POWELL / GOVE : DROPPING THE PILOTS?

Jerome Powell looked ill at ease twice at his Wednesday press conference, with neither occasion related to monetary policy. While in the UK, Gove’s sidelining is the end of any chance of reform from this UK government.

Oddly when asked about his ‘hand in the till’, for bailing out his own family position in US Municipal bonds, Powell barely flinched. So why then is he worried?

The Powell press conference - what riled him?

He should be upset that the unemployment rate among black Americans is twice the level it was pre-COVID, at over 6% still. Given his pledge to hold the money taps open till that is fully recovered, which has for a while been clearly impossible without traumatic inflation, harming those same citizens, that should concern him.

This has long been Powell’s talisman to ward off the hard left, who are bent on two great goals, firstly taking over the reins of power by ejecting him and secondly finishing off Wall Street, as they so nearly did under Obama. Kamala Harris has not been in that triumphant position, at least not yet, so do the left really want to accept another deputy?

I doubt it.

So, the two questions Powell was riled by, were one about the new deputy governor, who has in this case the power to drive the regulatory agenda, mandated under Dodd Franks. Now, if one of Senator Warren’s acolytes can be inserted there, Powell will find life immeasurably harder. But for markets worse still,(the second question) was if Powell himself is chopped (Trump looked into it) before the recovery is complete. A weakened Biden has few other goodies to offer, if his portmanteau bill to throw $3 trillion of cash to his voters fails, scrapping a top Trump nominee at the Fed, might be the political trade-off.

While for Powell, as this all starts to get rather dirty, I could see him for the first time, asking if he was really that bothered.

The US recovery - stimulus, markets, and minorities unemployment

The rest was all telegraphed passivity, still pumping enormous stimulus into the US economy, long after the recovery is running hot.

The US 10-year bond resumed its gentle lapping sound against the low-rate rocks, the storm of inflation roared on overhead, and the shadow of crossed fingers, fell on every vault.

The market has turned, in the US at least, from worrying about ‘when’, to guessing ‘how high’, with, given the global malaise, some confidence that “not very” is the answer.

Chop the Chair of the Fed, and that delicate illusion shatters. While whatever his politics, shipping Jerome off the transom, will hurt those same beleaguered minorities most. We should never underestimate the zeal of a convert, and he is that.

Sidelining Gove

We have not seen that kind of zeal on these shores for over a decade. True, various short-lived moneymen have breezed through ministries, failing to unpick their form and function, scattered management speak and chums’ contracts around equally liberally, and left.

But lifting the drains, sorting the plumbing, fixing the boiler type reform, no, Gove is oddly (because he was useless at it) the last of those to fall. But he had the great merit of scaring people and driving legislation, which with the stodgy morass of public sector spend, is part of the battle. But the idea that he can either help on “levelling up” (which is just a catch phrase, and always will be) or pacify the Celtic fringe, hungry for real power (and unaware it does not exist) is risible.

Meanwhile, the Cabinet Office is quietly stripped of ministers, to be put back in the box marked “too difficult” once more.

A parallel with Chinese policies

This is like selling the inhabitants of East Turkmenistan down the road for some of Chairman Xi’s foggy promises on future coal fired power stations. It would be sad if it weren’t true.

Although China is now helping us return to a land beloved by investors, where money is scarce and hence actually earns a return. While risk still clearly comes in many forms; including Marxist morality, that is, if such a thing exists.

Big corporate failures do at least achieve that heightened risk awareness.

Charles Gillams

Monogram Capital Management Ltd

:) You might already know that 'dropping the pilot' is a famous cartoon by Tenniel from 1890 when the Kaiser dropped Bismarck.

EVERY DOG

Boris seems slowly to be turning into the opposition to his own party, which I suppose is not new for him. Meanwhile China also seems to be hitting an identity crisis. Neither bodes well for investors.

We apparently have a real budget due soon, but this vain Prime Minister seems bent on upstaging his own team, so we had a pile of tax rises and changes to tax law bundled out in a haphazard fashion in response to the endless (and insatiable) demands of one ministry.

A likely collision course with natural Tories

That pretty well defines bad governance, and these ad hoc excursions into major spending plans are a hallmark of waste and short termism. So, to me the investor headline should be about planning ahead for the Tory government to either fail in front of an exhausted electorate, or less plausibly given the large majority, to implode. But have no doubt that No 10 and the mass of the Tory party are now set on a collision course.

The extraordinary extravagance of the blunt furlough scheme has always been the fiscal problem, and it is hard to believe, as many bosses are clamouring for new migration to solve multiple labour problems, largely in some measure of their own making, that the government has still parked up a fair chunk of two million workers, on pretty close to full pay.

I struggle to comprehend that number in a hot summer labour market, nor do I see why employers would cling onto staff until October at which point, presumably they take a decision? Are these ghost workers? Already happily in new jobs, but having done a deal with their bosses to split the loot, their fake pay for not being? Are these people HR have forgotten or are too scared to fire? Will they really try to pick up work they put down eighteen months back, in a largely different world and probably for a now quite alien organisation?

Who knows, but the whole thing cost £67 billion (so far) and that’s what Boris needs back. I challenge anyone to give a lucid explanation of how his latest proposal “fixes” social care for the elderly. Nor to explain how in parts of the country like this, with no state care home provision anyway, it can ever be called “fair”. So, to me, it is just bunce for the ever-gaping maw of the state, and the idea, with Boris in charge, that it will ever be temporary or even accounted for, is somewhat risible.

What would “fix” social care is transparent, autonomous, local provision, not bullied by a dozen state agencies, not run by money grubbing doctors, not harried by property developers and absurd land costs, nor daft HMRC grabs on stand-by staff pay, and it needs to be highly invested in simple technology, all IT integrated with the NHS; not this crippled, secretive, subscale mess.

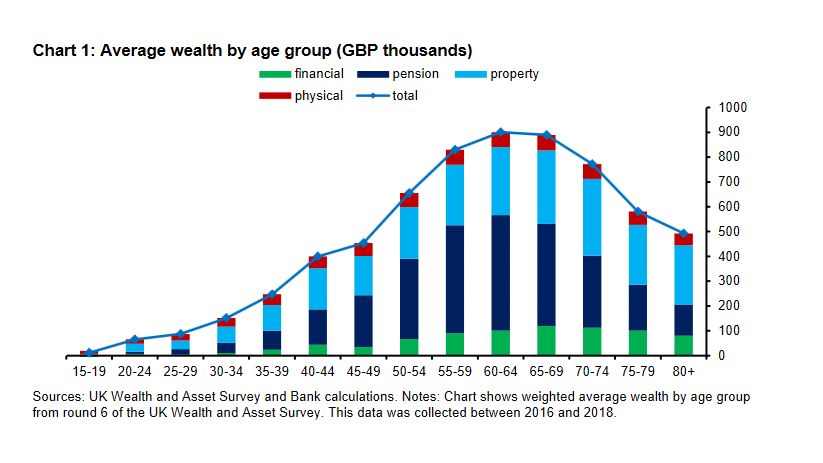

It is not that there is no problem, but it is as much operational as financial. A recent Bank of England paper looking at wealth distribution highlights how in retirement property comes to both dominate assets and also shrinks far more slowly with age.

(Sourced from this speech given at the London School of Economics, by Gertjan Vlieghe, member of the Bank of England’s Monetary Policy Committee.)

Of course, the crux here is seeing a family home as both an asset and an essential for life. That is the distortion, and this fiddling with care rules attacks the symptom, not the cause.

Can you trust a word he says?

So, now tax on income rises, a broken promise, employer tax rises, broken promise, the ‘triple lock’ on pensions is ditched, broken promise, and to top it off those working beyond normal retirement age (now 66) get a 25% tax penalty, via another broken promise. Oh, and if you are mug enough to save, then dividends will get hit too.

Again, there is a real problem but this is by no means a logical answer either: I guess the Treasury were applying heat on excess debt, and this is sand kicked back in their face, but it shows no sign of anyone solving anything. The UK has both high debt levels and no supportive currency block around it, sure France and Italy look bad, but they have Germany to help. The UK does not. Hence the anxiety.

So, Boris has had a fine Cameron-like bonfire of dozens of electoral promises; the worm turned on Cameron (and Clegg) when he couldn’t keep his word, and so it will turn on Boris. This time he won’t have Corbyn as the pantomime bete noir to bail him out. Indeed, Kier Starmer’s response linking this problem to inflated property prices is remarkably prescient, even if his typically confiscational solution is not.

These tax levels (as a % of GDP) have not been seen in fifty years, for an economy with a noticeably less effective grasp on government expenditure and a rather less globally competitive commercial base.

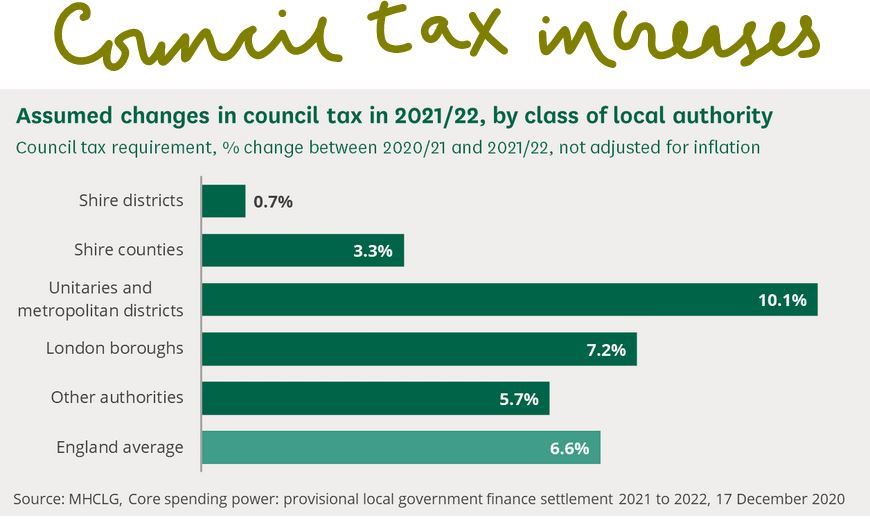

While tax rises are emerging everywhere (see below), and public service reform has become a simple money equation, need more service, spend more money, a dangerous one-way road.

Source: from this primary report

While notably, ‘buy to let’ is again left untouched. London house prices have doubled in this century, the FTSE 100 has moved from circa 6800 at its late 1999 peak to 7030 now and remains below pre-pandemic levels. So clearly this is not the time to hit the investors in jobs and business, who have had a 5% nominal gain (that is a 60% real loss) in twenty years and yet to leave the buy to let rentiers trading in second-hand hopes, with their 60% real gain in that time, untouched.

And don’t give us the dividends argument; the buy to let plutocrats get plenty of rent and all their sticky little service charges. This measure simply hits the workers and investors in business and pampers the bureaucrats and the rentiers. It makes very little sense, unless you are a senior civil servant or a retired prime minister, like Blair, of course.

Chinese insularity - the new version

Meanwhile China I feel is now detaching itself from both the rule of international law (in so far as it ever bothered) and more interestingly the world financial system. It may indeed end up better off, but for now (and this is also a change from much of the last 50 years) it does not feel it needs to attract external capital.

So much of its trade and capital markets engagement has been predicated on securing capital; this is an odd and novel twist. Although perhaps a logical response to the West, who rather than conserving capital as a scare resource, are immersing the world in torrents of surplus cash and inflation.

Much of China’s policy about their own global investment (so outside China) also used to have the same theme, driven by the desire for returns, influence and to hold their own export-based currency down.

But no more, it seems, and their inherent desire for autarchy, the hermit kingdom trope, has only been emphasized by Trump, WHO and the madness of the internet. It apparently wants to be the new Germany, (no longer the new USA), so it will be insular and conservative: cautious, not driven mad by debt and the baubles it procures.

Well, if true it will be different, whether it can really be done, without a wave of disruptive defaults is unclear, but don’t doubt the length of vision, so unlike our own government. While a theme of this century has also been where China leads, the rest must reluctantly follow.

Even a dog has its day, but for investors both the UK and China now feel significantly more canine than at the start of the summer.

Some Big Calls

First posted on 7th February 2021

US Markets: The ‘no-Trump’ response

We may learn a little about markets from the curious absence of Trump.

We had been confidently told that without him the US stock markets would fold, and as US markets collapse, these days so do global ones. Indeed, not just relying on the US, has become the fund management challenge of the last decade.

Well, he went, admittedly in a two-stage collapse, but he and the Republicans are out of office, yet the apparent upset in Georgia passed with barely a market ripple. Markets just went on up, unconcerned. Now some of that is their appetite for short term debt fueled spending, which even if you know makes little sense, it is folly to stand in the way of.

But beyond it, higher taxes and lower growth must be the consequence, if you are buying stocks on a 6 times multiple of earning the next two years matter a lot, but when buying them on the current S&P 500 forecast of 25.35 times earnings, that implies those later high tax years must surely be in the equation too.

Has the market priced in the downside?

So, what seems to have happened, is the downside of future years has been calmly offset against the short-term gains of a stimulus package: is that logical? It seems unlikely, if nothing else a big corporate tax rise is due, to notionally pay for it all, plus a fair slice of traditional “stick it to the rich” revenge legislation.

The assumption seems to be that the winners in the higher consumption aisle will be neatly offset by those who suffer from the new regulations. We are less sure and do feel the ultimate impact will inevitably be lower US growth.

Of course, tech might solve all, but then it is very richly valued already. It might solve the growth problem, but could still be loss making for investors, at these levels.

That is not to say that Biden put on a poor show in his advocating a “go big” package, he did it lucidly and with passion, a good speech.

For all that, when a new leader arrives and confidently asserts lots of economists (but notably not including The Economist this week) think he’s doing the right thing, it means trouble ahead. While his near certainty that the US would consequently be back to full employment by Christmas was touching, but absurd. The excess stimulus might get growth back to pre-pandemic levels, but that’s really not the same as employment.

The China issue remains big.

Another really big asset allocation call:

We are hearing ever more gruesome tales about East Turkmenistan, following on from decades of horrors from Tibet, both sovereign states seized by China in the political chaos after WWII.

If you see them like the other nations seized by Mao’s fellow imperialist Stalin, at much the same time, you will understand the repression. Although as ever with China, with a big dose of racism, against the 7% of their population who are not ethnically Han Chinese, plus of Communism, which still stands against any form of religion, be it Buddhist (Tibet) or Islam.

Will Biden care more or less than Trump about human rights? Well obviously, he will care more, as something is more than nothing. But will he be more effective than Trump, indeed do the Chinese find an unpredictable enemy with a penchant for sudden tariffs, harder to deal with, than a believer in the international order and gentle fireside chats?

Well here cynicism prevails: these are nations caught between empires, like Poland was for centuries; any tension in the international order will always see a land grab by their bigger neighbours.

I also believe Biden will find the proposed attacks on American consumption through both higher taxes and the removal of cheap energy and labour, can perhaps withstand also keeping Trump’s price rising tariffs in place. As notably he has done just that, to date. Indeed, he seems to be out-Trumping Trump on Federal procurement and protectionism.

But I still don’t think cutting China out of global trade, however barbarous their actions have been, is a runner. I think the vile abuses of power can go on, just as the EU has already handed a free pass to China’s torture chambers to plough on, by agreeing a new trade deal with no human rights teeth. So, in time, realpolitik will triumph with Biden.

It was I suppose nice to see China (after a pause for thought) suggesting locking up elected politicians in Burma, after the Army grew tired of holding all the cards, but getting no thanks for it, was a poor move. But there was a long enough pause to just tell the junta they didn’t mean it and were really rather pleased. A little more discord, more repression of the ‘tribal’ areas along their shared border, more sanctions to exploit, a few less pesky journalists, all are very much in China’s interest.

So, I see a curious dichotomy, in the Han Chinese areas, Tesla car plants, Apple phone stores, Starbucks a plenty, for a sophisticated technologically advanced middle class, will all thrive. While the minority non-Han areas will be pillaged for resources and labour and if they are good, be re-settled and re-educated and polished up for tourists. A bit like California in the 19th Century. So perhaps Xi is right, only China can split China, but then history suggests, it will, one day.

But not any time soon; you can take a moral position on Chinese racism, or an economic one on Chinese dynamism, but I am fairly sure the market will easily favour the majority.

This of course does create another ESG contradiction, the US high flyers rely on selling to the Han Chinese but are keen to exploit minority Chinese labour forces and natural resources. We can look forward to a great deal of sophistication in somehow disconnecting the two.

Efficacy of the Astra Zeneca / Oxford vaccine

Finally, I should mention the battering the EU and even perhaps the Euro (at a nine month low) has taken from the principled resistance to fudging the data exhibited by German scientists. The scientists are right, the evidence base for efficacy in the over 55 age group is indeed absent. Excitable politicians, including the normally precise Macron, have said it means it is ineffective, which it does not, only that proof is lacking.

Now that is presumably in part to cover the arrogant and inflexible EU procurement process, so full of checks and balances it strangles itself.

Boris’s vaccination stance

While Boris (faced with the same data) decided to wing it, correctly seeing that to save the NHS and his own electoral chances in May, he would rather give a potentially useless but harmless jab to millions of elderly disease vectors, than talk about due process. For once his disdain for the experts paid off.

The opposition in the meantime pleaded for a longer deprivation of our liberty by a longer pointless lockdown. Thank you for that suggestion.

Call it luck, if you will, but Boris has spent a long time practicing that ex tempore talent.

Proof might have been lacking, but it looked a jolly good bet. It sure was.

Charles Gillams

Monogram Capital Management Ltd

Fiasco

First Posted on 7th March 2021

WHY SYSTEMS FAIL, AND IT IS REALLY NOT ABOUT MONEY

A winter lockdown forces us all to examine our domestic interiors, with in my case perhaps a superfluity of paper, which led me to “Fiasco”, by Thomas E. Ricks. It is a seminal description of how complex systems create monsters and then fail, not for lack of effort, nor goodwill, nor money, but from thrashing about with no coherent strategy.

Indeed, arguably all those three inputs make matters worse. The tale simply told, in a largely deadpan tone, is of the greatest failure of American foreign policy since Pearl Harbour, and the greatest crime perpetuated by a British Prime Minister, since the Bengal Famine. It is how Bush, looking for revenge after 9/11, has spawned the disasters of the modern Middle East and locked us all into an unending cycle of terrorism and for the millions of people in the Middle East and beyond, brought poverty and despair.

Strategy matters

How? Well as Ricks tells it, they used the wrong tool for the wrong job: the strategy was hazy, mission creep endemic, the reporting system mangled everything to suit those making the reports. In the meantime, the aims kept shifting, and staff rotation and comfort swamped the original purpose of simply executing the mission.

While those they were sent to save, service and otherwise succour, were embittered and made hostile by the sacrifices they were expected to make, in return for specious, obscure propaganda.

So that led to the USA seeing the Iraqi people as the enemy, not just their crazed leader, while the entire Iraqi government was blamed for funding and concealing these non- existent weapons. Read it. Because from that flowed the failure of Phase IV (the post conflict reconstruction), the hostile occupation (not liberation) of Iraq, the idiocy of making that occupation subservient to Pentagon (not civilian) demands, the destruction of the fragile sectarian balance between Shia and Sunni, the rise of ISIS, the Syrian nightmare, Yemen, and the Iran nuclear programme.

Meanwhile, the attendant loss of money, the coming to power of the isolationist and militia based right wing in the US, the triumph of China in the emerging world, the resurgence of Russian thuggery all remorselessly followed on. Simply unbelievable. As Hicks writes it, you can hear the quiet click, as the lid of Pandora’s box was ever so gently released; beats bat breeding labs in Wuhan for the sheer laconic horror of it.

They did start the fire.

I do not know what the Pope going to Baghdad shows, beyond a startling personal courage, but it is no ordinary trip. The story also shows how in the modern world massive complex heavily manned delivery systems just can’t operate. They are dinosaurs. There was nothing inherently wrong with the US Army, but yet it created its own defeat.

WHY THIS SYSTEM WILL FAIL TOO, AND AGAIN, IT IS NOT ABOUT THE MONEY

So, to the UK budget, another set of tactical responses to poorly understood problems, hemmed in by contradictory rules, horribly distorted by politics. Sadly, the government really does believe it is the presentation that matters, not delivery. So, we had Rishi, spooling out unending largesse, and crudely claiming he was going to level with us, and level up North Yorkshire, and hand out freeport concessions to his chums and give Ulster another £5m for their paramilitaries (oh, you missed that one?).

A more extensive piece will shortly be on our website. It questions whether we are building back better. To me this looks more like ‘business as usual’, no growth, no decent jobs, London’s supremacy ploughing on, the regions thrown scraps. Green? When you freeze vehicle fuel prices for the eleventh year? Hardly. So yes, the budget was a relief, but no it should not have been. I doubt if markets will like it much, just because the publicans do.

DEBT AND EQUITY MARKETS AND INTEREST RATES

Markets Well, there is another puzzle, I thought the august President of Queens’ College Cambridge was going to self-combust into his tache, such was his thrill at seeing the bond vigilantes shooting up the US ten-year interest rate, during the week. Biden must pay his electoral base the bribe needed to win those Georgia Senate seats, at the full inflationary excess of $1.9 trillion, pumped onto an economy that is already visibly and dangerously overheating. The one Game Stop we do need, won’t happen.

So, you have $27 trillion and rising of outstanding US government debt, do the maths, if the bond vigilantes push rates up by 1% for the average duration of that debt, 65 months, that will cost you some $1.5 trillion back. So sure, you can cough up on your election pork, but it will cost the American people $3.4 trillion to do that.

Well, we don’t actually think that attempted rate increase can stick, for all the reasons it failed to stick over the last decade. Powell at the Fed then agrees with us, which on past form is perhaps an ominous sign of our approaching error (or possibly his gaining of wisdom).

Equity markets certainly felt unhinged; they started to whipsaw around in a frankly worrying fashion. On prior performance this does need sorting out, before it is safe to go back in. If (of all places) the US will lead on raising rates, it has to then pull up all other global interest rates, which we know will slow growth and take the wind out of the recovery. Indeed, it may threaten it, it has to cut (see above) how much governments can then borrow, has to start foreign exchange rates jockeying for position, has to question the whole free money basis of tech valuations.

I simply don’t think this recovery and these valuations can stand that just yet, and after a decent pause, the Fed (like many other Central Banks do already) will have to act to somehow hold down rates. Whatever Governments say, money does have a time value, and behaving as if it does not, is rather unwise. But I think extend and pretend will still persist for a while yet.

Charles Gillams

Monogram Capital Management Ltd