Jerome K Wiley?

We do think Powell is running off a cliff, just not the one the market assumes. As we endured the wettest February since (at least) 1836, when William Lamb was prime minister, and the wettest Tory government since records began, is there any chance of dryer times?

But first the tiresome tango of rate rises, the market swept to and fro, nation by nation, until the firm stamp of a well-heeled bond whips the whole mass back round again.

Bailey of the BoE, and Powell of the Fed

So, this week it is to be Bailey first out the gate, FTSE up, bond yields down, next week who knows? That rates will fall this year is the only certainty and the big US markets have built a near vertical climb out of that snippet. But you will note, not in rate sensitive stocks, the Russell (small cap) is still pretty flat, weighed down by the regional banks that dominate it.

And Powell, he’s guessing or as he calls it is “data dependent”, but for all that he is pretty happy projecting those guesses forward. So, he has moved from three rate cuts this year, to a new position of ? Well - three rate cuts this year. Not much data dependency there.

Before long he will run out of “this year”, because the inflation numbers are not behaving, nor critically is the oil price. Like Bailey in the UK, he is desperate to cut and under heavy political pressure to do so, both have said 2% inflation is not now needed, just moves in the right direction.

I feel the only thing that can get us there is a sudden (and indeed overdue) drop in the energy price, which we do expect in the summer, but who knows? It has held up rather well so far.

So, at the moment, Powell is perhaps running on thin air. Protectionism and vote buying fiscal measures mean he can’t get there without some other help.

Markets are supercharged – is it sustainable though?

And if rate cuts are what has supercharged markets in the US, I don’t see that as sustainable right through the year. It might instead be the possibility of a more market friendly, fiscally prudent, Trump, which would be more logical, in some ways; but that still feels implausible.

Nor do I see, as yet, many other markets joining in. Partly, why own anything else but the NASDAQ? Some markets have moved (Germany, Japan) but you could also argue that was after being oversold for too long. While the Swiss have cut rates, it is in part (as ever) to restrain their currency, I am less sure others will want to move ahead of the US.

They may be forced to, but there again their scope before European and UK elections looks limited. And some parts of the market, like UK smaller companies and many REITs (and some renewables) are not signalling anything but yet more damage and destruction, from suspect refinancing at high rates and over optimism on revenue.

Air Cushions

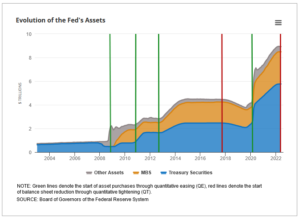

It was notable too how keen Powell is to slow the tightening imposed by reducing the Federal Reserve bond holdings, which has to date been done at a fairly brisk pace. He now talks of stabilising holdings, (in other words resuming bond buying, stopping the runoff of expired holdings) at what seems a high level, for fear of taking too much liquidity out of the system.

From this explanatory article on the process by the Richmond Fed.

For a while rates and reserve sales were working as one against inflation, but not for much longer it seems. Which should be good for bitcoin and other liquidity consuming monsters, if nothing else.

Who is Next in the UK?

The interesting Tory battle is between the Official wing, now entrenched in power, and showing no sign of intelligent life, beyond wanting to “make a good fist of it” in the inevitable electoral defeat. Then there is the Rebel wing, keen to cause trouble, break things, get popular support, or be nasty, if it gets them attention. Although the Official wing regards this as disloyal, it follows an old pattern. It is not just about this particular bunch: see this paper.

Faced with a like quandary under Blair, the Tory party swung left, towards the centre and power, just as Gordon Brown started the decade long Labour march to irrelevance. The Official assumption is that will work again, although the alternative scenario is that Starmer settles down in the centre for the long haul, and the Rebel wing, kept securely away from power, withers for lack of a structure.

But all ruling parties were, by definition, rebels once.

Back in 1836, William Lamb was an unsuccessful politician, wrapped around by Peel, sent to the House of Lords, then brought back as a centrist Prime Minister, and being generally useless, was turfed out again, after naming an Australian city, en route. One must hope for no repeats from history.

William Lamb, Lord Melbourne – from this site

It does not feel time for compromise candidates, nor will a ‘safe pair of hands’ do. Rishi is in a fight.

Meanwhile the fields here feel like salt marshes, dark water lurking in deep cracks, the lips of which slide into clay and suck at the soles of your feet. We certainly could do with some heat.

I do expect this run in markets to go on, but the upside in the big US indices looks more limited and broader participation elsewhere will await those rate cuts. Both their size and speed have a capacity to disappoint, especially when they are so hotly anticipated.

The politics, a long time coming, may become more influential. It could get choppy.

We will take an Easter break, after what feels like a long spring.

And return with the sun (we hope) on 14th April.

JENSEITS VON GUT UND BOSE

We ponder the point of the UK markets, ignore clashing BRICs, set up for the slow fall in interest rates in 2024, yes, long lags are long.

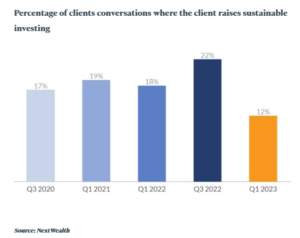

There are two investor markets, one akin to gambling and speculation, one allocating capital efficiently to invest capital or fund governments. But like weeds in a nutrient rich field, spare liquidity attracts the rankest growth of useless vegetation. There’s no clear way of knowing which is which. Money famously does not smell, and clients don’t really care much about how they earn a return, whatever they may say.

From: The FT Adviser Website

Fads and fashions in investing fuel some success at first - then they can no longer conquer new lands, and deflate, dragging down asset values as they go.

ARE INDIVIDUAL UK STOCKS WORTHWHILE?

I look back, as all investors should from time to time, at my successes and failures. Luckily out and out failures are pretty rare, and in some measure, so are successes, as I quickly milk the wins (usually from takeover bids), so they disappear from the record.

This leaves me a pretty solid mass of fairly dull UK equity holdings, I slightly favour value over growth. So, I know a simple snapshot won’t reveal the steady benefit of, at times, decades of good dividends.

But at the end of it all, for a UK investor, what remains is a mass of general mediocrity. Resource stocks have been good to me, still are, but the mass of industrials? Not really.

Or property companies?

Well big dividends from REITS, but again not really. Of financials? Again, long years of high dividends, but capital values stay scarred by the GFC. Chemicals, retailers, distributors, tech, utilities: well, all fascinating, with some good runs, often good yields. But in the end?

I could ignore such perennial plodders when their yields were far above base rate, but they are now surpassed, by a simple savings account.

So, I do wonder at times like this, why I hold them. Doubtless we will get rallies, but the tone feels a tad discouraging just now. And I sense the politicians of all hues, who seem to be eager to relieve me of anything that looks like a nominal gain, or enforce their often extreme views on my assets.

PERHAPS OTHERS DO IT BETTER

My long-term winners by and large stack up in investment companies, with specialist fund managers, and almost entirely overseas, or at the very least global. Not that is much of a surprise, we have mentioned before how the FTSE100 has not moved much in twenty, going on twenty-five years. Yet again it has flattered to deceive this year, yet again it has that slumping dinosaur feel to the graph.

The UK is not alone in that. Most of Western Europe shares that fate, and Eastern European investing has been a good way to create losses. Somehow Europe’s governments have done just enough to keep investing alive - and somehow the stock markets have had just enough liquidity to avoid collapse.

It is partly why so many investors love small companies, but they are savagely cyclical, as we are seeing just now.

I could blame management, and their apparently limitless greed, but while many quoted boards maybe have rogues or knaves, but nigh on all of them? No, I won’t accept that.

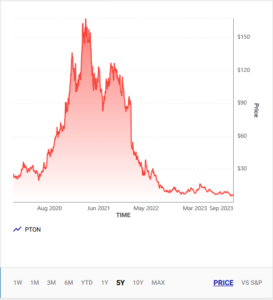

Globalization has freed capital to move easily and fast. Far faster than any real business can adjust, and in this world the ability to attract capital is vital. True many attract it, to waste it, like a meme stock, or Peloton, but it would be wrong to see that as a line of tricksters repeatedly finding ways to con the market (although many have) more about the power of liquidity to inflate prices, attract buyers, inflate prices once more, in an unending climb. That is until the last buyer has paid up, and the tipping point is reached.

Taken from this website

Then the whole thing unwinds downwards, down to a true value, or less.

WHERE NOW?

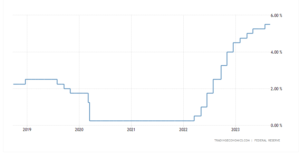

On the one hand, as interest rates fall, and they will do soon, even if that one last hike is much discussed and may well happen, the path looking forward is downwards.

FED rates in the last 5 years

This should benefit value stocks, as more and more dividends emerge once more above the high-water line of cash deposits. Rates won’t go all the way back to zero, that is gone, but should start on the way down.

On the other hand, the liquidity trade is here to stay, money attracts money until the thermal tops out and the vultures glide along to the next spiral, or indeed back to the last one.

And looking over decades, as fund managers must, that is all that happens in most markets globally, one or two have true secular growth that also gets returned to investors (a key caveat), most seem not to. Investors become either hobbyists in love with a stock or short-term traders. It is notable how many of the new breed of big company directors spurn the shares of their own companies, bar a token few thousand.

Markets seem to have progressively been made easier for momentum, versus ‘true’ investors, allocating capital to create real jobs. The capital allocation bit is worthy but dull, and arguably governments and regulators seem to have strangled it into stasis.

The endless, joyful, mindless dance of momentum, is simpler, prettier, easier to tax, cheaper to trade; quite wonderful really. But is it much else besides that, or is it substance without meaning?

It is odd how governments moan about the lack of growth and yet cripple capital allocation. In a market system, the best capital allocator wins. It is really quite simple.

Once the tightening stops, there should be more currency stability (of sorts) as all the Central Banks realign their rate patterns again. In (to us) an unresolved month, the dollar’s strength has been notable, when not a lot else was.

Skipping along

Skipping is the week’s theme, following the inadvertent use of the term by the Fed Chairman, along with the rather weird behaviour of Jeremy Hunt.

Although any skipping seems unlikely soon, on this side of the Atlantic.

The dear old ‘recession’ still lingers, unseen but feared, like an ex Prime Minister. We are convinced it will arrive, but as a ‘technical’ recession only. It should be hard for anyone to be surprised. Labour markets are much stickier and far more fragmented. Supply is short, so any systemic shock feels unlikely. While as old hands keep noting, single figure mortgage rates, well below inflation rates, are hardly restrictive.

Chair Powell (almost) mentions ‘skipping’.

Jerome Powell was bowling along contentedly, when he suddenly described the Reserve Board’s June inactivity as ‘skipping’. Although it actually was just a ‘skip’, before he realised the error and with a guilty look speedily reverted to the far more passive ‘pausing’. But we knew how he was thinking. He was going to keep his foot on the neck of borrowers for a bit longer – interestingly, he refers to real rates of interest, as somehow unjust and injurious. Odd that when asked anything about fiscal policy he instantly plays the neutral, technical banker, no good and evil there.

Moves in the real economy.

So, what has really happened?

Not a lot, energy prices have climbed all the way up, and now slid all the way down. Aggressive fiscal stimulus continues, any chance Biden has to bribe the electorate with their own money, he still takes. Employment remains strong, although there is some tightening in hours worked, but it is still pretty hard to see how the Fed gets down to 2% inflation for a year or two.

And yet, markets by a mix of that unseen recession and faith in so called base effects, do think inflation by the autumn, will justify a real pause. No skipping.

UK Chancellor’s odd statements

Here in the UK Jeremy Hunt is in quite a different place. Inflation still looks high and embedded, but he has carefully outlined how he would keep going with substantial hand outs to offset inflation (aka fiscal stimulus).

However, inflation control was all for the Bank to sort out.

This is nonsense, of course. The UK Government is yet again stoking inflation while taking no responsibility for stopping it. He then gave a tortuous explanation as to why his policies have now produced exactly the same interest rates as the Truss typhoon, created by his reckless predecessor, but somehow, not at all the same.

Rate rises – a global feature.

Funny that, as we noted at the time, there was little odd about the October rate spike, and much that the Bank could have done (but refused to) by a prompt rate rise (matching the US) to stabilise the currency and inflation.

Rate rises are a global feature, with not a lot one small country could do about it.

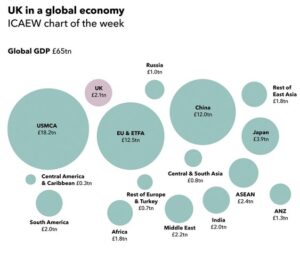

2021 chart produced by the UK Institute of Chartered Accountants

So quite where the virtue of the Truss toppling quarter point rise is now, is rather unclear.

As sterling shows, the prize for that autumnal sloth will be higher rates (and inflation) than elsewhere for longer. The thing about fire fighting is the sooner you start the less you have to do.

So how did Monogram’s methodology work?

Our in-house model switched into Japan in December 2022 and Europe in March 2023. As we only ever deal in half a dozen big global index Exchange Traded Funds, this is not a tickle, but 25% of the total equity position in (or out) at once.

Brutal and scary, but effective.

We look at the signal, kick the tyres, thump the bonnet, turn it off and on again, look for reasons to ignore it, and then six months later look back in wonder and say, “oh yes, that was right”. These signals are delicate enough to very seldom feel right at the time, but after almost a decade of running the model, we have learnt to obey.

So, our Momentum performance discussion, yet again, is about how much we made, not about in which direction the money went. While the GBP version, seeing similar signals, has also never come out of the S&P 500, which for a good while also felt wrong, but it seems was right, taking a long view. The USD model was more skittish but is back in both (S&P and NASDAQ) US indices now.

So, we do know where momentum has been, and it is quite strong.

Markets in the political timeline

The rational thinkers say the market is (still) too expensive, but the trend followers don’t agree, who is right?

We tend to feel just as Central Bankers were very slow to spot inflation, they are possibly being too slow to see it has now been contained, and the US skip may be a pause and then a snooze. Which would be very convenient for the Fed during the US Primaries, allowing for cuts into the US election?

Related to that, we watch with amusement a dialogue about the attractiveness of stock exchanges, in particular in London, couched entirely in terms of what potential listing companies say they want. Not a mention of what investors want, as if they just don’t matter. Quite absurd, as what all listings need is a deep market, good liquidity, stable tax regimes, and an attractive base currency.

Is London aiming to provide these? We seem to favour founders – so, tweaks to voting rights, smaller free floats, fewer shareholder rights. But then oops! No buyers.

This is worse than nonsense, it damages what little is left of London’s reputation. In this market you start with the buyers. The price performance of many a recent IPO spells out the problem, the sellers are finding it too easy to deceive people – a call is needed for greater transparency, longer lock-ins, and less pandering to insiders and their advisers (not more).

A RIGHT OLD TONKIN

About Influence – American and Russian, mediated by the Chinese

So, to start with what does worry us: That is the slide to a hot war with the powerful Eastern autocracies, fueled by the EU with Napoleonic tendencies, an old man in the White House and a curious sense of ‘crusades’ with no consequences.

For those with long memories of American imperialism, the latest drama even fits neatly as a modern Gulf of Tonkin, a key moment in the slide to war. In that case (south of Hanoi) the clash was naval not aerial but was still notable as one directly between the warring parties and not just their local proxies.

While elsewhere the pieces move, China can not let Russia fail, nor descend into chaos, their long-shared border must stay intact and secure. They no more want the US there than the Russians do. The first step after his confirmation as ruler for life, by Xi, was indeed to go to Moscow.

And the bitter battles in the Middle East of Persian against Arab, Sunni against Shia have cooled abruptly, under Chinese influence. The world once more understands that the US is the threat to peace and stability, not just their fractious neighbours.

For Biden it is an easy fight, the Pentagon so far has played a blinder, what can go wrong? While, for now, France is Europe, no other large state has anything like their stability, Italy is led by the unspeakable, Germany has free market liberals in a bizarre ruling alliance with Greens, Spain is wrapped in its own forthcoming general election, the UK both distinctly detached and under a caretaker government.

The UK budget said nothing, incidentally.

Main influences in France.

While the left in France, as the above photograph shows, are very alive to Macron’s ambitions, to add more territory to the EU, arrange more protectionism for French goods and to suck the labour force out of adjacent states to serve the Inner Empire. Just like Bonaparte tried (and failed) to do, with dire consequences for the French nation.

For all that, the domestic fracas in France (which makes our own strikes look rather tame) was inevitable. Raising (by not a lot) the pension age from 62 to 64, against our own 67 looks small, but it was a clear campaign pledge.

The absence of any minor party wishing to self-destruct, by supporting it in the French legislature, is no great surprise either. So, he has implemented it by decree and Macron has dared the opposition to now either remove his prime ministerial nominee, or shut up.

Banking On Nothing

So, what of markets? Well, the end of SVB is no great loss, it had several policies that had to implode if rates rose, especially on the lending side. It was painfully ‘woke’; I can tell you more about the Board Members sexual orientation, gender and ethnicity than their banking experience, the former just creeps into the end of their latest Annual Report, the latter was invisible to me.

SVB’s long list of ESG triumphs and poses (and it is long) at no point included not going bust. It did commit an extra $5billion to climate change lending, which I guess has all gone up in smoke now. Still apart from all being fired, the bank insolvent, the remnants rescued by the hated Washington mob, under investigation by the DoJ, all the rest of their “G” was superb, and so, so, cool.

I don’t see Credit Suisse as a danger, although it may be in danger. It has had an appalling run of misfortunes, with musical chairs at the top, but it remains a cornerstone of Swiss identity. To let it fold would be highly damaging and cause shockwaves in derivatives markets.

Influence on the markets

So, I do understand the Friday sell off (who wants to be weekend long with regulators on the loose). And we do understand markets needed to go down, after the big October bounce, indeed it was a key reason for our building up over 33% cash or near cash at the previous month end. We knew the winter rally was fake.

But I don’t see this as much more. Retest of the S&P 500 October low? It should not be. I take a lot of heart from bitcoin soaring (63% YTD); if liquidity was short, that would not have happened.

But for all that, I don’t like March in financial markets, too much is uncertain. So, this is more a time for cautious adding, rather than hard buying, but if we get to Easter (and hoping to be wrong on the Tonkin analogy) it does seem a better prospect.

Nor do I see how the various central banks can justify a pause in rate rises, at this point, but nor will they go in hard, that would be folly.

This Fed has made enough mistakes already.

The Art of the Possible

Image from Wikemedia - by Neide José Paixão

Looking at Absolute Return – Can it be Done?

A wise old hand once told me that all investors want is protection from inflation; do that, earn your fees and your job’s done. Read more