Where will the cards fall ?

The half year approaches - what has happened? Two very different quarters so far. And Investment Trusts complain too much, having stuffed their boards with placeholders with minimal stakes in the shares and multiple appointments. In markets many things still depend on how the cards (and ballots) fall.

THE FIRST HALF

With current interest rates for hard currency, high yield bonds, around 6%, you would expect riskier equity markets to be giving you over 10% a year, made up of a mix of capital and dividends. That’s the bar; it is quite high just now.

Looking back a year, only Japan and America comfortably achieve that, the S&P up +24%, NASDAQ up +30%, Nikkei up +14%. Germany creeps in at +10%, neither France nor the UK do. Outside developed markets, it is largely dire, only India at +25%.

Then looking just at the first half, all of Japan and Germany’s gains came in the first quarter, so they are now sitting well off their twelve-month highs. While as we know the big three, S&P, NASDAQ and SENSEX, are now close to all-time highs, they powered through the second quarter.

So, the challenge is, do they go on up, do the markets that have fallen back, after a good first quarter, come back to life, or do some of the dogs perform?

Some major markets, Friday close and intra day

I have no great faith in the UK market, nor in a new government being much better at growth (it can hardly be worse) than the current mob. But there are cheap looking international stocks in the UK and the punishment meted out to real assets, by interest rates and shrinking bank balance sheets, might be finally ending.

While quite clearly the good middle tier stocks are easily cheap enough to lure in bidders from abroad or private equity, in some number. UK valuations are in short OK, not something you can necessarily say about the US.

The residual underperforming markets do often have a nice yield, but who cares? With bond yields high and staying high, in an appreciating currency, why take a cut in yield in order to buy equities? Plenty of time for that later.

Anyhow in most European and Emerging markets, equities seem not to be able to get out from under their own feet, endlessly tripping over their own fractured politics.

INVESTMENT TRUSTS

We are hearing a lot of moaning about Investment Trusts, which the FCA really do not like. EU law always struggled with the trust concept anyway. That the FCA has shown no interest in freeing us from those shackles is not a surprise, it seems they too would rather channel money to Nvidia than invest in the UK. Here is their Lordships’ briefing on what EU rules we might be repealing. Nothing for Investment Trusts.

I am on balance on the Trust’s side, I do think closed end structures (as they all are) allow long term decisions, while protecting daily dealing, one of Europe’s quirky hang ups. Daily dealing is fine in deep markets, but an illusion in many medium and small equity markets. With liquidity ever more narrowly focused, closed end funds seem more, not less, important, for balanced capital allocation, competition and growth.

Trusts directors should also protect investors from over mighty fund management houses, who treat closed end funds with disdain, as captive funds, with often high fees. Their greed lets in low-cost passive competitors. Instead, their permanent capital should come with an obligation to hunt down good, index beating performance.

Sadly, the FCA has perpetuated a system, where the fund management house appoints the Boards, not, in reality, the other way round. So, they are decorative, good for marketing, and highly unlikely to fire the manager. Too many are industry insiders, serving on multiple trust boards, often in sequence. Seldom do they have an investment of at least their annual pay cheque in their current Trust, and often, little investing expertise in the relevant area.

So, Investment Trust boards hardly ever sack fund managers for poor performance. David Einhorn explains the bigger issue very clearly, noting benchmark hugging over time is what investors now get. There is a clear link to poor performance and bigger discounts, and to big discounts and treating shareholders badly: One area where big certainly does not mean better.

Rather than sabotage the sector with old, irrelevant EU law, the FCA should be hunting down poor performance, and making the “independent” directors just that, including banning directors shuffling around a set of one-manager trusts.

INTEREST RATES

We have just had Powell hold US rates, saying it is all data dependent, and slightly oddly he conceded the expectation is for a pick up in inflation, on the technical grounds that the abrupt drop in inflation last year, creates base effects.

Although he rules out more hikes; you get the feeling if he had held his nerve last summer, and added a bit more, inflation could be beaten by now. Not that he wants to or can add such instability now, so he is stuck, and we with him, watching paint dry.

With no real distress there is no pressure to cut prices, service inflation remains too high, energy prices are still quite strong, so no longer giving a deflationary boost. Both the AI boom and the resulting stock price gains, encourage consumer spending and keep (in most sectors) a strong labour market.

Markets are evidently OK with that, falling rates, no recession, growing earnings, is almost ideal. Meanwhile we are all hoping that Congress will keep either of the two old men from doing anything unusually silly, and the electorate will keep Congress on a tight leash.

Quite a lot of hoping and several months still to go.

DREAMERS

What would Trump’s high tariff isolationist world look like? What would the mirror image be in Xi’s China? Not now, not next week, but rolling into the next decade.

And whatever portfolio theory says, and whatever the optimistic investor believes, 80% of my own portfolio is flotsam, drifting up and down on Pacific tides. Stocks I both like and which have compounded over decades are remarkably few. Oh, and a brief word on African housing.

GOING IT ALONE

But first, to give it the grand name, autarchy, or self-sufficiency. A bit of a joke - the Soviet Union tried it, Iran tries it, China famously only revived after ditching it.

But it is back in fashion, and not just in strange places. The EU industrial and agricultural policy is starting to look like a version; beyond their four walls they need carbon and chemicals, but within them they don’t, nor will they allow imports of them (or products including them). Quite fantastic.

Trump is on his 60% tariffs line. Xi clearly wants to cut off foreign capital, as it arrives infected with democracy and transparency, and the associated foreign reporting or verification.

So, could they? Yes, the US could - it is big enough, can do most things, and largely trades internally. While at least in Trump’s imagination the commercial borders are sealed, and so enforceable.

What goes wrong? Well at some, quite distant, point people stop expecting to trade with the US. So, at its most extreme, if China can’t sell to the US, it won’t buy from them either. But that is decades away, most Chinese production can probably take a 300% tariff, and still sell at a profit.

The flip side of the tariff is the huge salary for a barista, or a trucker. The latter is not so far away. Prices of domestic US production must rise, to allow the blue-collar Mid-West to rejuvenate. US consumers of course (including that barista) will pay vastly more for US goods, or will get hit with the import tariff; this of course is a tax on them.

What about Xi? Well again it is possible - that’s how China ran for much of his life, with a lot of new infrastructure, industrialization, since installed. He can do it all again. There, unlike in the US, the issue is capital. As a big net exporter, an area that will itself be under pressure, money will be harder to find; it already is.

THE NIGHTMARE

Countries that go through this closing cycle typically also do default (as the Soviets did, as US (and UK) railways did,). Folly, but it can be done.

The US has been going down this route since Obama, Trump talked a lot about it, but Biden too sees the resulting wage inflation as a good thing. So, it is the next US President’s policy either way.

Obama was keen on hitting capital markets (FATCA was and remains both a non-tariff barrier (I am being polite here) and a tariff on external capital) and I suspect a Biden administration must do the same, to balance the books.

While Xi never really left protectionism, WTO and GATT were mainly honoured in the breach.

And Europe? There is quite a strong strategic need to expand to the East, although as that goes through (and we are talking the mid 2030’s here) Ukrainian farmers, like Polish farmers today, will buckle under the rules; it barely matters about the Donbas, the EU will shut those heavy industries down too.

So, I think autarchy can work for all three, it will support a large uncompetitive labour force, and consumer choice will vanish. In many cases there will be lower quality and high prices. All three will attack (or in some cases keep attacking) capital flows.

And in the end, the entrepots will survive, those not in any such block, like the UAE or Singapore today, Amsterdam in the 17th Century, Yemen under the Romans and Victorian Britain.

The winners will be flexible, a tad amoral, assertive, in fluid alliances, but reliant on gold not steel to survive. And they will suck in entrepreneurial talent too. At a strategic level, that feels the place to be looking. Although buying uncompetitive heavy industries before their brief period of tariff induced profitability, has a short-term allure.

DOGS OR GREYHOUNDS ?

The ludicrous halving of CGT allowances, based on some fantasy “yield” number from the equally ludicrous HMRC, via the OBR, means once again the tiresome process of harvesting losses is upon us. No longer can they sit unloved at the back, snoozing; out they must come.

And what a tale of dross they reveal, and scattered amongst them so many once “good ideas” and busted yield stocks. Well, it sticks in the throat, but perhaps sticking it in a US wonder stock for six months is better?

Of course, if I knew when I acquired them that the FTSE was moribund for two decades, I would never have bothered. Seems it is time to simplify.

COLLATERAL

And lastly African housing. It was one of Gordon Brown’s (and the PRA’s) great achievements to get UK banks out of overseas assets, far too volatile, currency? foreigners?- Who needs them? Bring it all home and inflate the UK housing market with safe, cheap, mortgages.

So, Citizens went, Barclays were hounded out of South Africa, and so on – although their post-sale performance has really not been great either. Africa now just does not have proper mortgage financing for the vast bulk of the population. This is at a level I had failed to fully comprehend.

You think that despite everything, Africa must have got better. But no housing, so less health, less stability, no financial security. Safe recycling of profits in the continent is still hard. Aid can’t create institutional reform, but that’s the need.

If you look for the breakout into developed status, it starts there.

The Glass Bead Game

We look today at a domestic version of a complex, rulebound meaningless pursuit that too many of our brightest and best waste their lives pursuing, and whose twists and spirals ultimately signify nothing. I mean the UK Office of Budget Responsibility (OBR), of which I took a tour this week. Almost nothing there is as it seems.

Meanwhile markets reprise 2023, with tech or bust once more. Although tech and bust is the market fear, as fiscal stimulus and services inflation hold rates too high for some to survive.

UK OBR

The OBR was an explicitly political creation of the coalition government in 2010, with a remit to somehow restrain the ever-increasing debt governments take on, to bribe electors. They were also keeping half an eye on the much older ‘debt ceiling’ style US legislation. It failed; so now the OBR just thrives on telling the government how much more it can spend or not collect, with spurious accuracy; purportedly managing public money.

It doesn’t forecast anything as a forecast is an expected outturn. All it does is crank the handle on the old, discredited Treasury model, creating projections. A projection is 1) a ‘what if’ assuming all other things are equal and 2) only as good as its underlying model.

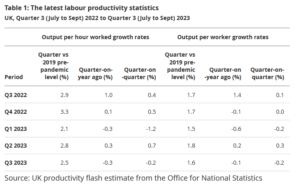

One clear flaw is the requirement to take government spending plans as viable when they are usually not. They also have no idea where public sector productivity is heading. It has no remit to look at how productivity might be helped and no capacity to look back at how wrong its old ‘forecasts’ were. That is the job of the National Audit Office, it seems.

It also won’t talk to the Bank of England, as that organization has executive powers (to raise or lower rates) and the OBR apparently must just be a commentator: more glass bead rules.

So, it fiddles with the model and its six hundred inputs and countless equations to give precise answers to pointless questions, because each answer sits in its own vacuum.

There’s a heavy focus too on tax revenue, but with quite a thin staff, this results in excessive reliance on HMRC, who can be hopelessly wrong (and typically over optimistic on tax yields). But again, if the tax bods claim some complex, job destroying, arcane nonsense will raise income, in it goes. The side effects of such decisions must also be ignored.

It has no remit to assess how taxes impact productivity, which partly explains many of Hunt’s blatantly anti-growth measures. As a result, the economy is locked into low productivity, getting steadily worse.

From the ONS flash report here

For all that the financial press will be full of the OBR cogitations on the forthcoming budget (March 6th). One little bit of power they do have involves a requirement for the Chancellor to give ten days’ notice of the budget contents (hence no doubt the usual leakage levels) and for two months before that, they sift through proposals and indicate how each, in isolation, would work. The economy is an interconnected entity, they know, yet there is no attempt to give us an overall view.

THE LOST RALLY

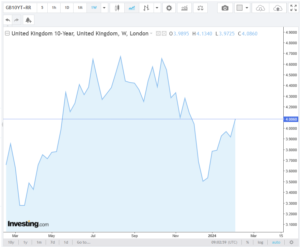

I have few rational reasons why anyone would lend the UK Government at under 4% for ten years, were it not for some foolish faith in the OBR projections, without reading the small print.

Which brings us to markets: back in November the UK ten-year gilt yielded 4.5%, by about Christmas falling to 3.5%, and now it is back over 4% and headed higher.

Chart from this website

Quite a spin in ten weeks for a ten-year duration instrument. This is why that Christmas rally in value stocks was ignited, and indeed started to push out into Real Estate, various Alternatives and certain smaller stocks.

Although it didn’t move those stocks most sensitive to the credit markets, who will need to rollover/refinance current debt. This affects for example, the renewables, private equity, and office property. The problem there is of both rates and availability. With the scale of asset mark downs, whether interest is 6% or 8% is not the issue; there is no funding appetite even at 20%.

The year-end rally moved a wide group of stocks, from extremely cheap to still very cheap. We then realized that it was not yet safe to go back in, so buyers evaporated, and prices faded. With state debt at 4%, against persistent inflation, fixed income is also oddly unenticing. So, the market default has been to pile back into the biggest, most liquid, US tech stocks and similar easy-in/easy-out momentum trades, like bitcoin.

There is little sign of deflation in services, no evidence of it in housing, where supply issues dominate, and little in financial services; indeed, all the supply side mess of COVID and excess regulation, is simply getting worse. Public sector pay inflation is also high and going higher (don’t tell the OBR).

This does not dent the 2024 story of cutting rates and hence higher stock markets, but it may require some patience, and that delay may itself create more pain.

The Glass Bead Game and the ‘lost marbles’ qualification for office

Our games of self deception are not to be confused with lost marbles of course; it turns out that the onset of senility is now a bar to being prosecuted for storing secret state papers and also, somehow, a recommendation for re-election for four more years, to the most powerful post in the world.

If that ends up giving us Trump again, by default, presumably he will at least have a defense in future years, against those same crimes? He does not have the “Biden defense” available at present, perhaps thankfully.

As the OBR shows, very clever institutions can come up with very silly solutions.

Reserve in Reverse

Fallen Emperor?

With almost two thirds of global equity markets represented by the US, the fall in the dollar so far this year is quite dramatic, and for many investments, more important than the underlying asset.

UK retail investors are especially exposed to this, as although Jeremy Hunt (UK Chancellor) may not notice it, the US is where most UK investors went, when his party’s policies ensured the twenty-year stagnation in UK equity prices.

While Sunak continues to pump up wage inflation, which he claims, “won’t cause inflation, raise taxes or increase borrowings” Has he ever sounded more transparently daft? Sterling, knowing bare faced lies well enough, then simply drifts higher. Markets know such folly in wage negotiation can only lead to inflation and higher interest rates.

We noted back in the spring, in our reference to “dollar danger” that this trade (sell dollar, buy sterling) had started to matter, and we began looking for those hedged options, and to reduce dollar exposure. To a degree this turned out to be the right call, but in reality, the rate of climb of the NASDAQ, far exceeded the rate of the fall in the dollar.

While sadly the other way round, a lot of resource and energy positions fell because of weaker demand and the extra supply and stockpile drawdowns, which high prices will always produce. But that decline was then amplified by the falling dollar, as most commodities are priced in dollars. So, a lot of ‘safe’ havens (with high yields) turn out to have been unsafe again.

The impact of currency on inflation

Currency also has inflation impacts. Traditionally if the pound strengthens by 20%, then UK input prices fall 20%. The latest twelve-month range is from USD1.03 to USD1.31 now, a 28% rise in sterling.

In a lot of the inflation data, this is amplified by a similar 30% fall in energy, from $116 to $74 a barrel for crude over a year. In short, a massive reversal in the double price shock of last year. In fairness this is what Sunak had been banking on, and why the ‘greedflation’ meme is able to spread. But while that effect is indeed there, other policy errors clearly override and mask it.

A Barrier to the Fed.

In the US we expect the converse, rising inflation from the falling currency, maybe that is creeping through, but not identified as such, just yet, as price falls from supply chains clearing lead the way, but it is in there.

Finally, of course, this time, the dire performance of the FTSE is probably related to the same FX effect on overseas earnings assumptions. Plus, the odd mix of forecast data and historic numbers that we see increasingly and idiosyncratically used just in the UK. If the banks forecast a recession, regardless of that recession’s absence, they will raise loan loss reserves, and cut profits, even if the reserves never get used.

Meanwhile, UK property companies are now doing the same, valuing collapsing asset values on the basis of the expected recession, and not on actual trades. So, if you have an index with heavy exposures to stocks, that half look back, half reflect forward fears, it will usually be cheaper than the one based on reality.

Why so Insipid?

OK, so why is the dollar weak? Well, if we knew that, we would be FX traders. But funk and the Fed’s ‘front foot’ posture are the best answers we have, and both seem likely to be transient too.

If the world is saying don’t buy dollars, either from fear of the pandemic or Russian tank attacks or bank failures, that’s the funk. As confidence resumes and US equity valuations look more grotesque, the sheep venture further up the hill and out to sea. To buy in Europe or Japan, they must sell dollars.

The VIX, in case you were not watching, has Smaug like, resumed its long-tailed slumber, amidst a pile of lucre.

From Yahoo Finance CBOE Volatility Index

So as the four horsemen head back to the stables, the dollar suffers a loss.

The Fed was also into inflation fighting early; it revived the moribund bond markets, enticed European savers with positive nominal rates, (a pretty low-down trick, to grab market share) and announced the end of collective regal garment denial policies. But having started and then had muscular policies, it must end sooner, and perhaps at a lower level. So that too leads to a sell off in the dollar.

Where do we go instead?

So where do investors go instead?

In general, it is either to corporate debt, or other sovereigns. Japan is not playing, the Euro maybe fun, but not so much if Germany is getting back to normal sanity and balancing the books again. So, the cluster of highly indebted Western European issuers are next.

Sterling now ticks those boxes, plenty of debt, liquid market, no fear of rate cuts for a while, irresponsible borrowing, what is not to like?

For How Long

When does that end? Well, the funk has ended. You can see how the SVB failure caused a dip in the spring, but now the curve looks upward again. Although fear can come back at any time, as could some good news for the UK on inflation. However even the sharp drop the energy/exchange rate effects will cause soon, leave UK base rates well south of UK inflation rates.

So, every bit of good news for the Fed, is bad news if you hold US stocks here.

How high and how fast does sterling go?

Well, it has a bit of a tailwind, moves like any other market in fits and starts, but could well go a bit more in our view. Oddly the FTSE would be a hedge (of sorts).

PICTURES OF MATCHSTICK MEN

I noted at the end of our last bulletin, that markets are feeling strangely bullish, for a few reasons, which I share. Although only in some places. I still find little attractive in most debt markets. They are cheap, but given losses this year, are they good value?

And UK politics is becoming boring, which is no bad thing.

So, were we right to predict that interest rates alone cannot tame inflation?

Our original thesis for this year, that interest rates could not tame inflation alone, maybe is right. The level needed would cause too much damage. But that is applicable (we now see) to the UK, but not as yet to the US. And oddly perhaps not as yet to the EU either, although Lagarde midweek, perhaps had the same tilt. But German profligacy may wreck that.

The logic is the same for them all. You can’t tame this beast by rate rises alone, as double figure inflation needs double figure interest rates and that is just not happening.

The UK is certainly not prepared for that level of rates and fiscal restraint is therefore now required. Fiscal drag will do some of the heavy lifting, and energy price declines a fair bit more.

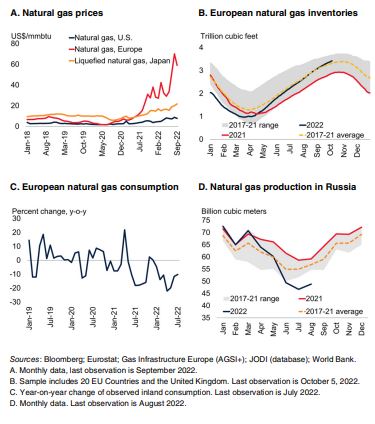

Some commodity market statistics were released by the World Bank, this quarter. The above graph is extracted from their statistical report

But tax rises and government spending cuts will still be needed to cool the UK labour market. In particular the public sector must be reined in, or service cuts made.

Earnings will fall, taxes rise, growth stall, discontent rise. But still no collapse in housing (secondary) markets or in employment.

Nor do I therefore see much rise in loan defaults. This makes the recent round of forward-looking bank provisions unusually daft. You can’t audit the future, so how can you include it in historic accounts? A weird hybrid. Best to ignore all that and focus on now, and now is still not terrible. With a pretty hefty valuation discount in situ.

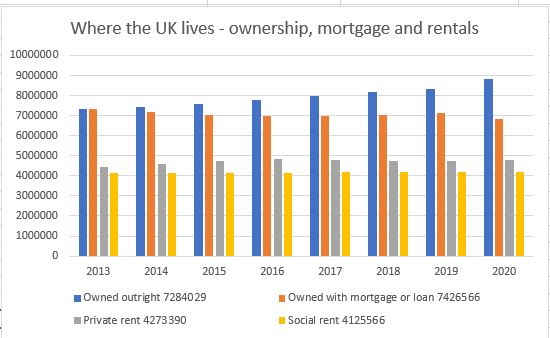

(Data downloaded from the Office of National Statistics for this in house graph).

The US political situation

In the US, The Federal Reserve have effectively said if there is no fiscal restraint, they will ramp up rates till there is, or inflation falls. That is scary, but it looks as if the Mid Terms will hobble Biden and stop some of his fiscally reckless measures. He thought the wave that toppled Kwasi missed him, but it was the same ocean, and likely will give him a rough ride too.

Biden’s approach felt good, overindulgence often does, but the pain of the untethered dollar is now starting to hurt US earnings, and in time US jobs, however much they dream of legislating against that. The impact of rate rises is also probably less than it sounds in the media, partly because most reporters are likely to have mortgages, whereas a growing number of investors don’t.

Overall US government policy remains to force up inflation and challenge the Fed to sort it out. Hence all the Fed threats are directed not at the market (which cares) but at The White House (that does not). Mid Terms (on the current path) will therefore be a big boost to US markets, as it means Congress at least, will start to work with, not against the Fed. As with Kwasi, a reckless budget will not pass unchallenged again this time. Those extremes belong to the COVID era, that is now over.

Comparison with the UK position – and where Europe maybe is headed

With that battle already won in the UK, both sterling and to a degree UK rates are reverting to the status quo ante. And as sterling rises so the FTSE falls; that link also remains. If the UK is neither chasing interest rates up, nor letting the pound fall, it gives Europe some cover to do likewise.

In truth although sounding dramatic, in the real world it is inflation that really counts not (as yet) interest rates which are still absurdly low.

The Tory Party – what can we discern?

Talking of status quo, that’s where the Tory party is now headed. Cameron drifted too far left, Boris dithered, Truss drifted right, and now the new government is a hybrid, although colloquial English perhaps has a stronger word for it.

I sense that spending decisions may correctly be back with a powerful Chancellor. There is a seeming party truce till the next election, when half the current Cabinet seats will vanish anyway, and then who knows?

Or if this coup and enforced hybridisation fails, we really will know the party is split, and a General Election could follow. Unlikely, though.

Why bullish then?

US earnings except for highly indebted outfits, will probably stay surprisingly strong for a while yet. And likewise, the dollar pivot point is being pushed further out, as no one else in the developed world is going for rates quite that high (or that fast).

There are also two market forces to look out for, rising rates and slowing growth is one, but the simultaneous loss of liquidity is another. The former will cause a patchwork of changes, both good and bad, but the latter the ending of a multi-year bubble.

It all remains cyclical – a transition, not a bounce

The difference is key, rates are possibly a two-year cycle, a bubble a ten-year one. The bubble in non-revenue companies, and in absurd multiples for even profitable tech, will take longer to deflate, be slower to re-inflate and be muddied further by all that spare capital accelerating technological change. This is still not an area we either feel confident in, or trust their valuations.

If we really are back to the status quo in the UK, about to be in the US, why would markets be going down, down, deeper and down?