Where will the cards fall ?

The half year approaches - what has happened? Two very different quarters so far. And Investment Trusts complain too much, having stuffed their boards with placeholders with minimal stakes in the shares and multiple appointments. In markets many things still depend on how the cards (and ballots) fall.

THE FIRST HALF

With current interest rates for hard currency, high yield bonds, around 6%, you would expect riskier equity markets to be giving you over 10% a year, made up of a mix of capital and dividends. That’s the bar; it is quite high just now.

Looking back a year, only Japan and America comfortably achieve that, the S&P up +24%, NASDAQ up +30%, Nikkei up +14%. Germany creeps in at +10%, neither France nor the UK do. Outside developed markets, it is largely dire, only India at +25%.

Then looking just at the first half, all of Japan and Germany’s gains came in the first quarter, so they are now sitting well off their twelve-month highs. While as we know the big three, S&P, NASDAQ and SENSEX, are now close to all-time highs, they powered through the second quarter.

So, the challenge is, do they go on up, do the markets that have fallen back, after a good first quarter, come back to life, or do some of the dogs perform?

Some major markets, Friday close and intra day

I have no great faith in the UK market, nor in a new government being much better at growth (it can hardly be worse) than the current mob. But there are cheap looking international stocks in the UK and the punishment meted out to real assets, by interest rates and shrinking bank balance sheets, might be finally ending.

While quite clearly the good middle tier stocks are easily cheap enough to lure in bidders from abroad or private equity, in some number. UK valuations are in short OK, not something you can necessarily say about the US.

The residual underperforming markets do often have a nice yield, but who cares? With bond yields high and staying high, in an appreciating currency, why take a cut in yield in order to buy equities? Plenty of time for that later.

Anyhow in most European and Emerging markets, equities seem not to be able to get out from under their own feet, endlessly tripping over their own fractured politics.

INVESTMENT TRUSTS

We are hearing a lot of moaning about Investment Trusts, which the FCA really do not like. EU law always struggled with the trust concept anyway. That the FCA has shown no interest in freeing us from those shackles is not a surprise, it seems they too would rather channel money to Nvidia than invest in the UK. Here is their Lordships’ briefing on what EU rules we might be repealing. Nothing for Investment Trusts.

I am on balance on the Trust’s side, I do think closed end structures (as they all are) allow long term decisions, while protecting daily dealing, one of Europe’s quirky hang ups. Daily dealing is fine in deep markets, but an illusion in many medium and small equity markets. With liquidity ever more narrowly focused, closed end funds seem more, not less, important, for balanced capital allocation, competition and growth.

Trusts directors should also protect investors from over mighty fund management houses, who treat closed end funds with disdain, as captive funds, with often high fees. Their greed lets in low-cost passive competitors. Instead, their permanent capital should come with an obligation to hunt down good, index beating performance.

Sadly, the FCA has perpetuated a system, where the fund management house appoints the Boards, not, in reality, the other way round. So, they are decorative, good for marketing, and highly unlikely to fire the manager. Too many are industry insiders, serving on multiple trust boards, often in sequence. Seldom do they have an investment of at least their annual pay cheque in their current Trust, and often, little investing expertise in the relevant area.

So, Investment Trust boards hardly ever sack fund managers for poor performance. David Einhorn explains the bigger issue very clearly, noting benchmark hugging over time is what investors now get. There is a clear link to poor performance and bigger discounts, and to big discounts and treating shareholders badly: One area where big certainly does not mean better.

Rather than sabotage the sector with old, irrelevant EU law, the FCA should be hunting down poor performance, and making the “independent” directors just that, including banning directors shuffling around a set of one-manager trusts.

INTEREST RATES

We have just had Powell hold US rates, saying it is all data dependent, and slightly oddly he conceded the expectation is for a pick up in inflation, on the technical grounds that the abrupt drop in inflation last year, creates base effects.

Although he rules out more hikes; you get the feeling if he had held his nerve last summer, and added a bit more, inflation could be beaten by now. Not that he wants to or can add such instability now, so he is stuck, and we with him, watching paint dry.

With no real distress there is no pressure to cut prices, service inflation remains too high, energy prices are still quite strong, so no longer giving a deflationary boost. Both the AI boom and the resulting stock price gains, encourage consumer spending and keep (in most sectors) a strong labour market.

Markets are evidently OK with that, falling rates, no recession, growing earnings, is almost ideal. Meanwhile we are all hoping that Congress will keep either of the two old men from doing anything unusually silly, and the electorate will keep Congress on a tight leash.

Quite a lot of hoping and several months still to go.

THROUGH A GLASS

This is a curious market, swinging between pessimism and optimism on the thinnest of data. Is this rally for real, or just more rotation? Is the UK really breaking free?

Certainly, if you include dividends (and it is odd that we don’t in the UK; others do) there is indeed something moving in the UK. But is it more than one big takeover bid and a rising dollar, this time?

While the continued weakness in the AIM smaller companies index in particular, but also setbacks in some Emerging Markets (like Brazil) suggest this is indeed just jousting.

What can we see?

Markets have had a couple of sudden, dramatic jolts upward in the last eight months. Some ran up hard from October, while the FTSE sat trading sideways till mid-February (at 7,500) then launched upwards climbing almost a 1,000 points to now, and along the way had a shedload of ex-dividend dates to battle with, adding yet more to that return.

Others like the NASDAQ began their charge earlier, in the last week of October, then eased off in April, where they peaked and went sideways. The Mumbai SENSEX did almost the same, and again has been sideways since April. While the Japanese TOPIX took off in late December, but also peaked in late March.

That topping out in late March and early April does fit with the realization that US rate cuts had been, at best, substantially delayed.

Spinning, not climbing

That feels like rotation not recovery. The merry-go-round has just ended up on our own doorstep of late. If you look elsewhere, in small caps, my bell weather of doom, the Amati AIM VCT has been relentlessly down since late 2021, but has very slight recent uptick, and is trading on quite a slim discount now.

My other small cap telltale is Herald IT, very much taking off in late October and still making new highs, with (for this stock) a narrowing discount. Albeit it has a much less restricted remit and some of its small companies turn out to be quite big.

On a one-year basis, the US, Japan, India, Brazil all top a healthy 20% return, but on a three-month basis, only the Hang Seng (amazingly) hits double figures, a good chunk of which was last week, and Brazil is negative.

So no, not a classic recovery led by small caps and emerging markets, something more obscure.

But will it be another fake, like that immense pre-Christmas rally? Well fundamentals would still say yes, which is why I find it irksome.

Rate cuts - how many, how soon?

To me rate cuts look nothing like as baked in or as fast as in December; there really is no economic crisis, no recession. Growth keeps on, surprisingly strong despite so called high interest rates.

A rapid staccato set of cuts just won’t happen, it will be a gentle decline driven as much by politics as economics, and absent a crack in the labour markets (also not visible) not really going that low.

In particular, rates would then be neither low enough to give value stocks the boost of having their yields go way above gilts or treasuries, nor will they allow them to refinance absurdly cheap debt, at the same old give away rates. Both of which felt very much part of the pre-Christmas rally.

Until some sign of fiscal tightening (post elections) appears, we do expect the economy to run hot, and we do want central banks to have leeway to cut rates. And we want savings rewarded, modest but controlled inflation, sensible capital allocation, so what’s not to like?

Yet we have the risk off, value heavy rally from Christmas reprised, in what looks like a very different world, triggered it seems by Powell promising not to raise rates (as if he ever would).

So, we have a classic unloved rally, with summer doldrums and unpredictable US elections coming, to add to my unease.

The longer term, as I said, still looks fine, but we have to get there first.

What do UK local elections conceal?

Labour looks like a dead cert still, but it will be oddly unloved. Although in electoral terms (given first past the post in the UK) having four or five 10% opponents is a delight (Greens, Pro Palestine (if different), Lib Dems, Reform and that mysterious Independent group, mainly but not entirely unbadged Tories).

The total seat score and an absolute majority remains certain, but it does give some scope for odd three-way fights and surprises.

Then, there is the work of the Electoral Commission, creating weird new electoral patchworks out of their ruthless numerical hegemony. It is not clear how that shakes out.

It does also add an element of jeopardy, should one alternative faction catch fire. It will also leave a complex, disputatious opposition adding sand to the fuel lines, as the next Government tries to achieve something.

This also looks like a local councilor low (or high) water mark, solid Tory areas seem to have stayed resilient, and in the vast bulk of the middle ground, where the national majority rules don’t apply, ‘no overall control’ has done exceptionally well of late.

So, I quite like this market, nice to see some prices get off the floor and move past my “always buy” category, nice to see years of adding into falling prices finally reverse, but it is not (if it ever was) entirely logical.

The economic outlook is different from last year, and this rally should therefore be different.

That in many ways it is not, feels odd.

The name of the game

What is the point of investing? How has that changed over time.? Do we still need so many choices? Are single stocks relevant? And we salute the prime palindrome.

We were taught that investing is an economic process for allocating capital to allow competition to seek out the best opportunities and fund the best businesses for the benefit of all. Countries with good markets have good capital allocation, grow faster as enterprises with the best return on capital, and then attract more of it.

Really? Not what it looks like now. Things change. The old gateways got knocked down, so anyone can access any investment anywhere. The paternalistic City was never sure about that, but in reality, markets followed communications, which went global.

The FCA (and to a degree the SEC) has a muscle memory of these protected times, and constantly wants to suppress innovation, keep new issues and ideas away from investors. Slow it all down, so they don’t just regulate markets, but control them. But excess capital flows are changing all that. It is instructive how the SEC, by trying to stop Bitcoin, has simply made it respectable and transacting in it safe.

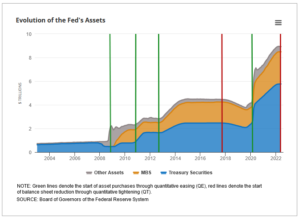

And looking skyward and not understanding how this excess liquidity is created by quantitative easing is sadly no longer viable for investors; entire economies are built on it, like Japan. Nor is it transitory, it is embedded in the US and EU as much as anywhere.

Governments hoped to take control, using QE they forced the cost, to them, of debt down to zero, on the way creating such a shortage of bonds, that prices rocketed. Paradoxically as did equities, for they could keep offering a yield and had no “lower bound”, so their prices could rise for ever.

Then equity investors got back in control, they realised they could move the price, on the thin sliver of equities that are actually traded, pretty much as they wished. In particular they could signal or co-ordinate, so that everyone was on board with the price direction. Which is both the meme stock phenomenon, but also at the heart of momentum investment.

And liquid, global, interconnected exchanges were designed to let all those price signals out in an instant. Of course, co-ordinating them takes only a few seconds more.

THE POINT IS

Which brings us back to what the point of investing is. I am only interested in capital allocation, if by understanding it and dissecting the choices, I can get better returns.

I can have an altruistic angle of course, I just like old style engineering and banking outfits, I sponsored the IPO of an art gallery once. I have a soft spot for Kenya and Bulgaria. I want to avoid ‘defence’ industries, I dislike tobacco and polluters, and not sold on slave labour either. How nice, and in the investing world, how utterly useless. Never, ever, fall in love with a stock they said: quite right, sadly.

Indeed, what you and I call capital allocation is what others call hot money, and it moves faster and faster. As for those bad actors, well money always attracts crime, the faster it moves the more options for criminals exist, quite a few of whom wear suits.

But then who needs stocks and analysis when you can now buy a market cheaply? Everything says invest in multiple geographies, but really? The process I have outlined above favours one or two markets, they win, so they give a good capital return, so they win again, almost regardless of what the underlying business does.

Indeed, Bitcoin shows, it can indeed be regardless of the underlying asset. Coordination and belief matter, not reality.

So, what of all the rest, the unfashionable markets, unfashionable stocks, they just keep underperforming, keep being sold, with very little scope to recover. With rates low it was possible to pay a competitive dividend, but when money market funds are expected to offer you twice the rate of inflation, even those dividends are unattractive, and they get taxed hard.

NO COMPETITION IN COMPETITION

While the Government has also destroyed the competitive market for companies, by largely sidelining hostile takeover bids. In any event issuing poorly rated paper for poorly rated paper never sounds great. But that closes out profitable exits; sure you get insiders sweeping the Aim floor for cheap deals, but by definition those are not competitive, you can’t have two sides both inside.

The government knows that almost any deal has a loser, or someone not as well protected for life, as they had hoped. Which means media noise and MP’s getting lobbied, so far better to ‘long grass’ it, via a competition investigation. Isn’t it odd that the competitive market in asset allocation created by an active takeover market, is the one market the competition authorities simply won’t investigate. But without that cheap stocks just stay cheap, it is why buy backs are so prevalent: the companies are right, the price is wrong.

Of course, index investing has issues, you buy the bomb maker, cigarette seller and dodgy legal firm all in one bundle, but that’s the game. If it is big enough, it goes in the index, and you buy the package.

And hot stocks are likely to favour low commission markets, and low transaction costs. It may be an accident, that UK commission and tax is based on total deal value, but US commission is based on share count (and there is no stamp tax). But it does mean that you buy a share in Berkshire Hathaway for the same dealing cost as one in Game Stop, or if you prefer Nvidia and Trump Media.

Assuming sanity, you trade in the US, or in stamp free index ETF’s, not UK stocks. Although the FCA are fighting a rearguard action against both ideas, with the discrimination against holding ETFs seeming particularly bone headed and indeed against consumer interests.

But few stocks, fewer markets, more hot stock volatility, it is just the way we have set it up, don’t be surprised that is how capital is now allocated, growth funded, prosperity achieved and destroyed.

TIME FOR A BREAK

As for this market, it had to break, we have said it for a while.

Levels have dropped sharply, and money is rotating back into bonds, or at least not flowing out of bonds.

Waiting to see through the summer, when that first rate cut arrives and who wins the US Presidential election, is all impacting the hot flows and making staying in cash feel easier.

While a more sinister undertow is coming from the narrative that the terminal interest rate settles out higher.

Our core assumption is still that real interest rates are now in a steady decline, but the equity bonanza of negative real rates is not coming back anytime soon. While for now, only one Central Bank and one market is going to keep on winning the hot money race. No prizes for second anymore.

The Winner Takes It All.

Jerome K Wiley?

We do think Powell is running off a cliff, just not the one the market assumes. As we endured the wettest February since (at least) 1836, when William Lamb was prime minister, and the wettest Tory government since records began, is there any chance of dryer times?

But first the tiresome tango of rate rises, the market swept to and fro, nation by nation, until the firm stamp of a well-heeled bond whips the whole mass back round again.

Bailey of the BoE, and Powell of the Fed

So, this week it is to be Bailey first out the gate, FTSE up, bond yields down, next week who knows? That rates will fall this year is the only certainty and the big US markets have built a near vertical climb out of that snippet. But you will note, not in rate sensitive stocks, the Russell (small cap) is still pretty flat, weighed down by the regional banks that dominate it.

And Powell, he’s guessing or as he calls it is “data dependent”, but for all that he is pretty happy projecting those guesses forward. So, he has moved from three rate cuts this year, to a new position of ? Well - three rate cuts this year. Not much data dependency there.

Before long he will run out of “this year”, because the inflation numbers are not behaving, nor critically is the oil price. Like Bailey in the UK, he is desperate to cut and under heavy political pressure to do so, both have said 2% inflation is not now needed, just moves in the right direction.

I feel the only thing that can get us there is a sudden (and indeed overdue) drop in the energy price, which we do expect in the summer, but who knows? It has held up rather well so far.

So, at the moment, Powell is perhaps running on thin air. Protectionism and vote buying fiscal measures mean he can’t get there without some other help.

Markets are supercharged – is it sustainable though?

And if rate cuts are what has supercharged markets in the US, I don’t see that as sustainable right through the year. It might instead be the possibility of a more market friendly, fiscally prudent, Trump, which would be more logical, in some ways; but that still feels implausible.

Nor do I see, as yet, many other markets joining in. Partly, why own anything else but the NASDAQ? Some markets have moved (Germany, Japan) but you could also argue that was after being oversold for too long. While the Swiss have cut rates, it is in part (as ever) to restrain their currency, I am less sure others will want to move ahead of the US.

They may be forced to, but there again their scope before European and UK elections looks limited. And some parts of the market, like UK smaller companies and many REITs (and some renewables) are not signalling anything but yet more damage and destruction, from suspect refinancing at high rates and over optimism on revenue.

Air Cushions

It was notable too how keen Powell is to slow the tightening imposed by reducing the Federal Reserve bond holdings, which has to date been done at a fairly brisk pace. He now talks of stabilising holdings, (in other words resuming bond buying, stopping the runoff of expired holdings) at what seems a high level, for fear of taking too much liquidity out of the system.

From this explanatory article on the process by the Richmond Fed.

For a while rates and reserve sales were working as one against inflation, but not for much longer it seems. Which should be good for bitcoin and other liquidity consuming monsters, if nothing else.

Who is Next in the UK?

The interesting Tory battle is between the Official wing, now entrenched in power, and showing no sign of intelligent life, beyond wanting to “make a good fist of it” in the inevitable electoral defeat. Then there is the Rebel wing, keen to cause trouble, break things, get popular support, or be nasty, if it gets them attention. Although the Official wing regards this as disloyal, it follows an old pattern. It is not just about this particular bunch: see this paper.

Faced with a like quandary under Blair, the Tory party swung left, towards the centre and power, just as Gordon Brown started the decade long Labour march to irrelevance. The Official assumption is that will work again, although the alternative scenario is that Starmer settles down in the centre for the long haul, and the Rebel wing, kept securely away from power, withers for lack of a structure.

But all ruling parties were, by definition, rebels once.

Back in 1836, William Lamb was an unsuccessful politician, wrapped around by Peel, sent to the House of Lords, then brought back as a centrist Prime Minister, and being generally useless, was turfed out again, after naming an Australian city, en route. One must hope for no repeats from history.

William Lamb, Lord Melbourne – from this site

It does not feel time for compromise candidates, nor will a ‘safe pair of hands’ do. Rishi is in a fight.

Meanwhile the fields here feel like salt marshes, dark water lurking in deep cracks, the lips of which slide into clay and suck at the soles of your feet. We certainly could do with some heat.

I do expect this run in markets to go on, but the upside in the big US indices looks more limited and broader participation elsewhere will await those rate cuts. Both their size and speed have a capacity to disappoint, especially when they are so hotly anticipated.

The politics, a long time coming, may become more influential. It could get choppy.

We will take an Easter break, after what feels like a long spring.

And return with the sun (we hope) on 14th April.

Sleight of Hand

This week, we speculate as to what the FCA is really after in their Practitioner Survey. How closely do their actions follow their words, with the new Consumer Duty laws? And we also look at Hunt’s budget and the likely forthcoming non-impact on stock markets.

FED UP FEEDBACK

Periodically member firms get quizzed on how we see the FCA; this time they promised a shorter form. Well, if that’s shorter, I’d hate to see the long one. Take a look here. Thirty-nine questions, but so many cover multiple topics, it feels more like a hundred.

It is typical of such surveys designed by marketing advisors: a few soft questions, how are you today type guff, a few “have you stopped beating your wife” ones, just to check you are actually awake, then a lot of navel gazing on SICGO. They really despise it.

This is purportedly about promoting competition. Which actually makes the regulator’s job harder – encouraging more firms and lowering the barriers to entry for new firms. The FCA does not like that idea much; so, note, it is a SECONDARY International Competitiveness and Growth OBJECTIVE, get the Secondary stress, minor, icing on the cake stuff. Objective, so just an aspiration, not real. Their minutes (above) even admit that.

Then we have more ‘are you happy questions’, then some tiresome back scratching ones, just how great are we at seminars? answering the phone? sending you flowers? You get the picture.

Then a few global ones, how good are we at promoting world peace and intergalactic harmony? By this stage you are probably wondering what this is, I am. And the idea creeps in that it is nothing to do with the poor regulated mugs, anyhow. So probably not much to do with the consumer either.

Meanwhile I see a landscape of poor consumer outcomes, vast sales driven peddlers of half-truths, a fair bit of market abuse, absurd barriers to entry, the insiders and regulators getting fat, the savers, investors and users of capital paying for it all.

NEW LAW OLD RULES

They also published “A new Consumer Duty Feedback to CP21/36 and final rules” more terribly exciting stuff, a mere 70 pages of it. They make much of the “Risk of Retrospection”, saying “we were clear that the Duty would not have retrospective effect and would not apply to past actions by firms”.

OK, this is a key political input; the industry has had enough of new rules, looking back. So, I take it that we won’t see big attacks on UK listed finance firms this time?

Not so, you guessed it, the entire financial sector is suddenly seeing bigger provisions, because, it seems, of the new rules. It looks very much like the damaging hits on SJP Close, Lloyds, are exactly this, retrospective application of laws, an action so vociferously foresworn by the regulator.

And this helps competition how? Well not at all. But do remember it is a secondary aim and applies only to “competition in the interests of consumers” so not real competition, but one where the mechanism (competition) and the outcome (interests of consumers) get muddled up.

So, for instance destroying UK financial services firms is fine if done “in the interests of consumer” and what could be more in their ‘interests’ than getting money back on a contract they willingly (and legally) signed ten years ago?

And that’s why choice and consumer outcomes are being lost in box ticking and adverts of fluffy kittens, sunsets on beaches and the like. Just look at the UK ISA advertisements, do they tell you anything? Beyond heavy hints at nirvana with no work.

HUNT’S LAST HURRAH

The budget? Well, it is so dull, you feel it is simply what the HMRC nerds wanted. More complexity, a few free hits (non doms), more CGT breaks for landlords, for the rentiers not the creators, less employee NI, but no change to employer NI, that actual tax on jobs remains as harsh as ever.

We are well into Q1 now, so I guess the intriguing thing is more this firm Treasury conviction, adopted by the OBR, that inflation will fall towards 2% in Q2. Given their prior errors, that is very bullish, and does not support base rates at 5.25%, frankly not even at 3.25%.

It is all circular, despite commentators’ child-like obsession with margins for error. If inflation stays high, tax raised stays higher, covering higher public sector spend. So low inflation is (oddly) a cautious model prediction.

The market does not believe it. Nor do we. Not quite chapeau consumption time, but I don’t see 2% this year. I am not sure where this recession is, but not in any of the streets I walk down.

If interest rates are really about to fall off a cliff, the FTSE looks oddly stuck, miles behind the US indices, and sterling also looks curiously strong. If saving rates are about to be pummelled, the yield stocks that fill the FTSE will suddenly look very cheap. Which suggests the markets are not buying it, not yet.

A 500-point rally might even be plausible, if the OBR is right, but it is not, and talk of headroom is nonsense. This remains an expansionist fiscal mind set, but of quite limited duration, hence the market caution.

Elsewhere we are in ‘riding-the-tiger’ time: if you are onboard, how and when do you get off it?