Rishi or Truss, can either be worse than Boris?

Also, we do seem to be decisively leaving the decade of low rates and by implication the experiment of quantitative easing. On a twelve-month basis, bar the FTSE 100, all major markets are down, although that is only just true for Europe and Japan. The Nasdaq and Aim are the big losers, and their recent recovery looks like a head fake to us.

We look at the global economy, and investment options.

So, what does the race for the next UK prime minister now look like?

It is not that important anyway, if as I assume, the next election is lost already.

These are stand in candidates, with no real grip on the party and likely to be loathed by the surviving group of Tory MP after that 2025 contest. Like a relegated football manager, they will have shaky job prospects.

Is there much to choose between them? Again, I am not sure, they have established that the party to its core hates higher taxation, whatever fantasies Boris had, and some at least understand that a smaller government or higher debt, is what the hard choices of governing are about.

I rather expect much of the ‘difficult’ stuff attempted by the last Cabinet will get ditched by new ministers. It still would be wrong to say the new team can’t achieve much, the governing majority is solid, and further bloodletting inconceivable. I would anticipate that they will still have two and a half years to run.

The two candidates compared

Sunak is admired for his high-profile experience as Chancellor, disliked for his willingness to raise taxes, loathed for wielding the knife on Boris. Truss is thought to be opportunistic, and rather unfairly for being dim and not substantial.

But I don’t expect much of a change, more fiscal conservatism, less besotted greenery, perhaps less socially liberal, but only to the extent of holding the line, not really rowing back. Short term stability, long term decline.

Preparing for another European killing field?

But you do feel Sunak would be less of a cold war warrior.

The report that the Chief of the British General Staff had called this “our 1937 moment” and launched “Operation MOBILISE” suggests the bloodlust is well and truly up, all adding to the hefty training programme. We are already deep into a proxy war ourselves.

I hear it is just as insane in the Pentagon. There is even high level gossip about this being the final great “killing field” in our centuries’ old hostility to Russia.

Economy : two questions affecting interest rates and inflation

As for the global economy, we had two great questions for the year, how long could the Fed “extend and pretend” over inflation, and how quickly everyone else would then play catch up.

Well pretty well the day Powell was re-confirmed earlier this year, he binned the Jackson Hole pretence that high employment did not have to mean high inflation.

I suspect (and so do markets) that he won’t really go after inflation, if he did so, we would have interest rates in double figures by Christmas.

Bread, job, and a roof, these three a politician must provide, and just one without the others, is a vote destroyer.

The current modest level of rate rises will let inflation creep lower, but will not control it, and we don’t see interest rates topping out for quite a while, not helped by the very low starting point. Although overall, it looks like the currency markets are forcing the rest of the world to follow in raising rates quite fast and in the end, to the same levels. Nevertheless, in Europe the response to double digit inflation, has so far only extended to ending negative rates.

As if that will matter, as the Euro collapses; they will have to move faster. Lagarde confidently delivering total guff and mysterious lawyerly threats won’t save Italy.

The economic models everyone is relying on to forecast otherwise, seem to assume no incremental rise in energy prices next year, and indeed a sizable fall. That maybe so, but there will still be a lag as this year’s rises have not been fully absorbed and will echo and bounce around the economy for a while to come. Not least through a still very tight labour market, which has several years of lost capacity due to COVID and indeed the familiar demographic time bomb.

A slackening in wage inflation needs US and Northern European unemployment to at least double; no sign of that yet. It is a muddled employment market with spatial and skill deficits, so increasing capacity where it matters, will take time. Not least because of persistent high surplus labour levels to the South and West in Europe.

So, if the Fed (and Wall Street) insists (as it does) on calling this transitory inflation, or now the new phrase, ‘peak inflation’, they are simply using dud econometric models (again).

What next?

Cash flow will again be king, capital will be well rewarded in the bond markets, dividends will have competition, non-dividend payers face a long winter. Experience of the dot com bust, and then the banking crisis, suggests it takes three or four years to retool models based on prior poor capital allocation (and boy have we had that). Not the three or four months which is being assumed.

Granted we were oversold at 3666 on the S&P 500, perhaps an auspicious low. Yields meanwhile had shot out beyond reason, but reluctantly we consider this pleasant bounce can’t survive. We accept too that earnings are OK, but they are in most cases a poor indicator of economic forces that take years to establish themselves. The extinction of even capitalist dinosaurs takes time.

And then there is the great concertina of rates: ignore what each Central Bank says, in the end they must march to one beat, that of the dollar.

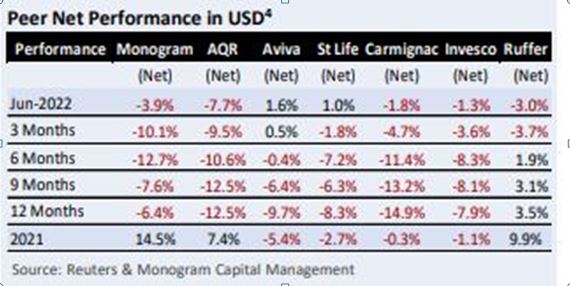

Monogram performance, compared to others in the Absolute Return sector

It is striking that our USD MonograM model now holds no equities or bonds, our GBP MonograM model is fully invested in both. While the list of storied Absolute Return managers who fail to beat our model remains embarrassing.

Download the newsletter of which this table is a section, for the full data.

There is no availability of this model, except through ourselves; perhaps it is time to talk to us about using it?

Do get in touch, an exploratory discussion is never wasted.

We wish you a pleasant summer: as good Europeans, we will fall silent for August.

I hope it all looks clearer when we return.

Charles A R Gillams