The name of the game

What is the point of investing? How has that changed over time.? Do we still need so many choices? Are single stocks relevant? And we salute the prime palindrome.

We were taught that investing is an economic process for allocating capital to allow competition to seek out the best opportunities and fund the best businesses for the benefit of all. Countries with good markets have good capital allocation, grow faster as enterprises with the best return on capital, and then attract more of it.

Really? Not what it looks like now. Things change. The old gateways got knocked down, so anyone can access any investment anywhere. The paternalistic City was never sure about that, but in reality, markets followed communications, which went global.

The FCA (and to a degree the SEC) has a muscle memory of these protected times, and constantly wants to suppress innovation, keep new issues and ideas away from investors. Slow it all down, so they don’t just regulate markets, but control them. But excess capital flows are changing all that. It is instructive how the SEC, by trying to stop Bitcoin, has simply made it respectable and transacting in it safe.

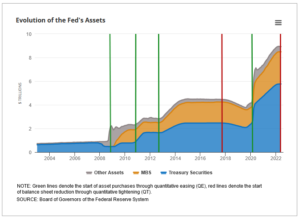

And looking skyward and not understanding how this excess liquidity is created by quantitative easing is sadly no longer viable for investors; entire economies are built on it, like Japan. Nor is it transitory, it is embedded in the US and EU as much as anywhere.

Governments hoped to take control, using QE they forced the cost, to them, of debt down to zero, on the way creating such a shortage of bonds, that prices rocketed. Paradoxically as did equities, for they could keep offering a yield and had no “lower bound”, so their prices could rise for ever.

Then equity investors got back in control, they realised they could move the price, on the thin sliver of equities that are actually traded, pretty much as they wished. In particular they could signal or co-ordinate, so that everyone was on board with the price direction. Which is both the meme stock phenomenon, but also at the heart of momentum investment.

And liquid, global, interconnected exchanges were designed to let all those price signals out in an instant. Of course, co-ordinating them takes only a few seconds more.

THE POINT IS

Which brings us back to what the point of investing is. I am only interested in capital allocation, if by understanding it and dissecting the choices, I can get better returns.

I can have an altruistic angle of course, I just like old style engineering and banking outfits, I sponsored the IPO of an art gallery once. I have a soft spot for Kenya and Bulgaria. I want to avoid ‘defence’ industries, I dislike tobacco and polluters, and not sold on slave labour either. How nice, and in the investing world, how utterly useless. Never, ever, fall in love with a stock they said: quite right, sadly.

Indeed, what you and I call capital allocation is what others call hot money, and it moves faster and faster. As for those bad actors, well money always attracts crime, the faster it moves the more options for criminals exist, quite a few of whom wear suits.

But then who needs stocks and analysis when you can now buy a market cheaply? Everything says invest in multiple geographies, but really? The process I have outlined above favours one or two markets, they win, so they give a good capital return, so they win again, almost regardless of what the underlying business does.

Indeed, Bitcoin shows, it can indeed be regardless of the underlying asset. Coordination and belief matter, not reality.

So, what of all the rest, the unfashionable markets, unfashionable stocks, they just keep underperforming, keep being sold, with very little scope to recover. With rates low it was possible to pay a competitive dividend, but when money market funds are expected to offer you twice the rate of inflation, even those dividends are unattractive, and they get taxed hard.

NO COMPETITION IN COMPETITION

While the Government has also destroyed the competitive market for companies, by largely sidelining hostile takeover bids. In any event issuing poorly rated paper for poorly rated paper never sounds great. But that closes out profitable exits; sure you get insiders sweeping the Aim floor for cheap deals, but by definition those are not competitive, you can’t have two sides both inside.

The government knows that almost any deal has a loser, or someone not as well protected for life, as they had hoped. Which means media noise and MP’s getting lobbied, so far better to ‘long grass’ it, via a competition investigation. Isn’t it odd that the competitive market in asset allocation created by an active takeover market, is the one market the competition authorities simply won’t investigate. But without that cheap stocks just stay cheap, it is why buy backs are so prevalent: the companies are right, the price is wrong.

Of course, index investing has issues, you buy the bomb maker, cigarette seller and dodgy legal firm all in one bundle, but that’s the game. If it is big enough, it goes in the index, and you buy the package.

And hot stocks are likely to favour low commission markets, and low transaction costs. It may be an accident, that UK commission and tax is based on total deal value, but US commission is based on share count (and there is no stamp tax). But it does mean that you buy a share in Berkshire Hathaway for the same dealing cost as one in Game Stop, or if you prefer Nvidia and Trump Media.

Assuming sanity, you trade in the US, or in stamp free index ETF’s, not UK stocks. Although the FCA are fighting a rearguard action against both ideas, with the discrimination against holding ETFs seeming particularly bone headed and indeed against consumer interests.

But few stocks, fewer markets, more hot stock volatility, it is just the way we have set it up, don’t be surprised that is how capital is now allocated, growth funded, prosperity achieved and destroyed.

TIME FOR A BREAK

As for this market, it had to break, we have said it for a while.

Levels have dropped sharply, and money is rotating back into bonds, or at least not flowing out of bonds.

Waiting to see through the summer, when that first rate cut arrives and who wins the US Presidential election, is all impacting the hot flows and making staying in cash feel easier.

While a more sinister undertow is coming from the narrative that the terminal interest rate settles out higher.

Our core assumption is still that real interest rates are now in a steady decline, but the equity bonanza of negative real rates is not coming back anytime soon. While for now, only one Central Bank and one market is going to keep on winning the hot money race. No prizes for second anymore.

The Winner Takes It All.

Jerome K Wiley?

We do think Powell is running off a cliff, just not the one the market assumes. As we endured the wettest February since (at least) 1836, when William Lamb was prime minister, and the wettest Tory government since records began, is there any chance of dryer times?

But first the tiresome tango of rate rises, the market swept to and fro, nation by nation, until the firm stamp of a well-heeled bond whips the whole mass back round again.

Bailey of the BoE, and Powell of the Fed

So, this week it is to be Bailey first out the gate, FTSE up, bond yields down, next week who knows? That rates will fall this year is the only certainty and the big US markets have built a near vertical climb out of that snippet. But you will note, not in rate sensitive stocks, the Russell (small cap) is still pretty flat, weighed down by the regional banks that dominate it.

And Powell, he’s guessing or as he calls it is “data dependent”, but for all that he is pretty happy projecting those guesses forward. So, he has moved from three rate cuts this year, to a new position of ? Well - three rate cuts this year. Not much data dependency there.

Before long he will run out of “this year”, because the inflation numbers are not behaving, nor critically is the oil price. Like Bailey in the UK, he is desperate to cut and under heavy political pressure to do so, both have said 2% inflation is not now needed, just moves in the right direction.

I feel the only thing that can get us there is a sudden (and indeed overdue) drop in the energy price, which we do expect in the summer, but who knows? It has held up rather well so far.

So, at the moment, Powell is perhaps running on thin air. Protectionism and vote buying fiscal measures mean he can’t get there without some other help.

Markets are supercharged – is it sustainable though?

And if rate cuts are what has supercharged markets in the US, I don’t see that as sustainable right through the year. It might instead be the possibility of a more market friendly, fiscally prudent, Trump, which would be more logical, in some ways; but that still feels implausible.

Nor do I see, as yet, many other markets joining in. Partly, why own anything else but the NASDAQ? Some markets have moved (Germany, Japan) but you could also argue that was after being oversold for too long. While the Swiss have cut rates, it is in part (as ever) to restrain their currency, I am less sure others will want to move ahead of the US.

They may be forced to, but there again their scope before European and UK elections looks limited. And some parts of the market, like UK smaller companies and many REITs (and some renewables) are not signalling anything but yet more damage and destruction, from suspect refinancing at high rates and over optimism on revenue.

Air Cushions

It was notable too how keen Powell is to slow the tightening imposed by reducing the Federal Reserve bond holdings, which has to date been done at a fairly brisk pace. He now talks of stabilising holdings, (in other words resuming bond buying, stopping the runoff of expired holdings) at what seems a high level, for fear of taking too much liquidity out of the system.

From this explanatory article on the process by the Richmond Fed.

For a while rates and reserve sales were working as one against inflation, but not for much longer it seems. Which should be good for bitcoin and other liquidity consuming monsters, if nothing else.

Who is Next in the UK?

The interesting Tory battle is between the Official wing, now entrenched in power, and showing no sign of intelligent life, beyond wanting to “make a good fist of it” in the inevitable electoral defeat. Then there is the Rebel wing, keen to cause trouble, break things, get popular support, or be nasty, if it gets them attention. Although the Official wing regards this as disloyal, it follows an old pattern. It is not just about this particular bunch: see this paper.

Faced with a like quandary under Blair, the Tory party swung left, towards the centre and power, just as Gordon Brown started the decade long Labour march to irrelevance. The Official assumption is that will work again, although the alternative scenario is that Starmer settles down in the centre for the long haul, and the Rebel wing, kept securely away from power, withers for lack of a structure.

But all ruling parties were, by definition, rebels once.

Back in 1836, William Lamb was an unsuccessful politician, wrapped around by Peel, sent to the House of Lords, then brought back as a centrist Prime Minister, and being generally useless, was turfed out again, after naming an Australian city, en route. One must hope for no repeats from history.

William Lamb, Lord Melbourne – from this site

It does not feel time for compromise candidates, nor will a ‘safe pair of hands’ do. Rishi is in a fight.

Meanwhile the fields here feel like salt marshes, dark water lurking in deep cracks, the lips of which slide into clay and suck at the soles of your feet. We certainly could do with some heat.

I do expect this run in markets to go on, but the upside in the big US indices looks more limited and broader participation elsewhere will await those rate cuts. Both their size and speed have a capacity to disappoint, especially when they are so hotly anticipated.

The politics, a long time coming, may become more influential. It could get choppy.

We will take an Easter break, after what feels like a long spring.

And return with the sun (we hope) on 14th April.

Reserve in Reverse

Fallen Emperor?

With almost two thirds of global equity markets represented by the US, the fall in the dollar so far this year is quite dramatic, and for many investments, more important than the underlying asset.

UK retail investors are especially exposed to this, as although Jeremy Hunt (UK Chancellor) may not notice it, the US is where most UK investors went, when his party’s policies ensured the twenty-year stagnation in UK equity prices.

While Sunak continues to pump up wage inflation, which he claims, “won’t cause inflation, raise taxes or increase borrowings” Has he ever sounded more transparently daft? Sterling, knowing bare faced lies well enough, then simply drifts higher. Markets know such folly in wage negotiation can only lead to inflation and higher interest rates.

We noted back in the spring, in our reference to “dollar danger” that this trade (sell dollar, buy sterling) had started to matter, and we began looking for those hedged options, and to reduce dollar exposure. To a degree this turned out to be the right call, but in reality, the rate of climb of the NASDAQ, far exceeded the rate of the fall in the dollar.

While sadly the other way round, a lot of resource and energy positions fell because of weaker demand and the extra supply and stockpile drawdowns, which high prices will always produce. But that decline was then amplified by the falling dollar, as most commodities are priced in dollars. So, a lot of ‘safe’ havens (with high yields) turn out to have been unsafe again.

The impact of currency on inflation

Currency also has inflation impacts. Traditionally if the pound strengthens by 20%, then UK input prices fall 20%. The latest twelve-month range is from USD1.03 to USD1.31 now, a 28% rise in sterling.

In a lot of the inflation data, this is amplified by a similar 30% fall in energy, from $116 to $74 a barrel for crude over a year. In short, a massive reversal in the double price shock of last year. In fairness this is what Sunak had been banking on, and why the ‘greedflation’ meme is able to spread. But while that effect is indeed there, other policy errors clearly override and mask it.

A Barrier to the Fed.

In the US we expect the converse, rising inflation from the falling currency, maybe that is creeping through, but not identified as such, just yet, as price falls from supply chains clearing lead the way, but it is in there.

Finally, of course, this time, the dire performance of the FTSE is probably related to the same FX effect on overseas earnings assumptions. Plus, the odd mix of forecast data and historic numbers that we see increasingly and idiosyncratically used just in the UK. If the banks forecast a recession, regardless of that recession’s absence, they will raise loan loss reserves, and cut profits, even if the reserves never get used.

Meanwhile, UK property companies are now doing the same, valuing collapsing asset values on the basis of the expected recession, and not on actual trades. So, if you have an index with heavy exposures to stocks, that half look back, half reflect forward fears, it will usually be cheaper than the one based on reality.

Why so Insipid?

OK, so why is the dollar weak? Well, if we knew that, we would be FX traders. But funk and the Fed’s ‘front foot’ posture are the best answers we have, and both seem likely to be transient too.

If the world is saying don’t buy dollars, either from fear of the pandemic or Russian tank attacks or bank failures, that’s the funk. As confidence resumes and US equity valuations look more grotesque, the sheep venture further up the hill and out to sea. To buy in Europe or Japan, they must sell dollars.

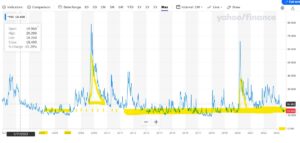

The VIX, in case you were not watching, has Smaug like, resumed its long-tailed slumber, amidst a pile of lucre.

From Yahoo Finance CBOE Volatility Index

So as the four horsemen head back to the stables, the dollar suffers a loss.

The Fed was also into inflation fighting early; it revived the moribund bond markets, enticed European savers with positive nominal rates, (a pretty low-down trick, to grab market share) and announced the end of collective regal garment denial policies. But having started and then had muscular policies, it must end sooner, and perhaps at a lower level. So that too leads to a sell off in the dollar.

Where do we go instead?

So where do investors go instead?

In general, it is either to corporate debt, or other sovereigns. Japan is not playing, the Euro maybe fun, but not so much if Germany is getting back to normal sanity and balancing the books again. So, the cluster of highly indebted Western European issuers are next.

Sterling now ticks those boxes, plenty of debt, liquid market, no fear of rate cuts for a while, irresponsible borrowing, what is not to like?

For How Long

When does that end? Well, the funk has ended. You can see how the SVB failure caused a dip in the spring, but now the curve looks upward again. Although fear can come back at any time, as could some good news for the UK on inflation. However even the sharp drop the energy/exchange rate effects will cause soon, leave UK base rates well south of UK inflation rates.

So, every bit of good news for the Fed, is bad news if you hold US stocks here.

How high and how fast does sterling go?

Well, it has a bit of a tailwind, moves like any other market in fits and starts, but could well go a bit more in our view. Oddly the FTSE would be a hedge (of sorts).

Pain delayed, pleasure denied

We look at the startling emergence of another US based tech bubble, the failure of value investing and offer some reflections on the UK market.

The Bones of World Financial Markets.

This has been a baffling half year in which, with few exceptions, we have ended up going sideways for most of it. The exceptions were in descending order, within equities, the NASDAQ (by a mile), Japan, Germany, the S&P and France. Although all, especially Japan, offset by a weakening local currency for UK investors. A quite unusual, largely unrelated, mix of old and new.

Overall, cyclicals in general, and energy in particular, as well as bonds, and China have been painful and financials at best so-so. It feels like a year to not hold what worked last year and vice versa. Nor is it as simple as growth versus value; neither have worked consistently, except in the case of a small (but rotating) group of tech stocks.

Our view thus far, has been that until global growth starts to move, we stay out of the way. This has been wrong, because the overvalued US mega stocks, were almost the only game in town. Yet jumping in now, of course, also feels very dangerous.

However, a few of our growth markers have, even if flat on the year, started to shift, not the highly speculative micro stuff, which is still falling away, but the solid middle ground. The hot India tech sector, far more connected to Silicon Valley than we realise, has suddenly jumped.

Macro Skeleton

What about the underlying macro story? Well, the pain of the invisible recession, and the pleasure of resulting rate cuts, have been delayed and denied respectively.

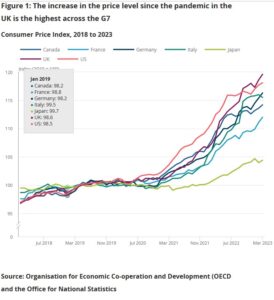

From the UK office of National Statistics – see this chart more clearly on this page.

From the UK office of National Statistics – see this chart more clearly on this page.

Well, there it is, poorly controlled inflation persists, a longer rate squeeze may still be needed. The vanishing China post-lockdown boom means that there was no sudden stimulus to offset that. Our published data (from Andrew Hunt) was saying Chinese ports were remarkably empty three months ago, from soft export demand, a good lead indicator.

All of that was hidden by strong services demand, and in closed economies (as the UK is oddly becoming) there is no relief valve, and hence it suffers embedded high inflation. But clearly consumption is dropping in the US, recent retailer numbers are all over the place, confirming those China export stats.

While on commodities, the failure of sanctions to impact energy is ever more clear, and I doubt OPEC’s ability to stem the energy glut. As a final blow to value stocks, “higher for longer”, on interest rates, which we have been predicting for two years, hurts indebted companies, who increasingly have to refinance at high rates. It also makes their dividend yields less attractive.

When rate cuts do come, growth having survived the storm, may well soar; as we have noted before, the prevailing fashion in investing heavily favours so called “tech moats” and dislikes debt. That markets keep seeking out new moats, real or imagined, is all part of that.

The speed at which digital currency and virtual reality have become old jokes, but generative AI will save us all, is remarkable.

Bond Dilemmas

In bonds we have seen no point in our lending to governments at rates that are below inflation; in most of the world as inflation falls, bonds still remain unattractive, as yields then start to drop too. So, the bond trade has been messy to say the least.

With greater certainty about a consumption recession, the fear of defaults also rises, and the longer rates are high, the more that refinance risk looms. Jumping a spike is possible, vaulting a table, without spilling your drinks, rather less so.

There is also still a ton of money parked up in fixed interest, just waiting for the equity ‘all clear’.

Lost London?

The UK market (yet again) simply flattered to deceive; I struggle to see much hope for it. While we can hope the likely change of government will be an enhancement, it really will just entrench welfare dependency and producer capture of state services, albeit in a rather more disciplined way.

The risk of Brexit always was that we would use our new freedom to rebuild old prisons. Can a new flag on an old workhouse change much? As for where our stunningly high inflation comes from, again, it must be our own creation, the Ukraine energy peak is now a dip, so it is not imported.

While no one wants to say it, tax rises, especially of such magnitude of corporation tax, in particular, are inflationary, but so is the cheap theft of frozen income tax thresholds. Trade unions employ good economists too, they negotiate for higher take home pay. Rate rises also cause extra inflation, especially with our persistent high national and consumer debt levels.

Sterling strength (it is now moving up against the Euro too) is a sign of markets seeing the UK as the best bet for avoiding rate cuts (and for getting more rate rises). That is not a good sign domestically.

The Sleep of Reason

Big picture risk assessments today, and worries about the prevailing style of regulation - we look at where the next bank blow up maybe. We’re assuming this will again be caused by regulators and their herding behaviour. On the upside, an improving medium-term market outlook. Also, dollar danger.

But before I begin…

First of all, many thanks to those who replied to our sentiment survey, you are a cautious crowd! Over half (53%) sitting on the fence, alongside us. The largest directional group is bullish on equities (18%), but it is a pretty even bull/bear split with bonds, and quite a few equity bears too.

Regulatory Myopia and Declining Banks

Bank boards (and auditors) are still clearly confusing regulatory approval with sound banking, in the odd belief that excuse will wash, when they implode. In particular we worry about the vast amount of debt that is sitting on bank balance sheets, at below current market levels, and not in this case issued by governments.

We have notable anxiety about two areas, fixed rate mortgages and investment grade debt where, especially for the former, the numbers are vast. Perhaps the tightening steps to date appear so ineffective, just because so much of this old low-cost issuance, is only very slowly rolling off .

Big picture – the effect of long dated low-cost loans, with rising interest rates

This leaves cheap money in the system, funded by banks, that have to pay way more to keep funding these long-term deals. They’re doing this typically with short-term sources, like deposits. In sub-prime, asset finance, trade finance, consumer finance, none of it matters much, as they are pretty short duration. Which is where most people worry, because of default rates, we don’t.

But in mortgages especially the regulator typically issues the future economic scenarios to banks, who then price (originate) and provide for losses against that projection.

If that projection is absurdly few rate rises, for a decade (as it was till fairly recently), it seems banks just follow obediently along. As a result, they have issued vast amounts of long dated, low cost loans based on false or unrealistic assumptions.

Those regulator driven economic assumptions/scenarios are key, and yet are lost in the detail. Each bank has to publish them if you dig deep enough. (Some are on p155-157 of the HSBC accounts, for example, if you have the stamina.)

Re-mortgages – what they contribute to our big picture

The other part is refresh rates, in a falling interest rate world, borrowers re-mortgage every few years, but in a rising one early redemptions virtually stop. So, the whole system gums up, without fresh liquidity. Regulators have not seen, and have no data, on such a ‘higher rates for longer’ world. So, it is assumed that world cannot exist. While the key thing (still) on these scenarios is that interest rates are still assumed to be like rockets, straight up straight down.

Now if you assume that, there is some short term pain, but normal service resumes soon enough with no long-term issue. But is it realistic? It is a vast slow moving market as in this publication of the FCA’s mortgage lending statistics .

Inevitably the scenario dispersion used is small, indicating a regulatory finger remains on the scales. So, most banks take the Central Bank forecast as the middle way, with say 10% either side. All as at the historic balance sheet date. Last year they were nonsense even before publication, two months on.

That is aside from Hong Kong, where real economic models, with real outcome ranges are visible. For most markets you see a skein of twisted rope drifting laconically into the future, but on HK they produce an exploding ammunition graph, smoke trails looping everywhere.

To a lesser extent BP debt (a classic investment grade, big, global borrower) is a similar problem. It has half fixed, half floating issuance, but the fixed is at 3% with a fourteen-year average term and the floating at twice that, at 6%. Now someone holds that fixed debt, and if regulated it will have to now be held below par. Are BP going to prepay it? Despite the roar of cash coming in, why would they? It is stuck, unusable for 14 years, unless inflation (and rates) collapse as fast as predicted.

What else is driving markets?

The big upside drivers to us are, the end of COVID, the end of the energy spike and falling rates. The first two will help through 2023 and 2024. Rising rates are still hurting, but again 2024 and beyond looks good.

While the biggest current downside driver is the recession, which will impact 2023, but again rebound in 2024. So, the issue is: will the rather timorous monetary tightening and anaemic reductions in the absurd fiscal overdrive, be enough to defuse all that good news coming in the next year?

Markets apparently think not.

We are particularly struck by the NASDAQ up 18% year to date, yet our tech bell weather share, Herald Investment Trust (HIT) is still (marginally) down YTD. So is this a bitcoin-type story (all about liquidity) or is it based on tech fundamentals? If the latter, then why is it seemingly glued to the US, and not translatable? Even failing to reach non-US holders of US companies.

For now, until the price of global tech shifts, I treat the US as a special case; growth is not back yet.

While the currency charts are unclear, it does also feel like the beginning of the end of the great dollar story, with sterling persistently ticking higher of late.

From: this page published by the NY federal reserve.

From: this page published by the NY federal reserve.

That’s a real danger for portfolios that thrived on dollar power last year.

We close wishing you a happy Easter break. We will be back with St George.