN BLUE

At times in Manchester, it felt like everyone was looking for something. As government steps up spending initiatives, and empowers regional governance, and drives big spending on not achieving net zero, the chorus of demands for more taxpayers’ cash grew deafening.

There was utter silence on efficiency or capital allocation; it was all just “a good thing” to spend more.

And oddly too, with so much lip service to the long term and reducing debt and halving inflation, the ‘how’ of those was also ignored. Surely halving inflation is not even a government task? It was devolved to Bailey of the Bank - yet we heard not a word of criticism. If ever an eight-year commitment to a disastrously run project needed cancelling, his appointment looks to be just that.

This would spare him (and us) those endless letters on why he’s failing to control inflation.

For all that Conference was oddly cheerful - quite a bit of steel on show, from Suella of course, the only natural politician involved - some guts from Steve Barclay at Health, and Stride, a little less convincingly, at work and pensions - else, all rather wooden and on autocue. Although you could not help but notice that Farage still charms the fringe crowds.

COMPETENT DELIVERY?

The abiding issue remains competent delivery. It was odd to hear the government on HS2 arguing for accountability by sacking their own Euston delivery team. As if the failure of HS2 is not theirs, and theirs alone.

Instead of penny packet incrementalism, government needs a holistic delivery view - perhaps why France can build a TGV, and we simply cannot.

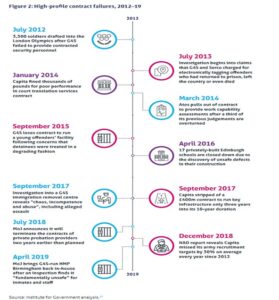

From this report of the Institute for Government

From this report of the Institute for Government

The Maude/Osborne “reforms” destroyed half our domestic contractors, by a short-term focus and ceaselessly moving the goalposts. As a result, home grown firms are in the minority on the HS2 contractor list, and giant multinationals with more lawyers than bulldozers were the main bidders.

They want top dollar to take on the risk of a lazy, indecisive government machine - no wonder.

THE CHANGE PRIME MINISTER?

We have been very clear since 2019, that the Tories can’t win another term, none of that changes, but the scale and composition of the anti-Tory majority next year is rather less clear.

In many ways, the best case for a Labour defeat, at the next election, is that the Tories have done it all already. They have blown the bank on out-of-control spending, splurged on unaffordable welfare, and raised taxes to unsustainable levels.

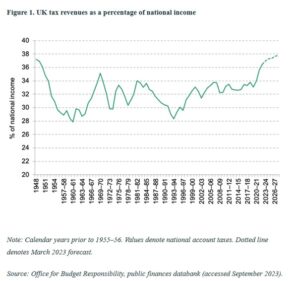

From this website

From this website

This government also crashed the pound, let inflation loose, let rhetoric overtake sense and has gone in hock to foreign debtors. I suppose they have yet to invade a sovereign country without a UN mandate, but they are working on that too.

So? Well oddly Starmer is still slightly boxed in, and in terms of polling data, not really getting much help from the weak Lib Dems, in those critical three-way marginals in the South. While Scotland clearly has had enough of the SNP running Scotland, it is less clear that they don’t want the cause of independence to be heard in London. The Rutherglen by-election could be sending both messages, but in a general election voters only send one. I would not assume that genie is back in the bottle just yet.

JITTERBUG BLUES

We continue to see US rates above inflation, which is very different from UK rates which are still below.

So exactly what Powell (and Bailey) are doing with selling down the Central Banks balance sheets at a time of maximum new issuance, is not clear; it solidifies vast paper losses, creates new losses on the rest, so seems to be quite a pricey warning shot to politicians. But it is a plausible reason (along with super high levels of new issuance) for current bond market nerves.

We have always felt the Central Bank models, where whatever the question the answer is “it will be fine in two years” are a fiction. The awareness that rates and inflation are staying high, is long overdue. But we have been in no doubt about it, for two years, nor have we ever flinched in our aversion to bonds, we were never being paid enough for the risk.

The jitters in the bond market feel more like a turning point, the sudden chop as the tide turns. The dollar has risen; people want to be there; if there is enough demand, that will lower bond yields again. So, I am not looking at US rates rising, so much as at the battle switching back to fiscal policy. Although in the end if Biden really wants 7% rates, I guess he can try to have them.

The UK and Europe are less contested, the labour market in Europe at least is not that tight, although still at record low unemployment levels, but with a lot of surplus workers in France, Spain, and Italy, and especially amongst the young. Euro interest rates are also really quite low still and are not yet looking restrictive.

So, it looks like another round of softening currencies, stagnant inflation and rate rise pressure. Central Banks still hope they have done enough. Even so it is quite odd that UK long rates are only just touching the level of a year ago, logically they should be two points higher. As for oil, we have seen this autumnal spike as a little surprising but transient, and as ever at this time of year, the short-term path is weather related.

Overall if the start is any guide, October yet again could be rough for markets, but longer term still looks brighter.