Here we talk about the delights of the Conservative Party Conference in rainy Manchester, the failure of the in-built two-year time horizon in inflation models, and what may happen to interest rates.

FANTASY IN BLUE

At times in Manchester, it felt like everyone was looking for something. As government steps up spending initiatives, and empowers regional governance, and drives big spending on not achieving net zero, the chorus of demands for more taxpayers’ cash grew deafening.

There was utter silence on efficiency or capital allocation; it was all just “a good thing” to spend more.

And oddly too, with so much lip service to the long term and reducing debt and halving inflation, the ‘how’ of those was also ignored. Surely halving inflation is not even a government task? It was devolved to Bailey of the Bank – yet we heard not a word of criticism. If ever an eight-year commitment to a disastrously run project needed cancelling, his appointment looks to be just that.

This would spare him (and us) those endless letters on why he’s failing to control inflation.

For all that Conference was oddly cheerful – quite a bit of steel on show, from Suella of course, the only natural politician involved – some guts from Steve Barclay at Health, and Stride, a little less convincingly, at work and pensions – else, all rather wooden and on autocue. Although you could not help but notice that Farage still charms the fringe crowds.

COMPETENT DELIVERY?

The abiding issue remains competent delivery. It was odd to hear the government on HS2 arguing for accountability by sacking their own Euston delivery team. As if the failure of HS2 is not theirs, and theirs alone.

Instead of penny packet incrementalism, government needs a holistic delivery view – perhaps why France can build a TGV, and we simply cannot.

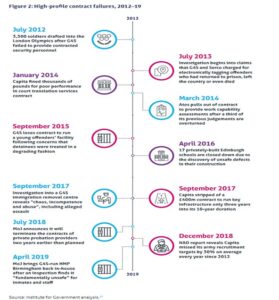

From this report of the Institute for Government

From this report of the Institute for Government

The Maude/Osborne “reforms” destroyed half our domestic contractors, by a short-term focus and ceaselessly moving the goalposts. As a result, home grown firms are in the minority on the HS2 contractor list, and giant multinationals with more lawyers than bulldozers were the main bidders.

They want top dollar to take on the risk of a lazy, indecisive government machine – no wonder.

THE CHANGE PRIME MINISTER?

We have been very clear since 2019, that the Tories can’t win another term, none of that changes, but the scale and composition of the anti-Tory majority next year is rather less clear.

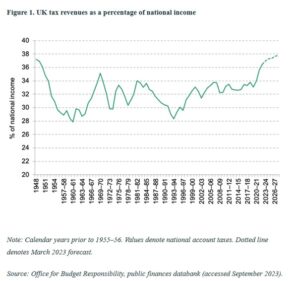

In many ways, the best case for a Labour defeat, at the next election, is that the Tories have done it all already. They have blown the bank on out-of-control spending, splurged on unaffordable welfare, and raised taxes to unsustainable levels.

From this website

From this website

This government also crashed the pound, let inflation loose, let rhetoric overtake sense and has gone in hock to foreign debtors. I suppose they have yet to invade a sovereign country without a UN mandate, but they are working on that too.

So? Well oddly Starmer is still slightly boxed in, and in terms of polling data, not really getting much help from the weak Lib Dems, in those critical three-way marginals in the South. While Scotland clearly has had enough of the SNP running Scotland, it is less clear that they don’t want the cause of independence to be heard in London. The Rutherglen by-election could be sending both messages, but in a general election voters only send one. I would not assume that genie is back in the bottle just yet.

JITTERBUG BLUES

We continue to see US rates above inflation, which is very different from UK rates which are still below.

So exactly what Powell (and Bailey) are doing with selling down the Central Banks balance sheets at a time of maximum new issuance, is not clear; it solidifies vast paper losses, creates new losses on the rest, so seems to be quite a pricey warning shot to politicians. But it is a plausible reason (along with super high levels of new issuance) for current bond market nerves.

We have always felt the Central Bank models, where whatever the question the answer is “it will be fine in two years” are a fiction. The awareness that rates and inflation are staying high, is long overdue. But we have been in no doubt about it, for two years, nor have we ever flinched in our aversion to bonds, we were never being paid enough for the risk.

The jitters in the bond market feel more like a turning point, the sudden chop as the tide turns. The dollar has risen; people want to be there; if there is enough demand, that will lower bond yields again. So, I am not looking at US rates rising, so much as at the battle switching back to fiscal policy. Although in the end if Biden really wants 7% rates, I guess he can try to have them.

The UK and Europe are less contested, the labour market in Europe at least is not that tight, although still at record low unemployment levels, but with a lot of surplus workers in France, Spain, and Italy, and especially amongst the young. Euro interest rates are also really quite low still and are not yet looking restrictive.

So, it looks like another round of softening currencies, stagnant inflation and rate rise pressure. Central Banks still hope they have done enough. Even so it is quite odd that UK long rates are only just touching the level of a year ago, logically they should be two points higher. As for oil, we have seen this autumnal spike as a little surprising but transient, and as ever at this time of year, the short-term path is weather related.

Overall if the start is any guide, October yet again could be rough for markets, but longer term still looks brighter.