We ponder the point of the UK markets, ignore clashing BRICs, set up for the slow fall in interest rates in 2024, yes, long lags are long.

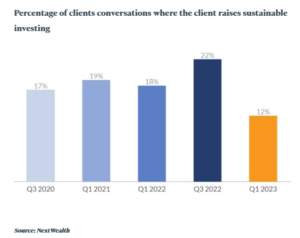

There are two investor markets, one akin to gambling and speculation, one allocating capital efficiently to invest capital or fund governments. But like weeds in a nutrient rich field, spare liquidity attracts the rankest growth of useless vegetation. There’s no clear way of knowing which is which. Money famously does not smell, and clients don’t really care much about how they earn a return, whatever they may say.

From: The FT Adviser Website

Fads and fashions in investing fuel some success at first – then they can no longer conquer new lands, and deflate, dragging down asset values as they go.

ARE INDIVIDUAL UK STOCKS WORTHWHILE?

I look back, as all investors should from time to time, at my successes and failures. Luckily out and out failures are pretty rare, and in some measure, so are successes, as I quickly milk the wins (usually from takeover bids), so they disappear from the record.

This leaves me a pretty solid mass of fairly dull UK equity holdings, I slightly favour value over growth. So, I know a simple snapshot won’t reveal the steady benefit of, at times, decades of good dividends.

But at the end of it all, for a UK investor, what remains is a mass of general mediocrity. Resource stocks have been good to me, still are, but the mass of industrials? Not really.

Or property companies?

Well big dividends from REITS, but again not really. Of financials? Again, long years of high dividends, but capital values stay scarred by the GFC. Chemicals, retailers, distributors, tech, utilities: well, all fascinating, with some good runs, often good yields. But in the end?

I could ignore such perennial plodders when their yields were far above base rate, but they are now surpassed, by a simple savings account.

So, I do wonder at times like this, why I hold them. Doubtless we will get rallies, but the tone feels a tad discouraging just now. And I sense the politicians of all hues, who seem to be eager to relieve me of anything that looks like a nominal gain, or enforce their often extreme views on my assets.

PERHAPS OTHERS DO IT BETTER

My long-term winners by and large stack up in investment companies, with specialist fund managers, and almost entirely overseas, or at the very least global. Not that is much of a surprise, we have mentioned before how the FTSE100 has not moved much in twenty, going on twenty-five years. Yet again it has flattered to deceive this year, yet again it has that slumping dinosaur feel to the graph.

The UK is not alone in that. Most of Western Europe shares that fate, and Eastern European investing has been a good way to create losses. Somehow Europe’s governments have done just enough to keep investing alive – and somehow the stock markets have had just enough liquidity to avoid collapse.

It is partly why so many investors love small companies, but they are savagely cyclical, as we are seeing just now.

I could blame management, and their apparently limitless greed, but while many quoted boards maybe have rogues or knaves, but nigh on all of them? No, I won’t accept that.

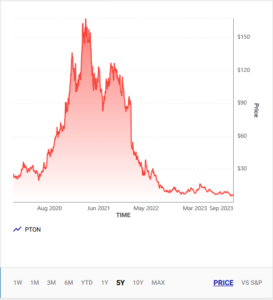

Globalization has freed capital to move easily and fast. Far faster than any real business can adjust, and in this world the ability to attract capital is vital. True many attract it, to waste it, like a meme stock, or Peloton, but it would be wrong to see that as a line of tricksters repeatedly finding ways to con the market (although many have) more about the power of liquidity to inflate prices, attract buyers, inflate prices once more, in an unending climb. That is until the last buyer has paid up, and the tipping point is reached.

Taken from this website

Then the whole thing unwinds downwards, down to a true value, or less.

WHERE NOW?

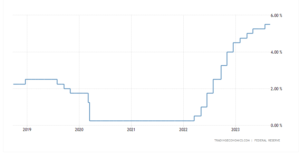

On the one hand, as interest rates fall, and they will do soon, even if that one last hike is much discussed and may well happen, the path looking forward is downwards.

FED rates in the last 5 years

This should benefit value stocks, as more and more dividends emerge once more above the high-water line of cash deposits. Rates won’t go all the way back to zero, that is gone, but should start on the way down.

On the other hand, the liquidity trade is here to stay, money attracts money until the thermal tops out and the vultures glide along to the next spiral, or indeed back to the last one.

And looking over decades, as fund managers must, that is all that happens in most markets globally, one or two have true secular growth that also gets returned to investors (a key caveat), most seem not to. Investors become either hobbyists in love with a stock or short-term traders. It is notable how many of the new breed of big company directors spurn the shares of their own companies, bar a token few thousand.

Markets seem to have progressively been made easier for momentum, versus ‘true’ investors, allocating capital to create real jobs. The capital allocation bit is worthy but dull, and arguably governments and regulators seem to have strangled it into stasis.

The endless, joyful, mindless dance of momentum, is simpler, prettier, easier to tax, cheaper to trade; quite wonderful really. But is it much else besides that, or is it substance without meaning?

It is odd how governments moan about the lack of growth and yet cripple capital allocation. In a market system, the best capital allocator wins. It is really quite simple.

Once the tightening stops, there should be more currency stability (of sorts) as all the Central Banks realign their rate patterns again. In (to us) an unresolved month, the dollar’s strength has been notable, when not a lot else was.