Jerome K Wiley?

We do think Powell is running off a cliff, just not the one the market assumes. As we endured the wettest February since (at least) 1836, when William Lamb was prime minister, and the wettest Tory government since records began, is there any chance of dryer times?

But first the tiresome tango of rate rises, the market swept to and fro, nation by nation, until the firm stamp of a well-heeled bond whips the whole mass back round again.

Bailey of the BoE, and Powell of the Fed

So, this week it is to be Bailey first out the gate, FTSE up, bond yields down, next week who knows? That rates will fall this year is the only certainty and the big US markets have built a near vertical climb out of that snippet. But you will note, not in rate sensitive stocks, the Russell (small cap) is still pretty flat, weighed down by the regional banks that dominate it.

And Powell, he’s guessing or as he calls it is “data dependent”, but for all that he is pretty happy projecting those guesses forward. So, he has moved from three rate cuts this year, to a new position of ? Well - three rate cuts this year. Not much data dependency there.

Before long he will run out of “this year”, because the inflation numbers are not behaving, nor critically is the oil price. Like Bailey in the UK, he is desperate to cut and under heavy political pressure to do so, both have said 2% inflation is not now needed, just moves in the right direction.

I feel the only thing that can get us there is a sudden (and indeed overdue) drop in the energy price, which we do expect in the summer, but who knows? It has held up rather well so far.

So, at the moment, Powell is perhaps running on thin air. Protectionism and vote buying fiscal measures mean he can’t get there without some other help.

Markets are supercharged – is it sustainable though?

And if rate cuts are what has supercharged markets in the US, I don’t see that as sustainable right through the year. It might instead be the possibility of a more market friendly, fiscally prudent, Trump, which would be more logical, in some ways; but that still feels implausible.

Nor do I see, as yet, many other markets joining in. Partly, why own anything else but the NASDAQ? Some markets have moved (Germany, Japan) but you could also argue that was after being oversold for too long. While the Swiss have cut rates, it is in part (as ever) to restrain their currency, I am less sure others will want to move ahead of the US.

They may be forced to, but there again their scope before European and UK elections looks limited. And some parts of the market, like UK smaller companies and many REITs (and some renewables) are not signalling anything but yet more damage and destruction, from suspect refinancing at high rates and over optimism on revenue.

Air Cushions

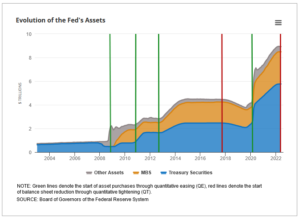

It was notable too how keen Powell is to slow the tightening imposed by reducing the Federal Reserve bond holdings, which has to date been done at a fairly brisk pace. He now talks of stabilising holdings, (in other words resuming bond buying, stopping the runoff of expired holdings) at what seems a high level, for fear of taking too much liquidity out of the system.

From this explanatory article on the process by the Richmond Fed.

For a while rates and reserve sales were working as one against inflation, but not for much longer it seems. Which should be good for bitcoin and other liquidity consuming monsters, if nothing else.

Who is Next in the UK?

The interesting Tory battle is between the Official wing, now entrenched in power, and showing no sign of intelligent life, beyond wanting to “make a good fist of it” in the inevitable electoral defeat. Then there is the Rebel wing, keen to cause trouble, break things, get popular support, or be nasty, if it gets them attention. Although the Official wing regards this as disloyal, it follows an old pattern. It is not just about this particular bunch: see this paper.

Faced with a like quandary under Blair, the Tory party swung left, towards the centre and power, just as Gordon Brown started the decade long Labour march to irrelevance. The Official assumption is that will work again, although the alternative scenario is that Starmer settles down in the centre for the long haul, and the Rebel wing, kept securely away from power, withers for lack of a structure.

But all ruling parties were, by definition, rebels once.

Back in 1836, William Lamb was an unsuccessful politician, wrapped around by Peel, sent to the House of Lords, then brought back as a centrist Prime Minister, and being generally useless, was turfed out again, after naming an Australian city, en route. One must hope for no repeats from history.

William Lamb, Lord Melbourne – from this site

It does not feel time for compromise candidates, nor will a ‘safe pair of hands’ do. Rishi is in a fight.

Meanwhile the fields here feel like salt marshes, dark water lurking in deep cracks, the lips of which slide into clay and suck at the soles of your feet. We certainly could do with some heat.

I do expect this run in markets to go on, but the upside in the big US indices looks more limited and broader participation elsewhere will await those rate cuts. Both their size and speed have a capacity to disappoint, especially when they are so hotly anticipated.

The politics, a long time coming, may become more influential. It could get choppy.

We will take an Easter break, after what feels like a long spring.

And return with the sun (we hope) on 14th April.

DREAMERS

What would Trump’s high tariff isolationist world look like? What would the mirror image be in Xi’s China? Not now, not next week, but rolling into the next decade.

And whatever portfolio theory says, and whatever the optimistic investor believes, 80% of my own portfolio is flotsam, drifting up and down on Pacific tides. Stocks I both like and which have compounded over decades are remarkably few. Oh, and a brief word on African housing.

GOING IT ALONE

But first, to give it the grand name, autarchy, or self-sufficiency. A bit of a joke - the Soviet Union tried it, Iran tries it, China famously only revived after ditching it.

But it is back in fashion, and not just in strange places. The EU industrial and agricultural policy is starting to look like a version; beyond their four walls they need carbon and chemicals, but within them they don’t, nor will they allow imports of them (or products including them). Quite fantastic.

Trump is on his 60% tariffs line. Xi clearly wants to cut off foreign capital, as it arrives infected with democracy and transparency, and the associated foreign reporting or verification.

So, could they? Yes, the US could - it is big enough, can do most things, and largely trades internally. While at least in Trump’s imagination the commercial borders are sealed, and so enforceable.

What goes wrong? Well at some, quite distant, point people stop expecting to trade with the US. So, at its most extreme, if China can’t sell to the US, it won’t buy from them either. But that is decades away, most Chinese production can probably take a 300% tariff, and still sell at a profit.

The flip side of the tariff is the huge salary for a barista, or a trucker. The latter is not so far away. Prices of domestic US production must rise, to allow the blue-collar Mid-West to rejuvenate. US consumers of course (including that barista) will pay vastly more for US goods, or will get hit with the import tariff; this of course is a tax on them.

What about Xi? Well again it is possible - that’s how China ran for much of his life, with a lot of new infrastructure, industrialization, since installed. He can do it all again. There, unlike in the US, the issue is capital. As a big net exporter, an area that will itself be under pressure, money will be harder to find; it already is.

THE NIGHTMARE

Countries that go through this closing cycle typically also do default (as the Soviets did, as US (and UK) railways did,). Folly, but it can be done.

The US has been going down this route since Obama, Trump talked a lot about it, but Biden too sees the resulting wage inflation as a good thing. So, it is the next US President’s policy either way.

Obama was keen on hitting capital markets (FATCA was and remains both a non-tariff barrier (I am being polite here) and a tariff on external capital) and I suspect a Biden administration must do the same, to balance the books.

While Xi never really left protectionism, WTO and GATT were mainly honoured in the breach.

And Europe? There is quite a strong strategic need to expand to the East, although as that goes through (and we are talking the mid 2030’s here) Ukrainian farmers, like Polish farmers today, will buckle under the rules; it barely matters about the Donbas, the EU will shut those heavy industries down too.

So, I think autarchy can work for all three, it will support a large uncompetitive labour force, and consumer choice will vanish. In many cases there will be lower quality and high prices. All three will attack (or in some cases keep attacking) capital flows.

And in the end, the entrepots will survive, those not in any such block, like the UAE or Singapore today, Amsterdam in the 17th Century, Yemen under the Romans and Victorian Britain.

The winners will be flexible, a tad amoral, assertive, in fluid alliances, but reliant on gold not steel to survive. And they will suck in entrepreneurial talent too. At a strategic level, that feels the place to be looking. Although buying uncompetitive heavy industries before their brief period of tariff induced profitability, has a short-term allure.

DOGS OR GREYHOUNDS ?

The ludicrous halving of CGT allowances, based on some fantasy “yield” number from the equally ludicrous HMRC, via the OBR, means once again the tiresome process of harvesting losses is upon us. No longer can they sit unloved at the back, snoozing; out they must come.

And what a tale of dross they reveal, and scattered amongst them so many once “good ideas” and busted yield stocks. Well, it sticks in the throat, but perhaps sticking it in a US wonder stock for six months is better?

Of course, if I knew when I acquired them that the FTSE was moribund for two decades, I would never have bothered. Seems it is time to simplify.

COLLATERAL

And lastly African housing. It was one of Gordon Brown’s (and the PRA’s) great achievements to get UK banks out of overseas assets, far too volatile, currency? foreigners?- Who needs them? Bring it all home and inflate the UK housing market with safe, cheap, mortgages.

So, Citizens went, Barclays were hounded out of South Africa, and so on – although their post-sale performance has really not been great either. Africa now just does not have proper mortgage financing for the vast bulk of the population. This is at a level I had failed to fully comprehend.

You think that despite everything, Africa must have got better. But no housing, so less health, less stability, no financial security. Safe recycling of profits in the continent is still hard. Aid can’t create institutional reform, but that’s the need.

If you look for the breakout into developed status, it starts there.

Investment, Politics and Economic cycles

An intriguing current question is which cycle are we in now? Is it the 2000 to 2022 one, or the 2008 to 2022 version? We look at the arguments, and the politics behind it all. And who exactly are energy sanctions designed to hurt?

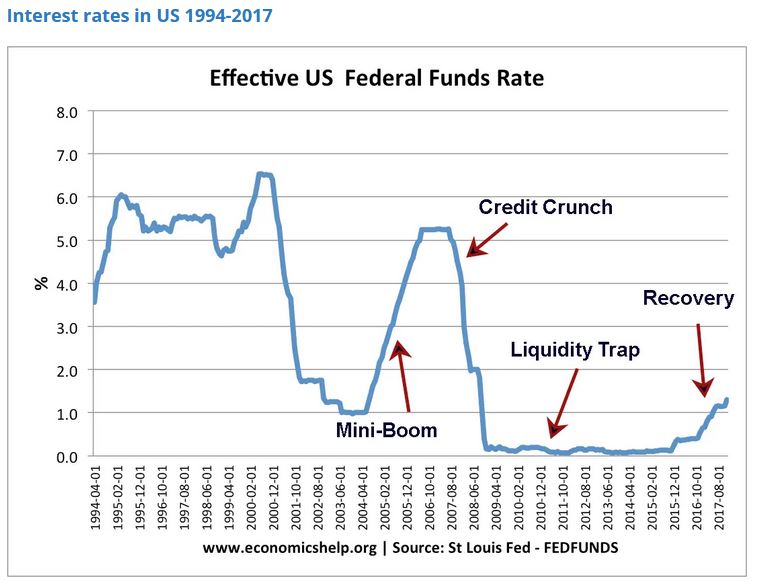

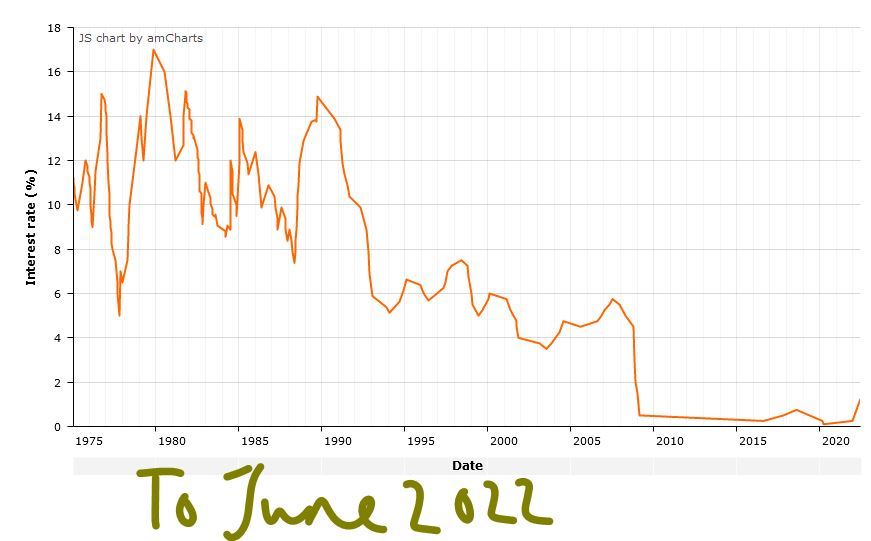

Hopefully, everyone has now understood it is not the 2020 + rate cycle. Why should it matter? Well, the implications for interest rates are startling. And indeed, for buying on the dip.

Interest rate cycles

If you consider that interest rates should be about 2% above inflation, to induce savers to defer their consumption, then this cycle really extends from 2000 onwards. The excess credit of that era, led firstly to the GFC in 2008. This in turn led to sudden a lack of credit, but ultimately exactly the same problem of excess debt has reappeared in 2022. The efforts to dampen cycles, seem to just exaggerate them. As does using the same remedy for two very different problems.

Here’s the US picture from the late 1990’s to 2017

In a similar way UK Base Rates in January 2000 were 5.5%, as they were in December 2007, before a long descent to 0.25% in August 2016 which largely held (with a few bumps) all the way to December 2021, when they were still 0.25%! That was before the recent rather modest rises. So, by our “inflation plus 2%” measure of sanity, October 2008 was the last time base rates were sensible.

Ref: this stats article

In other words, this crisis was foretold. SPACs were an early indicator which we mentioned back in 2020. So, if the GFC was caused by too much credit in the US sub-prime housing market, will the hallmark of this one be excess speculation in meme stocks and crypto currency? Clearly, we have now learnt that these “assets” are all distinctly well correlated with each other.

In which case, banking regulation was only half the answer to these vicious moves, because the regulatory perimeter is always too tight. The vandals will inevitably camp just outside the walls - wherever they are built.

Will inflation auto-correct?

It also raises the question of whether the “cure” to moderate this economic cycle is going to be a continuation of the same lax monetary policy. A rather fuzzy consensus has formed around the 3.5% level for interest rates to top out, falling back down in time.

We accept that is roughly the market belief, but feel it needs big assumptions about the auto-correction of inflation, which is presently just a fervent hope. In the real world (as distinct from asset bubbles) interest rates are too still low to matter, and we still have negative real rates on an exceptional scale. If Central Banks are really hoping to correct the laxity of 2007 to 2022, they will not stop at the current levels, but will go far beyond and cause a proper recession. But if they just want to re-establish the post 2008 consensus, they will go easy. They are talking about the former, acting like the latter with all their foot dragging and funny fixes. Is Euro fragmentation sorted? We doubt it. But if it is, they are not telling us, or really even defining what it is.

The ECB and our energy pricing policies

That partly is why markets are jittery, and why the ECB seeming to move from the cheap money forever camp (leaving Japan all alone there) to the appearance of being serious about inflation was so traumatic. We still don’t think they will tame inflation with interest rates alone, as by definition to do so breaks the Euro. This is because Italian debt in particular can’t be funded at any credible real interest rate. So, they too are just hoping for the best.

We also remain baffled by the West’s energy pricing policy that has created this sudden existential crisis. It was interesting to hear Boris telling a startled world, from Kigali, that not everyone feels creating a global food crisis is a rational approach to the Ukraine invasion. As if that was news, although it clearly was to him.

The politics behind it all

But there too we sense two underlying agendas.

Just as it is possible these interest rate rises are really to mop up the GFC policy errors, so also, a large part of the left is desperate for high energy prices. This includes the more thoughtful contingent hoping demand destruction will help sustainability goals (we ourselves have long advocated £2 per litre petrol, but gradually building to that over the last decade, not overnight), but also the more zealous, who are keen to exploit the crisis to render renewables competitive, that much sooner.

There are some big distortions in energy prices too, much of it created by the modern obsession with competition at all costs.

If this is so, then Russia is just a convenient excuse to ramp up carbon prices, blaming Putin for the resulting misery and achieving long-term goals. Certainly, Biden is acting that way, albeit, as ever talking the opposite way. Or rather his clever minders are.

There is a hint too that Boris is in the same deranged camp.

Oddly the EU led by Germany and Austria, with talk of restarting coal plants seem a little more pragmatic. Meanwhile the great beneficiary is Russia and the ever-stronger Rouble. They too have used the crisis to consolidate long term aims, not just in the war-torn rubble of Ukraine.

In short you either have inflation, or a credible short term means to create energy to replace Russian supplies, or high interest rates.

It is odd to think you would want to select just the first and last of that trio….unless your motivation was to correct another perceived policy error.

He who pays the piper

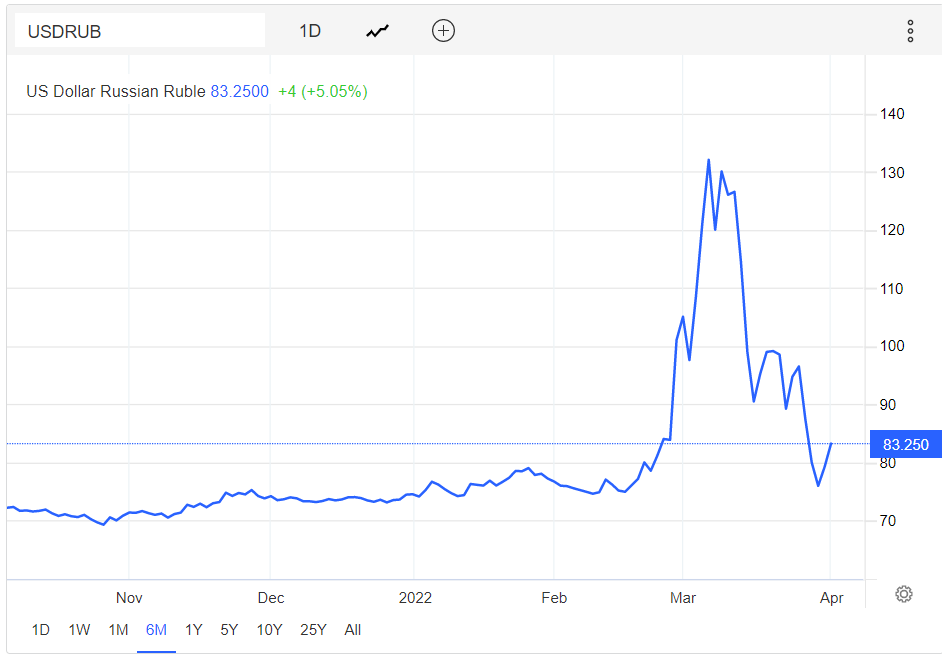

A very strange quarter: the FTSE100 was up, in sterling terms the S&P 500 was up, and the Russian Rouble ended where it was just before the Russian invasion. Short term dollar interest rates are nicely positive at last.

So where is the problem?

UK policy changes – could we finally be leading in economic policy?

Well, at long last the UK Chancellor has finally realised that just throwing money at inflation has one clear outcome: more inflation. This is tough lesson learnt back in the 1970’s and seemingly since forgotten.

If true it is a turning point and we predicted that it must always come sooner for the UK, if it persists in staying out of the Euro, than for bulkier continental currencies. Sunak also seems miraculously to be finally tackling some long overdue, multi-parliament, structural taxation issues, a rare sign of political maturity.

Whether he can hold the line against an increasingly dimwitted set of MPs and a media who constantly bay for more fuel to be added to the inflationary fire is unclear, but at least he has had the courage to step out into the unknown night, not cower by his warming bonfire of magic myths.

Nor is it clear whether he has the clout to unpick the cosy mess created by Theresa May and her childlike energy price fixing, or the ensuing nonsense from Ofgen. This fine-tuned capacity to the point of absurdity, guaranteeing a massive breakdown in the generating buffers, which had been painstakingly installed under a series of Labour governments.

Inflation policy is being taken seriously

But Rishi is trying; to cool inflation you simply must have demand destruction, there is no choice. This type of deep-seated widespread inflation will be hard to quell in any other way. True, areas of it can be contained, but it is hard to hold it all.

He is lucky to be helped by a Bank of England that seems to be serious about its brief, not regard it like Lagarde and Powell, as some kind of political inconvenience, to be wished away in double talk and evasion.

But he’s unlucky in other ways; we noted a while back that China no longer seemed to care about headlong export led growth, or more broadly about access to hard currency. It feels it can invest with and gain from its own currency and avoid importing the monetary excesses of the West. That in turn means it cares less about the endless flows of cheap goods to Europe and the US, and conversely about soaking up those surpluses in luxury goods and services. None of this is good for our inflation.

Meanwhile by eliminating the oddly divergent starting points for the two income taxes, National Insurance and Income Tax, Sunak has opened the way to many benefits. It continues to drop taxpayers out of the system, despite desperate measures by HMRC to suck more in. A key step, and a sign of, for once, a more liberal, more efficient government. Many more steps are needed to unshackle wealth creation, but it is a start. It makes much of the Universal Credit complexity around thresholds also fall away. Most of all it is a step closer to combining the two income taxes.

Politically this is highly desirable, as it strips away the pretence of a low starting rate of taxes on income.

It perhaps even gives an excuse for the otherwise inexplicable step of introducing National Insurance on employees passed retirement age. Given so much of current inflation is due to the mass withdrawal of older workers, another step in that direction looks remarkably stupid, but perhaps it has a higher purpose. It is good to see that the “Amazon” tax as Business Rates should be called, as it gives Amazon such a massive earnings boost, is also clearly still under long term review.

Why has the rouble recovered?

Source : this page on tradingeconomics.

The recovery of the rouble is of course not a market step alone, doubling interest rates, exchange controls and the mass withdrawal of exports to Russia from the West, are part of the story too. But it also shows a turning point. At first the West was so shaken by Russian military attacks, it was prepared to follow its own scorched earth policy, regardless of the harm caused to our own people and employers.

But at some point, the realisation that Ukraine’s army would hold, that Putin’s army was not that good after all, especially up against modern weapons and we start to understand that the further blowing up of our own bridges just raised the ultimate bill. Here are the sanctions we've imposed.

So, it seems it is no longer true that any price is worth paying to help Ukraine or hinder Russia. Clearly, we don’t have to jettison all our principles in dealing with other tyrants, nor one hopes do we need to alienate every piece of remaining goodwill with the rest of the world, by panicked grandstanding.

The mob is still rampant, goaded by an American president for whom no European economic sacrifice is too great.

But maybe it is also time to tell Ukraine that no NATO also means no imminent EU: Brussels has its hands full with its own struggling ex-Soviet states.

And what about Powell and his policy?

Well, we don’t expect him to hold inflation down with his trivial rate rises, nor politically can he do more than tinker. It seems too that Lagarde at the very least has to get Macron back in, before telling the bitter truth about rates.

So, we feel the bond market has rates where the market would like them to be, in the US, not where they will be set by the Fed anytime soon. And the Euro is now in a very odd place, still with monetary stimulus being applied and with an unstable gap to US interest rates.

So, we may look to be where we were late last year, but in most cases the cracks are now alarmingly wide.

Europe, quite urgently, but the US as well needs a sharp jolt upwards in rates to halt inflation.

Oddly only the UK looks to have spotted the danger, stopped the false COVID ‘economic expansion’, tightened fiscal policy, reformed taxes and raised base rates steadily, towards where they need to be. How unusual.

Long may PartyGate continue if this is the end result.

We will take a break for Easter now, and resume on the 23rd.

If the first quarter is a guide, by then everything will have changed again.

First Principles

Principles may be lacking in certain quarters, but we will start with the economics of inflation rather than Boris.

How much inflation and for how long?

Inflation is simply too much demand for the available supply, nothing more complex than that. So, you tame it by either less demand or more supply. So, unlike it seems most Central Bank economists, who it turns out are just statisticians, for ever looking back, we must project forward.

That tells us quite clearly that the inflationary imbalance will persist as long as demand stays artificially high and supply is artificially constrained. It is that simple. Forget the rest.

So as long as governments have fiscal laxity, along with negative real interest rates, they are pushing up demand. As long as workers won’t or can’t work, it will reduce supply, as long as economic activity is made less efficient by government action and diktat, it will reduce supply; end of.

So, at the very least Central Bank balance sheets must start reducing, which is not happening, stimulus must be fully withdrawn, which is not happening, and the old workers and their old ways of working must resume, which is not happening. Fresh capital can certainly change some of that, but it takes time.

Putin, Oil, and Geopolitics

What about oil?

This is the one item that alone might distort the picture. Which is positive, as we see oil prices falling in the summer. We also don’t see the West has really grasped what Putin is up to; in all the cold war style hysteria, he is possibly just after what he says. This is for the West to stop fomenting rebellion in Russia’s sphere of influence, and to be clear about NATO expansion plans, where there are indeed none in existence. He might have higher hopes, perhaps of a deal on Crimea in exchange for the Donbas, but we doubt it (or his chances of getting it are low). As might we, less interference in our politics would be nice; but see previous answer.

Nor is it that clear he is actually rationing energy; it is telling that Russia is reported as not able to meet its OPEC + quota, which at these prices is crazy. His oil industry will have been hit by sanctions, and the loss of Western expertise, and the Russian economy will also have suffered under COVID. A loosening of sanctions would really help him, for all his bravado.

If that reading is correct, as the situation winds down and OPEC+ winds up production, oil prices will fall, I would expect quite substantially. Much of the energy spike is self-inflicted, with nuclear plant closing or offline in France and Germany, and reckless price controls, having made using UK gas storage unattractive. All of these things can be sorted out.

Any possible good outcomes on inflation?

So, to inflation, well it won’t care much about the pinpricks inflicted by the likely interest rate rises now under discussion, especially if they creep up so slowly no one notices. It needs a unified 1% OECD jump to cool this lot down, and the ending of stimulus. Neither is likely. Closing the US printing presses, were it to happen, does also have interesting global impacts, as Andrew Hunt notes.

We see it all turning rather glacially, with a bigger slump in inflation, if energy prices fall, but then being generally persistent in the 3% area for the rest of the year. We expect to have both higher rates and inflation for a while.

All of this is mighty tricky for investors, but I don’t sense that just bailing out is right, nor that the actual interest rate rise will cause an enduring slump in all asset prices. Investors have to own something, or they will sit and be mauled by inflation.

And what of Johnson?

It is easy to read the current level of confusion from either side’s viewpoint. Yet to me, I see the normal factional infighting, the usual media exaggeration, some political mischief making, but still no reason to depose a Prime Minister with a very clear mandate and a large majority. Like any large party the Tories have the embittered and passed over, the Remainers and fans of state intervention and a volatile and raw body of new recruits in seats no one ever expected to win. Plus, no doubt a few opportunists who sense that the heavy lifting on COVID and BREXIT is done, and they can now seize all the prizes.

The Tories do need a reset; it would be nice if Downing Street left Ministers to govern and simply acted as a cheerleader. Not that I see that happening, leaders and their hangers on always lust after more and more centralization, more control. But until a compelling, unifying, plausible Tory opponent appears, I foresee no change.

And in a way with reform all but dead, with Gove’s last hurrah on ‘Levelling Up’ a damp squib, it may not matter who leads the Tories, they have very little real power.

It is quite odd how big majorities do so little good, and how poor party discipline is, when they have them.

Charles Gillams