We look today at a domestic version of a complex, rulebound meaningless pursuit that too many of our brightest and best waste their lives pursuing, and whose twists and spirals ultimately signify nothing. I mean the UK Office of Budget Responsibility (OBR), of which I took a tour this week. Almost nothing there is as it seems.

Meanwhile markets reprise 2023, with tech or bust once more. Although tech and bust is the market fear, as fiscal stimulus and services inflation hold rates too high for some to survive.

UK OBR

The OBR was an explicitly political creation of the coalition government in 2010, with a remit to somehow restrain the ever-increasing debt governments take on, to bribe electors. They were also keeping half an eye on the much older ‘debt ceiling’ style US legislation. It failed; so now the OBR just thrives on telling the government how much more it can spend or not collect, with spurious accuracy; purportedly managing public money.

It doesn’t forecast anything as a forecast is an expected outturn. All it does is crank the handle on the old, discredited Treasury model, creating projections. A projection is 1) a ‘what if’ assuming all other things are equal and 2) only as good as its underlying model.

One clear flaw is the requirement to take government spending plans as viable when they are usually not. They also have no idea where public sector productivity is heading. It has no remit to look at how productivity might be helped and no capacity to look back at how wrong its old ‘forecasts’ were. That is the job of the National Audit Office, it seems.

It also won’t talk to the Bank of England, as that organization has executive powers (to raise or lower rates) and the OBR apparently must just be a commentator: more glass bead rules.

So, it fiddles with the model and its six hundred inputs and countless equations to give precise answers to pointless questions, because each answer sits in its own vacuum.

There’s a heavy focus too on tax revenue, but with quite a thin staff, this results in excessive reliance on HMRC, who can be hopelessly wrong (and typically over optimistic on tax yields). But again, if the tax bods claim some complex, job destroying, arcane nonsense will raise income, in it goes. The side effects of such decisions must also be ignored.

It has no remit to assess how taxes impact productivity, which partly explains many of Hunt’s blatantly anti-growth measures. As a result, the economy is locked into low productivity, getting steadily worse.

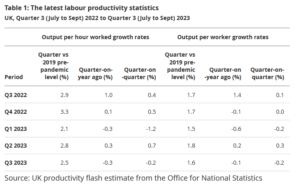

From the ONS flash report here

For all that the financial press will be full of the OBR cogitations on the forthcoming budget (March 6th). One little bit of power they do have involves a requirement for the Chancellor to give ten days’ notice of the budget contents (hence no doubt the usual leakage levels) and for two months before that, they sift through proposals and indicate how each, in isolation, would work. The economy is an interconnected entity, they know, yet there is no attempt to give us an overall view.

THE LOST RALLY

I have few rational reasons why anyone would lend the UK Government at under 4% for ten years, were it not for some foolish faith in the OBR projections, without reading the small print.

Which brings us to markets: back in November the UK ten-year gilt yielded 4.5%, by about Christmas falling to 3.5%, and now it is back over 4% and headed higher.

Chart from this website

Quite a spin in ten weeks for a ten-year duration instrument. This is why that Christmas rally in value stocks was ignited, and indeed started to push out into Real Estate, various Alternatives and certain smaller stocks.

Although it didn’t move those stocks most sensitive to the credit markets, who will need to rollover/refinance current debt. This affects for example, the renewables, private equity, and office property. The problem there is of both rates and availability. With the scale of asset mark downs, whether interest is 6% or 8% is not the issue; there is no funding appetite even at 20%.

The year-end rally moved a wide group of stocks, from extremely cheap to still very cheap. We then realized that it was not yet safe to go back in, so buyers evaporated, and prices faded. With state debt at 4%, against persistent inflation, fixed income is also oddly unenticing. So, the market default has been to pile back into the biggest, most liquid, US tech stocks and similar easy-in/easy-out momentum trades, like bitcoin.

There is little sign of deflation in services, no evidence of it in housing, where supply issues dominate, and little in financial services; indeed, all the supply side mess of COVID and excess regulation, is simply getting worse. Public sector pay inflation is also high and going higher (don’t tell the OBR).

This does not dent the 2024 story of cutting rates and hence higher stock markets, but it may require some patience, and that delay may itself create more pain.

The Glass Bead Game and the ‘lost marbles’ qualification for office

Our games of self deception are not to be confused with lost marbles of course; it turns out that the onset of senility is now a bar to being prosecuted for storing secret state papers and also, somehow, a recommendation for re-election for four more years, to the most powerful post in the world.

If that ends up giving us Trump again, by default, presumably he will at least have a defense in future years, against those same crimes? He does not have the “Biden defense” available at present, perhaps thankfully.

As the OBR shows, very clever institutions can come up with very silly solutions.