We look at the startling emergence of another US based tech bubble, the failure of value investing and offer some reflections on the UK market.

The Bones of World Financial Markets.

This has been a baffling half year in which, with few exceptions, we have ended up going sideways for most of it. The exceptions were in descending order, within equities, the NASDAQ (by a mile), Japan, Germany, the S&P and France. Although all, especially Japan, offset by a weakening local currency for UK investors. A quite unusual, largely unrelated, mix of old and new.

Overall, cyclicals in general, and energy in particular, as well as bonds, and China have been painful and financials at best so-so. It feels like a year to not hold what worked last year and vice versa. Nor is it as simple as growth versus value; neither have worked consistently, except in the case of a small (but rotating) group of tech stocks.

Our view thus far, has been that until global growth starts to move, we stay out of the way. This has been wrong, because the overvalued US mega stocks, were almost the only game in town. Yet jumping in now, of course, also feels very dangerous.

However, a few of our growth markers have, even if flat on the year, started to shift, not the highly speculative micro stuff, which is still falling away, but the solid middle ground. The hot India tech sector, far more connected to Silicon Valley than we realise, has suddenly jumped.

Macro Skeleton

What about the underlying macro story? Well, the pain of the invisible recession, and the pleasure of resulting rate cuts, have been delayed and denied respectively.

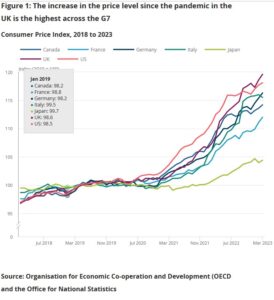

From the UK office of National Statistics – see this chart more clearly on this page.

From the UK office of National Statistics – see this chart more clearly on this page.

Well, there it is, poorly controlled inflation persists, a longer rate squeeze may still be needed. The vanishing China post-lockdown boom means that there was no sudden stimulus to offset that. Our published data (from Andrew Hunt) was saying Chinese ports were remarkably empty three months ago, from soft export demand, a good lead indicator.

All of that was hidden by strong services demand, and in closed economies (as the UK is oddly becoming) there is no relief valve, and hence it suffers embedded high inflation. But clearly consumption is dropping in the US, recent retailer numbers are all over the place, confirming those China export stats.

While on commodities, the failure of sanctions to impact energy is ever more clear, and I doubt OPEC’s ability to stem the energy glut. As a final blow to value stocks, “higher for longer”, on interest rates, which we have been predicting for two years, hurts indebted companies, who increasingly have to refinance at high rates. It also makes their dividend yields less attractive.

When rate cuts do come, growth having survived the storm, may well soar; as we have noted before, the prevailing fashion in investing heavily favours so called “tech moats” and dislikes debt. That markets keep seeking out new moats, real or imagined, is all part of that.

The speed at which digital currency and virtual reality have become old jokes, but generative AI will save us all, is remarkable.

Bond Dilemmas

In bonds we have seen no point in our lending to governments at rates that are below inflation; in most of the world as inflation falls, bonds still remain unattractive, as yields then start to drop too. So, the bond trade has been messy to say the least.

With greater certainty about a consumption recession, the fear of defaults also rises, and the longer rates are high, the more that refinance risk looms. Jumping a spike is possible, vaulting a table, without spilling your drinks, rather less so.

There is also still a ton of money parked up in fixed interest, just waiting for the equity ‘all clear’.

Lost London?

The UK market (yet again) simply flattered to deceive; I struggle to see much hope for it. While we can hope the likely change of government will be an enhancement, it really will just entrench welfare dependency and producer capture of state services, albeit in a rather more disciplined way.

The risk of Brexit always was that we would use our new freedom to rebuild old prisons. Can a new flag on an old workhouse change much? As for where our stunningly high inflation comes from, again, it must be our own creation, the Ukraine energy peak is now a dip, so it is not imported.

While no one wants to say it, tax rises, especially of such magnitude of corporation tax, in particular, are inflationary, but so is the cheap theft of frozen income tax thresholds. Trade unions employ good economists too, they negotiate for higher take home pay. Rate rises also cause extra inflation, especially with our persistent high national and consumer debt levels.

Sterling strength (it is now moving up against the Euro too) is a sign of markets seeing the UK as the best bet for avoiding rate cuts (and for getting more rate rises). That is not a good sign domestically.