We do think Powell is running off a cliff, just not the one the market assumes. As we endured the wettest February since (at least) 1836, when William Lamb was prime minister, and the wettest Tory government since records began, is there any chance of dryer times?

But first the tiresome tango of rate rises, the market swept to and fro, nation by nation, until the firm stamp of a well-heeled bond whips the whole mass back round again.

Bailey of the BoE, and Powell of the Fed

So, this week it is to be Bailey first out the gate, FTSE up, bond yields down, next week who knows? That rates will fall this year is the only certainty and the big US markets have built a near vertical climb out of that snippet. But you will note, not in rate sensitive stocks, the Russell (small cap) is still pretty flat, weighed down by the regional banks that dominate it.

And Powell, he’s guessing or as he calls it is “data dependent”, but for all that he is pretty happy projecting those guesses forward. So, he has moved from three rate cuts this year, to a new position of ? Well – three rate cuts this year. Not much data dependency there.

Before long he will run out of “this year”, because the inflation numbers are not behaving, nor critically is the oil price. Like Bailey in the UK, he is desperate to cut and under heavy political pressure to do so, both have said 2% inflation is not now needed, just moves in the right direction.

I feel the only thing that can get us there is a sudden (and indeed overdue) drop in the energy price, which we do expect in the summer, but who knows? It has held up rather well so far.

So, at the moment, Powell is perhaps running on thin air. Protectionism and vote buying fiscal measures mean he can’t get there without some other help.

Markets are supercharged – is it sustainable though?

And if rate cuts are what has supercharged markets in the US, I don’t see that as sustainable right through the year. It might instead be the possibility of a more market friendly, fiscally prudent, Trump, which would be more logical, in some ways; but that still feels implausible.

Nor do I see, as yet, many other markets joining in. Partly, why own anything else but the NASDAQ? Some markets have moved (Germany, Japan) but you could also argue that was after being oversold for too long. While the Swiss have cut rates, it is in part (as ever) to restrain their currency, I am less sure others will want to move ahead of the US.

They may be forced to, but there again their scope before European and UK elections looks limited. And some parts of the market, like UK smaller companies and many REITs (and some renewables) are not signalling anything but yet more damage and destruction, from suspect refinancing at high rates and over optimism on revenue.

Air Cushions

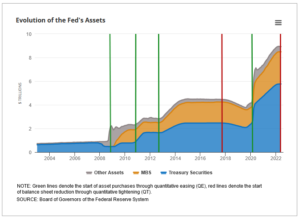

It was notable too how keen Powell is to slow the tightening imposed by reducing the Federal Reserve bond holdings, which has to date been done at a fairly brisk pace. He now talks of stabilising holdings, (in other words resuming bond buying, stopping the runoff of expired holdings) at what seems a high level, for fear of taking too much liquidity out of the system.

From this explanatory article on the process by the Richmond Fed.

For a while rates and reserve sales were working as one against inflation, but not for much longer it seems. Which should be good for bitcoin and other liquidity consuming monsters, if nothing else.

Who is Next in the UK?

The interesting Tory battle is between the Official wing, now entrenched in power, and showing no sign of intelligent life, beyond wanting to “make a good fist of it” in the inevitable electoral defeat. Then there is the Rebel wing, keen to cause trouble, break things, get popular support, or be nasty, if it gets them attention. Although the Official wing regards this as disloyal, it follows an old pattern. It is not just about this particular bunch: see this paper.

Faced with a like quandary under Blair, the Tory party swung left, towards the centre and power, just as Gordon Brown started the decade long Labour march to irrelevance. The Official assumption is that will work again, although the alternative scenario is that Starmer settles down in the centre for the long haul, and the Rebel wing, kept securely away from power, withers for lack of a structure.

But all ruling parties were, by definition, rebels once.

Back in 1836, William Lamb was an unsuccessful politician, wrapped around by Peel, sent to the House of Lords, then brought back as a centrist Prime Minister, and being generally useless, was turfed out again, after naming an Australian city, en route. One must hope for no repeats from history.

William Lamb, Lord Melbourne – from this site

It does not feel time for compromise candidates, nor will a ‘safe pair of hands’ do. Rishi is in a fight.

Meanwhile the fields here feel like salt marshes, dark water lurking in deep cracks, the lips of which slide into clay and suck at the soles of your feet. We certainly could do with some heat.

I do expect this run in markets to go on, but the upside in the big US indices looks more limited and broader participation elsewhere will await those rate cuts. Both their size and speed have a capacity to disappoint, especially when they are so hotly anticipated.

The politics, a long time coming, may become more influential. It could get choppy.

We will take an Easter break, after what feels like a long spring.

And return with the sun (we hope) on 14th April.