We move towards the end of the year with a great deal of challenging uncertainty and big calls to make, on inflation, China, US Politics, whether interest rates are pegged, and a few political issues. The temptation to sit it out and come back after Burns Night, is intense.

A lot of things will be clear then: the severity of the winter, and hence fuel prices, also of the EU COVID spike, the nerve of some Central Banks and who leads the largest one, and how the Beijing Olympics will go. All are potentially significant matters for investors.

Few of these issues are surprises, which is good, indeed we see advanced economies as being in fairly stable shape, but badly damaged by populist politicians, who can’t face telling voters that ‘nothing comes from nothing, nothing ever could’.

Inflation

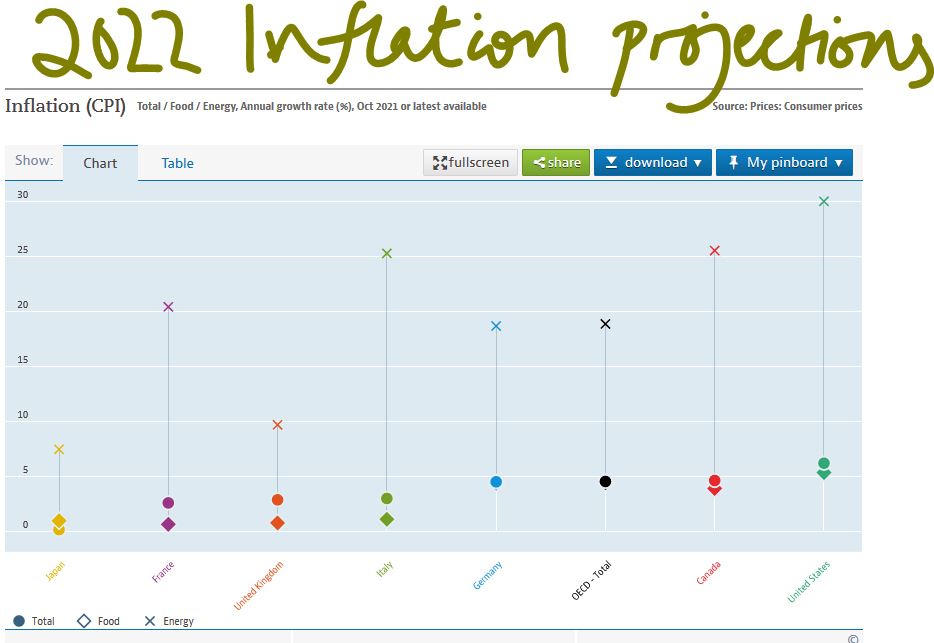

So, on inflation, we took some flak back in the Spring for talking about 5% inflation, but we regard that as pretty conservative now.

From the OECD data here.

We see it as structural too, not related solely to excess demand, supply chains or energy prices. All of these matter, but the last two are indeed transient, and excess demand is within the power of the fiscal and monetary authorities to affect. The real trouble is both the lingering and severe harm COVID is causing to productivity, especially in the service sector and in a public sector still too reliant on overmanning and allied with that, the curse of politicians trying to exploit the pandemic to pay off their chums.

Our conclusion is that we will have higher prices at least for the next two quarters and possibly all of next year. Critically Central Banks will most likely be powerless to prevent or reduce that, without bringing the house down.

Broken China?

One cannot but be envious of the performance turned in, yet again, by Scottish Mortgage. The half year gains are massively from one stock, Moderna, and then a broad raft of e-commerce and big data plays. So, really, they just continue to surf the NASDAQ run. By contrast their big cap China positions generally damaged performance but have not yet been visibly trimmed. Although China does drop from 24% to 17% of their NAV, which is significant, with North America rising from 50% to 57%. (I should also mention we don’t hold a position in this stock and have not had one this year.)

So, NASDAQ strength allows them to survive what for most fund managers has been the poison of owning anything in China this year. A decision we took, guided by our momentum models, very early.

We also note the manager’s viewpoint, which broadly aligns with a view that what Beijing is doing, is what the West should do as well, in attacking and controlling big tech platforms and their associated excesses. Telling the biggest companies to also do more to reduce inequality and cure social problems hurts profits; but they still see both as not unreasonable requests and they claim big Chinese companies are already willingly complying.

Yet for all the apparently cold rationality of the Scottish Mortgage viewpoint, we do understand it, and do see China trashing their participation in areas of global commerce and capital markets as an odd piece of self-harm, if it is really their aim, not just an ill-thought-out consequence of domestic actions.

So, we see the set back so far in China stock prices, as based on the possibility of the area being uninvestable, like Russia, but not yet on that certainty – see the how strong the trade figures are even with India, a so-called political antagonist. But tipping over to uninvestable would be a market shock and again we inch closer to that, with each diplomatic spat.

United States – and the Fed Chairman

The big US call, and again we signaled this as critical a while back, and actually well before the US Presidential Election, is about Powell. My sense is removing a competent Fed Chair for purely partisan reasons would be damaging to markets and the dollar. But the pressure on the ailing Biden to do just that feels intense, and I am struggling to see who in the White House will have the maturity to stop it, if Biden caves in.

Would a new Chair do things differently? Might markets push harder still for a rate rise and the dollar, short term at least, suffer? For now, re-appointment is still expected, but the odds on a shock are shortening.

Interest rates

The Bank of England is also, quietly in the midst of a storm, it is not actually independent however hard it claims otherwise, it relies too much on Whitehall just to survive, and, in a way, can’t do anything meaningful on inflation anyway. Still a rate rise, even a notional one, would show it is still awake. It makes little sense just now, but as a symbol might yet happen. To us it simply adds emphasis to the political chaos overtaking Johnson and the ongoing shift towards an institutional alignment with a Starmer government.

Material interest rate rises (so returning us to positive real rates) during 2022 therefore still feel impossible. Indeed, German rates have once more flirted with changing the nominal sign, only to collapse back into negative territory.

To sum up – where does that leave us?

Well curiously, mildly bullish. We may not much like the position, but who cares about that, our task is to make money for investors. We also have had a think about what rescued investors from the COVID slump, on the basis that a future sharp inflexion in interest rates could look much the same.

What we see is the power of real growth, not the flotsam of cash hungry concept companies that can never pay a dividend, but fast-growing, broad-based technology – following that has been the winner for a decade. We do want to call time on that, partly for the nonsense and scams it tugs along behind it, but we still struggle to see the turn.

Charles Gillams

Monogram Capital Management Ltd