Exchange Traded Model for Professional Investors

The Monogram

MomentuM Model

MomentuM Model

An evidence-based investment model with a focus on identifying momentum trends, low dealing costs and a blend of defensive (fixed interest, gold) and global growth (equities). This model seeks to provide capital growth from a very restricted list (under a dozen) of large Exchange Traded Funds (ETF’s). The model is steered by our Chief Investment Officer Charles Gillams as well as our proprietary technology. From April 2020 to December 2022 it returned 20% (USD hedged) and 26% (sterling unhedged).

Investment

Risk

4

Liquidity & NAV Calculation

Daily

Minimum

Investment

£50K

Annual Management

Fee

0.5%

Managed

Account Costs

<0.25%

Return %

Past three years*

21.9%

*Based on the past three years, 2020-2023. Please note: Past performance is not a reliable indicator of future results. The value of investments can go down as well as up, and you may not get back the full amount originally invested. Your capital may be at risk. **Data source: Stock Exchange/Reuters – Refinitiv. Return benchmarks below.

Who is this model suitable for?

Any investor looking to enhance the returns available from cash deposits for the medium to long term (three to five years) with a low tolerance for risk. This type of client is usually in a phase of life where they are looking to accumulate.

Objective

- We are looking for the best medium-term (one year) positive momentum (we then rank these and apply filters to prevent a concentration of risk)

- We are looking to hold assets for multiple years and identify major market turning points through the model to reduce portfolio drawdowns.

Strategy

- Invests only in large index-based Exchange Traded Funds and never individual stocks or derivatives.

- We only invest through low-cost Exchange Traded Funds (ETF’s)

- We use S&P500, NASDAQ, European, and three Asian, and one Latin American indices.

- Empirical and evidence-based, extensive backtesting

Resources

Performance

Since inception (April 2018 to December 2022), net of our fees.

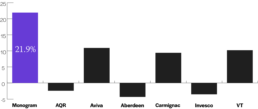

The Past Three years. Returns average.

How the Monogram model has performed relative to our benchmark companies.

Source: Stock Exchange/Reuters – Refinitiv.

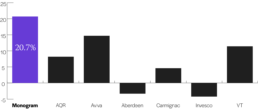

The Past Five years. Returns average.

How the Monogram model has performed relative to our benchmark companies.

Source: Stock Exchange/Reuters – Refinitiv.

Warning of risk

This model should not be a substitute for cash, as there is investment risk for your client.

Access this investment model

We work exclusively with Financial Intermediaries, Professional Clients. This is not an investment model directed at Retail Clients. As an Independent Financial Adviser, you can access this model through these platforms:

How the Model Works

The MonograM Model draws down data from the major global indexes and seeks out positive momentum on a 12-month rolling basis. (We use the capital M at the end of our name to denote it’s type – it is a Momentum model).

If a market has shown a net increase in total value in the last twelve months, it will advise the fund manager to consider investment, while any market without positive momentum is excluded. It then ranks those positive markets within four sectors, income, defensive, growth (developed), and growth (emerging). It has internal rules on switching, disinvestment and default investments.

Timely switching prompted

While many so-called passive-investment funds face added risk from the propensity to hold onto their ETFs (and therefore markets) for too long, the MonograM model is set up to try and ensure that when a market’s ‘momentum’ turns, or it falls behind another market, it will be switched.

Monthly investment committee reviews, to interpret signals

With that said, we also aim to avoid over-trading (which has cost and fiscal reporting implications), and we use our committee’s monthly review meetings to avoid any potential false signals.

The MonograM Model has been exhaustively tested to refine the competitive, low cost, simple Absolute Return Model. For more details on the theoretical basis behind the model, please feel free to get in touch via our Contact page here.

Flexibility – with full and transparent choice – select markets, sectors or stocks as requested

Although it is formally simple, the MonograM Momentum Model can be run on any selection of markets, sectors or stocks. It is adjusted on a strictly monthly basis as research has indicated overtrading is a source of poor performance. As an absolute return investment it only invests in large liquid ETFs representing the selected sectors, to reduce costs. It has no derivative content.

As such, it is structured to seek stable returns (see performance reports here). Despite appearances over long periods of time certain markets have dominated investment performance – a dominance revealed by careful statistical examination. Persisting with, for example, the NASDAQ and avoiding for example the FTSE 100, has been a remarkably effective strategy this century. The MonograM Momentum Model would have indicated that allocation before it had become so clearly beneficial.

Available in dollar or sterling, with monthly reports

The MonograM Momentum Fund is a tailored product, and as such, we run portfolios in both dollars and sterling, and provide a monthly report on each. However, it can be run in any convertible base currency the investor wishes to use. Equally, although it is provided as a standard format, the same Momentum theory can be modelled and provided for any liquid asset.

Easy entry and exit

We also aim to provide a totally transparent model, that can be exited or entered at the “flick of a switch” and all holdings liquidated within one business day.

Returns

Between January and December 2020, the Monogram Model yielded 11.7%, beating larger funds like Aviva and Invesco by a considerable margin.

The MonograM Model returned 2.3% in August 2021, and 18.6% from August 2020 to August 2021.

The MonograM Investment Philosophy

The investment objective of the MonograM Model product is to achieve performance in the top quartile of all Targeted Absolute Return Models (of which some 115 are listed, just in the UK). Actual performance has beaten this, with top decile positioning.

We consider drawdown the only relevant measure of risk and its avoidance is the cornerstone of our investment process. Our process relies on various techniques aimed at identifying, and avoiding underperforming assets. If need be, we are prepared to be fully invested in cash. In addition, we believe that markets and the decision-making process of investors in markets, is generally inefficient. We build portfolios that are resilient in the face of market declines and that compound positive returns stably over the course of the market cycle.

Risk Warning and Other Important Information

This information is intended only for Professional Clients as defined under the rules of the Financial Conduct Authority and is not directed at Retail Clients. If you are not sure which you are, please take advice from your independent financial adviser.

The contents of this page are intended as an information service. They are not recommendations and should not be used as a basis for investment. Information gathered directly or indirectly from this page is based on sources that MCM Limited and its personnel deem reliable but MCM Limited can under no circumstances be answerable for the totality or correctness of the information.

Past performance is not a reliable indicator of future results. The value of investments can go down as well as up and you may not get back the full amount originally invested. Your capital may be at risk.