Sunak's Slaughter

FALLEN WALLS, FALLING VOTES

A few stats: Labour collected 9,698k votes, the Tories 6,835k, Reform 4,114k.

In vote share terms it was 34% Labour, 24% Tory, 14% Reform, 12% Lib Dem. A united right would have been ahead of Starmer on 38%. Labour dropped votes, (9,698k for Starmer against 10,269k for Corbyn), since the last general election.

What Boris did, and Sunak failed to do, was hold Reform, who did not stand in 2019 in return for some nebulous hint. Farage was scurrying off to the US, until Sunak bizarrely announced policies designed to outflank Reform. In doing so, quite apart from baffling his own party, he broadcast his fear. Once the ridiculous return of National Service was rushed out, Farage knew Sunak’s weakness and duly reversed course.

Farage is in little mood to stop, his victory speech highlighted “the building of a centre right party”. No, not hyperbole, he already holds the votes, in no small part, from demonstrating the tiresome habit of consistency.

Although it is simplistic to see Reform as right wing, it is (in so far as it has policies) populist, it won its toehold in Westminster in seats of deprivation, not just of big Tory majorities. Part of its vote was from Labour, although it poses no risk to Starmer. But the Tories, after a virulent set of campaigns to deny Farage a seat, lacked the firepower this time. Farage is in the building.

But surely a great night for the clown party and Ed Davey? He has taken the absence of policy and the primacy of performance (the wrong sort) to new depths. He lost votes too, getting nearly 175,000 fewer than in 2019. Ed Davey had 3,520k, against 3,696k for Jo Swinson.

WHICH TORY PARTY?

What of the Tories now? They still need Farage’s vote bank. Either they neutralise it, as Boris did, or absorb it as John Major did, or they are out of power for a decade.

That seems obvious.

What seems highly risky, but quite likely, is they just leave Reform to fester. So, the ruling cabal of centre left Cameron acolytes plough on, piling defeat upon defeat.

Across Europe these archaic centre right parties have blown up, their only preservation is the equally ancient UK electoral system, for which the Tories (24% of the vote) seem the only advocates, Labour adopted a pro-PR vote motion at their last conference, and the Lib Dems, Reform and Green votes would easily make that a majority.

It is coming at some point. In some form.

Clipped from the Labour Policy Forum Page

Do not read too much into that SNP wipeout in Scotland: in the face of the extraordinary mix of sleaze (much unproven) and a well-funded (compared to England) but disastrous NHS, the SNP vote share held up at 30%, suggesting the dream has not died.

It will probably hold on to a high number of Holyrood seats, based on PR in those elections. The sole Tory loss in Scotland, saw a messy local fight between candidate and party.

Labour now has its own issues of success; it will be unwise to treat the more rural seats they have won, as any more than loans. Like the Tory Red Wall seats, these are unstable, single term members, it is not practical to help them (as Boris showed).

While Labour have also unleashed some big beasts, most notably Rees-Mogg and Liz Truss. The Tory party would be wise to lasso both, less they graze elsewhere; their attitude towards them will be very telling.

NEXT TIME

After the last election, in early 2020, even pre-COVID, I predicted 186 seats for the Tories in 2024, none in the Red Wall.

I am inclined to repeat that.

I see this as a Lib Dem high tide. Devoid of policy or power, stripped of the virulent anti Tory votes, unable to add voters, I see them fall away. While Reform is not close to power either, but the SNP will probably be resurgent. So, Labour could easily suffer a loss of a hundred seats, down to about 310, still the largest party, but potentially needing a deal to rule.

That is the real reason for Starmer to govern from the centre. For that he might actually win votes next time.

The extreme alternative outcomes are about the Tory/Reform issue: how the already dominant right-wing vote is divided. As in Europe, they are now numerically strong, and the deals to stifle those voters voices’ increasingly seedy and unstable.

If the Tories spurn their right wing, it splits to Reform.

If the Tories spurn their left wing it splits to the Lib Dems.

Either split creates a third party with over 100 seats and hence a route to power.

Instead, the Tories need unity, a cap on recriminations, no triumphal ascendancy, no coups, and an end to the chaos of central office, and its hapless parachute candidates. The party needs true devolved powers to the associations – and the party must spend money on good agents. That is where they will rebuild to back over 200 seats.

Then it has a chance.

Will it take it?

Despite the noise, as we listed above, successful political parties don’t add voters, in the main, they just don’t lose them.

Otherwise, markets feel dull, and thin. Central Banks have a sparse diary. France might excite, but likely will see stalemate. The big story remains the clash of the dwarves.

Charles Gillams

Too chilled

Markets seem far too relaxed about world elections; we suspect from ignorance. Logically if you move from certainty to uncertainty (with a range of possible outcomes) you should adjust your level of risk. India has already shown some of the volatility of the 'wait and see' approach.

Too hot?

So, we start there, where prior confidence in an enhanced majority for Modi, was well wide of the mark, he ended down 63 seats at 240; a majority is 272. Some of that chaos is the electoral system, and some of it the ban on opinion polls - although some accurate information inevitably crept out, despite restrictions, but international investors did not pay much attention to it.

So, when the exit polls announced all was well, the market rose, only to reverse hard when the real result emerged within a few hours. Although then buyers came back in, and we ended up flat.

From this website – date published : 8th June 2024.

On a call with local managers, (and the options for investment in India are wider than you might assume) clearly something had changed, one was almost pleading with the international audience not to take money out. Very little spooks other fund managers quite like being repeatedly asked to not redeem.

The Congress Party has almost doubled its seats, from 47 to 99, a strong result. The other beneficiary was the Samajwadi party, nominally socialist, with a strong presence in Uttar Pradesh, a vast Northern state. They went from 5 to 37 seats and are very much in Modi's BJP territory.

India has always had strong states, with the more populous ones often having a local ruling party, which has been around for ages. So, this is a reversion to the long term normal.

In house collage of a state by state analysis of Indian share ownership percentages

But that is what scares investors; coalitions nearly always break down. There was also damage to the Index from the Adani group of interlocking holdings (long hounded by Congress for alleged corruption).

A weaker Modi

That allied with the long-standing fears about political corruption, uncertainty of policy and no national enforcement, is an unwelcome reminder that Modi is now in his last term. Hopes that stability will follow him, rather than a swing back to the broken past, always felt optimistic.

The commonly voiced issue is that a weaker Modi will have less ability to drive structural reforms and will find it harder to resist welfare payments, and labour demands. Historically, some of these payments and concessions reach the poor, either in higher consumption or better services, but a great part gets stuck with middlemen. That should be less of a problem now, as a result of reforms already implemented, putting in a national bio identity scheme and almost universal individual banking services.

We will see.

While generally expecting strong growth to persist, we are now more cautious about signs of the lost consensus, into the medium term.

The UK - far too chilled

Which brings us to the farce that is a UK General Election, where such discourse as there is has been about whether families are or are not facing a £2,000 tax hike (or roughly 20% more for those on average earnings). Not knowing where they live, or how they spend their money, or indeed how they will adjust to high taxes, you can never tell these things with much accuracy.

This comes with minute (and futile) attempts to list every one of the myriad ways that the assumed tax hike won't happen and extracting a "pledge" from all parties not to raise them. As if all Chancellors do not have multiple ways to raise revenue, carte blanche to create new charges, and a great ability to lie or concoct exceptional circumstances to hit us. Sunak of all people should know that.

Yet most voters are thinking, is that all? Is it enough? We know that existing service demands are not being met and that no party seeks to resist the endless demand for expanded services.

I doubt if growth will save us either: we are close to the point where those that can take investment elsewhere, have left, and no sane investor would now invest, without substantial state subsidy. So, we are simply building up to an inevitable budget crisis in the medium term.

There are a few who hope that change will be its own reward, maybe, but we can't really tell much until after the first Budget, (Labour have pledged to revert to just one a year), and a couple of Parliamentary sessions.

Just waiting and hoping is illogical. Markets do just that, though.

Frozen in the US

Which brings us finally to the USA, the Presidential election feels (to me) fairly easy to call, but how the US Congress and Senate go, does not; the resulting power (or otherwise) of the President is less easy to predict. It may be that we get a split between parties again, which markets like, and it feels unlikely (but possible) that we end up with constitutional change, which markets certainly won't like.

The current Federal Reserve Chairman will be in office for all of 2025, but almost certainly not beyond that, and who replaces him, will figure high on the consequential concerns, as unlike other Central Bankers, he sets the global tone. Powell is not popular with either of the spendthrift presidential candidates seeking office. Nor will he be trying to get reappointed. He has been an odd and erratic champion for the dollar and sound money, but he has been that.

I am not sure other elections are so consequential, the European Parliament has hopefully done its worst already, while investors in both Mexico and South Africa are starting from a low base of limited ambition.

So, to us, the question is how long to follow benign short-term themes, while such dramatic shifts may be hitting us within six months.

Inactivity from ignorance remains attractive, but is it wise? At some point in the interim, markets will probably decide not.

NOT THE FOGGIEST

We have no idea why we are having a General Election just now. Not the foggiest idea how we remove the keystone of free trade and yet the edifice of beneficent competition remains intact. We have not much idea how you have free capital flows without free trade, or how floating exchange rates then work.

But we are all about to find out, apparently.

Meanwhile, we did enjoy Andrew Bailey’s valedictory talk, at least under this decade of Tory rule, to the LSE. It made clear the Bank’s view on its own Reserves and fired a shot across Rachel Reeves’ bow in the process.

ELECTION TIMING: WHY NOW?

We could speculate on Rishi’s slicing through the Gordian Knot, and admire his nerve in doing so; but it is just speculation. We do know a General Election costs about £20 million per political party (yes, only that much in the UK). This will have required many earnest meetings and interminable slide decks. So, it must have looked like a good idea, at least to someone.

It leaves some largely superficial legislation half completed, and hastens the retirement of hundreds of Tory MPs, voluntary or otherwise. Even Gove has gone. A whole new cast will take the stage. Starmer then has eight weeks of summer bedding-in, before the treadmill grinds into action for him too.

A new cast won’t change the script, however. They should be just as careful of sinking beneath ill-judged promises; delivery is all, and the toolbox is empty. Whilst coups and factions could be just as ridiculous.

A DIVIDED SMALLER GLOBAL ECONOMY

Free trade and the wealth of nations is much more interesting. In the last five years COVID has allowed the erection of unthinkable trade barriers. Meanwhile, an imperial power wary of spilling the precious blood of just one nation, has over indulged in the funding of extraordinary slaughter, in too many others.

We seem to have lost our view of one humanity seeking development and freedom from poverty, for a globe divided into blocks, quite familiar to Biden’s distant youth, but strange to us. Naked protectionism rules, now trumping even the climate emergency.

Sanctions pile upon sanctions, 16,000 against Russia alone. Yet all of the above is now normal. There are no rounds of trade talks. The WTO withers, for lack of an appeals panel. Neither Trump nor Biden helped by their blocking of appointments.

THE SUPPORTS LOOK ROTTEN TOO

But what else is supported by free trade? Well for a start free trade is the international version of competition. Competition has no inherent virtue; it is, like free trade, quite destructive of businesses, seeking the lowest price. So, it too is junk, only valid within the four walls of a protectionist jail, which is hardly valid at all.

So, once we accept globalization is irrelevant, out goes competition, or rather it becomes a political tool, and as such has no economic validity.

In this context, consider the issue of floating currencies; if we junk that, then out goes the free movement of capital as well.

Look at how China devalues the Yuan to offset tariffs. Or how Japan’s state policy is now devaluation.

We must expect some pretty hefty steps to shut out American access to markets or to act against floating currencies, coming down the track, if someone does not stop the madness. Nationalism will get ever harder to contain, once we don’t trade with each other. And superpower battles will lead to ever more defaults and destitution for the poorer countries. Look at Yemen, Venezuela, Myanmar, Somalia, Sudan, Afghanistan. Proxy wars are being fought in odd places; they are still people, and these are still wars.

Cut out free trade, and you cut out the economic heart of the globe.

NOT BANKING ON IT

Still taken from this Video of Andrew Bailey’s talk.

The graphs speak volumes – do look.

I didn’t know this was Bailey’s last gig before the election, but maybe he did. He made a densely argued case for being very careful about political tinkering with Central Bank Reserves.

As he tells it, we went from post war banks dedicated to commerce and trade in the 1950’s and 60’s. Then came the great liberalization of consumer finance, in the 1970’s and 1980’s, followed by a perilous patch of virtually no reserves, through much of Tony Blair’s time, quite visible for an extended period before the crash (the slim orange block below). However cleverly he called it global, it started in domestic errors.

Then the sudden explosion of reserves under Quantitative Easing, followed by the virtual end of commercial and business lending. The term funding scheme was an attempt to rectify a surge in consumer lending, but is now itself winding down.

So, to now when our system rests on vast bloated mortgage books and tons of gilts in the vaults. It still looks a very long way down to ‘normal’.

There were a couple of well-placed questions at the LSE, strongly hinting that the next Government will try to exploit those bank reserves (perhaps by stopping interest payments on commercial bank funds held at the Bank). Bailey was making the case for not reducing the balance sheet much below £400 billion, back to the 2016 level, that yellow shoulder on the graph.

That in itself is a sign that the banking system is not really working; as he ruefully noted, the recent crises (Silicon Valley Bank et al) came from not too little money in reserve, but too much in too few places.

And stock markets? Well childishly they seem pretty chill about it all. If money is being trashed, don’t hold money they say.

Well, do watch that ten-year gilt: for six months it has trended up.

What does that tell you? Not a sign of rate cuts soon. Almost back to the Truss spike, which apparently, we could not live with.

Like a few other things of late, it all looks fine, until it isn’t.

While the UK index is up overall, the indebted part is flat to falling, and there is plenty of that in the ‘value’ area.

THROUGH A GLASS

This is a curious market, swinging between pessimism and optimism on the thinnest of data. Is this rally for real, or just more rotation? Is the UK really breaking free?

Certainly, if you include dividends (and it is odd that we don’t in the UK; others do) there is indeed something moving in the UK. But is it more than one big takeover bid and a rising dollar, this time?

While the continued weakness in the AIM smaller companies index in particular, but also setbacks in some Emerging Markets (like Brazil) suggest this is indeed just jousting.

What can we see?

Markets have had a couple of sudden, dramatic jolts upward in the last eight months. Some ran up hard from October, while the FTSE sat trading sideways till mid-February (at 7,500) then launched upwards climbing almost a 1,000 points to now, and along the way had a shedload of ex-dividend dates to battle with, adding yet more to that return.

Others like the NASDAQ began their charge earlier, in the last week of October, then eased off in April, where they peaked and went sideways. The Mumbai SENSEX did almost the same, and again has been sideways since April. While the Japanese TOPIX took off in late December, but also peaked in late March.

That topping out in late March and early April does fit with the realization that US rate cuts had been, at best, substantially delayed.

Spinning, not climbing

That feels like rotation not recovery. The merry-go-round has just ended up on our own doorstep of late. If you look elsewhere, in small caps, my bell weather of doom, the Amati AIM VCT has been relentlessly down since late 2021, but has very slight recent uptick, and is trading on quite a slim discount now.

My other small cap telltale is Herald IT, very much taking off in late October and still making new highs, with (for this stock) a narrowing discount. Albeit it has a much less restricted remit and some of its small companies turn out to be quite big.

On a one-year basis, the US, Japan, India, Brazil all top a healthy 20% return, but on a three-month basis, only the Hang Seng (amazingly) hits double figures, a good chunk of which was last week, and Brazil is negative.

So no, not a classic recovery led by small caps and emerging markets, something more obscure.

But will it be another fake, like that immense pre-Christmas rally? Well fundamentals would still say yes, which is why I find it irksome.

Rate cuts - how many, how soon?

To me rate cuts look nothing like as baked in or as fast as in December; there really is no economic crisis, no recession. Growth keeps on, surprisingly strong despite so called high interest rates.

A rapid staccato set of cuts just won’t happen, it will be a gentle decline driven as much by politics as economics, and absent a crack in the labour markets (also not visible) not really going that low.

In particular, rates would then be neither low enough to give value stocks the boost of having their yields go way above gilts or treasuries, nor will they allow them to refinance absurdly cheap debt, at the same old give away rates. Both of which felt very much part of the pre-Christmas rally.

Until some sign of fiscal tightening (post elections) appears, we do expect the economy to run hot, and we do want central banks to have leeway to cut rates. And we want savings rewarded, modest but controlled inflation, sensible capital allocation, so what’s not to like?

Yet we have the risk off, value heavy rally from Christmas reprised, in what looks like a very different world, triggered it seems by Powell promising not to raise rates (as if he ever would).

So, we have a classic unloved rally, with summer doldrums and unpredictable US elections coming, to add to my unease.

The longer term, as I said, still looks fine, but we have to get there first.

What do UK local elections conceal?

Labour looks like a dead cert still, but it will be oddly unloved. Although in electoral terms (given first past the post in the UK) having four or five 10% opponents is a delight (Greens, Pro Palestine (if different), Lib Dems, Reform and that mysterious Independent group, mainly but not entirely unbadged Tories).

The total seat score and an absolute majority remains certain, but it does give some scope for odd three-way fights and surprises.

Then, there is the work of the Electoral Commission, creating weird new electoral patchworks out of their ruthless numerical hegemony. It is not clear how that shakes out.

It does also add an element of jeopardy, should one alternative faction catch fire. It will also leave a complex, disputatious opposition adding sand to the fuel lines, as the next Government tries to achieve something.

This also looks like a local councilor low (or high) water mark, solid Tory areas seem to have stayed resilient, and in the vast bulk of the middle ground, where the national majority rules don’t apply, ‘no overall control’ has done exceptionally well of late.

So, I quite like this market, nice to see some prices get off the floor and move past my “always buy” category, nice to see years of adding into falling prices finally reverse, but it is not (if it ever was) entirely logical.

The economic outlook is different from last year, and this rally should therefore be different.

That in many ways it is not, feels odd.

Altitude sickness

Do ‘higher rates for longer’ matter? Is China doing anything different? Has the UK election become a one-horse race?

So far, both the markets and Central Banks have acted as if rate rises matter far more than they do, in real life. High interest rates are simply a pot stirring device, they don’t take any money out, they just shift it from borrowers to savers at a higher speed. The net effect is that they don’t matter to the totality of an economy as such, although the government takes a slice (as ever), and the exchange rate may shift.

It can also change investment decisions, affect confidence, restrain borrowers. But these are generally quite gradual influences. And the pile up in savers’ cash offsets them. It is a change of content, not of quantum. Meanwhile, in order not to move the ‘confidence’ needle, governments get spooked and start giving more handouts in compensation.

Investment decisions focus as much on corporate tax rates, costs and technology as on interest rates. While the evidence of resulting restraint by borrowers, where the dominant one is actually the government, appears a bit thin and is longer duration. Even the UK mortgage market has perked up.

Where rate rises may matter more, is if the winners (savers) don’t spend, and the losers (borrowers) default, creating value destruction, rather than simply price movements. Not much of that is evident yet, as loan underwriting has (generally) been good, and neither the level of rates, nor their duration, has eaten far into the big credit buffers still in place.

Defaults on bank loans, set against the greatly increased rate differential’s impact on earnings, have been minor. Bank provisions for purely economic reasons are not rising fast.

Overall, given the dominance of the ‘vote buyers’ in most markets, I am not that worried by consumption, and judging by London theatre prices, the high end is not showing much restraint either. While all those second order effects don’t matter much this year.

It is no surprise to us that the world has now drifted back to ‘not many rate cuts’ nor is it clearly a disaster, for all the sudden market noise. The political imperative for a rate cut to throw before the electorate (justified or not) still leaves June in play.

It is fairly clear where the froth is, where any nosebleeds are due; also that this market response is all sentiment, unrelated to actual economic forces.

A SECOND LOOK AT CHINA

What of China? For a while in the un-investable box, and I think still largely so for the mainland indices. Reasons? political risk, both internally and externally, growing sanctions, unequal treatment of overseas investors, disappearances etc – same as ever. So why look again? Well in part if globally the UK looks cheap, China looks even cheaper, right at the bottom of the pile.

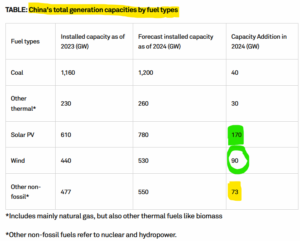

The mists seem to be clearing on their economic strategy : manufacturing is still at the heart of it, which implies so is exporting and hence some engagement with the wider world. Not just high-volume low-cost production, although recent trade statistics do show falling value on rising volume. But a clearly and often stated desire to move up the value chain, seems to be coming off.

China’s factories have a lot going for them, they are still building coal power plants (306, yes three hundred plus, currently in the works) and nuclear, (150 plants planned over the next decade) at high speed, plus plenty of renewables, providing abundant cheap energy.

From this site

Labour laws are to them just an amusing Western concern. Also noticeable is that Chinese universities still study real science, based on academic merit – they are the world leaders in many areas – just ask your university professor buddies.

Plus, they have no interest in electoral cycles.

If China wants to stay at the core of global manufacturing, it can. A flat rate 10% tariff seems to barely touch the existing and growing price advantage. There is also a point at which consumers will baulk at the price of domestic protected production, even in the US.

So, if China is simply the old ill tempered, paranoid, Communist dictatorship, flooding the world with cheap goods, stealing intellectual property and manipulating currency, then the problem is at least familiar.

In that case, it is not throwing its lot in with Russia and going back to Stone Age military adventures as yet.

So, when fund managers hang on to well researched individual stocks, knowing all that background, I am inclined to at least listen. Trade needs cash, wants cash, uses cash, needs investment and therefore some global engagement.

INTO THE ABYSS

We have long predicted the loss of the Tory Red Wall seats, one term rookies as we called them. Under 200 Tory seats left in six months, seems well-nigh inevitable as well. So yes, it is a one-horse race. And is Starmer really going to say anything substantial (and in truth there are quite a lot of plans and approaches on the table already)? I doubt it, he has no need to.

It is just the older and far tougher problem of working out how to pay for it all, without raising taxes so high no one wants to work, invest in the country or indeed live here. Given the record of the last century or so, expecting things to change now, is delightfully naïve. They won’t.

It needs radical reform of regulation, entitlements and cost bases. No more salami slicing, no more buying off vested interests. There is some of that from Wes Streeting, but a lot more would be needed, the new ministers must do more with less, not less with more.

Looking at how the UK and US markets have performed this year, tells you a lot about those expecting such a grown-up approach. A backstop approach is to plan for the change.

Where many people choose to live and work, will be decided within this year.