Sweet Dreams

Here we talk about the delights of the Conservative Party Conference in rainy Manchester, the failure of the in-built two-year time horizon in inflation models, and what may happen to interest rates.

FANTASY IN BLUE

At times in Manchester, it felt like everyone was looking for something. As government steps up spending initiatives, and empowers regional governance, and drives big spending on not achieving net zero, the chorus of demands for more taxpayers’ cash grew deafening.

There was utter silence on efficiency or capital allocation; it was all just “a good thing” to spend more.

And oddly too, with so much lip service to the long term and reducing debt and halving inflation, the ‘how’ of those was also ignored. Surely halving inflation is not even a government task? It was devolved to Bailey of the Bank - yet we heard not a word of criticism. If ever an eight-year commitment to a disastrously run project needed cancelling, his appointment looks to be just that.

This would spare him (and us) those endless letters on why he’s failing to control inflation.

For all that Conference was oddly cheerful - quite a bit of steel on show, from Suella of course, the only natural politician involved - some guts from Steve Barclay at Health, and Stride, a little less convincingly, at work and pensions - else, all rather wooden and on autocue. Although you could not help but notice that Farage still charms the fringe crowds.

COMPETENT DELIVERY?

The abiding issue remains competent delivery. It was odd to hear the government on HS2 arguing for accountability by sacking their own Euston delivery team. As if the failure of HS2 is not theirs, and theirs alone.

Instead of penny packet incrementalism, government needs a holistic delivery view - perhaps why France can build a TGV, and we simply cannot.

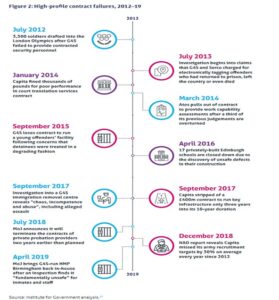

From this report of the Institute for Government

From this report of the Institute for Government

The Maude/Osborne “reforms” destroyed half our domestic contractors, by a short-term focus and ceaselessly moving the goalposts. As a result, home grown firms are in the minority on the HS2 contractor list, and giant multinationals with more lawyers than bulldozers were the main bidders.

They want top dollar to take on the risk of a lazy, indecisive government machine - no wonder.

THE CHANGE PRIME MINISTER?

We have been very clear since 2019, that the Tories can’t win another term, none of that changes, but the scale and composition of the anti-Tory majority next year is rather less clear.

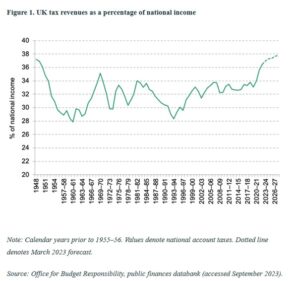

In many ways, the best case for a Labour defeat, at the next election, is that the Tories have done it all already. They have blown the bank on out-of-control spending, splurged on unaffordable welfare, and raised taxes to unsustainable levels.

From this website

From this website

This government also crashed the pound, let inflation loose, let rhetoric overtake sense and has gone in hock to foreign debtors. I suppose they have yet to invade a sovereign country without a UN mandate, but they are working on that too.

So? Well oddly Starmer is still slightly boxed in, and in terms of polling data, not really getting much help from the weak Lib Dems, in those critical three-way marginals in the South. While Scotland clearly has had enough of the SNP running Scotland, it is less clear that they don’t want the cause of independence to be heard in London. The Rutherglen by-election could be sending both messages, but in a general election voters only send one. I would not assume that genie is back in the bottle just yet.

JITTERBUG BLUES

We continue to see US rates above inflation, which is very different from UK rates which are still below.

So exactly what Powell (and Bailey) are doing with selling down the Central Banks balance sheets at a time of maximum new issuance, is not clear; it solidifies vast paper losses, creates new losses on the rest, so seems to be quite a pricey warning shot to politicians. But it is a plausible reason (along with super high levels of new issuance) for current bond market nerves.

We have always felt the Central Bank models, where whatever the question the answer is “it will be fine in two years” are a fiction. The awareness that rates and inflation are staying high, is long overdue. But we have been in no doubt about it, for two years, nor have we ever flinched in our aversion to bonds, we were never being paid enough for the risk.

The jitters in the bond market feel more like a turning point, the sudden chop as the tide turns. The dollar has risen; people want to be there; if there is enough demand, that will lower bond yields again. So, I am not looking at US rates rising, so much as at the battle switching back to fiscal policy. Although in the end if Biden really wants 7% rates, I guess he can try to have them.

The UK and Europe are less contested, the labour market in Europe at least is not that tight, although still at record low unemployment levels, but with a lot of surplus workers in France, Spain, and Italy, and especially amongst the young. Euro interest rates are also really quite low still and are not yet looking restrictive.

So, it looks like another round of softening currencies, stagnant inflation and rate rise pressure. Central Banks still hope they have done enough. Even so it is quite odd that UK long rates are only just touching the level of a year ago, logically they should be two points higher. As for oil, we have seen this autumnal spike as a little surprising but transient, and as ever at this time of year, the short-term path is weather related.

Overall if the start is any guide, October yet again could be rough for markets, but longer term still looks brighter.

Skipping along

Skipping is the week’s theme, following the inadvertent use of the term by the Fed Chairman, along with the rather weird behaviour of Jeremy Hunt.

Although any skipping seems unlikely soon, on this side of the Atlantic.

The dear old ‘recession’ still lingers, unseen but feared, like an ex Prime Minister. We are convinced it will arrive, but as a ‘technical’ recession only. It should be hard for anyone to be surprised. Labour markets are much stickier and far more fragmented. Supply is short, so any systemic shock feels unlikely. While as old hands keep noting, single figure mortgage rates, well below inflation rates, are hardly restrictive.

Chair Powell (almost) mentions ‘skipping’.

Jerome Powell was bowling along contentedly, when he suddenly described the Reserve Board’s June inactivity as ‘skipping’. Although it actually was just a ‘skip’, before he realised the error and with a guilty look speedily reverted to the far more passive ‘pausing’. But we knew how he was thinking. He was going to keep his foot on the neck of borrowers for a bit longer – interestingly, he refers to real rates of interest, as somehow unjust and injurious. Odd that when asked anything about fiscal policy he instantly plays the neutral, technical banker, no good and evil there.

Moves in the real economy.

So, what has really happened?

Not a lot, energy prices have climbed all the way up, and now slid all the way down. Aggressive fiscal stimulus continues, any chance Biden has to bribe the electorate with their own money, he still takes. Employment remains strong, although there is some tightening in hours worked, but it is still pretty hard to see how the Fed gets down to 2% inflation for a year or two.

And yet, markets by a mix of that unseen recession and faith in so called base effects, do think inflation by the autumn, will justify a real pause. No skipping.

UK Chancellor’s odd statements

Here in the UK Jeremy Hunt is in quite a different place. Inflation still looks high and embedded, but he has carefully outlined how he would keep going with substantial hand outs to offset inflation (aka fiscal stimulus).

However, inflation control was all for the Bank to sort out.

This is nonsense, of course. The UK Government is yet again stoking inflation while taking no responsibility for stopping it. He then gave a tortuous explanation as to why his policies have now produced exactly the same interest rates as the Truss typhoon, created by his reckless predecessor, but somehow, not at all the same.

Rate rises – a global feature.

Funny that, as we noted at the time, there was little odd about the October rate spike, and much that the Bank could have done (but refused to) by a prompt rate rise (matching the US) to stabilise the currency and inflation.

Rate rises are a global feature, with not a lot one small country could do about it.

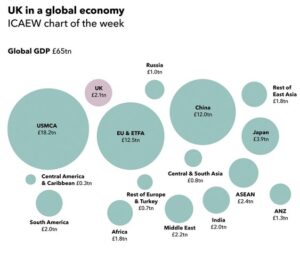

2021 chart produced by the UK Institute of Chartered Accountants

So quite where the virtue of the Truss toppling quarter point rise is now, is rather unclear.

As sterling shows, the prize for that autumnal sloth will be higher rates (and inflation) than elsewhere for longer. The thing about fire fighting is the sooner you start the less you have to do.

So how did Monogram’s methodology work?

Our in-house model switched into Japan in December 2022 and Europe in March 2023. As we only ever deal in half a dozen big global index Exchange Traded Funds, this is not a tickle, but 25% of the total equity position in (or out) at once.

Brutal and scary, but effective.

We look at the signal, kick the tyres, thump the bonnet, turn it off and on again, look for reasons to ignore it, and then six months later look back in wonder and say, “oh yes, that was right”. These signals are delicate enough to very seldom feel right at the time, but after almost a decade of running the model, we have learnt to obey.

So, our Momentum performance discussion, yet again, is about how much we made, not about in which direction the money went. While the GBP version, seeing similar signals, has also never come out of the S&P 500, which for a good while also felt wrong, but it seems was right, taking a long view. The USD model was more skittish but is back in both (S&P and NASDAQ) US indices now.

So, we do know where momentum has been, and it is quite strong.

Markets in the political timeline

The rational thinkers say the market is (still) too expensive, but the trend followers don’t agree, who is right?

We tend to feel just as Central Bankers were very slow to spot inflation, they are possibly being too slow to see it has now been contained, and the US skip may be a pause and then a snooze. Which would be very convenient for the Fed during the US Primaries, allowing for cuts into the US election?

Related to that, we watch with amusement a dialogue about the attractiveness of stock exchanges, in particular in London, couched entirely in terms of what potential listing companies say they want. Not a mention of what investors want, as if they just don’t matter. Quite absurd, as what all listings need is a deep market, good liquidity, stable tax regimes, and an attractive base currency.

Is London aiming to provide these? We seem to favour founders – so, tweaks to voting rights, smaller free floats, fewer shareholder rights. But then oops! No buyers.

This is worse than nonsense, it damages what little is left of London’s reputation. In this market you start with the buyers. The price performance of many a recent IPO spells out the problem, the sellers are finding it too easy to deceive people – a call is needed for greater transparency, longer lock-ins, and less pandering to insiders and their advisers (not more).

ALL QUIET: Covid and UK Property

A brief glance at an excellent first half for investors: thoroughly “risk on” for the first quarter, but a slower but still an upward grind thereafter. Not that such arbitrary dates matter. What does count is what can make it kick on from here?

Covid patterns

So, first a glance at COVID, or rather our reaction to it. The disease itself is now less important in most OECD economies, they have the capacity to deal with it, vile though it is, and the vaccine numbers are rising steadily, faster than we expected in the UK.

This is a screenshot from this website at Johns Hopkins University : https://coronavirus.jhu.edu/map.html

In raw demographic terms, in most places it is barely a flicker on the remorseless upward march of global population growth, but the extraordinary evasive action being taken mattered much more, and I see little sign of that abating.

Watch a dynamic map of all births and deaths at this site: https://srv1.worldometers.info/world-population/ (these figures include all deaths, not just from Covid 19.)

One of the key issues is that, for whatever reason, it is prone to sudden spikes, the only defence to which is almost complete (90%?) vaccine coverage. Indeed, the spikes can clearly ride quite widespread vaccination, higher than originally thought. But the spikes last weeks, perhaps a month, and for most of the year, most places are not experiencing them.

The trouble, especially in the UK, is our muddled policy response is to take down the economy on a semi-permanent basis, almost as a fetish against the lurking evil. To put in place colossal support measures for spikes that are transient is both cripplingly expensive and turns emergency response into embedded base cost. We are on a constant war footing, even when the enemy has seeped away to regroup.

So, despite Mr. Javid’s optimism, we do expect the bureaucracy to cling onto extensive controls, that limit capacity in public services and many consumer sectors. I had hoped that the ridiculous restrictions would bear down on the elite’s summer holidays, but I now understand they don’t care, as they clearly don’t obey them anyway.

HOW MUCH MORE DELAY CAN THIS 'REOPENING TRADE' TAKE?

Which brings us to two thoughts, firstly the re-opening trade is shrugging off some mighty setbacks, and very little of the run up from last November was based on controls extending into 2022.

At some point balance sheets will start to crack, and values will then retreat.

Commercial property sector

The other is a more sector specific concern, but also a straw in the wind, in the extension of the UK commercial eviction ban well into 2022. I don’t follow the logic of that, it is a significant ongoing seizure of private property rights, it is not clear to what end. It is not protecting jobs, unless furlough is also to be extended. It appears to assume businesses can occupy premises rent free for an extended time period, although the Government also suggests (slightly oddly) that much of their business support package (mainly loans, with government backing) can be used to pay rent.

Not that I care much for commercial landlords, who have long been over protected in the UK and exploitative, but it is to me, an odd move. We looked at real estate earlier in the year and expressed support for the TR Property Investment Trust in particular, in February, after which it has been on a run. But reading a quartet of March year end REIT annual accounts, I feel rather less sanguine: those are British Land, Land Securities, Helical and NewRiver.

The trouble here is they got hammered last year, with their March rent collections a mess, and double figure valuation drops on the retail side, they have been hammered again this year, with similar double figure write downs, and now it looks like they could be hammered for the current year too. That’s a lot of damage for the sector.

Office rents are holding up, collections are better, surrenders fewer, but they are running hard to stand still, with typical average lease lengths in single figures; this brings a lot of renewals too close for comfort. Time off debt maturities is also becoming significant.

Some Specifics on British Land, Land Securities, New River.

Equally clearly a lot of London occupiers, in particular, will have spare space, probably well into 2024 and maybe forever. Successive asset write downs, keep eating into the debt cushion, rates are low, so debt service is not an issue, but covenants are tightening, cash flow for development is getting squeezed and banks are not sitting back, just because the tenants have a state license not to pay.

They do differ of course, British Land is fairly serene, based on London offices. Land Securities having been boring for so long has appointed a new team, from the student accommodation and logistics worlds. Granted both were good performers in the last decade, but they are talking of ditching much of the existing portfolio, to chase development schemes. Brave if nothing else, one might say. Helical is smaller but goes for ultra-high quality office refurbishments and expansions, with tenants who can pay for quality, but each of their complex inner-city projects can take years to get through planning and their growth depends on a steady stream of them. After current ones complete, there will be a hiatus.

While NewRiver, always an aggressive high (and at times uncovered) yield stock, also looks strange. Debt is substantial, and another double figure fall in values could be harsh. Granted that would take more of its yields into double figure territory, in areas where demand (and alternative uses) should really provide a floor. But it also flirted with a badly timed foray into pubs, and their valuers are (to no great surprise) saying valuations for those are in the “who knows?” realm. Meanwhile the finance man is apparently jumping ship to lead a spin-off of the licensed premises, which sends some quite odd signals, although maybe holders have tired of his complex skills.

This leaves a more bifurcated market than ever, but with the risk of overvaluations both in the good stuff (last mile logistics in particular) and storage in general, and in residential.

By contrast UK retail is looking ever more wounded. It has been a great reopening trade, but unless the runway is really getting cleared, take off may now be too late for some.

Meanwhile Boris can’t seem to let go, having gained control, freedom is clearly an unattractive option to those in power. If that stays the same, we can see a perfect real estate storm brewing, if and when liquidity dries up a little.

The umbrella organisation, RICS, has in the mean time this summary to offer as its full market survey results.

Politics in the constituency of a murdered labour politician

Finally, the odd thing about Batley and Spen, was the idea that the Tories could win. I looked up the odds on Labour last week, at 4: 1 against, I found them most attractive. And that was based on my wrongly writing off Gorgeous George, who mercifully is one of a kind.

Without his strange allure it was and is very solidly Labour. Another non-story, I fear.

Charles Gillams

Monogram Capital Management Ltd