The Times They are A Changin’

Rishi or Truss, can either be worse than Boris?

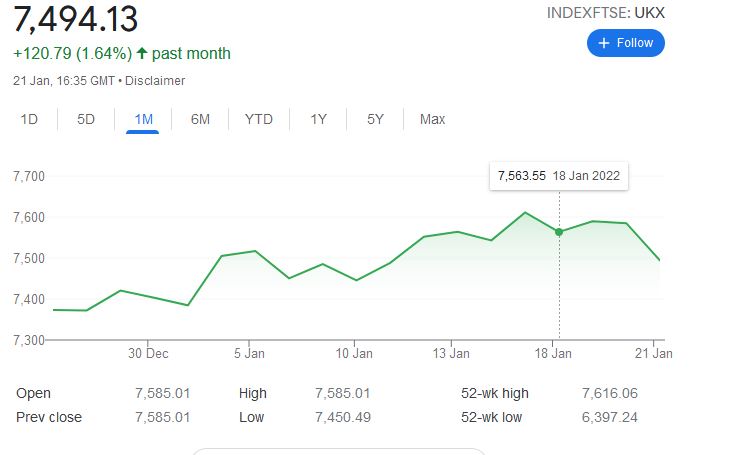

Also, we do seem to be decisively leaving the decade of low rates and by implication the experiment of quantitative easing. On a twelve-month basis, bar the FTSE 100, all major markets are down, although that is only just true for Europe and Japan. The Nasdaq and Aim are the big losers, and their recent recovery looks like a head fake to us.

We look at the global economy, and investment options.

So, what does the race for the next UK prime minister now look like?

It is not that important anyway, if as I assume, the next election is lost already.

These are stand in candidates, with no real grip on the party and likely to be loathed by the surviving group of Tory MP after that 2025 contest. Like a relegated football manager, they will have shaky job prospects.

Is there much to choose between them? Again, I am not sure, they have established that the party to its core hates higher taxation, whatever fantasies Boris had, and some at least understand that a smaller government or higher debt, is what the hard choices of governing are about.

I rather expect much of the ‘difficult’ stuff attempted by the last Cabinet will get ditched by new ministers. It still would be wrong to say the new team can’t achieve much, the governing majority is solid, and further bloodletting inconceivable. I would anticipate that they will still have two and a half years to run.

The two candidates compared

Sunak is admired for his high-profile experience as Chancellor, disliked for his willingness to raise taxes, loathed for wielding the knife on Boris. Truss is thought to be opportunistic, and rather unfairly for being dim and not substantial.

But I don’t expect much of a change, more fiscal conservatism, less besotted greenery, perhaps less socially liberal, but only to the extent of holding the line, not really rowing back. Short term stability, long term decline.

Preparing for another European killing field?

But you do feel Sunak would be less of a cold war warrior.

The report that the Chief of the British General Staff had called this “our 1937 moment” and launched “Operation MOBILISE” suggests the bloodlust is well and truly up, all adding to the hefty training programme. We are already deep into a proxy war ourselves.

I hear it is just as insane in the Pentagon. There is even high level gossip about this being the final great “killing field” in our centuries’ old hostility to Russia.

Economy : two questions affecting interest rates and inflation

As for the global economy, we had two great questions for the year, how long could the Fed “extend and pretend” over inflation, and how quickly everyone else would then play catch up.

Well pretty well the day Powell was re-confirmed earlier this year, he binned the Jackson Hole pretence that high employment did not have to mean high inflation.

I suspect (and so do markets) that he won’t really go after inflation, if he did so, we would have interest rates in double figures by Christmas.

Bread, job, and a roof, these three a politician must provide, and just one without the others, is a vote destroyer.

The current modest level of rate rises will let inflation creep lower, but will not control it, and we don’t see interest rates topping out for quite a while, not helped by the very low starting point. Although overall, it looks like the currency markets are forcing the rest of the world to follow in raising rates quite fast and in the end, to the same levels. Nevertheless, in Europe the response to double digit inflation, has so far only extended to ending negative rates.

As if that will matter, as the Euro collapses; they will have to move faster. Lagarde confidently delivering total guff and mysterious lawyerly threats won’t save Italy.

The economic models everyone is relying on to forecast otherwise, seem to assume no incremental rise in energy prices next year, and indeed a sizable fall. That maybe so, but there will still be a lag as this year’s rises have not been fully absorbed and will echo and bounce around the economy for a while to come. Not least through a still very tight labour market, which has several years of lost capacity due to COVID and indeed the familiar demographic time bomb.

A slackening in wage inflation needs US and Northern European unemployment to at least double; no sign of that yet. It is a muddled employment market with spatial and skill deficits, so increasing capacity where it matters, will take time. Not least because of persistent high surplus labour levels to the South and West in Europe.

So, if the Fed (and Wall Street) insists (as it does) on calling this transitory inflation, or now the new phrase, ‘peak inflation’, they are simply using dud econometric models (again).

What next?

Cash flow will again be king, capital will be well rewarded in the bond markets, dividends will have competition, non-dividend payers face a long winter. Experience of the dot com bust, and then the banking crisis, suggests it takes three or four years to retool models based on prior poor capital allocation (and boy have we had that). Not the three or four months which is being assumed.

Granted we were oversold at 3666 on the S&P 500, perhaps an auspicious low. Yields meanwhile had shot out beyond reason, but reluctantly we consider this pleasant bounce can’t survive. We accept too that earnings are OK, but they are in most cases a poor indicator of economic forces that take years to establish themselves. The extinction of even capitalist dinosaurs takes time.

And then there is the great concertina of rates: ignore what each Central Bank says, in the end they must march to one beat, that of the dollar.

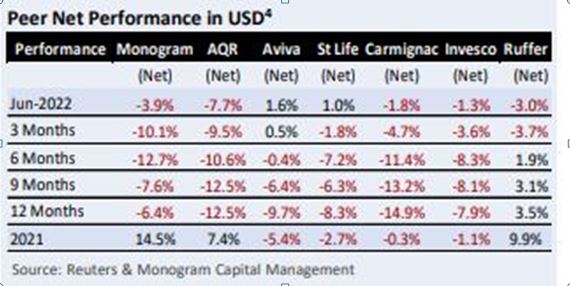

Monogram performance, compared to others in the Absolute Return sector

It is striking that our USD MonograM model now holds no equities or bonds, our GBP MonograM model is fully invested in both. While the list of storied Absolute Return managers who fail to beat our model remains embarrassing.

Download the newsletter of which this table is a section, for the full data.

There is no availability of this model, except through ourselves; perhaps it is time to talk to us about using it?

Do get in touch, an exploratory discussion is never wasted.

We wish you a pleasant summer: as good Europeans, we will fall silent for August.

I hope it all looks clearer when we return.

Charles A R Gillams

He who pays the piper

A very strange quarter: the FTSE100 was up, in sterling terms the S&P 500 was up, and the Russian Rouble ended where it was just before the Russian invasion. Short term dollar interest rates are nicely positive at last.

So where is the problem?

UK policy changes – could we finally be leading in economic policy?

Well, at long last the UK Chancellor has finally realised that just throwing money at inflation has one clear outcome: more inflation. This is tough lesson learnt back in the 1970’s and seemingly since forgotten.

If true it is a turning point and we predicted that it must always come sooner for the UK, if it persists in staying out of the Euro, than for bulkier continental currencies. Sunak also seems miraculously to be finally tackling some long overdue, multi-parliament, structural taxation issues, a rare sign of political maturity.

Whether he can hold the line against an increasingly dimwitted set of MPs and a media who constantly bay for more fuel to be added to the inflationary fire is unclear, but at least he has had the courage to step out into the unknown night, not cower by his warming bonfire of magic myths.

Nor is it clear whether he has the clout to unpick the cosy mess created by Theresa May and her childlike energy price fixing, or the ensuing nonsense from Ofgen. This fine-tuned capacity to the point of absurdity, guaranteeing a massive breakdown in the generating buffers, which had been painstakingly installed under a series of Labour governments.

Inflation policy is being taken seriously

But Rishi is trying; to cool inflation you simply must have demand destruction, there is no choice. This type of deep-seated widespread inflation will be hard to quell in any other way. True, areas of it can be contained, but it is hard to hold it all.

He is lucky to be helped by a Bank of England that seems to be serious about its brief, not regard it like Lagarde and Powell, as some kind of political inconvenience, to be wished away in double talk and evasion.

But he’s unlucky in other ways; we noted a while back that China no longer seemed to care about headlong export led growth, or more broadly about access to hard currency. It feels it can invest with and gain from its own currency and avoid importing the monetary excesses of the West. That in turn means it cares less about the endless flows of cheap goods to Europe and the US, and conversely about soaking up those surpluses in luxury goods and services. None of this is good for our inflation.

Meanwhile by eliminating the oddly divergent starting points for the two income taxes, National Insurance and Income Tax, Sunak has opened the way to many benefits. It continues to drop taxpayers out of the system, despite desperate measures by HMRC to suck more in. A key step, and a sign of, for once, a more liberal, more efficient government. Many more steps are needed to unshackle wealth creation, but it is a start. It makes much of the Universal Credit complexity around thresholds also fall away. Most of all it is a step closer to combining the two income taxes.

Politically this is highly desirable, as it strips away the pretence of a low starting rate of taxes on income.

It perhaps even gives an excuse for the otherwise inexplicable step of introducing National Insurance on employees passed retirement age. Given so much of current inflation is due to the mass withdrawal of older workers, another step in that direction looks remarkably stupid, but perhaps it has a higher purpose. It is good to see that the “Amazon” tax as Business Rates should be called, as it gives Amazon such a massive earnings boost, is also clearly still under long term review.

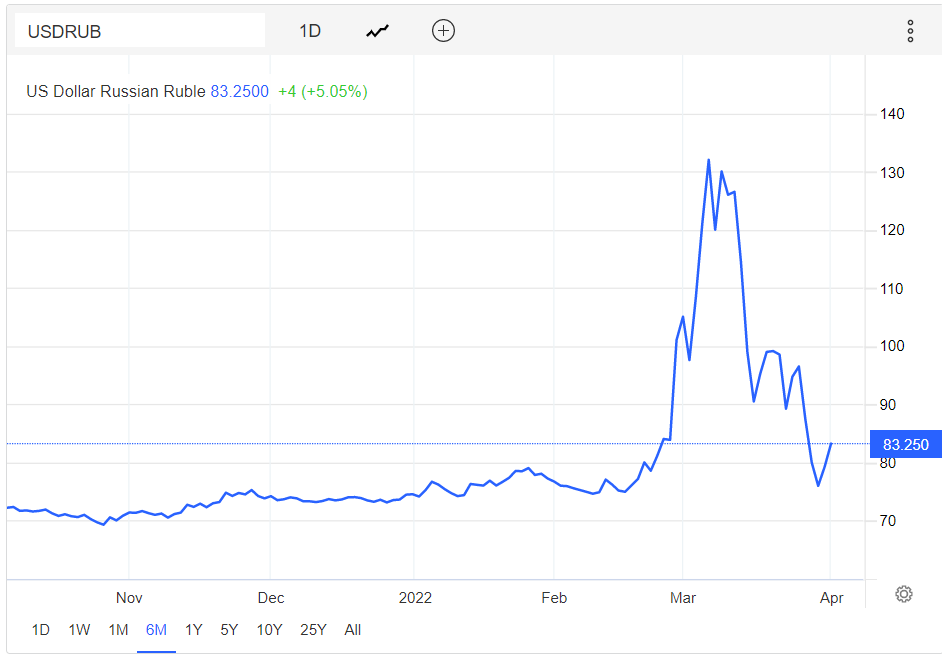

Why has the rouble recovered?

Source : this page on tradingeconomics.

The recovery of the rouble is of course not a market step alone, doubling interest rates, exchange controls and the mass withdrawal of exports to Russia from the West, are part of the story too. But it also shows a turning point. At first the West was so shaken by Russian military attacks, it was prepared to follow its own scorched earth policy, regardless of the harm caused to our own people and employers.

But at some point, the realisation that Ukraine’s army would hold, that Putin’s army was not that good after all, especially up against modern weapons and we start to understand that the further blowing up of our own bridges just raised the ultimate bill. Here are the sanctions we've imposed.

So, it seems it is no longer true that any price is worth paying to help Ukraine or hinder Russia. Clearly, we don’t have to jettison all our principles in dealing with other tyrants, nor one hopes do we need to alienate every piece of remaining goodwill with the rest of the world, by panicked grandstanding.

The mob is still rampant, goaded by an American president for whom no European economic sacrifice is too great.

But maybe it is also time to tell Ukraine that no NATO also means no imminent EU: Brussels has its hands full with its own struggling ex-Soviet states.

And what about Powell and his policy?

Well, we don’t expect him to hold inflation down with his trivial rate rises, nor politically can he do more than tinker. It seems too that Lagarde at the very least has to get Macron back in, before telling the bitter truth about rates.

So, we feel the bond market has rates where the market would like them to be, in the US, not where they will be set by the Fed anytime soon. And the Euro is now in a very odd place, still with monetary stimulus being applied and with an unstable gap to US interest rates.

So, we may look to be where we were late last year, but in most cases the cracks are now alarmingly wide.

Europe, quite urgently, but the US as well needs a sharp jolt upwards in rates to halt inflation.

Oddly only the UK looks to have spotted the danger, stopped the false COVID ‘economic expansion’, tightened fiscal policy, reformed taxes and raised base rates steadily, towards where they need to be. How unusual.

Long may PartyGate continue if this is the end result.

We will take a break for Easter now, and resume on the 23rd.

If the first quarter is a guide, by then everything will have changed again.

LOCATING THE ELUSIVE BASE

the investment impact of recent events

CRANES

I spent last Sunday in the elusive pursuit of grus grus, in the upper Marne basin, East of Paris. For some reason the Common Crane had already left in a bid to cross Central Europe, heading for the Artic, weeks earlier than in most seasons. Clearly, they knew something about the airspace ahead of them.

While the largely empty Lac du Der, also had lessons on levelling up; here was a vast and disruptive engineering scheme, it seemed executed without too much controversy, operating well and with the surrounding villages wealthy, quietly prosperous and largely content. Or so it looked in the February sunshine. It was all in pretty harmonious concord with nature too.

THE FRENCH MODEL

It seems the French can see the grand scope of government, the need to provide top class infrastructure. Here is their France Relance plan up to 2030. Up to 3-4 billion Euro is likely to be spent in 2022 alone.

The issue is perhaps not just politics, but the unspeakably low quality and lack of vision of the UK governing class. The French cities have retained their great buildings, the administration is a high profile and visible force, not something to park in the burbs, having ejected them from city centres to grab their assets for still more rentier housing. Nor does the state foolishly aim to do everything, the peage (and TGV) enable high class fast communication, but certainly not always for the lowest price. Nor is health care completely and absurdly free, irrespective of demand. But it is effective.

Power is cheap and plentiful, no hysteria about nuclear there, and the military proud and visible, even the transport police are packing heat. So, watch that off peak ticket schedule.

Of course, not all is rosy. COVID hysteria still ruled, masks and vaccine passes were required for everyone, for everything.

Yet if any UK government is serious about leveling up, (as in the recent White Paper) here is both a lesson, and an indication that Gove’s piffling attempts are a mockery; he needs more like £48 billion to start it, not £4.8 billion.

You feel they just picked up the easy option from the choices their tired civil servants had suggested. Perhaps it was the one that said, “No real impact, but sounds OK for now”.

UKRAINE - Did Putin miscalculate the West’s indifference?

Ukraine? Not a lot to add to that. We were wrong that Putin was not stupid enough to do it. Wrong too that it would be over in hours. So, treat our topical ignorance with care. Also, wrong that the West would shilly-shally over piecemeal sanctions. Whether we are wrong yet again in assuming that without a quick win, the sanctions will now damage the global economy quite badly, remains to be seen. I also suspect seizing Central Bank assets can only be done once and once done, global finance and investment will become far more fractured, forever.

But in truth, it was going that way already.

However, this blind market panic seems absurd. I really doubt if Putin, at this point, wants to line his battalions up on a border to provoke NATO, who are I suspect closer to an aerial counter strike than he thinks, and would indeed now love the excuse of any incursion on NATO soil.

He has made it into a popular potential war for the West, the most dangerous sort.

War Tactics

It looks to me as if Russia wants a pincer movement, to isolate Ukraine’s forces in the Donbass, plus a threat to Kiev to topple the government, but has he the muscle to take and hold all of the vast country? Even if he does, that does not suggest he will go further than Ukraine, just now.

While his aims are so blatantly false, success can be easily claimed for almost any outcome. So, a collapse in currencies, and stock markets across Eastern Europe, looks an exaggerated response. True, this is Germany’s worst nightmare come true, no competent military and a gun-shy US, so they must now realign fast, and where Germany goes, so goes the EU. It is not going to fold or fissure in the face of this explicit threat. Although Germany at heart is much more like the UK than France; rapid execution will not be quite as easy as simple announcements. Remember the farce over moving Tempelhof airport?

As yet, the final step of directly locking in Russian energy supplies, large parts of which go to German consumers, has not been taken, but that would, in the short term, be very costly.

Although high taxes on energy give governments a great incentive to let prices rip, (and demand destruction is great for the climate lobby too), but they are rather less popular at the ballot box.

Interest Rates

Meanwhile Powell remains determined to stay behind the curve on rate rises, it is as if the received wisdom on rates, indeed on Central Bank power, has been quietly ditched, and instead he is hoping inflation burns itself out through demand destruction/supply creation. Well, an interesting experiment, but if that’s the game, as we have predicted for a while, inflation will remain gently smouldering, but rate rises will still be very gradual.

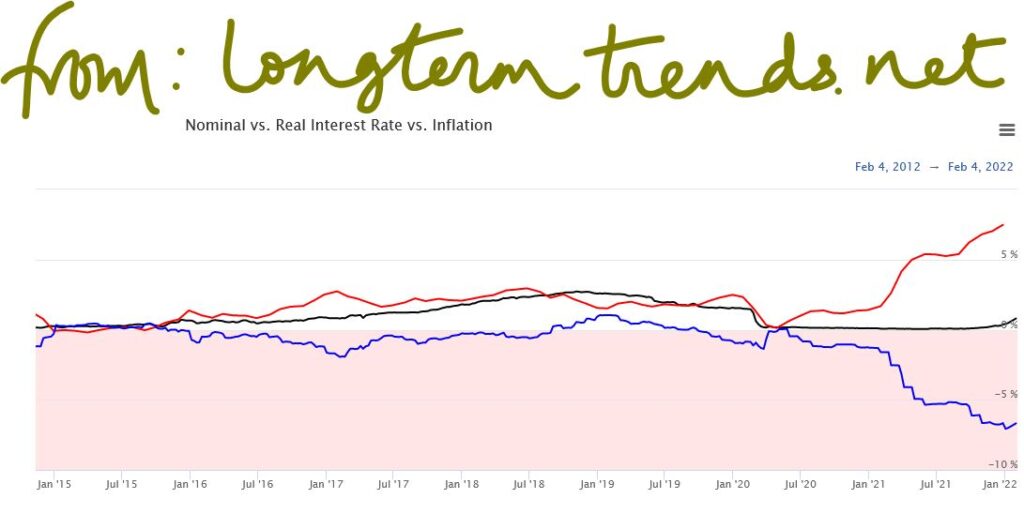

The Fed should have turned off the monetary stimulus and reset to ‘normal’ six months ago, by the time they finally move, it will be a full twelve months late. Real rates are deeply negative, levels not seen in decades, and moving fast, this is really not quarter point stuff.

All of the above implies on-going nominal economic growth, ongoing share price appreciation (at least in nominal terms) and an ongoing reward for borrowing to excess.

But despite the rush to safety currently supporting the US dollar (and US assets) the danger to markets is not just from the noisy, tragic, East but also from experimental monetary policy in the US.

DETONATION OR ROTATION

Two big market forces are at work just now, one is rotation out of the low interest rate winners, to wherever we go next, the other might be something more spectacular.

Enough of the market still sits in the “don’t know” category, to make everyone uneasy. The VIX is high.

So, what would cause the more explosive outcome? Traditionally higher rates divert more of the profits of indebted companies to banks and bondholders, so the theory goes, reducing dividends. Or at the more extreme level, this also makes refinancing debt harder.

This comes with a ‘second order’ impact, in that consumers or buyers also shovel more towards the banks, less towards the producers.

But none of this seems remotely likely yet, the world is awash with cash, and savings levels and interest rates have barely stirred from their COVID slumber.

Markets seem to be just talking about normalising, not slamming the brakes on.

Will we grow regardless of inflation?

The other big risk would be a failure of non-inflationary growth, which also seems unlikely. There are few practical signs of governments enacting the type of supply side restraint needed, we know. We still look for some self-restraint on how much governments seize in taxation; with high inflation taxes should be being cut, or thresholds systematically raised, but that’s also not happening.

The ‘idiot populace’ as curated by the media, constantly wants more supply side restrictions, greater consumption and lower prices, as if this was all somehow available; it is not. The worry here is that governments having messed up the big issues, give way to yet more populist demands for the impossible. At the same time, markets are also getting a little less keen to finance such nonsense or, being markets, raising the price at which they do so.

Well, all that is possibly true and has been happening for a while, but the old theory was that innovation was too fleet footed for any of that stuff to matter much. This is getting a bit tired, but broadly still seems to hold.

What if Ukraine does erupt?

So, the third detonator is in Vlad’s hands. Is a reverse Barbarossa coming down an autobahn near you? Well let’s assume yes, because he’s finally lost it. It is still fairly clear that if he steps onto NATO territory his army is in trouble, US and NATO airpower will rapidly outgun him. So, I discount that. But perhaps Ukraine does indeed end up like Belarus. China will support Putin, so the UN is irrelevant.

Then what? Well, a nation the size of Spain gets locked out of European commerce. Not important. Defence spend goes up? Well, some would say ‘about time’. Germany can decide to burn coal or nuclear or freeze, see previous answer. Come to that, so can we.

Given Russian gas must go somewhere, a bit like Iranian oil, it probably goes to China, which then trades it or cuts back its own Far East imports. Gas as we all know, can’t be stored for any useful length of time. Russia needs the earnings from it, so it will emerge on the market somewhere, at pretty much the current price.

It will be messy, it will create hard choices, but Russia is well on its way to autarky already, it can certainly live without dollars. Is this really a detonator? On its own, I doubt it.

Where is the rotation?

So, we still conclude all this market reaction is rotation, and it is out of overpriced US equities, where Biden created the biggest inflation bubble by far, and where interest rates are rising faster than elsewhere in the OECD. Hence, we see the hazard as mainly still on Wall Street, and to a lesser degree to the US economy. We’re looking at rising rates, a strong dollar, increased detachment from the global economy, and none of it helps earnings, but nothing is catastrophic either. The US (unlike the UK) wisely seized the chance to be energy independent.

But even so, we are not yet that concerned, valuations in the US are still extreme, as many sets of earnings seem to show, once the market looks at forward guidance, it shudders, and prices fall. A lot of built-in growth is needed to get price earnings ratios back down to earth, and that’s what’s being hit just now. To use a forty or fifty times earnings multiple, needs a lot of confidence about the future. That stretched temporal certainty is now lacking.

This is not that unusual for a rotation, but in that case, markets will bounce, and that will suddenly move a lot of funds off the side lines and back in. Where is that process now? Well going back to the Jan 27th low is causing some excitement. But we are not sure even that’s a disaster. Overall, the taking out of that and the October 2021 S&P low, won’t be fun, but the market still had a heck of a run up last year.

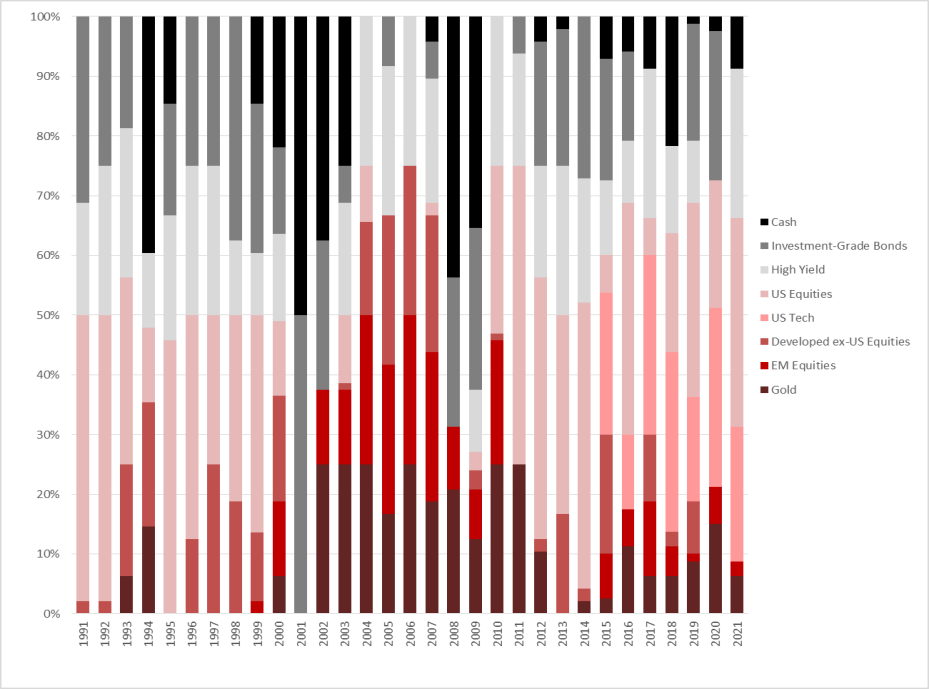

Have a look at where our MonograM investment model allocates funds based on momentum, over the last three decades, the US is absent for significant stretches. We rebalance monthly, the next one will be most interesting.

And inevitably, we do feel cautious too, but it is about levels, not wipe outs. Rotation not detonation.

Charles A R Gillams

Monogram Capital Management Ltd

Sea change

A trio of influential knaves to worry about this week, united by a belief that “this time is different”. Well pantomime season is behind us, however we can still all shout “oh no it isn’t”.

Boris seems to be the least of our problems, if the greatest of villains, for the scurrilous crime of enjoying himself, what a rat. While Powell is providing an increasing threat to the poor and exploited across the globe by generating financial instability, and the lamest of the lot, Lagarde is just repeating a political line. The Euro zone debt figures look like this. A sharp rise from an already overstretched position, but still benefiting from falling rates, so when that rate line turns, the problem will really bite.

Will markets ever trust the Fed (if they did this time, outside the gilded denizens of Wall Street) again? Hopefully not, the trouble with putting administrators in charge of Central Banks is they rely only on historic facts, it is in the job description, that’s what they polish, hone and serve up.

But the economy is dynamic

The mismatch is that the economy is dynamic, and has no printed rule book, beyond that of the rocket; what goes up, must come down, immutable like gravity. And you simply can’t wish gravity away.

So, this Fed is programmed to repeat what it can see looking backwards, and all the obedient commentators on Wall Street who simply echo its nonsense, are of little use, except to fleece the gullible and to signal false comfort to one another.

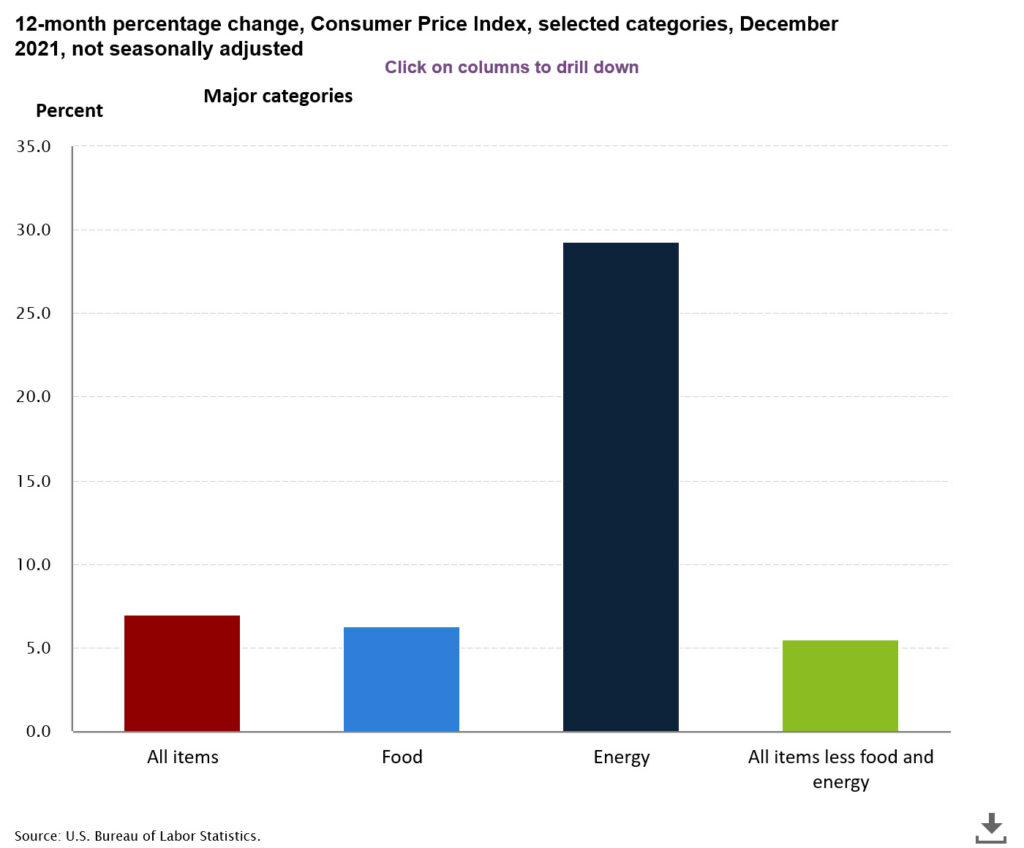

Having said for most of last year “there is no inflation” they have turned on a sixpence, to say inflation is now out of control. Talking of six or seven rate hikes; they wish, just banker’s fantasies. Although markets, not surprisingly, are now suddenly jittery.

Investment implications

This week we went from feeling over 20% cash was too cautious, to feeling we had missed the boat on value stocks, back to feeling 20% cash was really just fine, all in the space of four short days.

So, because that sea change in inflation expectations was so abrupt, this is a genuine dislocation, we do see the NASDAQ and both the concept stocks on infinite multiples and the mega tech stocks on thirty- or forty-times earnings, as in some trouble, in a process that does not feel over yet.

There is a ton of selling, and the spoofing assets, including crypto, will be heading down, in a dip that feels likely to be around for a little while. But two things stand out, firstly until rates start to top out, this excess money simply can’t go into bonds, so what happens to it? Secondly if the market assumptions about Powell and Lagarde are both right, you are going to be paid handsomely to hold dollars, while simultaneously being charged to hold Euros. We don’t see that as sustainable either. One must be wrong.

Looking ahead

This is why Lagarde’s confidence in no rate hikes, feels like a lawyer’s bluff, as if currencies move, it won’t be her choice for long. While uninvested money, on which fund management fees are still charged, always makes asset gatherers nervous; it will all go somewhere.

That also leaves the question of how much growth we will actually see, as if it is below expectations, then inflation will be choked off, labour force participation will fall, US rate rises will run out of steam. There are already signs of that. While given the scale of market movements, the ending of bond buying by the Fed (long overdue) and even a modest run off of the balance sheet, will be pretty irrelevant, both are really drops in the financial ocean.

The froth blown off

So, the good news is we will see normal investment conditions, the froth blown off, bonds producing a yield, along with slower growth and moderating inflation, which we do feel will be backing off by mid-year. All of course will rather depend on the progress of COVID, because we still see (and have done for nigh on two years) this inflation is directly caused by COVID responses.

Reducing the output capacity of the economy, with no cut in demand, has to cause price rises. These price rises will exist everywhere COVID does, so trying to pin them to a single cause or location is not easy. They will persist until the demand/capacity equations correct, which with COVID is a multi-year task.

The FTSE finally gets a look in

So, a sea change yes, a market dislocation yes, but if it is as bad as is currently feared, with some big winners resulting in the financials, real assets and energy. All of which, on those fundamentals, still look to us good value, hence the visible support for the FTSE 100.

While if it is not that bad, sufficient money will flow into US Treasury stock, from low interest areas, forcing the dollar to rise, and rates down, until other areas are simply pulled along. So no, we won’t then be getting seven rises on this data and equity markets can start to relax.

And what of Boris?

Finally, Boris, now degenerating into farce, but much as we hate what he has become, we recognize one wing of the Tory party feels he is too right wing, while another feels he is too left wing. Both dream of replacing him with their own, but in so far as he splits the difference, the risk that the other faction wins, should keep him in office.

Either faction will demand more of his replacement than they can ever deliver, given that core fundamental split, so such a divide simply hands Downing Street to Keir Starmer. For now, I still feel he survives, and given his nature he will remain impervious to change, but remarkably adept at promising it.

Sterling seems notably unfazed by it all.

Charles Gillams

Monogram Capital Management Limited