NOT THE FOGGIEST

We have no idea why we are having a General Election just now. Not the foggiest idea how we remove the keystone of free trade and yet the edifice of beneficent competition remains intact. We have not much idea how you have free capital flows without free trade, or how floating exchange rates then work.

But we are all about to find out, apparently.

Meanwhile, we did enjoy Andrew Bailey’s valedictory talk, at least under this decade of Tory rule, to the LSE. It made clear the Bank’s view on its own Reserves and fired a shot across Rachel Reeves’ bow in the process.

ELECTION TIMING: WHY NOW?

We could speculate on Rishi’s slicing through the Gordian Knot, and admire his nerve in doing so; but it is just speculation. We do know a General Election costs about £20 million per political party (yes, only that much in the UK). This will have required many earnest meetings and interminable slide decks. So, it must have looked like a good idea, at least to someone.

It leaves some largely superficial legislation half completed, and hastens the retirement of hundreds of Tory MPs, voluntary or otherwise. Even Gove has gone. A whole new cast will take the stage. Starmer then has eight weeks of summer bedding-in, before the treadmill grinds into action for him too.

A new cast won’t change the script, however. They should be just as careful of sinking beneath ill-judged promises; delivery is all, and the toolbox is empty. Whilst coups and factions could be just as ridiculous.

A DIVIDED SMALLER GLOBAL ECONOMY

Free trade and the wealth of nations is much more interesting. In the last five years COVID has allowed the erection of unthinkable trade barriers. Meanwhile, an imperial power wary of spilling the precious blood of just one nation, has over indulged in the funding of extraordinary slaughter, in too many others.

We seem to have lost our view of one humanity seeking development and freedom from poverty, for a globe divided into blocks, quite familiar to Biden’s distant youth, but strange to us. Naked protectionism rules, now trumping even the climate emergency.

Sanctions pile upon sanctions, 16,000 against Russia alone. Yet all of the above is now normal. There are no rounds of trade talks. The WTO withers, for lack of an appeals panel. Neither Trump nor Biden helped by their blocking of appointments.

THE SUPPORTS LOOK ROTTEN TOO

But what else is supported by free trade? Well for a start free trade is the international version of competition. Competition has no inherent virtue; it is, like free trade, quite destructive of businesses, seeking the lowest price. So, it too is junk, only valid within the four walls of a protectionist jail, which is hardly valid at all.

So, once we accept globalization is irrelevant, out goes competition, or rather it becomes a political tool, and as such has no economic validity.

In this context, consider the issue of floating currencies; if we junk that, then out goes the free movement of capital as well.

Look at how China devalues the Yuan to offset tariffs. Or how Japan’s state policy is now devaluation.

We must expect some pretty hefty steps to shut out American access to markets or to act against floating currencies, coming down the track, if someone does not stop the madness. Nationalism will get ever harder to contain, once we don’t trade with each other. And superpower battles will lead to ever more defaults and destitution for the poorer countries. Look at Yemen, Venezuela, Myanmar, Somalia, Sudan, Afghanistan. Proxy wars are being fought in odd places; they are still people, and these are still wars.

Cut out free trade, and you cut out the economic heart of the globe.

NOT BANKING ON IT

Still taken from this Video of Andrew Bailey’s talk.

The graphs speak volumes – do look.

I didn’t know this was Bailey’s last gig before the election, but maybe he did. He made a densely argued case for being very careful about political tinkering with Central Bank Reserves.

As he tells it, we went from post war banks dedicated to commerce and trade in the 1950’s and 60’s. Then came the great liberalization of consumer finance, in the 1970’s and 1980’s, followed by a perilous patch of virtually no reserves, through much of Tony Blair’s time, quite visible for an extended period before the crash (the slim orange block below). However cleverly he called it global, it started in domestic errors.

Then the sudden explosion of reserves under Quantitative Easing, followed by the virtual end of commercial and business lending. The term funding scheme was an attempt to rectify a surge in consumer lending, but is now itself winding down.

So, to now when our system rests on vast bloated mortgage books and tons of gilts in the vaults. It still looks a very long way down to ‘normal’.

There were a couple of well-placed questions at the LSE, strongly hinting that the next Government will try to exploit those bank reserves (perhaps by stopping interest payments on commercial bank funds held at the Bank). Bailey was making the case for not reducing the balance sheet much below £400 billion, back to the 2016 level, that yellow shoulder on the graph.

That in itself is a sign that the banking system is not really working; as he ruefully noted, the recent crises (Silicon Valley Bank et al) came from not too little money in reserve, but too much in too few places.

And stock markets? Well childishly they seem pretty chill about it all. If money is being trashed, don’t hold money they say.

Well, do watch that ten-year gilt: for six months it has trended up.

What does that tell you? Not a sign of rate cuts soon. Almost back to the Truss spike, which apparently, we could not live with.

Like a few other things of late, it all looks fine, until it isn’t.

While the UK index is up overall, the indebted part is flat to falling, and there is plenty of that in the ‘value’ area.

Altitude sickness

Do ‘higher rates for longer’ matter? Is China doing anything different? Has the UK election become a one-horse race?

So far, both the markets and Central Banks have acted as if rate rises matter far more than they do, in real life. High interest rates are simply a pot stirring device, they don’t take any money out, they just shift it from borrowers to savers at a higher speed. The net effect is that they don’t matter to the totality of an economy as such, although the government takes a slice (as ever), and the exchange rate may shift.

It can also change investment decisions, affect confidence, restrain borrowers. But these are generally quite gradual influences. And the pile up in savers’ cash offsets them. It is a change of content, not of quantum. Meanwhile, in order not to move the ‘confidence’ needle, governments get spooked and start giving more handouts in compensation.

Investment decisions focus as much on corporate tax rates, costs and technology as on interest rates. While the evidence of resulting restraint by borrowers, where the dominant one is actually the government, appears a bit thin and is longer duration. Even the UK mortgage market has perked up.

Where rate rises may matter more, is if the winners (savers) don’t spend, and the losers (borrowers) default, creating value destruction, rather than simply price movements. Not much of that is evident yet, as loan underwriting has (generally) been good, and neither the level of rates, nor their duration, has eaten far into the big credit buffers still in place.

Defaults on bank loans, set against the greatly increased rate differential’s impact on earnings, have been minor. Bank provisions for purely economic reasons are not rising fast.

Overall, given the dominance of the ‘vote buyers’ in most markets, I am not that worried by consumption, and judging by London theatre prices, the high end is not showing much restraint either. While all those second order effects don’t matter much this year.

It is no surprise to us that the world has now drifted back to ‘not many rate cuts’ nor is it clearly a disaster, for all the sudden market noise. The political imperative for a rate cut to throw before the electorate (justified or not) still leaves June in play.

It is fairly clear where the froth is, where any nosebleeds are due; also that this market response is all sentiment, unrelated to actual economic forces.

A SECOND LOOK AT CHINA

What of China? For a while in the un-investable box, and I think still largely so for the mainland indices. Reasons? political risk, both internally and externally, growing sanctions, unequal treatment of overseas investors, disappearances etc – same as ever. So why look again? Well in part if globally the UK looks cheap, China looks even cheaper, right at the bottom of the pile.

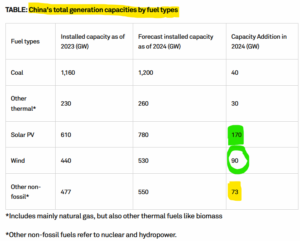

The mists seem to be clearing on their economic strategy : manufacturing is still at the heart of it, which implies so is exporting and hence some engagement with the wider world. Not just high-volume low-cost production, although recent trade statistics do show falling value on rising volume. But a clearly and often stated desire to move up the value chain, seems to be coming off.

China’s factories have a lot going for them, they are still building coal power plants (306, yes three hundred plus, currently in the works) and nuclear, (150 plants planned over the next decade) at high speed, plus plenty of renewables, providing abundant cheap energy.

From this site

Labour laws are to them just an amusing Western concern. Also noticeable is that Chinese universities still study real science, based on academic merit – they are the world leaders in many areas – just ask your university professor buddies.

Plus, they have no interest in electoral cycles.

If China wants to stay at the core of global manufacturing, it can. A flat rate 10% tariff seems to barely touch the existing and growing price advantage. There is also a point at which consumers will baulk at the price of domestic protected production, even in the US.

So, if China is simply the old ill tempered, paranoid, Communist dictatorship, flooding the world with cheap goods, stealing intellectual property and manipulating currency, then the problem is at least familiar.

In that case, it is not throwing its lot in with Russia and going back to Stone Age military adventures as yet.

So, when fund managers hang on to well researched individual stocks, knowing all that background, I am inclined to at least listen. Trade needs cash, wants cash, uses cash, needs investment and therefore some global engagement.

INTO THE ABYSS

We have long predicted the loss of the Tory Red Wall seats, one term rookies as we called them. Under 200 Tory seats left in six months, seems well-nigh inevitable as well. So yes, it is a one-horse race. And is Starmer really going to say anything substantial (and in truth there are quite a lot of plans and approaches on the table already)? I doubt it, he has no need to.

It is just the older and far tougher problem of working out how to pay for it all, without raising taxes so high no one wants to work, invest in the country or indeed live here. Given the record of the last century or so, expecting things to change now, is delightfully naïve. They won’t.

It needs radical reform of regulation, entitlements and cost bases. No more salami slicing, no more buying off vested interests. There is some of that from Wes Streeting, but a lot more would be needed, the new ministers must do more with less, not less with more.

Looking at how the UK and US markets have performed this year, tells you a lot about those expecting such a grown-up approach. A backstop approach is to plan for the change.

Where many people choose to live and work, will be decided within this year.

DREAMERS

What would Trump’s high tariff isolationist world look like? What would the mirror image be in Xi’s China? Not now, not next week, but rolling into the next decade.

And whatever portfolio theory says, and whatever the optimistic investor believes, 80% of my own portfolio is flotsam, drifting up and down on Pacific tides. Stocks I both like and which have compounded over decades are remarkably few. Oh, and a brief word on African housing.

GOING IT ALONE

But first, to give it the grand name, autarchy, or self-sufficiency. A bit of a joke - the Soviet Union tried it, Iran tries it, China famously only revived after ditching it.

But it is back in fashion, and not just in strange places. The EU industrial and agricultural policy is starting to look like a version; beyond their four walls they need carbon and chemicals, but within them they don’t, nor will they allow imports of them (or products including them). Quite fantastic.

Trump is on his 60% tariffs line. Xi clearly wants to cut off foreign capital, as it arrives infected with democracy and transparency, and the associated foreign reporting or verification.

So, could they? Yes, the US could - it is big enough, can do most things, and largely trades internally. While at least in Trump’s imagination the commercial borders are sealed, and so enforceable.

What goes wrong? Well at some, quite distant, point people stop expecting to trade with the US. So, at its most extreme, if China can’t sell to the US, it won’t buy from them either. But that is decades away, most Chinese production can probably take a 300% tariff, and still sell at a profit.

The flip side of the tariff is the huge salary for a barista, or a trucker. The latter is not so far away. Prices of domestic US production must rise, to allow the blue-collar Mid-West to rejuvenate. US consumers of course (including that barista) will pay vastly more for US goods, or will get hit with the import tariff; this of course is a tax on them.

What about Xi? Well again it is possible - that’s how China ran for much of his life, with a lot of new infrastructure, industrialization, since installed. He can do it all again. There, unlike in the US, the issue is capital. As a big net exporter, an area that will itself be under pressure, money will be harder to find; it already is.

THE NIGHTMARE

Countries that go through this closing cycle typically also do default (as the Soviets did, as US (and UK) railways did,). Folly, but it can be done.

The US has been going down this route since Obama, Trump talked a lot about it, but Biden too sees the resulting wage inflation as a good thing. So, it is the next US President’s policy either way.

Obama was keen on hitting capital markets (FATCA was and remains both a non-tariff barrier (I am being polite here) and a tariff on external capital) and I suspect a Biden administration must do the same, to balance the books.

While Xi never really left protectionism, WTO and GATT were mainly honoured in the breach.

And Europe? There is quite a strong strategic need to expand to the East, although as that goes through (and we are talking the mid 2030’s here) Ukrainian farmers, like Polish farmers today, will buckle under the rules; it barely matters about the Donbas, the EU will shut those heavy industries down too.

So, I think autarchy can work for all three, it will support a large uncompetitive labour force, and consumer choice will vanish. In many cases there will be lower quality and high prices. All three will attack (or in some cases keep attacking) capital flows.

And in the end, the entrepots will survive, those not in any such block, like the UAE or Singapore today, Amsterdam in the 17th Century, Yemen under the Romans and Victorian Britain.

The winners will be flexible, a tad amoral, assertive, in fluid alliances, but reliant on gold not steel to survive. And they will suck in entrepreneurial talent too. At a strategic level, that feels the place to be looking. Although buying uncompetitive heavy industries before their brief period of tariff induced profitability, has a short-term allure.

DOGS OR GREYHOUNDS ?

The ludicrous halving of CGT allowances, based on some fantasy “yield” number from the equally ludicrous HMRC, via the OBR, means once again the tiresome process of harvesting losses is upon us. No longer can they sit unloved at the back, snoozing; out they must come.

And what a tale of dross they reveal, and scattered amongst them so many once “good ideas” and busted yield stocks. Well, it sticks in the throat, but perhaps sticking it in a US wonder stock for six months is better?

Of course, if I knew when I acquired them that the FTSE was moribund for two decades, I would never have bothered. Seems it is time to simplify.

COLLATERAL

And lastly African housing. It was one of Gordon Brown’s (and the PRA’s) great achievements to get UK banks out of overseas assets, far too volatile, currency? foreigners?- Who needs them? Bring it all home and inflate the UK housing market with safe, cheap, mortgages.

So, Citizens went, Barclays were hounded out of South Africa, and so on – although their post-sale performance has really not been great either. Africa now just does not have proper mortgage financing for the vast bulk of the population. This is at a level I had failed to fully comprehend.

You think that despite everything, Africa must have got better. But no housing, so less health, less stability, no financial security. Safe recycling of profits in the continent is still hard. Aid can’t create institutional reform, but that’s the need.

If you look for the breakout into developed status, it starts there.

WENN DU LANGE IN EINEN ABGRUND BLICKST

We look briefly at China, not as an investment, but more an existential threat. And we finish the lessons of the Greek coup in 2015. While little else surprises? Except perhaps the pessimism apparently shown by the long bond.

But even that might have a good reason.

DIRE STRAITS

I looked idly at a certain pink paper’s New Year quiz and asked my companion for views, and on most topics, we had one, or could find one. But on one, ‘will Xi invade Taiwan?’ I had no idea.

Not because after Ukraine there is any doubt it would be mindlessly stupid to do so, and plunge China back into the dark ages. That much is obvious. There is no way China can “go it alone” - without Western markets, capital, and innovation, it heads back to where Iran, Pakistan, Congo, and Argentina have been.

But a distant echo tells me that I don’t know for certain. Perhaps my confidence that Putin would not be so stupid as to invade Ukraine, tints my view; I was wrong there.

I am also largely assuming any military contest is unpredictable, so I tend to focus on the long-term economic impacts alone. But I still don’t know that Xi won’t try, which will clearly crash world markets.

I will deliberately not gaze into that abyss, but I can’t ignore it. The best response I have is where two stocks are equally attractive, and on like valuations, I would buy the one with the lower Chinese exposure. Maybe my limited action says that I think it is possible, but really not that likely. The other option of course is adding to gold and safe haven currencies.

Looked at a Swiss Franc graph of late?

From : Google Finance currency page

Most investable firms can shed China, just as many have shed Russia, but at a much higher price. The reciprocal asset seizures will be vast.

And although it won’t cripple Starbucks, Tesla or Apple, it will be a big slice of asset destruction for them.

NO DEMOCRACY

Back to Greece - when we last wrote it was to note the ravages imposed by the EU and IMF on the Greek economy, and how the scars still remain. But completing Yanis Varoufakis and his seminal tome, other contexts are clear.

As an academic his note taking and indeed voice and video recordings were quite an exceptional contemporaneous record. Not just of Greece, but of how Europe really worked, in a crisis.

We forget now, that Ukraine also needed a big bailout in 2015, and a choice was made as to which mattered more to, in effect, Germany. The answer in 2015 was Ukraine, with the late Wolfgang Schauble wanting Greece out of the Euro, and Angela Merkel seeing that as a lesser evil, for Germany, than the collapse of the Ukrainian economy.

There is very little ‘EU’ in this incidentally, Germany was the dominant and controlling creditor. The IMF largely sat safely behind its super creditor status. As Yanis notes the IMF funds itself on interest, and that mainly comes from having plenty of distressed debt. Not an attractive feedback loop, however logical. And of course, it largely stood back from Greece – inactivity is often an action taken.

Moving on, the Greek crisis was closely followed by Brexit, at the time we thought that was chance. It is clear it was not, and both sides had learnt a lot from the prior event, to take into the next battle. The EU and Merkel in particular had no interest in rational arguments, having waded through all that guff in Greece; you can see Cameron may have been useless, but he really had no hand to play in his “re-negotiation”. Simply ‘nein’ had worked well in Greece, so Merkel pressed repeat.

The old apparatchik’s argument about “reform from the inside” was clearly flannel; popular mandates are for the birds. As a result, the Brexit faction knew it had to be a clean exit, with one shot to the head. Sadly, Theresa May failed to realise that, and when the EU subsequently realised she had thrown her majority away, they had no reason to agree any deal, or not to expect another craven capitulation.

What of Greece now?

Well, it simply lost a big chunk of its economy (circa 20%) to creditors and demolished welfare payments and entitlements, for a generation. Was that fatal? Not really, life expectancy rose through that decade, as elsewhere in Europe.

The left largely destroyed its high-water mark, one-off advantage, but remains a mid-teens political faction.

The October 2023 regional elections saw even more regional governorships fall to the centre right New Democracy. This was along with a rip-roaring stock market in 2023 as the long rebound continued.

EU

And in Europe? Well, those June Parliament elections are getting interesting, Syriza will suffer more losses, and the gains by the centre right in Italy, Holland etc. are likewise yet to show up in Strasbourg. This provides context for this week’s defenestration of the French prime minister, for a near novice (at ministerial level). It seems this was a poisoned chalice for the big guns of En Marche, as the party are well behind Le Pen in the polls.

The European Parliament is such a mash-up of parties, and with limited real power, no change can be dramatic, but for once it could be at least interesting. The super-spending high regulating internationalist left, may get a setback.

Financial markets

Markets? I don’t think they ever get going till after Martin Luther King’s birthday is celebrated on Monday. Despite the need for news, the decline in global rates is baked in, and remains positive for equities, especially rate sensitive stocks.

You can stare into the Chinese abyss, but be careful that is does not stare back at you, you will see what you most fear or least know, as Nietzsche knew.

Happy New Year.

Not what it seems?

Housing, China and Big Tech – all are regarded as ‘un-investable’ - ending last year the above three sectors were all under a cloud, but one broke free, why?

Plus, Powell scares the market by thinking too loudly.

HOUSE PRICES

Well let’s start with housing. UK residential property prices are holding up fairly well given the magnitude of rate rises, while UK housebuilder share prices look fairly awful. There is a confusing mix of income and capital issues to examine.

Housing itself holds up well – many reasons: demand of course, high levels of employment, heavy net migration and the normal new household formation provide a base demand level well above new build levels. At a time when it is unattractive to fund speculative new build (so units not pre-sold before commencement) because of finance charges, and with a planning system that is both over prescriptive and under resourced, supply will stay slow.

So, the logic of fairly steady prices for existing housing stock holds, buyers will need more cash, but with (in real terms) falling house prices, that can be done. It moves funds from (largely UK) borrowers to (largely UK) savers, but leaves total disposal income in the country (after HMRC takes a cut) largely unaltered.

While rising rentals, reflecting pent up demand and the pressure on debt funded landlords, adds to new build demand and provokes more supply at the institutional level, at least. So, we don’t see a price crash (however desirable in some areas) at these levels.

So why then are housebuilders so disliked? Sales of houses will indeed slow, so reducing dividend cover, but the core business itself is fine and the capital value holds steady, albeit discounted by more.

CHINA TRAPS

China? Here we have almost the same issue, fundamentally sound, but politically hard to justify investment. That taint spreads to companies that sell into China too. It is very hard to ignore this vast market, and the undoubted speed of innovation and high productivity of a command economy. When so many other places fall back, China is tempting.

China has the size, finance skills and levers to deliberately act counter-cyclically, stepping out of sync with the global economy. So (on that narrative) it has ducked the blight of post COVID reopening inflation, by a deliberately slow exit, stockpiling commodities, and then stepping out of the market to defuse price spikes.

Arguably even with foreign capital, it was happy to load up when it was cheap with few restrictions, on both equity and debt, but equally happy to step back when prices and restrictions start to apply. Choice or circumstance? In an opaque system who really knows. . . But a China slowdown is not the same in type or duration as a free market one.

Like housebuilders it remains uninvestable, but for all that, there is value.

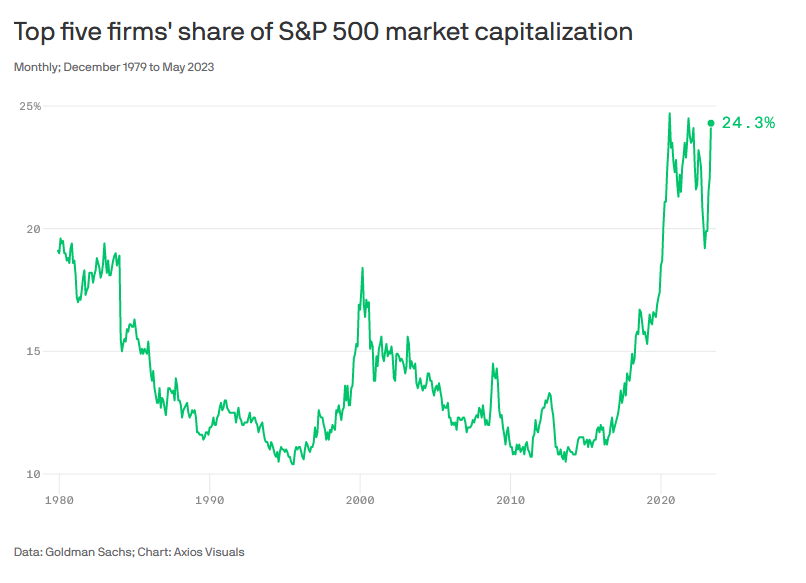

MEGA CAP VALUATIONS

So, to the third of the trinity, large cap tech. These are all US based, highly profitable, with not a lot of debt, but typically appear overvalued. In the old free money days, fast growing tech was enough, so the layer just below, also profitable, simply fed off the reflected glory of the mega caps, and so on all the way down to the start-ups and chronic loss makers. That link has broken, values are now about both size and sector. This is odd. Normally if you broke (say) Microsoft into ten equal parts the total value would go up. This year suggests it would now fall.

So, what are investors doing, if they are ignoring fundamentals? It seems the cash generating highly liquid stocks do enjoy excess market demand in tough times. Some of it is momentum following, some is a falling share count, but mainly it seems investors just really like the name recognition and deep liquidity, to trade the market.

From this website.

If so, it may be dangerous to write this group off. In a market going sideways they provide the price action, and it seems they are so big, so well entrenched and global, that the typical stock specific risk can almost be ignored. You need to be nimble; they fell hard in 2022, but their dominant recovery this year, providing nearly all of global equity performance might be the true reversion to the mean, rather than their sudden collapse when everything was being sold off last year. But that process does guarantee future volatility for them too, and history suggests it will not last.

DECLINE AND FAIL

We have nothing to add on what seems a be a new set of forever wars, beyond sadness and dismay. While whoever wins the 2024 elections on either side of the Atlantic, will be forced to do an “Erdogan turn”, or 360 spin. This could happen fairly soon after the polls close.

WHAT POWELL SAID

The markets seem not to like Jerome Powell’s musings on the vast range of things he does not know, at The Economic Club in New York this week. Does his calendar suddenly show his exit date, albeit over two years away? You could almost hear the soft polish of his resume to concede errors and some failed guesses. He even, twice, called US fiscal policy “unsustainable” although he was careful to say that was not now, but only in the future (after he’s left office that is.)

But the long run neutral rate? No idea. The Philipps Curve? No idea. Interest rate transmission rates? No idea. That’s not new, though - it is pretty much what “Data Dependent” always has meant, and markets were previously fine with that.

We will know soon enough, if rates are still rising globally. It certainly makes markets jittery, especially on Friday afternoons.