All kinds of everything

We move towards the end of the year with a great deal of challenging uncertainty and big calls to make, on inflation, China, US Politics, whether interest rates are pegged, and a few political issues. The temptation to sit it out and come back after Burns Night, is intense.

A lot of things will be clear then: the severity of the winter, and hence fuel prices, also of the EU COVID spike, the nerve of some Central Banks and who leads the largest one, and how the Beijing Olympics will go. All are potentially significant matters for investors.

Few of these issues are surprises, which is good, indeed we see advanced economies as being in fairly stable shape, but badly damaged by populist politicians, who can’t face telling voters that ‘nothing comes from nothing, nothing ever could’.

Inflation

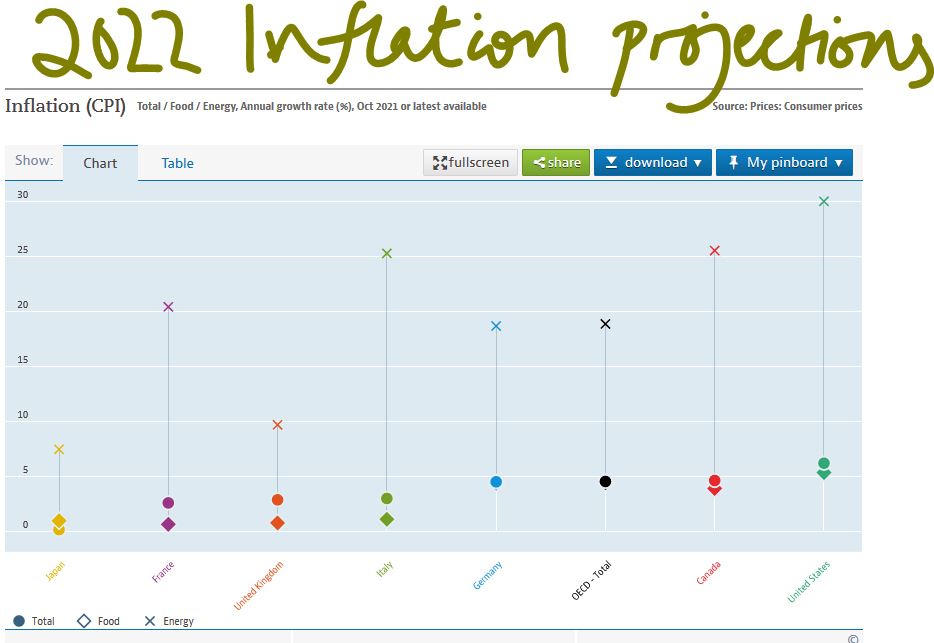

So, on inflation, we took some flak back in the Spring for talking about 5% inflation, but we regard that as pretty conservative now.

From the OECD data here.

We see it as structural too, not related solely to excess demand, supply chains or energy prices. All of these matter, but the last two are indeed transient, and excess demand is within the power of the fiscal and monetary authorities to affect. The real trouble is both the lingering and severe harm COVID is causing to productivity, especially in the service sector and in a public sector still too reliant on overmanning and allied with that, the curse of politicians trying to exploit the pandemic to pay off their chums.

Our conclusion is that we will have higher prices at least for the next two quarters and possibly all of next year. Critically Central Banks will most likely be powerless to prevent or reduce that, without bringing the house down.

Broken China?

One cannot but be envious of the performance turned in, yet again, by Scottish Mortgage. The half year gains are massively from one stock, Moderna, and then a broad raft of e-commerce and big data plays. So, really, they just continue to surf the NASDAQ run. By contrast their big cap China positions generally damaged performance but have not yet been visibly trimmed. Although China does drop from 24% to 17% of their NAV, which is significant, with North America rising from 50% to 57%. (I should also mention we don’t hold a position in this stock and have not had one this year.)

So, NASDAQ strength allows them to survive what for most fund managers has been the poison of owning anything in China this year. A decision we took, guided by our momentum models, very early.

We also note the manager’s viewpoint, which broadly aligns with a view that what Beijing is doing, is what the West should do as well, in attacking and controlling big tech platforms and their associated excesses. Telling the biggest companies to also do more to reduce inequality and cure social problems hurts profits; but they still see both as not unreasonable requests and they claim big Chinese companies are already willingly complying.

Yet for all the apparently cold rationality of the Scottish Mortgage viewpoint, we do understand it, and do see China trashing their participation in areas of global commerce and capital markets as an odd piece of self-harm, if it is really their aim, not just an ill-thought-out consequence of domestic actions.

So, we see the set back so far in China stock prices, as based on the possibility of the area being uninvestable, like Russia, but not yet on that certainty - see the how strong the trade figures are even with India, a so-called political antagonist. But tipping over to uninvestable would be a market shock and again we inch closer to that, with each diplomatic spat.

United States - and the Fed Chairman

The big US call, and again we signaled this as critical a while back, and actually well before the US Presidential Election, is about Powell. My sense is removing a competent Fed Chair for purely partisan reasons would be damaging to markets and the dollar. But the pressure on the ailing Biden to do just that feels intense, and I am struggling to see who in the White House will have the maturity to stop it, if Biden caves in.

Would a new Chair do things differently? Might markets push harder still for a rate rise and the dollar, short term at least, suffer? For now, re-appointment is still expected, but the odds on a shock are shortening.

Interest rates

The Bank of England is also, quietly in the midst of a storm, it is not actually independent however hard it claims otherwise, it relies too much on Whitehall just to survive, and, in a way, can’t do anything meaningful on inflation anyway. Still a rate rise, even a notional one, would show it is still awake. It makes little sense just now, but as a symbol might yet happen. To us it simply adds emphasis to the political chaos overtaking Johnson and the ongoing shift towards an institutional alignment with a Starmer government.

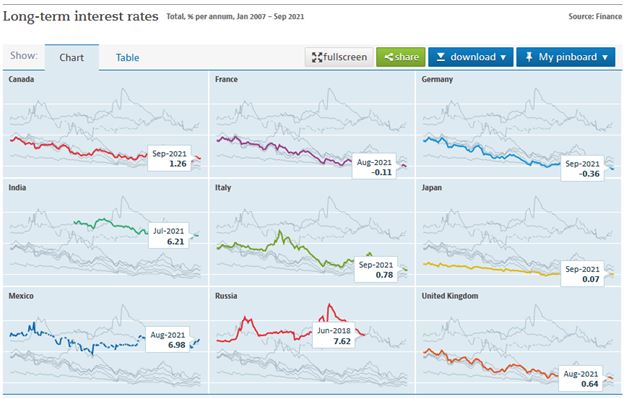

Material interest rate rises (so returning us to positive real rates) during 2022 therefore still feel impossible. Indeed, German rates have once more flirted with changing the nominal sign, only to collapse back into negative territory.

To sum up - where does that leave us?

Well curiously, mildly bullish. We may not much like the position, but who cares about that, our task is to make money for investors. We also have had a think about what rescued investors from the COVID slump, on the basis that a future sharp inflexion in interest rates could look much the same.

What we see is the power of real growth, not the flotsam of cash hungry concept companies that can never pay a dividend, but fast-growing, broad-based technology – following that has been the winner for a decade. We do want to call time on that, partly for the nonsense and scams it tugs along behind it, but we still struggle to see the turn.

Charles Gillams

Monogram Capital Management Ltd

Thin ice skaters or savants?

Are we drifting out further from the shore of reason, confident we can slide gracefully back to safety, or do we have insight others lack? Perhaps rates just can’t rise, whatever the inflation rate? If so, they are a paper tiger. While in a week others have pondered the failure of UK investing during this century, we look at why our biggest bank seems to hate the country.

I’m talking about the economics prognostications from HSBC, our largest bank. Following an intellectually flawed change in accounting standards (yes, another one), on top of the insanity of “mark to market” comes the “predicted loan loss model”.

Now professional bankers (unlike those in fintech) don’t make loans to lose money.

So, the politicians have instead required them to assume that they do.

Do the regulators know the industry they’re regulating?

Imagine portfolio management where you assume a certain portion of your buys always fail. Might be true, but how? And if you admit you have to buy a certain number of your holdings to instantly lose money, what do your investors feel?

But although banks advance money on the basis of their credit committee assessments, the hordes of regulators deem some of it is immediately lost. Being rational people on the whole, the banks, not great fans of predicting the future (given their record), hire economists to do this for them.

Economists, as we know, actually know little, but they do build nice econometric models. The regulators, who know even less, tweak the models, the bank Boards (see above) also tweak them. Soon every model is so tweaked that the economists wonder why they bothered.

UK shown as the riskiest of places to lend

Which leads us to page 62 of the HSBC Interim Report. We read it, so you don’t have to. There on the excitingly named, but dull as ditch water section called “Risk” it is set out.

Now HSBC lends globally: Mexico, India, Vietnam, Peoples Republic of China. So, guess where “The highest degree of uncertainty in expected credit loss estimates” relates to? Apparently, the basket case to end all wicker weaving is . . . Yes, the UK.

How?

Well first up their ‘central scenario’ model sees the short-term average UK interest rates for the next five years, as 0.6%. Which at least is positive (unlike France, as they hate Macron even more), France (i.e., the Euro) rates are assumed to stay negative till after 2026.

This gloomy central scenario has a 50% chance, although for France it is a tiny bit better at 45%.

Now these are central estimates, but their “downside scenario worst case outcome” for the UK is heavily weighted, with a chunky 30% chance, and oops, France then gets a 35% chance of that disaster, neatly using up the slack just given to them, by the central scenario.

Oh, and there’s worse: house prices crater, double figure unemployment is locked in etc.

And that’s a combined 80% of outcomes sorted; for a bank, that is pretty near certain.

China compared to the UK and France

What about Mainland China, then, their biggest market, if you now include Hong Kong. Well like the US (75%), China is at a high (80%) central scenario certainty, with Hong Kong at 75%. The worst-case scenario for the PRC is ranked at just a measly 8%, the lowest of any of their major markets.

Call it impossible - a prediction that China can’t fail.

Well, if that’s what the economists believe, who are the dumb Board to argue? Well of course they can, to cover their well-appointed posteriors, they then chuck another couple of billion of extra reserves in on top of the doomsday forecasts.

So, you see the vortex, everyone, regulators, economists, non-executives are just adding to reserves, like the good old days.

Maybe they are right, but we are seeing very little sign of those incredibly low global interest rates for five years, negative in France, 0.6% in the UK, 1.1% in the US? Really? If they are right, the markets are wrong.

And it is not just technical, with a 35% chance of France hitting the worst-case scenario, no wonder the Board has shipped out their French operations to a fin tech start up, albeit one backed by private equity giants Cerberus. Not an outfit known for overpaying. With five-year rates at 1.1% the dash for cash in the US makes sense too, selling out of their retail side as well. While with a virtually nailed on, global leading, 5% five-year average GDP growth in the PRC included, surely time to expand there?

Their loan book does not bear out HSBC’s bullish estimates of Chinese infallibility

So it is with some trepidation that we look at their loan book, on Real Estate, in China. It must be massive? Certainly, markets apparently assumed so last week. But no, a paltry $6.336 billion, for HSBC that’s a rounding error. Luckily too, all rock solid, just $28m of reserves needed, although given their certainty that almost feels excessive. The Board probably slipped that bit in.

I have great admiration for HSBC, and for me personally it is a long-term hold, but I have much less regard for regulators and ‘economists’ models, about which only one thing is certain. They are wrong.

So, I try to just strip out the predicted loan loss nonsense, but it is still driving asset allocations, even when palpably false. It explains much of the last two year’s volatility in bank share prices and reported profits, it also justified the highly damaging dividend ban.

Yet the HSBC share price is still not much above 50% of its pre-COVID peak. Great investor protection that was, it hammered HMRC receipts too, for what? Based on what?

Does anyone challenge those weird scenarios internally at HSBC?

Is there really a 35% chance of France virtually collapsing in the next five years?

Or is this just part of cozying up to China? In which case as the IMF has shown, bankers accused of fiddling data for China, are not always seen as professionals and can lack credibility.

Regulators should not impose those odd fictions on real investment decisions either.

If they do real economies and yes jobs, suffer.

Charles Gillams

Monogram Capital Management Ltd

POWELL / GOVE : DROPPING THE PILOTS?

Jerome Powell looked ill at ease twice at his Wednesday press conference, with neither occasion related to monetary policy. While in the UK, Gove’s sidelining is the end of any chance of reform from this UK government.

Oddly when asked about his ‘hand in the till’, for bailing out his own family position in US Municipal bonds, Powell barely flinched. So why then is he worried?

The Powell press conference - what riled him?

He should be upset that the unemployment rate among black Americans is twice the level it was pre-COVID, at over 6% still. Given his pledge to hold the money taps open till that is fully recovered, which has for a while been clearly impossible without traumatic inflation, harming those same citizens, that should concern him.

This has long been Powell’s talisman to ward off the hard left, who are bent on two great goals, firstly taking over the reins of power by ejecting him and secondly finishing off Wall Street, as they so nearly did under Obama. Kamala Harris has not been in that triumphant position, at least not yet, so do the left really want to accept another deputy?

I doubt it.

So, the two questions Powell was riled by, were one about the new deputy governor, who has in this case the power to drive the regulatory agenda, mandated under Dodd Franks. Now, if one of Senator Warren’s acolytes can be inserted there, Powell will find life immeasurably harder. But for markets worse still,(the second question) was if Powell himself is chopped (Trump looked into it) before the recovery is complete. A weakened Biden has few other goodies to offer, if his portmanteau bill to throw $3 trillion of cash to his voters fails, scrapping a top Trump nominee at the Fed, might be the political trade-off.

While for Powell, as this all starts to get rather dirty, I could see him for the first time, asking if he was really that bothered.

The US recovery - stimulus, markets, and minorities unemployment

The rest was all telegraphed passivity, still pumping enormous stimulus into the US economy, long after the recovery is running hot.

The US 10-year bond resumed its gentle lapping sound against the low-rate rocks, the storm of inflation roared on overhead, and the shadow of crossed fingers, fell on every vault.

The market has turned, in the US at least, from worrying about ‘when’, to guessing ‘how high’, with, given the global malaise, some confidence that “not very” is the answer.

Chop the Chair of the Fed, and that delicate illusion shatters. While whatever his politics, shipping Jerome off the transom, will hurt those same beleaguered minorities most. We should never underestimate the zeal of a convert, and he is that.

Sidelining Gove

We have not seen that kind of zeal on these shores for over a decade. True, various short-lived moneymen have breezed through ministries, failing to unpick their form and function, scattered management speak and chums’ contracts around equally liberally, and left.

But lifting the drains, sorting the plumbing, fixing the boiler type reform, no, Gove is oddly (because he was useless at it) the last of those to fall. But he had the great merit of scaring people and driving legislation, which with the stodgy morass of public sector spend, is part of the battle. But the idea that he can either help on “levelling up” (which is just a catch phrase, and always will be) or pacify the Celtic fringe, hungry for real power (and unaware it does not exist) is risible.

Meanwhile, the Cabinet Office is quietly stripped of ministers, to be put back in the box marked “too difficult” once more.

A parallel with Chinese policies

This is like selling the inhabitants of East Turkmenistan down the road for some of Chairman Xi’s foggy promises on future coal fired power stations. It would be sad if it weren’t true.

Although China is now helping us return to a land beloved by investors, where money is scarce and hence actually earns a return. While risk still clearly comes in many forms; including Marxist morality, that is, if such a thing exists.

Big corporate failures do at least achieve that heightened risk awareness.

Charles Gillams

Monogram Capital Management Ltd

:) You might already know that 'dropping the pilot' is a famous cartoon by Tenniel from 1890 when the Kaiser dropped Bismarck.

EVERY DOG

Boris seems slowly to be turning into the opposition to his own party, which I suppose is not new for him. Meanwhile China also seems to be hitting an identity crisis. Neither bodes well for investors.

We apparently have a real budget due soon, but this vain Prime Minister seems bent on upstaging his own team, so we had a pile of tax rises and changes to tax law bundled out in a haphazard fashion in response to the endless (and insatiable) demands of one ministry.

A likely collision course with natural Tories

That pretty well defines bad governance, and these ad hoc excursions into major spending plans are a hallmark of waste and short termism. So, to me the investor headline should be about planning ahead for the Tory government to either fail in front of an exhausted electorate, or less plausibly given the large majority, to implode. But have no doubt that No 10 and the mass of the Tory party are now set on a collision course.

The extraordinary extravagance of the blunt furlough scheme has always been the fiscal problem, and it is hard to believe, as many bosses are clamouring for new migration to solve multiple labour problems, largely in some measure of their own making, that the government has still parked up a fair chunk of two million workers, on pretty close to full pay.

I struggle to comprehend that number in a hot summer labour market, nor do I see why employers would cling onto staff until October at which point, presumably they take a decision? Are these ghost workers? Already happily in new jobs, but having done a deal with their bosses to split the loot, their fake pay for not being? Are these people HR have forgotten or are too scared to fire? Will they really try to pick up work they put down eighteen months back, in a largely different world and probably for a now quite alien organisation?

Who knows, but the whole thing cost £67 billion (so far) and that’s what Boris needs back. I challenge anyone to give a lucid explanation of how his latest proposal “fixes” social care for the elderly. Nor to explain how in parts of the country like this, with no state care home provision anyway, it can ever be called “fair”. So, to me, it is just bunce for the ever-gaping maw of the state, and the idea, with Boris in charge, that it will ever be temporary or even accounted for, is somewhat risible.

What would “fix” social care is transparent, autonomous, local provision, not bullied by a dozen state agencies, not run by money grubbing doctors, not harried by property developers and absurd land costs, nor daft HMRC grabs on stand-by staff pay, and it needs to be highly invested in simple technology, all IT integrated with the NHS; not this crippled, secretive, subscale mess.

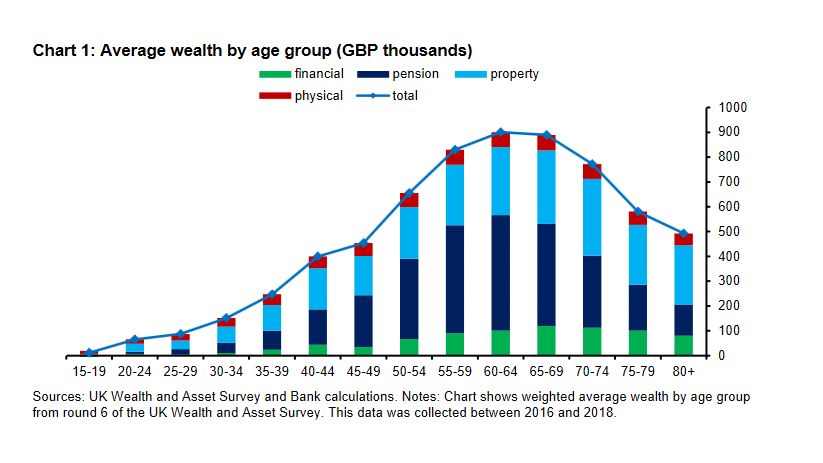

It is not that there is no problem, but it is as much operational as financial. A recent Bank of England paper looking at wealth distribution highlights how in retirement property comes to both dominate assets and also shrinks far more slowly with age.

(Sourced from this speech given at the London School of Economics, by Gertjan Vlieghe, member of the Bank of England’s Monetary Policy Committee.)

Of course, the crux here is seeing a family home as both an asset and an essential for life. That is the distortion, and this fiddling with care rules attacks the symptom, not the cause.

Can you trust a word he says?

So, now tax on income rises, a broken promise, employer tax rises, broken promise, the ‘triple lock’ on pensions is ditched, broken promise, and to top it off those working beyond normal retirement age (now 66) get a 25% tax penalty, via another broken promise. Oh, and if you are mug enough to save, then dividends will get hit too.

Again, there is a real problem but this is by no means a logical answer either: I guess the Treasury were applying heat on excess debt, and this is sand kicked back in their face, but it shows no sign of anyone solving anything. The UK has both high debt levels and no supportive currency block around it, sure France and Italy look bad, but they have Germany to help. The UK does not. Hence the anxiety.

So, Boris has had a fine Cameron-like bonfire of dozens of electoral promises; the worm turned on Cameron (and Clegg) when he couldn’t keep his word, and so it will turn on Boris. This time he won’t have Corbyn as the pantomime bete noir to bail him out. Indeed, Kier Starmer’s response linking this problem to inflated property prices is remarkably prescient, even if his typically confiscational solution is not.

These tax levels (as a % of GDP) have not been seen in fifty years, for an economy with a noticeably less effective grasp on government expenditure and a rather less globally competitive commercial base.

While tax rises are emerging everywhere (see below), and public service reform has become a simple money equation, need more service, spend more money, a dangerous one-way road.

Source: from this primary report

While notably, ‘buy to let’ is again left untouched. London house prices have doubled in this century, the FTSE 100 has moved from circa 6800 at its late 1999 peak to 7030 now and remains below pre-pandemic levels. So clearly this is not the time to hit the investors in jobs and business, who have had a 5% nominal gain (that is a 60% real loss) in twenty years and yet to leave the buy to let rentiers trading in second-hand hopes, with their 60% real gain in that time, untouched.

And don’t give us the dividends argument; the buy to let plutocrats get plenty of rent and all their sticky little service charges. This measure simply hits the workers and investors in business and pampers the bureaucrats and the rentiers. It makes very little sense, unless you are a senior civil servant or a retired prime minister, like Blair, of course.

Chinese insularity - the new version

Meanwhile China I feel is now detaching itself from both the rule of international law (in so far as it ever bothered) and more interestingly the world financial system. It may indeed end up better off, but for now (and this is also a change from much of the last 50 years) it does not feel it needs to attract external capital.

So much of its trade and capital markets engagement has been predicated on securing capital; this is an odd and novel twist. Although perhaps a logical response to the West, who rather than conserving capital as a scare resource, are immersing the world in torrents of surplus cash and inflation.

Much of China’s policy about their own global investment (so outside China) also used to have the same theme, driven by the desire for returns, influence and to hold their own export-based currency down.

But no more, it seems, and their inherent desire for autarchy, the hermit kingdom trope, has only been emphasized by Trump, WHO and the madness of the internet. It apparently wants to be the new Germany, (no longer the new USA), so it will be insular and conservative: cautious, not driven mad by debt and the baubles it procures.

Well, if true it will be different, whether it can really be done, without a wave of disruptive defaults is unclear, but don’t doubt the length of vision, so unlike our own government. While a theme of this century has also been where China leads, the rest must reluctantly follow.

Even a dog has its day, but for investors both the UK and China now feel significantly more canine than at the start of the summer.