By their works . . .

Well, the works this week: a pensive Jerome Powell does nothing, a reckless Andrew Bailey does nothing, Canada joins Biden in picking fights, and the bulk of most equity markets are stuck, going nowhere.

NO MORE US RISES

So, the apparently knowledgeable financial press said that Powell predicts rate rises? He said nothing of the sort of course. True the other members of the FOMC dot plots were in aggregate higher than the current rate, but by a fraction, it is like the average family being 2.4 children, meaning everyone, in the absence of King Solomon, has three children. No, it does not, it means on average there are no more rate rises.

So, Powell has stopped the runaway train, by lighting red flares in front of it and throwing railway sleepers across the track. Job done. Inflation is way below base rates. Bailey has asked nicely and tried to lasso the inflation express from half a mile down the track - won’t work. Inflation above base rates is misery, inflation below base rates is time to loosen.

Powell did start rambling, describing parts of the economy with “by their works ye shall know them” but decided that was all a bit erudite, before he had even finished the thought. He then reverted to the old saw, “forecasters are a humble lot, (with much to be humble about)”. Presumably that is unlike Central Bankers? I still think that judging them by their works makes sense.

But Powell is happy: the Q&A session threw him a litany of gloom, government shut down, students having to repay debt, auto plant shut downs, but no, all is fine.

The core US consumer and therefore the US economy, is in a good place was his verdict.

BAILEY DITHERS

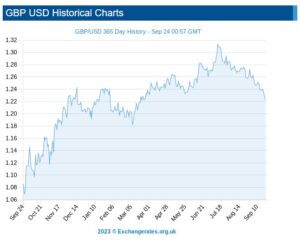

Bailey seems to like to crash the pound every October, which is not good for inflation, just as picking fights globally is not good for oil prices. And it is also bad for inflation.

And either the UK government will cave in to public sector strikes or productivity will keep falling due to said strikes. Neither are much good for the economy. Nor is it good for the markets: in performance terms, the UK remains the sick man of Europe, amongst major markets.

THE MAGNIFICENT SEVEN RIDE ON

I was at the annual Quality Growth conference in London again, a stock picker’s feast as usual. It seems that if enough stock pickers can agree on the menu, as the dominant prevailing theory of investments, they will drive the prices of their favoured stocks ever higher. Which they do, it seems. This is helped by the ‘over the long run valuations don’t matter’ line, pushed hard by Baillie Gifford (amongst others). You might recall my article on Scottish Mortgage a while back.

And of course, as we know from both index and momentum investing, once something starts to move in a flat market, it keeps moving.

But that leaves the vast bulk of quoted stocks flat or down on the year, which makes some sense. When rates rise, bonds are substituted for stocks. The last two quarters in particular have been flat to soft, and while some of these stocks may have hit a bottom, it is still very hard to tell.

The only good news for UK investors is that Andrew Bailey has ensured their overseas (especially US) stocks have a nice currency tailwind.

MADE IN JAPAN

Meanwhile from Comgest there’s a radically different view of Japan. The equity rally there has been fantastic, but it is not the typical exporter boom of a weak yen, in their view, but more about bank stocks soaring on the expectation of the end of Central Bank rate control. This allows their vast balance sheets to earn a real return, at last. This is quite a departure from the general explanations about “this is Japan’s time”. That one has caught me out far too often, but explains the horror show from respected funds like Baillie Gifford Shin Nippon - small and illiquid is just nasty everywhere.

So, although the global rally looks to be strong, it is terribly narrow, and built on different foundations in different places. Or more positively, a broad advance awaits the first rate cuts, either from triumph (US) having controlled inflation or disaster (Europe) having created a recession and left inflation out of control. Either route to rate cuts wins, it seems.

GLASSHOUSES AND THROWING STONES

Oddly, I feel the Canadian spat with India is really quite serious, the tendency of rich Northern countries to preach, in this case standing very carefully behind the only global superpower’s shoulder, really annoys the global South. It has been going on for centuries and is at heart simply the old colonial mindset.

India’s continuing reaction may well portray the accuracy (or otherwise) of the allegations, as on the face of it this is deeply insulting to the world’s largest country, and one that has tiptoed down the line between offending the West and creating starvation and destitution for millions in the South.

I don’t believe it - murdering virtuous plumbers in Canada over the Punjab, which has long ceased to be a primary source of domestic concern, is plain weird.

All things are possible, and India cares far more about Kashmiri terrorism (for instance), but if it is false, expect a sizable slap to Canadian interests, and more accommodation for Putin.

After all, if you are treated as if you are behaving like Putin, why would you ostracize him?

JENSEITS VON GUT UND BOSE

We ponder the point of the UK markets, ignore clashing BRICs, set up for the slow fall in interest rates in 2024, yes, long lags are long.

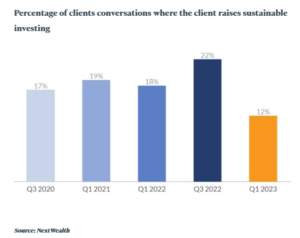

There are two investor markets, one akin to gambling and speculation, one allocating capital efficiently to invest capital or fund governments. But like weeds in a nutrient rich field, spare liquidity attracts the rankest growth of useless vegetation. There’s no clear way of knowing which is which. Money famously does not smell, and clients don’t really care much about how they earn a return, whatever they may say.

From: The FT Adviser Website

Fads and fashions in investing fuel some success at first - then they can no longer conquer new lands, and deflate, dragging down asset values as they go.

ARE INDIVIDUAL UK STOCKS WORTHWHILE?

I look back, as all investors should from time to time, at my successes and failures. Luckily out and out failures are pretty rare, and in some measure, so are successes, as I quickly milk the wins (usually from takeover bids), so they disappear from the record.

This leaves me a pretty solid mass of fairly dull UK equity holdings, I slightly favour value over growth. So, I know a simple snapshot won’t reveal the steady benefit of, at times, decades of good dividends.

But at the end of it all, for a UK investor, what remains is a mass of general mediocrity. Resource stocks have been good to me, still are, but the mass of industrials? Not really.

Or property companies?

Well big dividends from REITS, but again not really. Of financials? Again, long years of high dividends, but capital values stay scarred by the GFC. Chemicals, retailers, distributors, tech, utilities: well, all fascinating, with some good runs, often good yields. But in the end?

I could ignore such perennial plodders when their yields were far above base rate, but they are now surpassed, by a simple savings account.

So, I do wonder at times like this, why I hold them. Doubtless we will get rallies, but the tone feels a tad discouraging just now. And I sense the politicians of all hues, who seem to be eager to relieve me of anything that looks like a nominal gain, or enforce their often extreme views on my assets.

PERHAPS OTHERS DO IT BETTER

My long-term winners by and large stack up in investment companies, with specialist fund managers, and almost entirely overseas, or at the very least global. Not that is much of a surprise, we have mentioned before how the FTSE100 has not moved much in twenty, going on twenty-five years. Yet again it has flattered to deceive this year, yet again it has that slumping dinosaur feel to the graph.

The UK is not alone in that. Most of Western Europe shares that fate, and Eastern European investing has been a good way to create losses. Somehow Europe’s governments have done just enough to keep investing alive - and somehow the stock markets have had just enough liquidity to avoid collapse.

It is partly why so many investors love small companies, but they are savagely cyclical, as we are seeing just now.

I could blame management, and their apparently limitless greed, but while many quoted boards maybe have rogues or knaves, but nigh on all of them? No, I won’t accept that.

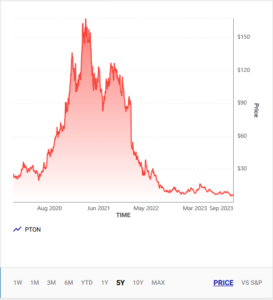

Globalization has freed capital to move easily and fast. Far faster than any real business can adjust, and in this world the ability to attract capital is vital. True many attract it, to waste it, like a meme stock, or Peloton, but it would be wrong to see that as a line of tricksters repeatedly finding ways to con the market (although many have) more about the power of liquidity to inflate prices, attract buyers, inflate prices once more, in an unending climb. That is until the last buyer has paid up, and the tipping point is reached.

Taken from this website

Then the whole thing unwinds downwards, down to a true value, or less.

WHERE NOW?

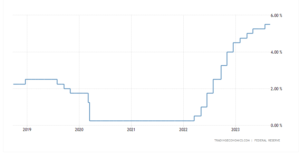

On the one hand, as interest rates fall, and they will do soon, even if that one last hike is much discussed and may well happen, the path looking forward is downwards.

FED rates in the last 5 years

This should benefit value stocks, as more and more dividends emerge once more above the high-water line of cash deposits. Rates won’t go all the way back to zero, that is gone, but should start on the way down.

On the other hand, the liquidity trade is here to stay, money attracts money until the thermal tops out and the vultures glide along to the next spiral, or indeed back to the last one.

And looking over decades, as fund managers must, that is all that happens in most markets globally, one or two have true secular growth that also gets returned to investors (a key caveat), most seem not to. Investors become either hobbyists in love with a stock or short-term traders. It is notable how many of the new breed of big company directors spurn the shares of their own companies, bar a token few thousand.

Markets seem to have progressively been made easier for momentum, versus ‘true’ investors, allocating capital to create real jobs. The capital allocation bit is worthy but dull, and arguably governments and regulators seem to have strangled it into stasis.

The endless, joyful, mindless dance of momentum, is simpler, prettier, easier to tax, cheaper to trade; quite wonderful really. But is it much else besides that, or is it substance without meaning?

It is odd how governments moan about the lack of growth and yet cripple capital allocation. In a market system, the best capital allocator wins. It is really quite simple.

Once the tightening stops, there should be more currency stability (of sorts) as all the Central Banks realign their rate patterns again. In (to us) an unresolved month, the dollar’s strength has been notable, when not a lot else was.

Pain delayed, pleasure denied

We look at the startling emergence of another US based tech bubble, the failure of value investing and offer some reflections on the UK market.

The Bones of World Financial Markets.

This has been a baffling half year in which, with few exceptions, we have ended up going sideways for most of it. The exceptions were in descending order, within equities, the NASDAQ (by a mile), Japan, Germany, the S&P and France. Although all, especially Japan, offset by a weakening local currency for UK investors. A quite unusual, largely unrelated, mix of old and new.

Overall, cyclicals in general, and energy in particular, as well as bonds, and China have been painful and financials at best so-so. It feels like a year to not hold what worked last year and vice versa. Nor is it as simple as growth versus value; neither have worked consistently, except in the case of a small (but rotating) group of tech stocks.

Our view thus far, has been that until global growth starts to move, we stay out of the way. This has been wrong, because the overvalued US mega stocks, were almost the only game in town. Yet jumping in now, of course, also feels very dangerous.

However, a few of our growth markers have, even if flat on the year, started to shift, not the highly speculative micro stuff, which is still falling away, but the solid middle ground. The hot India tech sector, far more connected to Silicon Valley than we realise, has suddenly jumped.

Macro Skeleton

What about the underlying macro story? Well, the pain of the invisible recession, and the pleasure of resulting rate cuts, have been delayed and denied respectively.

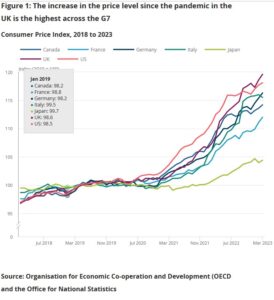

From the UK office of National Statistics – see this chart more clearly on this page.

From the UK office of National Statistics – see this chart more clearly on this page.

Well, there it is, poorly controlled inflation persists, a longer rate squeeze may still be needed. The vanishing China post-lockdown boom means that there was no sudden stimulus to offset that. Our published data (from Andrew Hunt) was saying Chinese ports were remarkably empty three months ago, from soft export demand, a good lead indicator.

All of that was hidden by strong services demand, and in closed economies (as the UK is oddly becoming) there is no relief valve, and hence it suffers embedded high inflation. But clearly consumption is dropping in the US, recent retailer numbers are all over the place, confirming those China export stats.

While on commodities, the failure of sanctions to impact energy is ever more clear, and I doubt OPEC’s ability to stem the energy glut. As a final blow to value stocks, “higher for longer”, on interest rates, which we have been predicting for two years, hurts indebted companies, who increasingly have to refinance at high rates. It also makes their dividend yields less attractive.

When rate cuts do come, growth having survived the storm, may well soar; as we have noted before, the prevailing fashion in investing heavily favours so called “tech moats” and dislikes debt. That markets keep seeking out new moats, real or imagined, is all part of that.

The speed at which digital currency and virtual reality have become old jokes, but generative AI will save us all, is remarkable.

Bond Dilemmas

In bonds we have seen no point in our lending to governments at rates that are below inflation; in most of the world as inflation falls, bonds still remain unattractive, as yields then start to drop too. So, the bond trade has been messy to say the least.

With greater certainty about a consumption recession, the fear of defaults also rises, and the longer rates are high, the more that refinance risk looms. Jumping a spike is possible, vaulting a table, without spilling your drinks, rather less so.

There is also still a ton of money parked up in fixed interest, just waiting for the equity ‘all clear’.

Lost London?

The UK market (yet again) simply flattered to deceive; I struggle to see much hope for it. While we can hope the likely change of government will be an enhancement, it really will just entrench welfare dependency and producer capture of state services, albeit in a rather more disciplined way.

The risk of Brexit always was that we would use our new freedom to rebuild old prisons. Can a new flag on an old workhouse change much? As for where our stunningly high inflation comes from, again, it must be our own creation, the Ukraine energy peak is now a dip, so it is not imported.

While no one wants to say it, tax rises, especially of such magnitude of corporation tax, in particular, are inflationary, but so is the cheap theft of frozen income tax thresholds. Trade unions employ good economists too, they negotiate for higher take home pay. Rate rises also cause extra inflation, especially with our persistent high national and consumer debt levels.

Sterling strength (it is now moving up against the Euro too) is a sign of markets seeing the UK as the best bet for avoiding rate cuts (and for getting more rate rises). That is not a good sign domestically.

Small Earthquake

Full year corporate accounts have now all been published, in several cases even read, so it is time to look at the raw data beneath all those clever funds and derivatives, at the underlying companies.

There are two themes emerging: one is the extraordinary scale of movements last year in defined benefit pension assets and liabilities, and the other is how we should evaluate the size of the Scottish discount.

Pension Asteroids Collide

Enormous numbers are shifting on defined benefit pension schemes, nearly all the big ones seeing asset losses of several billion, but with matched declines in liabilities of the same scale, leaving almost no apparent change, all stitched back together. This impacts in particular the big banks, utilities, resource majors and of course life companies.

It is a source of some nervousness, when large numbers crash about the balance sheet, dwarfing the trivial numbers in the profit and loss account. But they are also quite different items, the asset declines (from long dated gilts) are real money, stuff you could have woken up at the start of the year, picked up a phone and sold.

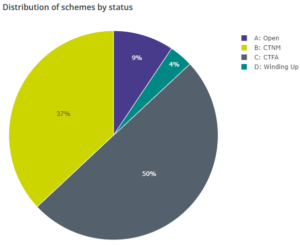

Yet the liabilities in terms of actual money to retirees hardly shifted, it was just discounted differently. While nearly all (91%) of the 5,000 odd UK schemes are either Closed To new members (CTNM) or to future accruals (CTFA). So, of little current relevance to operations.

From: This page on the UK Regulator’s website – the key to the abbreviations is also there.

What is relevant is the sudden loss of tens of billions of pounds ny these pension funds. But that is ignored, because of the liability offset, but it was lost and is gone. This came along with dramatic changes in the value of the gilts they hold, in cases by more than the unit value decline, as gilts were actually being sold quite hard too - a big chunk of assets that no longer exists.

Scottish Exceptionalism

So, to the Scottish discount. What is it? In our valuation models we discount earnings for political and operational risks, including for governance, including the location of the auditors. It is an internal assessment, so matters not a jot, unless others do the same.

We know the discount exists, the reversing tide of “swimmers” or companies raising money outside their domestic market, tells you the entire UK is already at a fair old discount to the US, even for companies with mainly US earnings. Should the same apply to Scotland? And by how much more? 20%? Whatever it is, it is getting bigger for us.

In my view if you are a FTSE100 Company, you have big four auditors, London office. Regional offices and smaller firms will be more dependent on a single big client and in enough cases to matter, that disproportionate power will swing it, for the Board, against the investors. Not that London based Big 4 is perfect (we know they are not).

So, to Scotland, there is a long-standing assumption they will use Scottish audit offices, and a drift to using Scottish firms too. This used to mean high quality, but I now sense they lack experience. Boards have also increasingly become reliant on a smaller pool of candidates, and two recent high-profile cases leave me wondering about their governance.

1. Scottish Mortgage Investment Trust

We sounded the alarm on the peculiarities of this popular fund two years or so ago, in their glory days. Like some other troubled funds, they took on more and more unquoted holdings. All disclosed and approved, but in the end clearly linking private and public markets, indeed boasting of how many of their quoted holdings started out as private ones. Well, a closed IPO market knocks that bet pretty hard. When a lot of them are also Chinese, that renders that pipeline even more suspect.

While disclosed, yes, but adequately disclosed? In one case they hold G, I, H, A, C, B Prefs and A Common Stock, with greatly varying valuations by class. We were nervous, when the share price failed to discount these holdings, at a time when other equity trusts, indeed private equity specialists, were facing growing discounts on their holdings.

That has now corrected, the Board has finally stood up to the manager and questioned the existence of the in-house skills to back up these valuations. But in the process our Scottish discount opened up.

From a three year high of over £14 per share, SMIT has fallen hard to just over £6, wiping out half the value or the thick end of £10bn, from presumably mainly UK retail holders. It has kept falling. I think it will need to list those unquoteds separately, and give holders a share in each asset pool, to regain its once illustrious crown.

2. John Wood Group

The John Wood Group, which operates in natural resource consulting and contracting, has been a disastrous investment. A well-respected consulting firm, its Board decided to merge with another well-respected quoted consulting firm, Amec: outcome? Hugely negative. Five years ago, its shares were over £5 and even quite recently shareholders were hoping a private equity bid would rescue them after only a 50% loss.

But having overseen that catastrophe, the Board seemed not to be listening. They only very reluctantly agreed to bid talks, and somewhere in those talks something persuaded the bidder to back off. From the bid inspired high of £2.55, it has now virtually halved again. The Board feels old style, out of date, insular. I particularly enjoyed (it is one of the few pleasures of reading so much verbiage) their illustration for the diversity report, (see below).

Extracted via screenshot from the Annual Report and Accounts of the John Wood Group

This reminded me of sitting on a School Curriculum Committee (see the fun I have). We had to cover multiculturism, and the teacher (in the high pale Cotswolds) chose India; intrigued I asked why? The answer was that allowed the topic to be covered for our forthcoming Ofsted inspection, by having a takeaway meal in class. That was it. No map, no history, no people, just an affiliated consumable.

But nice money for the executives, look at last year’s bonus structure. That odd picture served them well. For an original business that is now itself worth nothing and half of what it paid for Amec !

Now, but for that Board, or that history, Wood looks a nice business, cleaned up, $5 billion of apparently profitable sales, with a market cap of £1 billion, not a lot of debt, all three divisions profitable at least at the EBITDA line. Heavily exposed to renewables, including in North America, it even reports in dollars. You could argue the bid was low - no doubt the Board did - but if the price then halves, after the bid vanishes, how credible are they?

So, in comes the Scottish discount – because this pattern of behaviour speaks of a particular culture and leaves me feeling the need for a bigger safety margin, to buy a business from that region.

Tech Wreck or Much Ado

Talking Tech today - We think that market cycles are longer and far less repetitive than we like to assume.

Asset price ramps - the tech story

But each speculative ramp up and blow off in assets shares much the same features. Our view is the faster they go up, the less likely they are to recover having come back down. And a lot are pretty well back where they started, in price terms at least.

Yet the avarice of founders and sponsors in exploiting, seemingly without consequences, these destabilizing bubbles seems oddly popular, helped by the vast tax hauls they often create, themselves inflaming the process. The media of course delight in hyping them, somehow immune from the sin of market manipulation, which profits them mightily.

I suspect most investors have a ‘marker stock’, to indicate where we are in the cycle, to me it has been the Amati AIM VCT. It has a fair range of stocks, competent fund managers, a reasonable yield. It topped out first in about April last year, had another go at the top in late August or so, and has been downhill all the way since. About £200m of assets, a discount control in place, generally real companies, not concept stocks.

So not an obvious spoof.

This was unlike the SPACS, which we first highlighted in late 2020, and where they have been far more destructive, in most cases, even when containing a real business (and many did not).

Sometimes governments get pulled in too. All those profits make for flush lobbyists, generous donations. The London Stock Exchange, a quasi-regulator, bends easily to any wind that blows an irregular but ripe bounty to its coffers.

So, of all the myriad useful potential reforms and regulations, making SPACS easier was depressingly to the fore in ministerial recommendations. Likewise funny voting rights, which stop the founders getting hoofed out when it all goes south.

And what about crypto currencies?

We can debate whether crypto was the same, a lot of the crypto universe clearly was, and itself it was inflated by that same goldrush mentality. Indeed, plenty of market professionals tired of the chore of marketing real companies with real data are entranced by the lure of money for nothing.

Bitcoin is almost the perfect vehicle in this hyper speculative world, and yet we are ambivalent on it. It is very clean (once the dirty mining is done) and it produces carbon rather than arsenic (unlike gold) as a by-product. It can’t be tainted or doctored or indeed intercepted, so it is quite a pure asset. Of course, you can mislay it, and once lost it is rather elusive, it slips back into the great money sea and is lost quickly in the waves.

Some say it is too hard to turn into real money, dollars in the main, but nearly every investment is tough to realise, certainly most ‘alternatives’ are and far too often the fees investors are charged are based on inflated values.

Tech valuations

So, back in the tech wreck. We don’t believe the high valuations were ever anything but the flush through of extreme greed, created by an industry still able to sell duff product, to its heart’s content, for colossal fees, along with skilled media manipulation. Or as a recent Henderson’s fund manager report said “investment bankers, greedy management teams and ruthless private equity vendors” are to blame.

Judging the product in tech is always really hard. But judging what a reasonable value for the optionality of many of these shares is, should usually be far easier. A good rule of thumb is see how in “normal times” they are valued, both because that is when you will almost inevitably need to sell, but also it reflects the funder’s ability to keep propping up losses. That is typically not measured in decades, but at most a few years.

COVID did not help, it closed the new issue pipeline, devasted large areas of the existing market and of course washed torrents of hot cash over everything. Less to buy, more to buy it with, a bit of a feeding frenzy and away we went. But that’s now over.

Nor do I really think this vast pump and dump enterprise was undone, as the market wisdom is, just by the threat of rising rates. The idea you can precisely discount some pie in the sky projection also feels slightly odd. The precision of diamond to cut the substance of weak custard, seldom produces a sharp, solid, edge.

How might we regard “concept” tech stocks now?

Seen as driven by supply and demand, bulked up by liquidity and the “greater fool” argument should you unload the stock, means you should beware of the belief that many of these stocks are anywhere near a bottom, until either they produce real cash flow, or a period of years allows them to de-risk their valuations.

Seen in that light, and given the overhang of listing, taxation and scrutiny they now face, it should be more about how much should you discount their cash pile by, not what premium to NAV do they merit. Oh, and I’m talking about real Net Asset Value, not capitalized losses, (however you bottle it), a loss is not an asset, whatever the craven auditor says.

Nor is looking for a trade buyer sensible, buyers have to buy the whole thing, not a little slice where the value can easily be frothed up.

My preference is good active specialist tech managers. There are a few, at a nice discount, but pick your entry point with care, at this stage of the game.

A lot of the late 2020 and 2021 excitement turns out to be Much Ado About Nothing, a startling production (above) of which closed recently at the RSC.