The Times They are A Changin’

Rishi or Truss, can either be worse than Boris?

Also, we do seem to be decisively leaving the decade of low rates and by implication the experiment of quantitative easing. On a twelve-month basis, bar the FTSE 100, all major markets are down, although that is only just true for Europe and Japan. The Nasdaq and Aim are the big losers, and their recent recovery looks like a head fake to us.

We look at the global economy, and investment options.

So, what does the race for the next UK prime minister now look like?

It is not that important anyway, if as I assume, the next election is lost already.

These are stand in candidates, with no real grip on the party and likely to be loathed by the surviving group of Tory MP after that 2025 contest. Like a relegated football manager, they will have shaky job prospects.

Is there much to choose between them? Again, I am not sure, they have established that the party to its core hates higher taxation, whatever fantasies Boris had, and some at least understand that a smaller government or higher debt, is what the hard choices of governing are about.

I rather expect much of the ‘difficult’ stuff attempted by the last Cabinet will get ditched by new ministers. It still would be wrong to say the new team can’t achieve much, the governing majority is solid, and further bloodletting inconceivable. I would anticipate that they will still have two and a half years to run.

The two candidates compared

Sunak is admired for his high-profile experience as Chancellor, disliked for his willingness to raise taxes, loathed for wielding the knife on Boris. Truss is thought to be opportunistic, and rather unfairly for being dim and not substantial.

But I don’t expect much of a change, more fiscal conservatism, less besotted greenery, perhaps less socially liberal, but only to the extent of holding the line, not really rowing back. Short term stability, long term decline.

Preparing for another European killing field?

But you do feel Sunak would be less of a cold war warrior.

The report that the Chief of the British General Staff had called this “our 1937 moment” and launched “Operation MOBILISE” suggests the bloodlust is well and truly up, all adding to the hefty training programme. We are already deep into a proxy war ourselves.

I hear it is just as insane in the Pentagon. There is even high level gossip about this being the final great “killing field” in our centuries’ old hostility to Russia.

Economy : two questions affecting interest rates and inflation

As for the global economy, we had two great questions for the year, how long could the Fed “extend and pretend” over inflation, and how quickly everyone else would then play catch up.

Well pretty well the day Powell was re-confirmed earlier this year, he binned the Jackson Hole pretence that high employment did not have to mean high inflation.

I suspect (and so do markets) that he won’t really go after inflation, if he did so, we would have interest rates in double figures by Christmas.

Bread, job, and a roof, these three a politician must provide, and just one without the others, is a vote destroyer.

The current modest level of rate rises will let inflation creep lower, but will not control it, and we don’t see interest rates topping out for quite a while, not helped by the very low starting point. Although overall, it looks like the currency markets are forcing the rest of the world to follow in raising rates quite fast and in the end, to the same levels. Nevertheless, in Europe the response to double digit inflation, has so far only extended to ending negative rates.

As if that will matter, as the Euro collapses; they will have to move faster. Lagarde confidently delivering total guff and mysterious lawyerly threats won’t save Italy.

The economic models everyone is relying on to forecast otherwise, seem to assume no incremental rise in energy prices next year, and indeed a sizable fall. That maybe so, but there will still be a lag as this year’s rises have not been fully absorbed and will echo and bounce around the economy for a while to come. Not least through a still very tight labour market, which has several years of lost capacity due to COVID and indeed the familiar demographic time bomb.

A slackening in wage inflation needs US and Northern European unemployment to at least double; no sign of that yet. It is a muddled employment market with spatial and skill deficits, so increasing capacity where it matters, will take time. Not least because of persistent high surplus labour levels to the South and West in Europe.

So, if the Fed (and Wall Street) insists (as it does) on calling this transitory inflation, or now the new phrase, ‘peak inflation’, they are simply using dud econometric models (again).

What next?

Cash flow will again be king, capital will be well rewarded in the bond markets, dividends will have competition, non-dividend payers face a long winter. Experience of the dot com bust, and then the banking crisis, suggests it takes three or four years to retool models based on prior poor capital allocation (and boy have we had that). Not the three or four months which is being assumed.

Granted we were oversold at 3666 on the S&P 500, perhaps an auspicious low. Yields meanwhile had shot out beyond reason, but reluctantly we consider this pleasant bounce can’t survive. We accept too that earnings are OK, but they are in most cases a poor indicator of economic forces that take years to establish themselves. The extinction of even capitalist dinosaurs takes time.

And then there is the great concertina of rates: ignore what each Central Bank says, in the end they must march to one beat, that of the dollar.

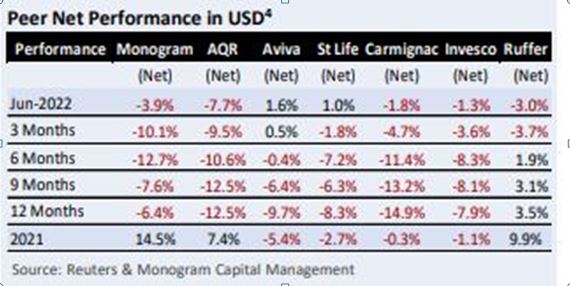

Monogram performance, compared to others in the Absolute Return sector

It is striking that our USD MonograM model now holds no equities or bonds, our GBP MonograM model is fully invested in both. While the list of storied Absolute Return managers who fail to beat our model remains embarrassing.

Download the newsletter of which this table is a section, for the full data.

There is no availability of this model, except through ourselves; perhaps it is time to talk to us about using it?

Do get in touch, an exploratory discussion is never wasted.

We wish you a pleasant summer: as good Europeans, we will fall silent for August.

I hope it all looks clearer when we return.

Charles A R Gillams

Seeking an end to the turmoil

This market turmoil feels interminable, as asset markets stumble to find a firm footing and churn relentlessly. Instinct says that’s a time to buy. But there is so much happening, as this multi-year trauma unwinds, it is quite hard to know what.

Although we try to segment it, the key problem is the terrible dishonesty of politicians, who have bullied their citizens into an unthinking reliance on institutionalised theft on a grand scale and a belief that nothing really matters, as long as you have a press release to deflect it.

IT IS ALL STILL COVID

So, working through piles of annual accounts, as a pleasant distraction, (I have always enjoyed history), the one repeated theme, is of shrinkage, under investment, caution. This, in a way, is natural because COVID reset two years of global production, and indeed destroyed large areas of output and services. Which also makes it terribly hard to understand what “normal” is now.

Not helped by the piteous vagaries of those craving spurious accuracy. Big banks and resource companies seem overall just to want to carry on shrinking, which is odd as their results seem very good. But they are not. All that has happened is they took big write offs and reserves in 2020 (which were not needed) and that then reversed in 2021. However, the underlying business volumes fell, the trend to more disposals than acquisitions was unremitting; these are shrinking businesses.

To the populists who believe higher taxation lowers inflation (are they mad?) and indeed, to market commentators, this looks good, but it is really not, productive employment is shrinking too, workforce participation is not roaring back.

And with inflation we will again see plenty of “top line beats” or rising revenue, but that too is an illusion. And indeed, raised dividends. For example, Shell now proudly offers a 4% dividend rise, as if that is generous; last decade it was, but not now.

That is now a real dividend cut.

As we struggle with a badly damaged global economy, government policy is unremittingly wrong-headed: you wonder what we could do worse than the vast debt fuelled bubble after COVID?

But then we stumble on the idea of doubling or trebling domestic fuel prices. We do this to punish big energy exporters like Saudi Arabia and Russia. Only a simple clown could believe that will help us, and only a child-like vandal, that it will halt Russian armies. We take our own possessions out and smash them on the street, like voodoo dolls, because we are hurting and want others to hurt too. Nuts - it is tearing our own clothes in blind anger, but we ourselves are not the enemy.

Meanwhile, underneath all this noise, is the game up?

Is the expansion we have seen for two decades based on cheap Asian product imports, and low interest rates fuelling inflation in non-traded goods now done? The non-traded category is everything that can’t be shipped in. Land, services and the like that must be consumed, where they are provided. Although with that went quite a lot of imported labour consumption too, of course.

I keep wanting to write positively on China, but I simply don’t know. Is their COVID winter politically sustainable? Is it a massive pivot back to a closed state? Was the aberration their great expansion, and they are now reverting to being a hermit kingdom? Instinct again says no, who would reverse the greatest success story of our time? But evidence the other way just slowly piles up. Another giant nation seems slowly to be sliding towards belligerent stagnation.

And so much went crazy with the toxic mix of low interest rates, and excess liquidity. We may at last have learnt that if you have a blocked pipe, spraying it with gold is not a remedy. The pipe stays blocked, but everyone gets flecks of gold on them. Better (and cheaper) to hire a plumber.

WHAT WILL BE THE THIRD POLICY ERROR?

We certainly don’t see the recent bubble implosion reversing, for all the bluster, crypto, and concept stocks, feel to us like a long term drag on the indices, remorsesly lower.

The turn feels to be more likely in bonds. The fight is between a shrinking set of outputs, but rising prices and apparently rising consumption. As long as policy blunders persist, and they show no sign of ending; then the upward pressure on rates will also persist.

But we doubt that any conceivable interest rate rise can solve this inflation. In short, the fire must burn itself out or at least no longer be stoked up.

In which case posturing about a long run 2% 3%, or 5% rate is really guesswork. But that’s the big question. If it is 3%, we are already there, but there is no great market conviction on that. At least the belated but long inevitable addition of the Europeans to rate rises, should take some heat off exchange rates.

LETTERS I’VE WRITTEN

What about Boris? I was quite surprised at the swift and co-ordinated move to a no confidence vote. The Tory party is rubbish at a lot, but plotting it does do rather well. And also surprised at the vote itself. The rebels can not win, without a candidate that both factions like, that is the real Tory party and this odd “Cameron light” lot in Downing Street. Of course, Boris himself is already largely that candidate, talks right, acts left. Which means all sides hate him, but neither can replace him, for fear of the ‘wrong type’ of fake instead. Just what you want to be, you will be in the end.

There was also a fair bit of bile, stirred up by the media, and rather infecting what are loosely called the “activists”, who are anything but, but do bend their MP’s ears. They just want to dislike Boris and his lack of scruples, but also like the gifts he brings them.

They don’t want local trouble, so enough of those MPs voted against him, to keep their local associations happy. If that “terrible man” stays in office, they can at least claim they did their bit, but ‘others’ then let the side down.

Will Boris last up to the election?

Our core belief remains Boris stays in power long enough to hand over to Keir and Nicola. But perhaps we have rather less conviction than last week. We thought Keir was more likely to be in trouble, but perhaps the Tory plotters could be desperate enough to finally agree on a candidate? Either way this is now a lame duck UK government.

But then like markets, outside events may rescue it, it’s just we really can’t see how at present.

As for where to consider investing? Our MonograM momentum model loves the dollar, for sterling investors and for USD ones, increasingly just cash, and decreasingly the S&P, so long the global refuge.

But that is in no way a recommendation, just an observation; more detail on our performance page.

Caution: Bumpy Road ahead

Puzzle: World markets have whipsawed in the last few weeks, from high anxiety to an almost beatific calm. The VIX volatility index has dropped to pretty well a post-pandemic low. Which should mean we all agree, but on what exactly? Rising inflation, yes, but how durable, and caused by what?

And that, we all accept, will make interest rates rise, yes, but how high for how long? Markets we feel are, to say the least, fragile.

At the turn, we know that moves can be dramatic both ways, for markets.

Are we really seeing a labour shortage? The UK truck drivers’ situation

What we see now is not a labour shortage, and hence political talk of stemming migration and higher wages is well off target. What it is, in part at least, is a failure of the routine operations of an incompetent government, something politicians typically don’t want to discuss.

The government has insinuated itself into so many areas, with its complex regulations, that the market economy now lies ensnared in myriad interlocking regulations, backed up by a deeply entrenched blame culture (and its friend the compensation economy).

To take one example, there is no shortage of truck drivers, but there is a shortage of qualified, approved, signed off and regulated truck drivers, because as part of the destructive lockdown, the government just halted the conveyor belt of required testing and approvals.

Truckers’ wages have for long been too low, of course, especially for the owner drivers in the spot market. What we have is not a labour shortage, it’s a paperwork shortage. The difference is vital for how enduring inflation is. A new driver will take a couple of decades to grow, but clearing a paperwork jam, a few months. One is enduring, the other transient.

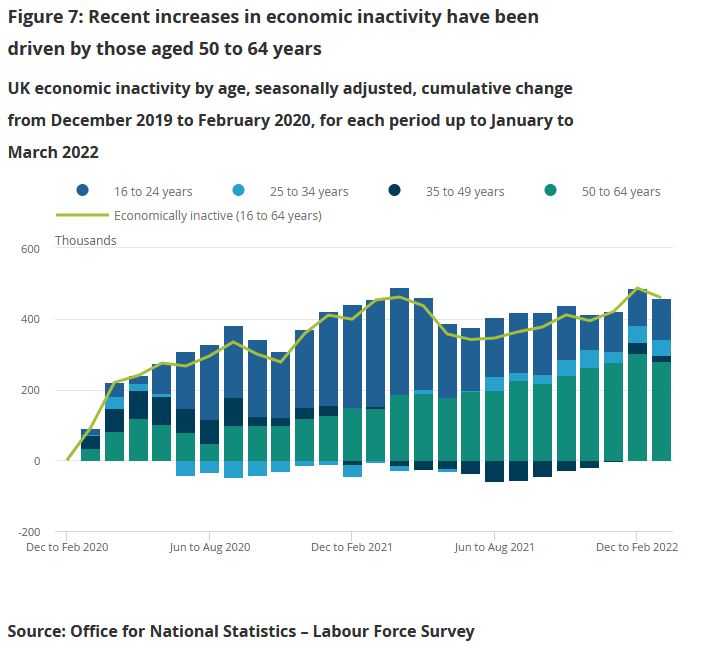

Withdrawal of older workers from the labour market

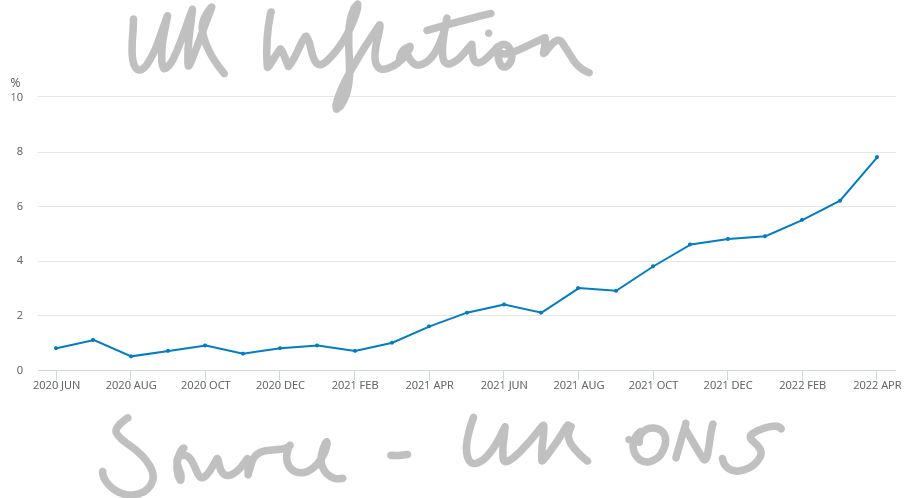

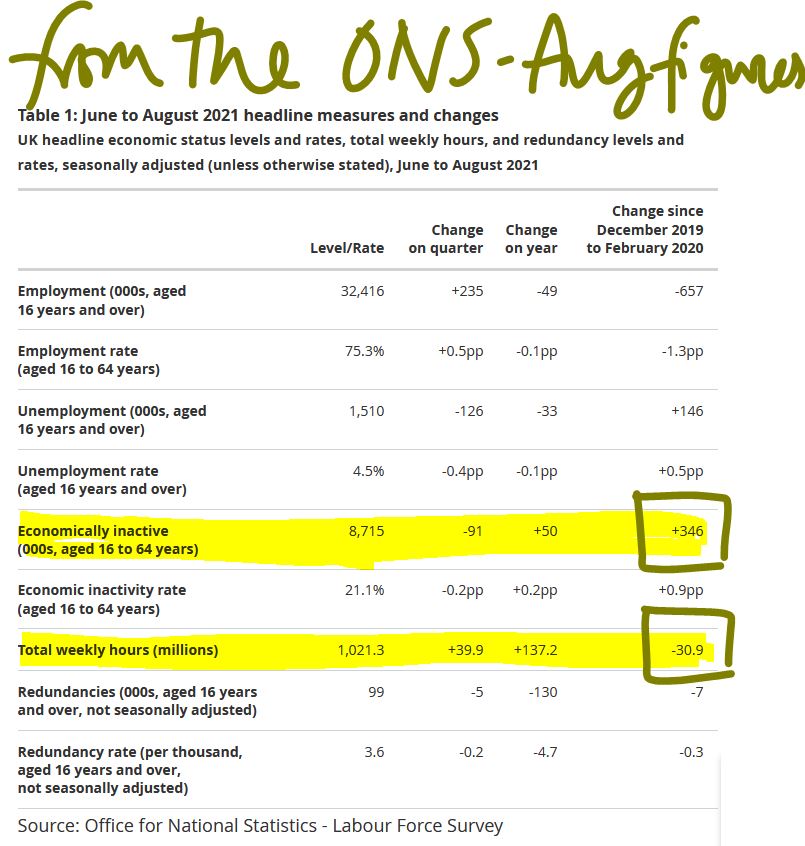

Work after all is something of a habit: once it is lost, it can be hard to understand why it existed. So, we see a marked increase in older workers in the UK who have just withdrawn from the market (Some thirty million fewer hours worked - see figure below). That too is not a labour shortage as such, they all still exist.

But if work was of marginal benefit to the worker, and the costs to resume work (actual or psychological) are high, disruption will cause the fringe or marginal job to be unfilled. Yet again more in the transient column than permanent.

Someone will waive the rules, or the government will notice, well before all drivers get paid high enough wages to cause embedded inflation. In any event articulated fuel tanker drivers tend to work for big employers, with good conditions, and are well organized. They have to be, after all they drive mobile bombs. The spot operator on a rigid rig is in a different market.

Inflation will most likely be transient

So, if it is not an actual labour shortage, it won’t cause wage inflation, and will be transient. Some other areas reliant on highly skilled older workers will continue to see standards fall, but generally younger workers will over time fill those slots and gradually acquire those skills. And it won’t be a long time.

Our view from way back was of 5% plus inflation and labour markets that struggle to clear this year. We were wrong to not foresee the failure of regulatory processes to keep up. However we still do see a permanently higher post COVID cost base and therefore in certain sectors, a large amount of marginal productive capacity are likely to be withdrawn from the market.

With a banking system that still struggles to offer commercial finance to the SME sector, because of excessive regulatory caution, there are swathes of jobs that have simply gone. So that labour will in time be redeployed. The current concern is that many of these workers show no desire, or ability under current conditions, to return to the market. But when they do, the capacity that has been destroyed will slowly return, and once more drive down prices.

Nor should we forget just how much the Exchequer loves inflation, as fiscal drag, their beloved tax on higher prices, smooths away so many budgetary blemishes. They will let it go, if they possibly can.

Commodity prices

On the input side we do still see commodity price rises as transitory, at least within the energy market. As others have noted much of that too is regulatory failure on a grand scale, not a true shortage. Price fixing by the state is a notoriously foolish concept, as we learnt in the 1970’s.

There are a number of other supply factors at play too, but while some will recur, most are temporary.

How long do we think the inflation spike will last?

So yes, inflation will spike, and yes it will stay elevated for much of next year, but no, we don’t see it as necessarily durable, once COVID restrictions and related behavioural changes vanish.

We are still pretty certain that the political costs of aggressive interest rate rises will outweigh any perceived price control benefit. As long as some Central Banks hold off rises, it will be very hard for others to do so, without sharp currency moves or bringing in formal exchange controls. That would in turn spook markets far more than rate rises.

The next phase of markets

All of this says to us that a major market dislocation, despite the benign signals, lies ahead in the next six months.

Markets shifting rapidly are more a sign of uncertainty than of a new degree of confidence, and we simply don’t trust it. We see inflation as apparently out of control, but no significant interest rate rise response is feasible. That can feel like stock nirvana, but also like investor purgatory, as you have no idea what is or is not a sustainable profit.

Charles Gillams

Monogram Capital Management Ltd

YELLOW BRICK ROAD

The recent elections in the UK probably result in a mildly stronger position for Boris in his Merkel persona, his Christian Democrat (CDU) disguise, so the fiscally left wing, culturally right-wing hybrid, that seems popular; but other than disasters averted, the poll achieves little more. For all the noise about the Hartlepool by-election, we are talking very small numbers, with a 40% turnout in a seat already slightly subscale due to depopulation and industrial decline. It has no resulting impact on the governing majority. Indeed, but for the Brexit Party, it would have been Tory already, so it really says nothing about the right-wing vote. The Tory Party is still miles from representing a majority view, but as long as the left is divided and the right united, that will persist.

Nor do I see much of interest in the council elections: a good result for the Tories in building on an already strong performance last time, which shifts the middle third of councils around in the quagmires of NOC or No Overall Control. This morass, like the bilges on a boat, washes left or right depending on the political tide. But with staff (and councillors) aware that only a few seats can shift them in or out of the NOC swamp, its impact is not great, particularly where they have elections three years out of four. These permanently transient councils tend to be run more for themselves than anything tedious like ideology or providing decent local services.

Neither Mayors nor Police Commissioners have any major power. Sadiq Khan, freshly back in office, faces a central government happy to call in his local plan (on housing) and impose central government representatives on his transport authority, thereby strapping one hand behind his back, in both his areas of real influence. Meanwhile London policing remains ultimately under Home Office control, so like the other areas is just for political grandstanding, not real service delivery. Policing in London also seems an enduring disaster: where it is needed, it is not wanted, where it is wanted, it is not needed.

Reading the Party Runes

So, what of Kier Starmer? Well, it also tells us little about his Cameron-lite policy of avoiding controversy, avoiding spending on fights he can neither win nor cares about, and ensuring he controls everything in the party. That policy is seemingly intact. The Corbyn wing will continue to spout for the microphones on demand, but matter little. The key issue is whether the big funders will want to have a go at winning the 2024 election. I think they will, but should they decide it too is lost, Starmer has a problem. If the party’s money bags decide he can’t win, he won’t.

For Boris it is at the least an endorsement of his recent COVID strategy, and that higher taxation to pay for the incredible spending splurge, has yet to impinge on voters’ minds. So, it permits him to carry on, but perhaps recover more of a strategic view, after the recent wallpaper storms? Does it make exiting COVID lockdowns any easier? Well, it should, but hard to tell if it will. Does it validate the extreme turn green? Not really, the Greens still did better in terms of new seats won, than either the Labour or Lib Dems, and are still advancing (from a very low base).

I am not sure if the Lib Dems expected much, they have Keir’s problem of irrelevance tied to being pro-European, when the EU is behaving more oddly than ever. So roughly holding their ground was fine. Indeed, they polled way ahead (17%) of national election ratings (which are more like 7%), but not over the magic 20% required to hit much power.

Those Strange US Job Numbers

Which brings us to the real shock from last week, the weird US jobs numbers on Friday. We have long said that how and if labour markets clear after the great lockdown experiment, is the vital economic issue. The problem never was the banks (so last crisis) nor the ability to borrow to sling money down the giant hole dug by the virus. Both are easy. But once you have smashed the economic system, does it regrow, like a lizard’s tail or simply start to rot and decay?

Many of us would have avoided the deep wound in the first place, but now the experiment has been started it must conclude. So, what did happen to slash monthly US job creation from expectations of a million to just a quarter of that? The instant reaction that it meant inflation has gone and so bonds were fine, was as instant reactions often are, garbage.

The bull or ‘Biden’ case is that as they have the right medicine, it just needs a bigger dose, or to take it for longer. Seems credible; labour force stats are notoriously volatile, some of the job losses came from manufacturing, where supply shortages are biting, but that’s transient. Some seem to indicate a mismatch of jobs to vacancies, hopefully also transitory.

Encouragingly, a spike in wage inflation and hourly rates indicated plenty of demand for workers.

Yet, slamming the brakes on, shutting the economy down and paying millions of people not to work, might have brutally destroyed the delicate economic system. Thousands of small firms, where the bulk of employment is created, have just gone. The complex prior system of sales, working capital, scheduling, delivering, inventory, payment has been eliminated. Sure, the people still exist, so do the premises, but the invisible mass, the self-directing hive, is lost: no map, no honey, no queen.

Bigger firms are also planning to work differently, perhaps needing less labour.

Once you stop working and get paid to be idle, and indeed have limited ways to spend your money, it feels easier to stay in bed, study Python, redecorate the house, or whatever, but not get back on the treadmill. Indeed, in a lot of cases, once you step off, stepping back on is hard and also downright counter intuitive. Sure, your old boss wants you back, but do you want the old boss back? Worth a look round at least? As the title song puts it, “there’s plenty like me to be found”.

Well, we still go with the bull case.

However, the bear one is not trivial. If you can’t get labour markets to clear, welfare will be embedded, as will high unemployment, deficits and unrest. It remains the most critical feature, worldwide of the recovery, and several questions about it remain as well, including the need to keep new bank lending elevated, cheap, available. Expanding needs cash, contracting creates it.

The oddity to us then remains, that if the liquidity barrage really does work, why should it work better in the US than elsewhere?

And if it works the same for all, don’t US markets then look rather expensive?

Charles Gillams

Monogram Capital Management Ltd

Rising Tides

First posted 21st March 2021

Interesting times.

Bond markets are out of the cage, off the deck, ready to rumble.

This week feels like another one of those big calls that investors have faced over the last year, and in many ways much less obvious. Forget the chatter, it is the bond markets that are now back in charge. While upsetting Californian law makers and the SEC is now small fry for Musk and Tesla, the bond markets will just roll over him. They are the gorilla in the room, for all those frothy tech valuations.

Bond holders are just dumping their holdings as fast as they can; like tectonic plates they move slow, but like any earthquake, you get the sudden shift, then the aftershocks, and then it will all settle down. But the landscape will have changed.

What has woken them up? Well inflation and the conviction that the colossal election bribes handed out by Joe Biden will cause inflation to go over 3% and perhaps, as important, possibly stay there. It is the stay there or persistency risk, we are looking at. We can all see a short-term inflation spike, from commodities and logistics snarl ups.

Now, everyone (including us) have been focused on excess capacity and deflationary forces. Indeed, as we keep being reminded, over 10 million Americans are out of work; but for some reason the nasty bond markets have decided giving those citizens jobs is not the priority.

So, the naïve equation Powell (at the Fed, who I keep reminding readers, is not an economist by training) is working on, is if you stuff circa 20% of US GDP in one end, all of course borrowed, out pops nationwide low paid jobs, focused on the low skilled workforce, by the ten million or so. Now that’s the bit which is no longer credible.

It seems more likely all that stuffing is instead creeping into asset price inflation, with virtual currencies attracting a lot of speculative flows and likewise hot stocks, be it SPACS or GameStop. None of these areas provide much of the required nationwide low skilled employment.

A Detailed Look at the UK Employment Statistics

So, what is happening? Well, a more detailed look at the labour market in the UK (not the US), provides some clues. My source is the Office for National Statistics, February Labour Market report. Not a bad date, as the year-on-year figures are clean; from the March one onwards, we will have the COVID shocks in the annual comparator.

The employment crisis is hitting the young hardest, under 25 employment is dire, of the job losses year on year, 58% were in those below 25. While we have both lower employment (so people exiting the labour market) and also higher unemployment (so not working, but available). Noting that furlough for these purposes remains classified as employed, which is a little moot.

But here is the paradox, wage inflation is also very apparent, hitting 4.7%, which is recorded as 3.8% above actual inflation, so a pretty high real rate. Now that’s not causing deflation at all.

While the furlough impact, doubled to December (from 5% to 10%) of the workforce, and no doubt has now gone up again, with the arts, entertainment and recreation industries (sic) and food service industries, each having over half their workforces on furlough.

So, while the claimant level has been stabilized quite well, we see relatively lower levels of actual employment, but with the secure workforce getting good pay rises, well over inflation, and those in less secure positions, or who are younger or in the wrong sector, hit hard.

Should Preserving Capacity be the Real Concern?

The assumption then is that the labour market is clearing, indeed faces inflation, for those in work, but for those who are not, there is a big presumption that the leisure sectors will bounce back hard and take up the slack. You wonder if just more money across the board, is the right way to tackle this specific problem. Oddly if this was in banking or steel, a targeted approach aimed at preserving capacity would now follow. Time to rethink that? Although if everyone gets a “gift”, then fewer people will complain they missed out, given how politically charged both steel and banks became, you can see why; but it is poor economic policy.

This two-speed position is also apparent in other Government statistics, tax gathering is going well, the annual self-assessment returns were higher than a year ago, and total tax returns only marginally lower due to reduced VAT income from the leisure sector. The strain on Government finances is on the other side, excessive spending, not reduced tax. On tax receipts, inflation via fiscal drag, is already working its magic.

What the Bond Market is Afraid of?

So, the bond market fear is that more of the stimulus will go to the “wrong” places, than the “right” places, creating inflation in areas that are already running hot. While Central Banks have apparently decided they no longer think about money, just the jobs market. Which is also odd, because they have so little control over it.

Indeed, the heavy political pressure in the US to sharply raise the minimum wage, must work in the opposite way, as must the surge in automation and home working. It is noticeable that when Trump tried to turbocharge labour markets with a tax cut, we had a pre-emptive rate rise from the Federal Reserve. Clearly this time round Janet Yellen has told Powell that if he tries that stunt again, he is out.

So, What do Investors do?

We did not expect this rise in rates so soon, but nor do we see it automatically stopping at this level, as Powell has clearly said he won’t intervene more to hold rates down, nor will he acquiesce by raising overnight rates.

Broadly rising rates, with rising inflation is good for equities, but the end of free money is less good for the out and out speculators, who can gamble on trivial things, without a great deal of care.

It is these periods of cross currents, short sharp movements, that are toughest to navigate. While the first order effects will be in falling bond prices and the badly overvalued tech markets globally deflating; so, all of that stuff with inflated multiples or no real sales. But the second order impact will be on equity markets overall and on currencies.

At some point if you can get a nice return in bonds, even better a real return for holding them, there will be a lot of money heading that way. It is a finely judged switchback, taken at speed, if they raise rates and then find inflation (and employment) actually starts to fall, the Fed can again wreak havoc by going too fast.

While elsewhere boring may in the end be best, especially in well run financials. There is an old market saying that a rising tide lifts all boats, but perhaps not the electric ones this time?

Our own Performance

Our own VT Global Total Return Fund has now had three distinct patches of outperformance, in the last year, as against behemoths in the Absolute Return space. All, as it happens, since Monogram joined the team, as investment advisors, although that really is co-incidence.

One such good patch would be fine for us. It is of course partly good timing (for whatever reason), but it may also be that small, focused funds like ours, can simply turn that much faster and make the needed adjustments more quickly.

Which then generates patches of outperformance, three in a row is starting to make a real difference compared to just “buying IBM”.

While we are now running unusually high cash levels, we know markets don’t stay this kind for long.

Charles Gillams

Monogram Capital Management Ltd