NOT THE FOGGIEST

We have no idea why we are having a General Election just now. Not the foggiest idea how we remove the keystone of free trade and yet the edifice of beneficent competition remains intact. We have not much idea how you have free capital flows without free trade, or how floating exchange rates then work.

But we are all about to find out, apparently.

Meanwhile, we did enjoy Andrew Bailey’s valedictory talk, at least under this decade of Tory rule, to the LSE. It made clear the Bank’s view on its own Reserves and fired a shot across Rachel Reeves’ bow in the process.

ELECTION TIMING: WHY NOW?

We could speculate on Rishi’s slicing through the Gordian Knot, and admire his nerve in doing so; but it is just speculation. We do know a General Election costs about £20 million per political party (yes, only that much in the UK). This will have required many earnest meetings and interminable slide decks. So, it must have looked like a good idea, at least to someone.

It leaves some largely superficial legislation half completed, and hastens the retirement of hundreds of Tory MPs, voluntary or otherwise. Even Gove has gone. A whole new cast will take the stage. Starmer then has eight weeks of summer bedding-in, before the treadmill grinds into action for him too.

A new cast won’t change the script, however. They should be just as careful of sinking beneath ill-judged promises; delivery is all, and the toolbox is empty. Whilst coups and factions could be just as ridiculous.

A DIVIDED SMALLER GLOBAL ECONOMY

Free trade and the wealth of nations is much more interesting. In the last five years COVID has allowed the erection of unthinkable trade barriers. Meanwhile, an imperial power wary of spilling the precious blood of just one nation, has over indulged in the funding of extraordinary slaughter, in too many others.

We seem to have lost our view of one humanity seeking development and freedom from poverty, for a globe divided into blocks, quite familiar to Biden’s distant youth, but strange to us. Naked protectionism rules, now trumping even the climate emergency.

Sanctions pile upon sanctions, 16,000 against Russia alone. Yet all of the above is now normal. There are no rounds of trade talks. The WTO withers, for lack of an appeals panel. Neither Trump nor Biden helped by their blocking of appointments.

THE SUPPORTS LOOK ROTTEN TOO

But what else is supported by free trade? Well for a start free trade is the international version of competition. Competition has no inherent virtue; it is, like free trade, quite destructive of businesses, seeking the lowest price. So, it too is junk, only valid within the four walls of a protectionist jail, which is hardly valid at all.

So, once we accept globalization is irrelevant, out goes competition, or rather it becomes a political tool, and as such has no economic validity.

In this context, consider the issue of floating currencies; if we junk that, then out goes the free movement of capital as well.

Look at how China devalues the Yuan to offset tariffs. Or how Japan’s state policy is now devaluation.

We must expect some pretty hefty steps to shut out American access to markets or to act against floating currencies, coming down the track, if someone does not stop the madness. Nationalism will get ever harder to contain, once we don’t trade with each other. And superpower battles will lead to ever more defaults and destitution for the poorer countries. Look at Yemen, Venezuela, Myanmar, Somalia, Sudan, Afghanistan. Proxy wars are being fought in odd places; they are still people, and these are still wars.

Cut out free trade, and you cut out the economic heart of the globe.

NOT BANKING ON IT

Still taken from this Video of Andrew Bailey’s talk.

The graphs speak volumes – do look.

I didn’t know this was Bailey’s last gig before the election, but maybe he did. He made a densely argued case for being very careful about political tinkering with Central Bank Reserves.

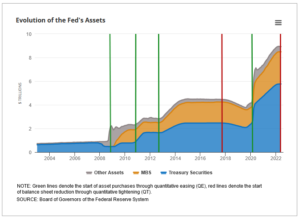

As he tells it, we went from post war banks dedicated to commerce and trade in the 1950’s and 60’s. Then came the great liberalization of consumer finance, in the 1970’s and 1980’s, followed by a perilous patch of virtually no reserves, through much of Tony Blair’s time, quite visible for an extended period before the crash (the slim orange block below). However cleverly he called it global, it started in domestic errors.

Then the sudden explosion of reserves under Quantitative Easing, followed by the virtual end of commercial and business lending. The term funding scheme was an attempt to rectify a surge in consumer lending, but is now itself winding down.

So, to now when our system rests on vast bloated mortgage books and tons of gilts in the vaults. It still looks a very long way down to ‘normal’.

There were a couple of well-placed questions at the LSE, strongly hinting that the next Government will try to exploit those bank reserves (perhaps by stopping interest payments on commercial bank funds held at the Bank). Bailey was making the case for not reducing the balance sheet much below £400 billion, back to the 2016 level, that yellow shoulder on the graph.

That in itself is a sign that the banking system is not really working; as he ruefully noted, the recent crises (Silicon Valley Bank et al) came from not too little money in reserve, but too much in too few places.

And stock markets? Well childishly they seem pretty chill about it all. If money is being trashed, don’t hold money they say.

Well, do watch that ten-year gilt: for six months it has trended up.

What does that tell you? Not a sign of rate cuts soon. Almost back to the Truss spike, which apparently, we could not live with.

Like a few other things of late, it all looks fine, until it isn’t.

While the UK index is up overall, the indebted part is flat to falling, and there is plenty of that in the ‘value’ area.

Altitude sickness

Do ‘higher rates for longer’ matter? Is China doing anything different? Has the UK election become a one-horse race?

So far, both the markets and Central Banks have acted as if rate rises matter far more than they do, in real life. High interest rates are simply a pot stirring device, they don’t take any money out, they just shift it from borrowers to savers at a higher speed. The net effect is that they don’t matter to the totality of an economy as such, although the government takes a slice (as ever), and the exchange rate may shift.

It can also change investment decisions, affect confidence, restrain borrowers. But these are generally quite gradual influences. And the pile up in savers’ cash offsets them. It is a change of content, not of quantum. Meanwhile, in order not to move the ‘confidence’ needle, governments get spooked and start giving more handouts in compensation.

Investment decisions focus as much on corporate tax rates, costs and technology as on interest rates. While the evidence of resulting restraint by borrowers, where the dominant one is actually the government, appears a bit thin and is longer duration. Even the UK mortgage market has perked up.

Where rate rises may matter more, is if the winners (savers) don’t spend, and the losers (borrowers) default, creating value destruction, rather than simply price movements. Not much of that is evident yet, as loan underwriting has (generally) been good, and neither the level of rates, nor their duration, has eaten far into the big credit buffers still in place.

Defaults on bank loans, set against the greatly increased rate differential’s impact on earnings, have been minor. Bank provisions for purely economic reasons are not rising fast.

Overall, given the dominance of the ‘vote buyers’ in most markets, I am not that worried by consumption, and judging by London theatre prices, the high end is not showing much restraint either. While all those second order effects don’t matter much this year.

It is no surprise to us that the world has now drifted back to ‘not many rate cuts’ nor is it clearly a disaster, for all the sudden market noise. The political imperative for a rate cut to throw before the electorate (justified or not) still leaves June in play.

It is fairly clear where the froth is, where any nosebleeds are due; also that this market response is all sentiment, unrelated to actual economic forces.

A SECOND LOOK AT CHINA

What of China? For a while in the un-investable box, and I think still largely so for the mainland indices. Reasons? political risk, both internally and externally, growing sanctions, unequal treatment of overseas investors, disappearances etc – same as ever. So why look again? Well in part if globally the UK looks cheap, China looks even cheaper, right at the bottom of the pile.

The mists seem to be clearing on their economic strategy : manufacturing is still at the heart of it, which implies so is exporting and hence some engagement with the wider world. Not just high-volume low-cost production, although recent trade statistics do show falling value on rising volume. But a clearly and often stated desire to move up the value chain, seems to be coming off.

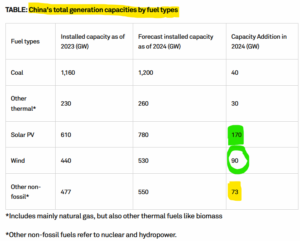

China’s factories have a lot going for them, they are still building coal power plants (306, yes three hundred plus, currently in the works) and nuclear, (150 plants planned over the next decade) at high speed, plus plenty of renewables, providing abundant cheap energy.

From this site

Labour laws are to them just an amusing Western concern. Also noticeable is that Chinese universities still study real science, based on academic merit – they are the world leaders in many areas – just ask your university professor buddies.

Plus, they have no interest in electoral cycles.

If China wants to stay at the core of global manufacturing, it can. A flat rate 10% tariff seems to barely touch the existing and growing price advantage. There is also a point at which consumers will baulk at the price of domestic protected production, even in the US.

So, if China is simply the old ill tempered, paranoid, Communist dictatorship, flooding the world with cheap goods, stealing intellectual property and manipulating currency, then the problem is at least familiar.

In that case, it is not throwing its lot in with Russia and going back to Stone Age military adventures as yet.

So, when fund managers hang on to well researched individual stocks, knowing all that background, I am inclined to at least listen. Trade needs cash, wants cash, uses cash, needs investment and therefore some global engagement.

INTO THE ABYSS

We have long predicted the loss of the Tory Red Wall seats, one term rookies as we called them. Under 200 Tory seats left in six months, seems well-nigh inevitable as well. So yes, it is a one-horse race. And is Starmer really going to say anything substantial (and in truth there are quite a lot of plans and approaches on the table already)? I doubt it, he has no need to.

It is just the older and far tougher problem of working out how to pay for it all, without raising taxes so high no one wants to work, invest in the country or indeed live here. Given the record of the last century or so, expecting things to change now, is delightfully naïve. They won’t.

It needs radical reform of regulation, entitlements and cost bases. No more salami slicing, no more buying off vested interests. There is some of that from Wes Streeting, but a lot more would be needed, the new ministers must do more with less, not less with more.

Looking at how the UK and US markets have performed this year, tells you a lot about those expecting such a grown-up approach. A backstop approach is to plan for the change.

Where many people choose to live and work, will be decided within this year.

Jerome K Wiley?

We do think Powell is running off a cliff, just not the one the market assumes. As we endured the wettest February since (at least) 1836, when William Lamb was prime minister, and the wettest Tory government since records began, is there any chance of dryer times?

But first the tiresome tango of rate rises, the market swept to and fro, nation by nation, until the firm stamp of a well-heeled bond whips the whole mass back round again.

Bailey of the BoE, and Powell of the Fed

So, this week it is to be Bailey first out the gate, FTSE up, bond yields down, next week who knows? That rates will fall this year is the only certainty and the big US markets have built a near vertical climb out of that snippet. But you will note, not in rate sensitive stocks, the Russell (small cap) is still pretty flat, weighed down by the regional banks that dominate it.

And Powell, he’s guessing or as he calls it is “data dependent”, but for all that he is pretty happy projecting those guesses forward. So, he has moved from three rate cuts this year, to a new position of ? Well - three rate cuts this year. Not much data dependency there.

Before long he will run out of “this year”, because the inflation numbers are not behaving, nor critically is the oil price. Like Bailey in the UK, he is desperate to cut and under heavy political pressure to do so, both have said 2% inflation is not now needed, just moves in the right direction.

I feel the only thing that can get us there is a sudden (and indeed overdue) drop in the energy price, which we do expect in the summer, but who knows? It has held up rather well so far.

So, at the moment, Powell is perhaps running on thin air. Protectionism and vote buying fiscal measures mean he can’t get there without some other help.

Markets are supercharged – is it sustainable though?

And if rate cuts are what has supercharged markets in the US, I don’t see that as sustainable right through the year. It might instead be the possibility of a more market friendly, fiscally prudent, Trump, which would be more logical, in some ways; but that still feels implausible.

Nor do I see, as yet, many other markets joining in. Partly, why own anything else but the NASDAQ? Some markets have moved (Germany, Japan) but you could also argue that was after being oversold for too long. While the Swiss have cut rates, it is in part (as ever) to restrain their currency, I am less sure others will want to move ahead of the US.

They may be forced to, but there again their scope before European and UK elections looks limited. And some parts of the market, like UK smaller companies and many REITs (and some renewables) are not signalling anything but yet more damage and destruction, from suspect refinancing at high rates and over optimism on revenue.

Air Cushions

It was notable too how keen Powell is to slow the tightening imposed by reducing the Federal Reserve bond holdings, which has to date been done at a fairly brisk pace. He now talks of stabilising holdings, (in other words resuming bond buying, stopping the runoff of expired holdings) at what seems a high level, for fear of taking too much liquidity out of the system.

From this explanatory article on the process by the Richmond Fed.

For a while rates and reserve sales were working as one against inflation, but not for much longer it seems. Which should be good for bitcoin and other liquidity consuming monsters, if nothing else.

Who is Next in the UK?

The interesting Tory battle is between the Official wing, now entrenched in power, and showing no sign of intelligent life, beyond wanting to “make a good fist of it” in the inevitable electoral defeat. Then there is the Rebel wing, keen to cause trouble, break things, get popular support, or be nasty, if it gets them attention. Although the Official wing regards this as disloyal, it follows an old pattern. It is not just about this particular bunch: see this paper.

Faced with a like quandary under Blair, the Tory party swung left, towards the centre and power, just as Gordon Brown started the decade long Labour march to irrelevance. The Official assumption is that will work again, although the alternative scenario is that Starmer settles down in the centre for the long haul, and the Rebel wing, kept securely away from power, withers for lack of a structure.

But all ruling parties were, by definition, rebels once.

Back in 1836, William Lamb was an unsuccessful politician, wrapped around by Peel, sent to the House of Lords, then brought back as a centrist Prime Minister, and being generally useless, was turfed out again, after naming an Australian city, en route. One must hope for no repeats from history.

William Lamb, Lord Melbourne – from this site

It does not feel time for compromise candidates, nor will a ‘safe pair of hands’ do. Rishi is in a fight.

Meanwhile the fields here feel like salt marshes, dark water lurking in deep cracks, the lips of which slide into clay and suck at the soles of your feet. We certainly could do with some heat.

I do expect this run in markets to go on, but the upside in the big US indices looks more limited and broader participation elsewhere will await those rate cuts. Both their size and speed have a capacity to disappoint, especially when they are so hotly anticipated.

The politics, a long time coming, may become more influential. It could get choppy.

We will take an Easter break, after what feels like a long spring.

And return with the sun (we hope) on 14th April.

Sleight of Hand

This week, we speculate as to what the FCA is really after in their Practitioner Survey. How closely do their actions follow their words, with the new Consumer Duty laws? And we also look at Hunt’s budget and the likely forthcoming non-impact on stock markets.

FED UP FEEDBACK

Periodically member firms get quizzed on how we see the FCA; this time they promised a shorter form. Well, if that’s shorter, I’d hate to see the long one. Take a look here. Thirty-nine questions, but so many cover multiple topics, it feels more like a hundred.

It is typical of such surveys designed by marketing advisors: a few soft questions, how are you today type guff, a few “have you stopped beating your wife” ones, just to check you are actually awake, then a lot of navel gazing on SICGO. They really despise it.

This is purportedly about promoting competition. Which actually makes the regulator’s job harder – encouraging more firms and lowering the barriers to entry for new firms. The FCA does not like that idea much; so, note, it is a SECONDARY International Competitiveness and Growth OBJECTIVE, get the Secondary stress, minor, icing on the cake stuff. Objective, so just an aspiration, not real. Their minutes (above) even admit that.

Then we have more ‘are you happy questions’, then some tiresome back scratching ones, just how great are we at seminars? answering the phone? sending you flowers? You get the picture.

Then a few global ones, how good are we at promoting world peace and intergalactic harmony? By this stage you are probably wondering what this is, I am. And the idea creeps in that it is nothing to do with the poor regulated mugs, anyhow. So probably not much to do with the consumer either.

Meanwhile I see a landscape of poor consumer outcomes, vast sales driven peddlers of half-truths, a fair bit of market abuse, absurd barriers to entry, the insiders and regulators getting fat, the savers, investors and users of capital paying for it all.

NEW LAW OLD RULES

They also published “A new Consumer Duty Feedback to CP21/36 and final rules” more terribly exciting stuff, a mere 70 pages of it. They make much of the “Risk of Retrospection”, saying “we were clear that the Duty would not have retrospective effect and would not apply to past actions by firms”.

OK, this is a key political input; the industry has had enough of new rules, looking back. So, I take it that we won’t see big attacks on UK listed finance firms this time?

Not so, you guessed it, the entire financial sector is suddenly seeing bigger provisions, because, it seems, of the new rules. It looks very much like the damaging hits on SJP Close, Lloyds, are exactly this, retrospective application of laws, an action so vociferously foresworn by the regulator.

And this helps competition how? Well not at all. But do remember it is a secondary aim and applies only to “competition in the interests of consumers” so not real competition, but one where the mechanism (competition) and the outcome (interests of consumers) get muddled up.

So, for instance destroying UK financial services firms is fine if done “in the interests of consumer” and what could be more in their ‘interests’ than getting money back on a contract they willingly (and legally) signed ten years ago?

And that’s why choice and consumer outcomes are being lost in box ticking and adverts of fluffy kittens, sunsets on beaches and the like. Just look at the UK ISA advertisements, do they tell you anything? Beyond heavy hints at nirvana with no work.

HUNT’S LAST HURRAH

The budget? Well, it is so dull, you feel it is simply what the HMRC nerds wanted. More complexity, a few free hits (non doms), more CGT breaks for landlords, for the rentiers not the creators, less employee NI, but no change to employer NI, that actual tax on jobs remains as harsh as ever.

We are well into Q1 now, so I guess the intriguing thing is more this firm Treasury conviction, adopted by the OBR, that inflation will fall towards 2% in Q2. Given their prior errors, that is very bullish, and does not support base rates at 5.25%, frankly not even at 3.25%.

It is all circular, despite commentators’ child-like obsession with margins for error. If inflation stays high, tax raised stays higher, covering higher public sector spend. So low inflation is (oddly) a cautious model prediction.

The market does not believe it. Nor do we. Not quite chapeau consumption time, but I don’t see 2% this year. I am not sure where this recession is, but not in any of the streets I walk down.

If interest rates are really about to fall off a cliff, the FTSE looks oddly stuck, miles behind the US indices, and sterling also looks curiously strong. If saving rates are about to be pummelled, the yield stocks that fill the FTSE will suddenly look very cheap. Which suggests the markets are not buying it, not yet.

A 500-point rally might even be plausible, if the OBR is right, but it is not, and talk of headroom is nonsense. This remains an expansionist fiscal mind set, but of quite limited duration, hence the market caution.

Elsewhere we are in ‘riding-the-tiger’ time: if you are onboard, how and when do you get off it?

Skipped - what will 2024 look like?

May I say we told you so? In "Skipping Along" before the summer break we called the end to rate rises, and by the November Fed meeting, we were well on board for a "rip your face off" rally. Feeling ripped? Anyone coming to the equity party in December, has just not been paying attention.

And our powerful MomentuM model had investors buying Japan and European Indices LAST December, so they have milked that entire rally. It also signaled buying back into the NASDAQ from May, arguably a bit late, but still very effective.

Jerome Powell said nothing new this week, and the New Year still looks bright for the beaten-up stocks, regions and sectors, as rates decline. I suspect prospects for the perennial winners to keep on winning are not too bad. Although economic growth will suffer (and so will earnings), but valuations still have some space to catch up amongst a lot of this year's losers, as discount rates keep swinging lower and bond yields dwindle.

A RED CHRISTMAS – Looking forward a year.

A year ahead, politics looks more interesting: so, what will the newly elected British House of Commons do next Christmas? What are the choices and likely outcomes?

The new Labour prime minister will care relatively little about political opponents, and quite a lot about holding party discipline.

Nor, we are told, will he seek early solutions to some of the more intractable constitutional problems (Second Chamber, Proportional Representation, Party Funding etc.), as based on his predecessor's experience, that just wastes precious time.

For all that, when it comes, his manifesto will (at last you may say) be festooned in clear deliverables, a plan to govern, at least for the next year. While Rachel Reeves is influential, the drive will be legislative, not economic. But as ever The Chancellor will have to then deliver the possible.

A DOLLOP OF BORROWING

So, more debt, extra tax, spending cuts are the options facing her, to fund that manifesto along with a cursory fig leaf for growth. The latter is needed (like the absurd Tory public spending targets) to get the Office for Budget Responsibility on side. Albeit responsibility is what you take, whereas the OBR offer simply a comptometer's sign off on specious forecasts.

For all that the Treasury thinks Gilt markets pay attention to the OBR, although I doubt it. So very early on, the rather too stringent self-imposed spending and funding restraints the Tories have adopted, will be quietly reconfigured. The rise again of a few PFI like schemes to keep stuff off the books is likely; Labour does not do fiscal hawks.

Falling interest rates and lower indexation provide small windfalls, and binning the 'irresponsible' Tory promises of tax cuts, won't hurt the numbers either. So yes, more debt, low tens of billions at least will be used.

A SPLASH OF TAX

What of tax? Can the pips be made to squeak. Yes, again, I am sure they will be, although not really on income tax, and I think for employed staff not on NI either. Labour has no love of the entrepreneur, who is too poor to hire lobbyists or to make donations. So, a bit more squeezed there off the self-employed and small business owners.

I expect a big hike in fuel tax, especially petrol and aviation fuel, under a green cloak, generating another £10 billion. Consumption taxes remain rewarding: VAT rates, thresholds, and exemptions are all likely targets. And if they are inflationary, just adjust them away in your numbers. Nothing new – claiming them to be a 'one off' (of course).

UK property taxes are low in the South East, due to a long-standing failure to re-rate, so there is some scope there. With more housing coming, this will likely be punitive. But there are other enduring loopholes, that make little sense: REITs, Limited Liability Partnerships, a lot of EIS, VCT, Freeport stuff, albeit none of that is big ticket. I guess some simple populist tariffs may arrive as well. Labour is at heart protectionist.

All in all, I expect Labour to get enough from extra debt and taxation to provide a budget to tackle (rather than just top up deficits in the funding of) some long-standing reforms. I'd also expect seizures of assets. The Treasury seems to have a taste for balancing the books illegally, and there is little judicial protection.

PRESENTS FOR SOME

I don't expect infrastructure or defense budgets to be much loved – that's some of the cuts. The undoubted green spend will likely benefit (or keep on benefiting) China's manufacturers, more than the UK, but do still expect energy prices to go on up. They are the modern sin tax.

But higher tax, debt and spending can be pretty good for the economy, as Biden has shown, it all depends on how long you can get others to fund you for, and at what price.

Much as I am sure Labour don't want to crash the pound, they normally eventually find a way to do so, and for all my glib assumptions, they will be starting far closer to the edge than most new governments, for some while.

THE HANGOVER

How useful is that analysis? Well don't expect the FTSE to collapse, this will be a spending regime, but do expect stock specific damage, although arguably a lot of that is in the price of impacted sectors, or indeed the long standing (and ongoing) flight from UK equities overall.

The FTSE is mired in a twenty-year stagnation, from 7,000 in 2000 to well, 7,000 now, although not to altogether discount the medium-term Tory inspired rally. Note what Labour, even Blairite Labour, gives you.

On the other hand, sitting, duck-like, waiting to be hit, or worse buying into vulnerable areas, feels quite high risk.

The election outcome is (and has been for a while) clear. Nor is this a safe European coalition of the sane and less sane. It will be red through and through.

Given so many other options, and that some of the pain will be direct on pensions and property, it seems a good time to start planning on the investment side.

The MP's pension fund invests only 1.7% in UK listed equity. Do they know something?

Have a magnificent Christmas and thank you for reading.

We will be back on January 14th.

Charles Gillams

17-12-2023