Jerome K Wiley?

We do think Powell is running off a cliff, just not the one the market assumes. As we endured the wettest February since (at least) 1836, when William Lamb was prime minister, and the wettest Tory government since records began, is there any chance of dryer times?

But first the tiresome tango of rate rises, the market swept to and fro, nation by nation, until the firm stamp of a well-heeled bond whips the whole mass back round again.

Bailey of the BoE, and Powell of the Fed

So, this week it is to be Bailey first out the gate, FTSE up, bond yields down, next week who knows? That rates will fall this year is the only certainty and the big US markets have built a near vertical climb out of that snippet. But you will note, not in rate sensitive stocks, the Russell (small cap) is still pretty flat, weighed down by the regional banks that dominate it.

And Powell, he’s guessing or as he calls it is “data dependent”, but for all that he is pretty happy projecting those guesses forward. So, he has moved from three rate cuts this year, to a new position of ? Well - three rate cuts this year. Not much data dependency there.

Before long he will run out of “this year”, because the inflation numbers are not behaving, nor critically is the oil price. Like Bailey in the UK, he is desperate to cut and under heavy political pressure to do so, both have said 2% inflation is not now needed, just moves in the right direction.

I feel the only thing that can get us there is a sudden (and indeed overdue) drop in the energy price, which we do expect in the summer, but who knows? It has held up rather well so far.

So, at the moment, Powell is perhaps running on thin air. Protectionism and vote buying fiscal measures mean he can’t get there without some other help.

Markets are supercharged – is it sustainable though?

And if rate cuts are what has supercharged markets in the US, I don’t see that as sustainable right through the year. It might instead be the possibility of a more market friendly, fiscally prudent, Trump, which would be more logical, in some ways; but that still feels implausible.

Nor do I see, as yet, many other markets joining in. Partly, why own anything else but the NASDAQ? Some markets have moved (Germany, Japan) but you could also argue that was after being oversold for too long. While the Swiss have cut rates, it is in part (as ever) to restrain their currency, I am less sure others will want to move ahead of the US.

They may be forced to, but there again their scope before European and UK elections looks limited. And some parts of the market, like UK smaller companies and many REITs (and some renewables) are not signalling anything but yet more damage and destruction, from suspect refinancing at high rates and over optimism on revenue.

Air Cushions

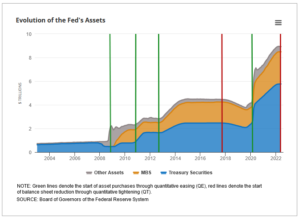

It was notable too how keen Powell is to slow the tightening imposed by reducing the Federal Reserve bond holdings, which has to date been done at a fairly brisk pace. He now talks of stabilising holdings, (in other words resuming bond buying, stopping the runoff of expired holdings) at what seems a high level, for fear of taking too much liquidity out of the system.

From this explanatory article on the process by the Richmond Fed.

For a while rates and reserve sales were working as one against inflation, but not for much longer it seems. Which should be good for bitcoin and other liquidity consuming monsters, if nothing else.

Who is Next in the UK?

The interesting Tory battle is between the Official wing, now entrenched in power, and showing no sign of intelligent life, beyond wanting to “make a good fist of it” in the inevitable electoral defeat. Then there is the Rebel wing, keen to cause trouble, break things, get popular support, or be nasty, if it gets them attention. Although the Official wing regards this as disloyal, it follows an old pattern. It is not just about this particular bunch: see this paper.

Faced with a like quandary under Blair, the Tory party swung left, towards the centre and power, just as Gordon Brown started the decade long Labour march to irrelevance. The Official assumption is that will work again, although the alternative scenario is that Starmer settles down in the centre for the long haul, and the Rebel wing, kept securely away from power, withers for lack of a structure.

But all ruling parties were, by definition, rebels once.

Back in 1836, William Lamb was an unsuccessful politician, wrapped around by Peel, sent to the House of Lords, then brought back as a centrist Prime Minister, and being generally useless, was turfed out again, after naming an Australian city, en route. One must hope for no repeats from history.

William Lamb, Lord Melbourne – from this site

It does not feel time for compromise candidates, nor will a ‘safe pair of hands’ do. Rishi is in a fight.

Meanwhile the fields here feel like salt marshes, dark water lurking in deep cracks, the lips of which slide into clay and suck at the soles of your feet. We certainly could do with some heat.

I do expect this run in markets to go on, but the upside in the big US indices looks more limited and broader participation elsewhere will await those rate cuts. Both their size and speed have a capacity to disappoint, especially when they are so hotly anticipated.

The politics, a long time coming, may become more influential. It could get choppy.

We will take an Easter break, after what feels like a long spring.

And return with the sun (we hope) on 14th April.

The Glass Bead Game

We look today at a domestic version of a complex, rulebound meaningless pursuit that too many of our brightest and best waste their lives pursuing, and whose twists and spirals ultimately signify nothing. I mean the UK Office of Budget Responsibility (OBR), of which I took a tour this week. Almost nothing there is as it seems.

Meanwhile markets reprise 2023, with tech or bust once more. Although tech and bust is the market fear, as fiscal stimulus and services inflation hold rates too high for some to survive.

UK OBR

The OBR was an explicitly political creation of the coalition government in 2010, with a remit to somehow restrain the ever-increasing debt governments take on, to bribe electors. They were also keeping half an eye on the much older ‘debt ceiling’ style US legislation. It failed; so now the OBR just thrives on telling the government how much more it can spend or not collect, with spurious accuracy; purportedly managing public money.

It doesn’t forecast anything as a forecast is an expected outturn. All it does is crank the handle on the old, discredited Treasury model, creating projections. A projection is 1) a ‘what if’ assuming all other things are equal and 2) only as good as its underlying model.

One clear flaw is the requirement to take government spending plans as viable when they are usually not. They also have no idea where public sector productivity is heading. It has no remit to look at how productivity might be helped and no capacity to look back at how wrong its old ‘forecasts’ were. That is the job of the National Audit Office, it seems.

It also won’t talk to the Bank of England, as that organization has executive powers (to raise or lower rates) and the OBR apparently must just be a commentator: more glass bead rules.

So, it fiddles with the model and its six hundred inputs and countless equations to give precise answers to pointless questions, because each answer sits in its own vacuum.

There’s a heavy focus too on tax revenue, but with quite a thin staff, this results in excessive reliance on HMRC, who can be hopelessly wrong (and typically over optimistic on tax yields). But again, if the tax bods claim some complex, job destroying, arcane nonsense will raise income, in it goes. The side effects of such decisions must also be ignored.

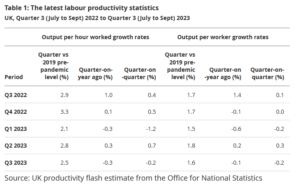

It has no remit to assess how taxes impact productivity, which partly explains many of Hunt’s blatantly anti-growth measures. As a result, the economy is locked into low productivity, getting steadily worse.

From the ONS flash report here

For all that the financial press will be full of the OBR cogitations on the forthcoming budget (March 6th). One little bit of power they do have involves a requirement for the Chancellor to give ten days’ notice of the budget contents (hence no doubt the usual leakage levels) and for two months before that, they sift through proposals and indicate how each, in isolation, would work. The economy is an interconnected entity, they know, yet there is no attempt to give us an overall view.

THE LOST RALLY

I have few rational reasons why anyone would lend the UK Government at under 4% for ten years, were it not for some foolish faith in the OBR projections, without reading the small print.

Which brings us to markets: back in November the UK ten-year gilt yielded 4.5%, by about Christmas falling to 3.5%, and now it is back over 4% and headed higher.

Chart from this website

Quite a spin in ten weeks for a ten-year duration instrument. This is why that Christmas rally in value stocks was ignited, and indeed started to push out into Real Estate, various Alternatives and certain smaller stocks.

Although it didn’t move those stocks most sensitive to the credit markets, who will need to rollover/refinance current debt. This affects for example, the renewables, private equity, and office property. The problem there is of both rates and availability. With the scale of asset mark downs, whether interest is 6% or 8% is not the issue; there is no funding appetite even at 20%.

The year-end rally moved a wide group of stocks, from extremely cheap to still very cheap. We then realized that it was not yet safe to go back in, so buyers evaporated, and prices faded. With state debt at 4%, against persistent inflation, fixed income is also oddly unenticing. So, the market default has been to pile back into the biggest, most liquid, US tech stocks and similar easy-in/easy-out momentum trades, like bitcoin.

There is little sign of deflation in services, no evidence of it in housing, where supply issues dominate, and little in financial services; indeed, all the supply side mess of COVID and excess regulation, is simply getting worse. Public sector pay inflation is also high and going higher (don’t tell the OBR).

This does not dent the 2024 story of cutting rates and hence higher stock markets, but it may require some patience, and that delay may itself create more pain.

The Glass Bead Game and the ‘lost marbles’ qualification for office

Our games of self deception are not to be confused with lost marbles of course; it turns out that the onset of senility is now a bar to being prosecuted for storing secret state papers and also, somehow, a recommendation for re-election for four more years, to the most powerful post in the world.

If that ends up giving us Trump again, by default, presumably he will at least have a defense in future years, against those same crimes? He does not have the “Biden defense” available at present, perhaps thankfully.

As the OBR shows, very clever institutions can come up with very silly solutions.

Sweet Dreams

Here we talk about the delights of the Conservative Party Conference in rainy Manchester, the failure of the in-built two-year time horizon in inflation models, and what may happen to interest rates.

FANTASY IN BLUE

At times in Manchester, it felt like everyone was looking for something. As government steps up spending initiatives, and empowers regional governance, and drives big spending on not achieving net zero, the chorus of demands for more taxpayers’ cash grew deafening.

There was utter silence on efficiency or capital allocation; it was all just “a good thing” to spend more.

And oddly too, with so much lip service to the long term and reducing debt and halving inflation, the ‘how’ of those was also ignored. Surely halving inflation is not even a government task? It was devolved to Bailey of the Bank - yet we heard not a word of criticism. If ever an eight-year commitment to a disastrously run project needed cancelling, his appointment looks to be just that.

This would spare him (and us) those endless letters on why he’s failing to control inflation.

For all that Conference was oddly cheerful - quite a bit of steel on show, from Suella of course, the only natural politician involved - some guts from Steve Barclay at Health, and Stride, a little less convincingly, at work and pensions - else, all rather wooden and on autocue. Although you could not help but notice that Farage still charms the fringe crowds.

COMPETENT DELIVERY?

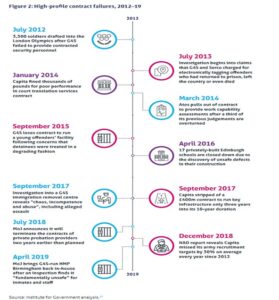

The abiding issue remains competent delivery. It was odd to hear the government on HS2 arguing for accountability by sacking their own Euston delivery team. As if the failure of HS2 is not theirs, and theirs alone.

Instead of penny packet incrementalism, government needs a holistic delivery view - perhaps why France can build a TGV, and we simply cannot.

From this report of the Institute for Government

From this report of the Institute for Government

The Maude/Osborne “reforms” destroyed half our domestic contractors, by a short-term focus and ceaselessly moving the goalposts. As a result, home grown firms are in the minority on the HS2 contractor list, and giant multinationals with more lawyers than bulldozers were the main bidders.

They want top dollar to take on the risk of a lazy, indecisive government machine - no wonder.

THE CHANGE PRIME MINISTER?

We have been very clear since 2019, that the Tories can’t win another term, none of that changes, but the scale and composition of the anti-Tory majority next year is rather less clear.

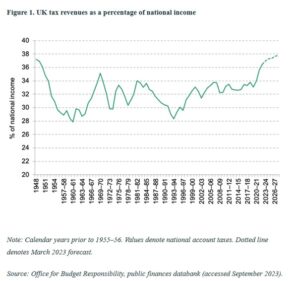

In many ways, the best case for a Labour defeat, at the next election, is that the Tories have done it all already. They have blown the bank on out-of-control spending, splurged on unaffordable welfare, and raised taxes to unsustainable levels.

From this website

From this website

This government also crashed the pound, let inflation loose, let rhetoric overtake sense and has gone in hock to foreign debtors. I suppose they have yet to invade a sovereign country without a UN mandate, but they are working on that too.

So? Well oddly Starmer is still slightly boxed in, and in terms of polling data, not really getting much help from the weak Lib Dems, in those critical three-way marginals in the South. While Scotland clearly has had enough of the SNP running Scotland, it is less clear that they don’t want the cause of independence to be heard in London. The Rutherglen by-election could be sending both messages, but in a general election voters only send one. I would not assume that genie is back in the bottle just yet.

JITTERBUG BLUES

We continue to see US rates above inflation, which is very different from UK rates which are still below.

So exactly what Powell (and Bailey) are doing with selling down the Central Banks balance sheets at a time of maximum new issuance, is not clear; it solidifies vast paper losses, creates new losses on the rest, so seems to be quite a pricey warning shot to politicians. But it is a plausible reason (along with super high levels of new issuance) for current bond market nerves.

We have always felt the Central Bank models, where whatever the question the answer is “it will be fine in two years” are a fiction. The awareness that rates and inflation are staying high, is long overdue. But we have been in no doubt about it, for two years, nor have we ever flinched in our aversion to bonds, we were never being paid enough for the risk.

The jitters in the bond market feel more like a turning point, the sudden chop as the tide turns. The dollar has risen; people want to be there; if there is enough demand, that will lower bond yields again. So, I am not looking at US rates rising, so much as at the battle switching back to fiscal policy. Although in the end if Biden really wants 7% rates, I guess he can try to have them.

The UK and Europe are less contested, the labour market in Europe at least is not that tight, although still at record low unemployment levels, but with a lot of surplus workers in France, Spain, and Italy, and especially amongst the young. Euro interest rates are also really quite low still and are not yet looking restrictive.

So, it looks like another round of softening currencies, stagnant inflation and rate rise pressure. Central Banks still hope they have done enough. Even so it is quite odd that UK long rates are only just touching the level of a year ago, logically they should be two points higher. As for oil, we have seen this autumnal spike as a little surprising but transient, and as ever at this time of year, the short-term path is weather related.

Overall if the start is any guide, October yet again could be rough for markets, but longer term still looks brighter.

By their works . . .

Well, the works this week: a pensive Jerome Powell does nothing, a reckless Andrew Bailey does nothing, Canada joins Biden in picking fights, and the bulk of most equity markets are stuck, going nowhere.

NO MORE US RISES

So, the apparently knowledgeable financial press said that Powell predicts rate rises? He said nothing of the sort of course. True the other members of the FOMC dot plots were in aggregate higher than the current rate, but by a fraction, it is like the average family being 2.4 children, meaning everyone, in the absence of King Solomon, has three children. No, it does not, it means on average there are no more rate rises.

So, Powell has stopped the runaway train, by lighting red flares in front of it and throwing railway sleepers across the track. Job done. Inflation is way below base rates. Bailey has asked nicely and tried to lasso the inflation express from half a mile down the track - won’t work. Inflation above base rates is misery, inflation below base rates is time to loosen.

Powell did start rambling, describing parts of the economy with “by their works ye shall know them” but decided that was all a bit erudite, before he had even finished the thought. He then reverted to the old saw, “forecasters are a humble lot, (with much to be humble about)”. Presumably that is unlike Central Bankers? I still think that judging them by their works makes sense.

But Powell is happy: the Q&A session threw him a litany of gloom, government shut down, students having to repay debt, auto plant shut downs, but no, all is fine.

The core US consumer and therefore the US economy, is in a good place was his verdict.

BAILEY DITHERS

Bailey seems to like to crash the pound every October, which is not good for inflation, just as picking fights globally is not good for oil prices. And it is also bad for inflation.

And either the UK government will cave in to public sector strikes or productivity will keep falling due to said strikes. Neither are much good for the economy. Nor is it good for the markets: in performance terms, the UK remains the sick man of Europe, amongst major markets.

THE MAGNIFICENT SEVEN RIDE ON

I was at the annual Quality Growth conference in London again, a stock picker’s feast as usual. It seems that if enough stock pickers can agree on the menu, as the dominant prevailing theory of investments, they will drive the prices of their favoured stocks ever higher. Which they do, it seems. This is helped by the ‘over the long run valuations don’t matter’ line, pushed hard by Baillie Gifford (amongst others). You might recall my article on Scottish Mortgage a while back.

And of course, as we know from both index and momentum investing, once something starts to move in a flat market, it keeps moving.

But that leaves the vast bulk of quoted stocks flat or down on the year, which makes some sense. When rates rise, bonds are substituted for stocks. The last two quarters in particular have been flat to soft, and while some of these stocks may have hit a bottom, it is still very hard to tell.

The only good news for UK investors is that Andrew Bailey has ensured their overseas (especially US) stocks have a nice currency tailwind.

MADE IN JAPAN

Meanwhile from Comgest there’s a radically different view of Japan. The equity rally there has been fantastic, but it is not the typical exporter boom of a weak yen, in their view, but more about bank stocks soaring on the expectation of the end of Central Bank rate control. This allows their vast balance sheets to earn a real return, at last. This is quite a departure from the general explanations about “this is Japan’s time”. That one has caught me out far too often, but explains the horror show from respected funds like Baillie Gifford Shin Nippon - small and illiquid is just nasty everywhere.

So, although the global rally looks to be strong, it is terribly narrow, and built on different foundations in different places. Or more positively, a broad advance awaits the first rate cuts, either from triumph (US) having controlled inflation or disaster (Europe) having created a recession and left inflation out of control. Either route to rate cuts wins, it seems.

GLASSHOUSES AND THROWING STONES

Oddly, I feel the Canadian spat with India is really quite serious, the tendency of rich Northern countries to preach, in this case standing very carefully behind the only global superpower’s shoulder, really annoys the global South. It has been going on for centuries and is at heart simply the old colonial mindset.

India’s continuing reaction may well portray the accuracy (or otherwise) of the allegations, as on the face of it this is deeply insulting to the world’s largest country, and one that has tiptoed down the line between offending the West and creating starvation and destitution for millions in the South.

I don’t believe it - murdering virtuous plumbers in Canada over the Punjab, which has long ceased to be a primary source of domestic concern, is plain weird.

All things are possible, and India cares far more about Kashmiri terrorism (for instance), but if it is false, expect a sizable slap to Canadian interests, and more accommodation for Putin.

After all, if you are treated as if you are behaving like Putin, why would you ostracize him?

Skipping along

Skipping is the week’s theme, following the inadvertent use of the term by the Fed Chairman, along with the rather weird behaviour of Jeremy Hunt.

Although any skipping seems unlikely soon, on this side of the Atlantic.

The dear old ‘recession’ still lingers, unseen but feared, like an ex Prime Minister. We are convinced it will arrive, but as a ‘technical’ recession only. It should be hard for anyone to be surprised. Labour markets are much stickier and far more fragmented. Supply is short, so any systemic shock feels unlikely. While as old hands keep noting, single figure mortgage rates, well below inflation rates, are hardly restrictive.

Chair Powell (almost) mentions ‘skipping’.

Jerome Powell was bowling along contentedly, when he suddenly described the Reserve Board’s June inactivity as ‘skipping’. Although it actually was just a ‘skip’, before he realised the error and with a guilty look speedily reverted to the far more passive ‘pausing’. But we knew how he was thinking. He was going to keep his foot on the neck of borrowers for a bit longer – interestingly, he refers to real rates of interest, as somehow unjust and injurious. Odd that when asked anything about fiscal policy he instantly plays the neutral, technical banker, no good and evil there.

Moves in the real economy.

So, what has really happened?

Not a lot, energy prices have climbed all the way up, and now slid all the way down. Aggressive fiscal stimulus continues, any chance Biden has to bribe the electorate with their own money, he still takes. Employment remains strong, although there is some tightening in hours worked, but it is still pretty hard to see how the Fed gets down to 2% inflation for a year or two.

And yet, markets by a mix of that unseen recession and faith in so called base effects, do think inflation by the autumn, will justify a real pause. No skipping.

UK Chancellor’s odd statements

Here in the UK Jeremy Hunt is in quite a different place. Inflation still looks high and embedded, but he has carefully outlined how he would keep going with substantial hand outs to offset inflation (aka fiscal stimulus).

However, inflation control was all for the Bank to sort out.

This is nonsense, of course. The UK Government is yet again stoking inflation while taking no responsibility for stopping it. He then gave a tortuous explanation as to why his policies have now produced exactly the same interest rates as the Truss typhoon, created by his reckless predecessor, but somehow, not at all the same.

Rate rises – a global feature.

Funny that, as we noted at the time, there was little odd about the October rate spike, and much that the Bank could have done (but refused to) by a prompt rate rise (matching the US) to stabilise the currency and inflation.

Rate rises are a global feature, with not a lot one small country could do about it.

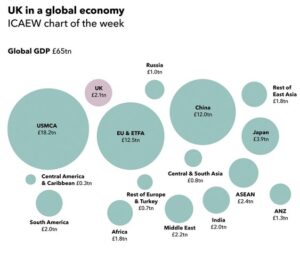

2021 chart produced by the UK Institute of Chartered Accountants

So quite where the virtue of the Truss toppling quarter point rise is now, is rather unclear.

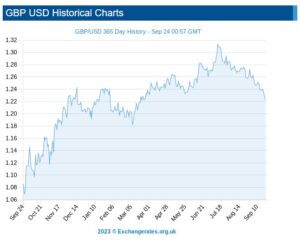

As sterling shows, the prize for that autumnal sloth will be higher rates (and inflation) than elsewhere for longer. The thing about fire fighting is the sooner you start the less you have to do.

So how did Monogram’s methodology work?

Our in-house model switched into Japan in December 2022 and Europe in March 2023. As we only ever deal in half a dozen big global index Exchange Traded Funds, this is not a tickle, but 25% of the total equity position in (or out) at once.

Brutal and scary, but effective.

We look at the signal, kick the tyres, thump the bonnet, turn it off and on again, look for reasons to ignore it, and then six months later look back in wonder and say, “oh yes, that was right”. These signals are delicate enough to very seldom feel right at the time, but after almost a decade of running the model, we have learnt to obey.

So, our Momentum performance discussion, yet again, is about how much we made, not about in which direction the money went. While the GBP version, seeing similar signals, has also never come out of the S&P 500, which for a good while also felt wrong, but it seems was right, taking a long view. The USD model was more skittish but is back in both (S&P and NASDAQ) US indices now.

So, we do know where momentum has been, and it is quite strong.

Markets in the political timeline

The rational thinkers say the market is (still) too expensive, but the trend followers don’t agree, who is right?

We tend to feel just as Central Bankers were very slow to spot inflation, they are possibly being too slow to see it has now been contained, and the US skip may be a pause and then a snooze. Which would be very convenient for the Fed during the US Primaries, allowing for cuts into the US election?

Related to that, we watch with amusement a dialogue about the attractiveness of stock exchanges, in particular in London, couched entirely in terms of what potential listing companies say they want. Not a mention of what investors want, as if they just don’t matter. Quite absurd, as what all listings need is a deep market, good liquidity, stable tax regimes, and an attractive base currency.

Is London aiming to provide these? We seem to favour founders – so, tweaks to voting rights, smaller free floats, fewer shareholder rights. But then oops! No buyers.

This is worse than nonsense, it damages what little is left of London’s reputation. In this market you start with the buyers. The price performance of many a recent IPO spells out the problem, the sellers are finding it too easy to deceive people – a call is needed for greater transparency, longer lock-ins, and less pandering to insiders and their advisers (not more).