Do ‘higher rates for longer’ matter? Is China doing anything different? Has the UK election become a one-horse race?

So far, both the markets and Central Banks have acted as if rate rises matter far more than they do, in real life. High interest rates are simply a pot stirring device, they don’t take any money out, they just shift it from borrowers to savers at a higher speed. The net effect is that they don’t matter to the totality of an economy as such, although the government takes a slice (as ever), and the exchange rate may shift.

It can also change investment decisions, affect confidence, restrain borrowers. But these are generally quite gradual influences. And the pile up in savers’ cash offsets them. It is a change of content, not of quantum. Meanwhile, in order not to move the ‘confidence’ needle, governments get spooked and start giving more handouts in compensation.

Investment decisions focus as much on corporate tax rates, costs and technology as on interest rates. While the evidence of resulting restraint by borrowers, where the dominant one is actually the government, appears a bit thin and is longer duration. Even the UK mortgage market has perked up.

Where rate rises may matter more, is if the winners (savers) don’t spend, and the losers (borrowers) default, creating value destruction, rather than simply price movements. Not much of that is evident yet, as loan underwriting has (generally) been good, and neither the level of rates, nor their duration, has eaten far into the big credit buffers still in place.

Defaults on bank loans, set against the greatly increased rate differential’s impact on earnings, have been minor. Bank provisions for purely economic reasons are not rising fast.

Overall, given the dominance of the ‘vote buyers’ in most markets, I am not that worried by consumption, and judging by London theatre prices, the high end is not showing much restraint either. While all those second order effects don’t matter much this year.

It is no surprise to us that the world has now drifted back to ‘not many rate cuts’ nor is it clearly a disaster, for all the sudden market noise. The political imperative for a rate cut to throw before the electorate (justified or not) still leaves June in play.

It is fairly clear where the froth is, where any nosebleeds are due; also that this market response is all sentiment, unrelated to actual economic forces.

A SECOND LOOK AT CHINA

What of China? For a while in the un-investable box, and I think still largely so for the mainland indices. Reasons? political risk, both internally and externally, growing sanctions, unequal treatment of overseas investors, disappearances etc – same as ever. So why look again? Well in part if globally the UK looks cheap, China looks even cheaper, right at the bottom of the pile.

The mists seem to be clearing on their economic strategy : manufacturing is still at the heart of it, which implies so is exporting and hence some engagement with the wider world. Not just high-volume low-cost production, although recent trade statistics do show falling value on rising volume. But a clearly and often stated desire to move up the value chain, seems to be coming off.

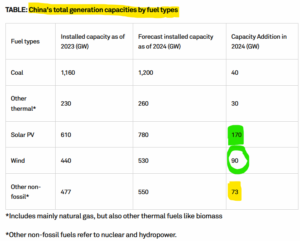

China’s factories have a lot going for them, they are still building coal power plants (306, yes three hundred plus, currently in the works) and nuclear, (150 plants planned over the next decade) at high speed, plus plenty of renewables, providing abundant cheap energy.

From this site

Labour laws are to them just an amusing Western concern. Also noticeable is that Chinese universities still study real science, based on academic merit – they are the world leaders in many areas – just ask your university professor buddies.

Plus, they have no interest in electoral cycles.

If China wants to stay at the core of global manufacturing, it can. A flat rate 10% tariff seems to barely touch the existing and growing price advantage. There is also a point at which consumers will baulk at the price of domestic protected production, even in the US.

So, if China is simply the old ill tempered, paranoid, Communist dictatorship, flooding the world with cheap goods, stealing intellectual property and manipulating currency, then the problem is at least familiar.

In that case, it is not throwing its lot in with Russia and going back to Stone Age military adventures as yet.

So, when fund managers hang on to well researched individual stocks, knowing all that background, I am inclined to at least listen. Trade needs cash, wants cash, uses cash, needs investment and therefore some global engagement.

INTO THE ABYSS

We have long predicted the loss of the Tory Red Wall seats, one term rookies as we called them. Under 200 Tory seats left in six months, seems well-nigh inevitable as well. So yes, it is a one-horse race. And is Starmer really going to say anything substantial (and in truth there are quite a lot of plans and approaches on the table already)? I doubt it, he has no need to.

It is just the older and far tougher problem of working out how to pay for it all, without raising taxes so high no one wants to work, invest in the country or indeed live here. Given the record of the last century or so, expecting things to change now, is delightfully naïve. They won’t.

It needs radical reform of regulation, entitlements and cost bases. No more salami slicing, no more buying off vested interests. There is some of that from Wes Streeting, but a lot more would be needed, the new ministers must do more with less, not less with more.

Looking at how the UK and US markets have performed this year, tells you a lot about those expecting such a grown-up approach. A backstop approach is to plan for the change.

Where many people choose to live and work, will be decided within this year.