JENSEITS VON GUT UND BOSE

We ponder the point of the UK markets, ignore clashing BRICs, set up for the slow fall in interest rates in 2024, yes, long lags are long.

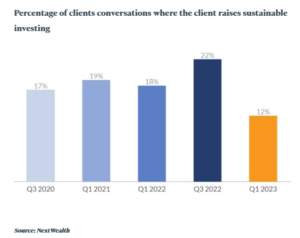

There are two investor markets, one akin to gambling and speculation, one allocating capital efficiently to invest capital or fund governments. But like weeds in a nutrient rich field, spare liquidity attracts the rankest growth of useless vegetation. There’s no clear way of knowing which is which. Money famously does not smell, and clients don’t really care much about how they earn a return, whatever they may say.

From: The FT Adviser Website

Fads and fashions in investing fuel some success at first - then they can no longer conquer new lands, and deflate, dragging down asset values as they go.

ARE INDIVIDUAL UK STOCKS WORTHWHILE?

I look back, as all investors should from time to time, at my successes and failures. Luckily out and out failures are pretty rare, and in some measure, so are successes, as I quickly milk the wins (usually from takeover bids), so they disappear from the record.

This leaves me a pretty solid mass of fairly dull UK equity holdings, I slightly favour value over growth. So, I know a simple snapshot won’t reveal the steady benefit of, at times, decades of good dividends.

But at the end of it all, for a UK investor, what remains is a mass of general mediocrity. Resource stocks have been good to me, still are, but the mass of industrials? Not really.

Or property companies?

Well big dividends from REITS, but again not really. Of financials? Again, long years of high dividends, but capital values stay scarred by the GFC. Chemicals, retailers, distributors, tech, utilities: well, all fascinating, with some good runs, often good yields. But in the end?

I could ignore such perennial plodders when their yields were far above base rate, but they are now surpassed, by a simple savings account.

So, I do wonder at times like this, why I hold them. Doubtless we will get rallies, but the tone feels a tad discouraging just now. And I sense the politicians of all hues, who seem to be eager to relieve me of anything that looks like a nominal gain, or enforce their often extreme views on my assets.

PERHAPS OTHERS DO IT BETTER

My long-term winners by and large stack up in investment companies, with specialist fund managers, and almost entirely overseas, or at the very least global. Not that is much of a surprise, we have mentioned before how the FTSE100 has not moved much in twenty, going on twenty-five years. Yet again it has flattered to deceive this year, yet again it has that slumping dinosaur feel to the graph.

The UK is not alone in that. Most of Western Europe shares that fate, and Eastern European investing has been a good way to create losses. Somehow Europe’s governments have done just enough to keep investing alive - and somehow the stock markets have had just enough liquidity to avoid collapse.

It is partly why so many investors love small companies, but they are savagely cyclical, as we are seeing just now.

I could blame management, and their apparently limitless greed, but while many quoted boards maybe have rogues or knaves, but nigh on all of them? No, I won’t accept that.

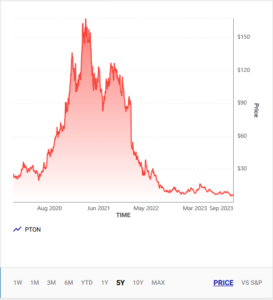

Globalization has freed capital to move easily and fast. Far faster than any real business can adjust, and in this world the ability to attract capital is vital. True many attract it, to waste it, like a meme stock, or Peloton, but it would be wrong to see that as a line of tricksters repeatedly finding ways to con the market (although many have) more about the power of liquidity to inflate prices, attract buyers, inflate prices once more, in an unending climb. That is until the last buyer has paid up, and the tipping point is reached.

Taken from this website

Then the whole thing unwinds downwards, down to a true value, or less.

WHERE NOW?

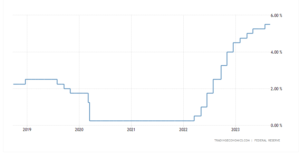

On the one hand, as interest rates fall, and they will do soon, even if that one last hike is much discussed and may well happen, the path looking forward is downwards.

FED rates in the last 5 years

This should benefit value stocks, as more and more dividends emerge once more above the high-water line of cash deposits. Rates won’t go all the way back to zero, that is gone, but should start on the way down.

On the other hand, the liquidity trade is here to stay, money attracts money until the thermal tops out and the vultures glide along to the next spiral, or indeed back to the last one.

And looking over decades, as fund managers must, that is all that happens in most markets globally, one or two have true secular growth that also gets returned to investors (a key caveat), most seem not to. Investors become either hobbyists in love with a stock or short-term traders. It is notable how many of the new breed of big company directors spurn the shares of their own companies, bar a token few thousand.

Markets seem to have progressively been made easier for momentum, versus ‘true’ investors, allocating capital to create real jobs. The capital allocation bit is worthy but dull, and arguably governments and regulators seem to have strangled it into stasis.

The endless, joyful, mindless dance of momentum, is simpler, prettier, easier to tax, cheaper to trade; quite wonderful really. But is it much else besides that, or is it substance without meaning?

It is odd how governments moan about the lack of growth and yet cripple capital allocation. In a market system, the best capital allocator wins. It is really quite simple.

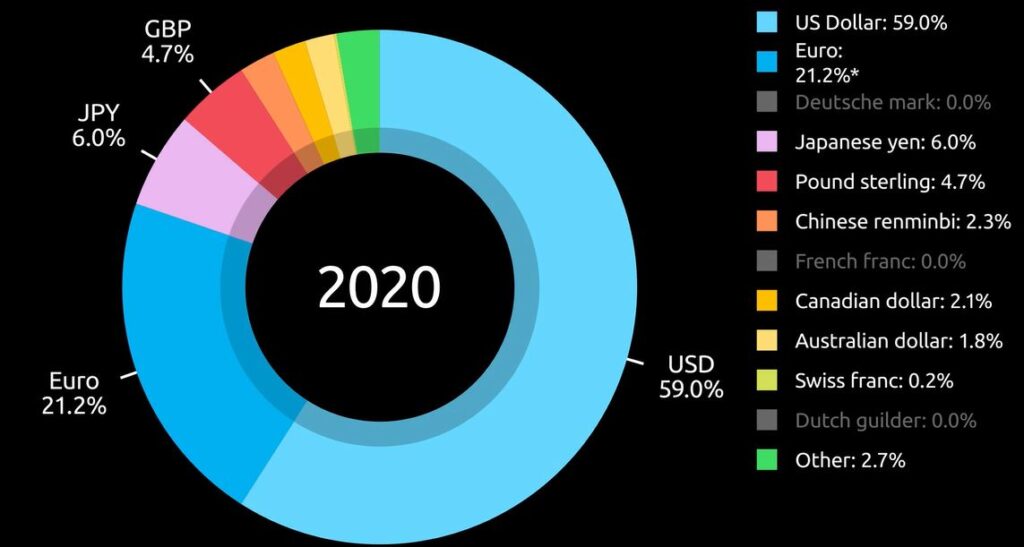

Once the tightening stops, there should be more currency stability (of sorts) as all the Central Banks realign their rate patterns again. In (to us) an unresolved month, the dollar’s strength has been notable, when not a lot else was.

WHAT DO THEY KNOW OF ENGLAND?

Let us look at tech, private equity and this seeming market bounce, driven by those sectors. The NASDAQ is up almost 10% at 11,320 after a trio of twelve-month lows in the mid 10,300’s, the latest of those lows just this week. Meanwhile it looks like the US Elections have delivered both gridlock and a rebuff for Trump, which some see as a perfect mix.

Today’s post title is derived from Rudyard Kipling at his most sanguine and reflective.

I HAVE FLUNG YOUR STOUTEST STEAMERS TO ROOST

The true horror of the tech wreck has also been concealed for UK investors, by the climb in the dollar, a move that seems to be going into reverse. In terms of closing prices sterling has rallied hard from 1.08 to 1.18 in a little over a month. This has left the NASDAQ collapse, from touching 16,000 - brutally exposed, now without much of the concealing currency appreciation.

Where is the Nasdaq headed?

We suspect that the NASDAQ is heading lower still, but accept that is a big call.

From this page on Tradingeconomics

It remains a crowded space for a lot of unprofitable companies to jostle, as they build market share. This disguises the possibility that in some spaces, even owning the entire market will still be loss making.

However, market sentiment has perhaps turned, the tech rubbish generally got chucked out early. The subsequent switching out of the tech majors probably had to be into Treasuries, where their recent price rises suggest some demand, or into cash.

It remains a crowded space for a lot of unprofitable companies to jostle, as they build market share. This disguises the possibility that in some spaces, even owning the entire market will still be loss making. Bumping up against that is the second phase of the market collapse, as the multiples on profitable tech giants returned to earth.

And cash (and oddly apparently the S&P) has also been seeing inflows from China and crypto, as those areas have sold down hard. There is also the unpleasant negative impact of holding cash, on returns. Put this together with sentiment, and this may well help the NASDAQ bounce into the year end. However, many fund managers cite the dotcom bust as meaning this is now starting a multi-year sideways recovery phase, not a quick bounce at all.

LONG BACKED BREAKERS CROON

A concurrent look at Private Equity is important. NASDAQ multiples drive much of their values and are falling, and with such a recent twelve-month low, Q3 valuations (private equity valuations are always lagged) have further losses built in. And a sprinkling of those will now also be based on a significantly higher dollar too. That won’t be pretty either.

Plus, as we know there are some spectacular blow ups lurking in there, the insolvent FTX was a big investor in, and investee company for, some well-known PE names. Overall, despite solid reports, I am still expecting some fair-sized holes in quoted private equity, as either the NASDAQ rises and the dollar falls, causing currency losses, or the NASDAQ falls and the dollar rises and the one again masks the other.

Access to distress financing, has it seems largely vanished, as it does at times like this, making the chance of highly damaging wipe outs, not just down rounds, much greater.

A possible dollar sterling parity?

But those talking of dollar sterling parity are surely way off now. So, regardless of future disasters, I want more information before seeing UK Quoted Private Equity Investment Trusts as a buy. About six months after the NASDAQ bottom, will be a good valuation point, and that likely means Q3 2023. At that point we will know what the current large discounts really refer to; I don’t expect them to look anything like as generous.

THE UK - UNDER A SHRIEKING SKY

There is a lot of market optimism about the next UK budget, based on Hunt being really nasty. That may overstate his hand, as the Government has long abandoned reform, it can only support out of control spending by harsh tax rises, which will certainly kill jobs, but probably the wrong ones.

Nor can it do much to enhance investment and has foresworn labour market reforms, so both of those, with existing policies and more rate rises, must encourage the persistence of poor productivity.

Although of course the real budget numbers will be barely mentioned; energy, rate rises, and inflation are largely out of Hunt’s hands. He is lucky all three do look a lot better than when he was installed. So, the need for harsh medicine is rather reduced, and may even disappoint.

But just as the rally helped US risk assets, so it helped others, like property, come off a deeply oversold floor. TR Property Investment Trust has jumped 30% in a month, for example, and still yields over 4%.

Post Mid-term elections for the US

And coming full circle, although slowing inflation took a lot of the credit, at least some of the post Mid Term bounce came from realising that the Federal Reserve now has an ally in the legislature. It can be less vigorous in steering the economy, just relying on the brake pedal, as Biden and Congress are no longer able to simultaneously hammer the accelerator.

Overall, however we still remain cautious, we expect this pre-Christmas rally to fade, rate rises to persist into at least Q2 2023 and rate cuts to be a 2024 feature. And peak gloom lies ahead as those rate rises conclude and then start to actually bite.

Looking ahead

In general markets have had a solid look at the worst case this year, from famine to invasion and nuclear war, to out-of-control Central Banks and deluded politicians, and nothing terribly dramatic has transpired. So even with bad things still happening, we don’t see a repeat of this year’s dramatic falls either.

Charles Gillams

- The Kipling Society meets on November 16th, at the Royal Overseas League.

FEEDING FIDO

International interest rates - what a dog’s dinner! But perhaps also a wake-up call: this is real life - governing for your social media feed does not work. We take a glance, too at the property market.

MARKET EVENT OR MACRO?

Our view has long been that we need rates at 5% to make a dent in labour inflation, both in the UK and US. It looks like the Fed (to our surprise) finally agreed. But with that comes a risk of overshoot, driven by the timing of the US mid-term elections. Powell, perhaps rather more attuned to politics than his banker colleagues, was keen to drop the bombshell early, rather than on 2nd November, right on top of the mid-term elections. So, I think the Fed’s now done with giant rises. Future rises may be less and spaced out, and quite possibly not that many.

One of the most chilling sections in Powell’s press conference was when asked about the global implications: yes, he assured us, he quite often takes tea with international colleagues. That was it. This time round the US is happy to crash through the global economy without a care in the world.

Encouraging short sellers

It seems Bailey of the Bank failed to get the memo, because oblivious to the soaring dollar, he stuck to plodding domestic rate rises, as if Leviathan was not bursting forth from the deep. Lifting rates by 0.5% when the dollar lifted 0.75% the day before felt like a joke. And if Bailey could not see that, the markets could: UK two-year gilts abruptly repriced to US rates.

But sterling is still hobbled by UK rates at 2.25% - too low. By trying to be clever on the rate rise, Bailey has simply let the short sellers in. As the chart below shows, having already hit the renminbi and the yen, it was obvious who was next. Sterling is a small but liquid currency block, with no allies – so it typically pays more to borrow. The markets just needed the signal.

From : this site’s fine moving graphs

I doubt all that volatility really makes much difference to the real economy. Indeed, the Bank has now braced sterling nicely. As for the pension schemes, the FCA (Bailey’s last top job) created the foible of pensions being forced to hold loads of so called “risk free” assets to prop up UK government borrowing. A most amusing idea, always going to blow up one day.

Not that sure even 4.5% rates will slow wage inflation up. But we will know soon enough, after all the destination was to us never in doubt, just the arrival time. I still see the strain of rates rising to (say) 8% as too much for the electorate in either the US (the leader) or the UK (who follow).

Recession fears?

Nor do I consider either the US or UK end rates to be high enough to cause a severe recession, although clearly, they will have an impact on asset prices, and in the end, labour markets.

So, I conclude this is more a market event than an economic one. And surprisingly it is all in bonds (and therefore currencies).

Investors will hang back until they see those settle down and that could take the rest of the year. So, although everything is perhaps cheap, the VIX will keep many on the side-lines.

The UK at least feels at bargain levels, but buying dollar stocks still feels somewhat pricey.

BRICKS AND MORTAR

So, to property. Well, we got this one wrong. Partly we failed to see Ukraine becoming a big war, but one with no quick winner. This triggered European (in particular) energy inflation. Partly we therefore saw interest rate rises staying in single figures, which is not what some REIT prices imply.

Not that we have changed our longer term “4&4” view on interest rates and inflation, (so higher for longer) but other investors and markets clearly have. You can’t fight the tape.

In general, outside the warehouse sector, real estate companies (unlike say Private Equity) had already taken the hit to values, their balance sheets showed the new world, backed by real deals. So, adding a second discount does seem odd.

Gearing levels are not high, and debt maturities well extended, and interest (still) well covered. Maybe private markets are worse, but it is not clear why that contagion spreads into quoted ones. If there is a blow up, it is not obviously in public markets or mainstream lending.

But if quoted markets are right, what of residential markets?

Well logically as they are still going up, do residential prices now have a big drop built in, which is yet to happen? The price of mortgage banks, home builders and builders’ merchants all say ‘yes’. But how will it happen? It is not a big sector in UK public markets, but the odd couple that do exist (Mountview, Grainger) have also taken a hammering. They have some debt and are rental specialists (of various types).

So, markets say yes, house prices will also collapse.

Do I believe that? Anymore than talk of imminent dollar sterling parity and 8% base rates? Frankly no. Stagnate, chop around, go sideways, blow the froth off. Sure. Collapse; is wishful thinking.

After Armageddon I fully expect to see a plucky estate agent emerge from the ruins, justifying an offer above the asking price for the debris, with potential (but may need planning consents).

So, if true, that means despite a hair-raising ride, those mortgage banks and residential owners will in time emerge resilient.

Sadly, for many, that also suggests, without forced sellers from the buy to let market (where there will be a few), the stock of housing units won’t change and therefore nor will rents. Housing stock is very lagged and current moves will only close the pipeline two years out. Only mass unemployment hits rents, and if this is a market event, not an economic one, it won’t change, because structural unemployment is not the issue. Indeed, we are at record low unemployment levels.

In summary

A market tremor created in Washington, was transmitted to the UK, and is now rippling round the world; either currencies hold their interest rate differential with the dollar, or get crushed.

Old news; it is odd isn’t it, how so many clever people failed to read the memo?

INDIA : ‘OUTER CHINA ‘CROST THE BAY’?

Is India really rising?

For much of last year India was the top major stock market, and remains the best on a twelve-month basis, the main index up +9%: not bad, we look at why. While less exotically the lags in global markets, when the macro picture is changing rapidly, are getting tough to navigate. Too many fund managers and Wall Street analysts simply don’t change, when the facts do.

Indian Stock Market rises to 4th largest, globally

First to India, in Premier Modi’s time in office it has gone from the tenth largest global economy to knocking on fifth, which is now predicted for 2027.

If true it will have overtaken a lot of Europe on the way. It is also already the fourth largest global stock market.

Welfare - and Highways in India

It has done it in part by two great leaps, firstly to take the millions of poor onto a national database for the direct distribution of welfare, creating the fastest monetisation of a society in history: the type of simple, big scale computerisation that works. It allows vast, complex, nimble schemes, both for welfare and tax, to be executed without a morass of red tape and civil servants milking them. The cash, meanwhile, gets right to the app of the men (or importantly as often) women who need it. Secondly it has taken a once Federal system, at least in commerce terms and unified it, creating a true single market. Neither seem that big, but both were critical steps. Remember how fond we were of the European Single Market? This one is twice the size.

While on the ground, the highway network has expanded by 50% since 2014 and in the air the number of domestic air travellers has doubled, air freight is almost as fast growing. A great deal of this is built on the IT sector, which has doubled in the last decade, and was already pretty big.

India seems to have achieved all of that while cutting oil consumption (per unit of GDP), and while racing ahead with the renewables it is so well suited for. It is also as we now know, one of the world’s big grain, especially wheat, exporters.

Some patches of India excel, others not so much

Stock market performance has been good over that time too. I went to kick the irrigation pipes in Modi’s Gujarat, before he got the top job. I liked what I saw; they were colossal and the vision to take them far inland, well away from current irrigation, spoke of a great ambition. The co-ordination and mechanisation spoke of good (and rather un-Indian) execution. It was a shock, when in Bengal at that time, I felt it was mired in politics, with too many huddled and piteous masses, inhabiting another century. But the West and South of the country were different; Bangalore was already aping Silicon Valley, albeit with traffic congestion to match.

That has kept going, tough reforms, enacted on a big scale were needed, and have been provided. But for markets, especially for the ex-colonial power, it has not been easy. Modi is a populist, he tore up the Mauritius tax treaty, introducing CGT to offshore investors, re-wrote the tax law to force Vodafone India into a billion-dollar insolvency, and had to have national assets embarrassingly repossessed, before paying Cairn back an unlawful billion-dollar tax heist.

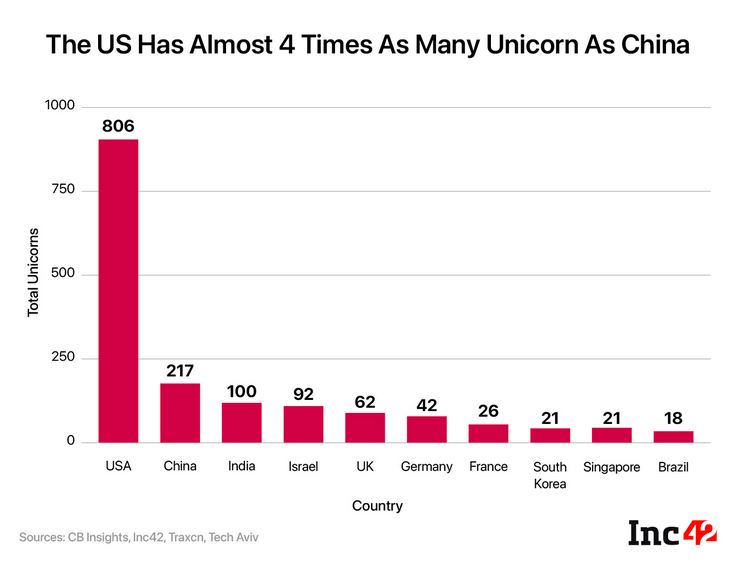

The other big risk was that the park was overrun by unicorns, and it was (and is) hard to know which will flourish, exploiting this vast unified fast-growing market (the OECD say the fastest growing large economy this year) and which will get foot rot in the monsoon floods.

While some of that was also funk money from Silicon Valley, which may now return to base, as the NASDAQ valuations fold, and indeed from China, which still remains in a different universe.

The history of jumping on (or falling under) Indian juggernauts, is not that great either. Racy IPO valuations falling to earth, have been painfully apparent.

But perhaps India will indeed come up like thunder, outer China, ‘crost the bay*.

Now to Stock Markets - in a word, Horrible.

We are having the normal churn, as a lot of vested interests and ‘long term holds’ get destroyed and no one seems to know where the lags are, in either debt or equity markets; a toxic mix. Certainly not company management, and therefore not the big lines of “analysts” often printing corporate client forecasts on fancy notepaper. Odd how so many research teams think the FD they diligently talk to has a clue. They do eventually (one hopes) but day to day, week by week, not really.

The finance team in companies

The finance team sits at the end of long and confused reporting lines, stuffed with dud AI (especially on inventory), and with no handle on returns, credits or sudden weather spikes. Knowledge? No, not much. While on top of erratic demand, their supply chains are like using a rubber band to pick a lock - all over the place and unpredictable, and remarkably elastic. Trouble is what you ordered, the currency, the freight costs and arrival dates are all plus or minus quite a lot. Fine if you can sell all you land, at any price, not so good when others have too much stock too.

Try picking a reliable single digit margin, out of that morass.

So, when rates and demand shift fast, forecasts simply melt away. Valuations don’t really change of course, but market prices do, and that’s when you need to clearly know fundamental values. The rest is froth, just crypto analysis, not the real thing.

So, markets that rely on earnings forecasts quarter by quarter, could go just about anywhere, because no one knows.

For me, now is the time to buy cheap quality, with a yield, but otherwise just watch the spectacle from the sidelines.

Hard Landings?

Local elections tell us remarkably little about national ones. We reflect on those. Meanwhile US equity markets are in turmoil, and some big numbers are changing very fast - some further musings.

Do English local elections count ?

We start with the UK, or rather English local elections, the devolved governments (oddly) have a rather greater read through from local to national. But overall, nothing in the results changed our view that Boris will probably survive, unless the Tory party unites around an alternative, which is pretty near impossible: it has too many splits.

Nor has our long-standing opinion that all Keir needs to do is keep his head down and he will be the next Prime Minister changed. Although if Labour starts to believe it is a shoo in, and can pick who it likes as leader, it will also self-destruct. Which is just about the only chance the Liberal Democrats have of being relevant.

Just how politically marginal local elections are, is shown by the surge of support for the Greens, apparently the very voters the weird Tory infatuation with hard left environmental policies were meant to entice.

Indeed, a whole set of Tory policies designed to raise energy prices, have gone down like a lead balloon.

What voters want and politicians need to deliver

You do wonder if they will ever get round to realising voters really want just three things, a roof over their heads, bread on the table and a job. Deliver those and do so competently, and politics is easy.

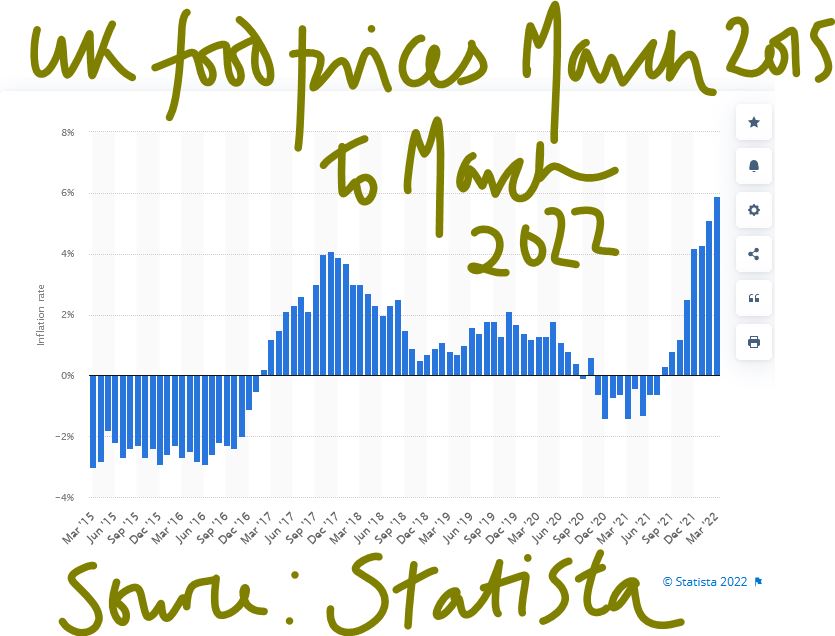

The roof bit is a shambles; it turns out policies designed to enrich cabinet members and senior civil servants with buy to let portfolios, are not so good for anyone else. I suspect the job bit will soon turn turtle, and the bread bit is going off the rails too. See graph below:

Here is a link to the relevant page on Statista

We notice that the big Western democracies still seem hell bent on raising energy prices, which is universally unpopular.

UK local elections - a brief look at opposition policies

So, the other thing markets in the UK (and sterling) will be doing is wonder about Starmer policies, more critically does he have the “bottom” to either appoint radical reformers, or have them lined up in key seats? Let’s say he does. He will still continue the headlong wealth destruction of punitive taxation and the assault on business investment. He will over-regulate (that’s his background). The sole variable therefore feels like any plausible capacity to reform.

He is not afraid of hard choices, or of thinking long, both good points and incidentally he is not Blairite enough to be America’s poodle and get involved in picking pointless foreign wars. Although he will likely dismember the United Kingdom, either of political necessity or by accident. We really can’t see much support for sterling in that package.

Central Banks - are they signalling a hard landing?

Inflation is spiking into double figures, and Central Banks are explaining

1) it is really not their fault

2) they are only responsible for “core inflation” (so without the important stuff)

3) but anyway they must still raise rates to offset the malign effects of other state policies.

It is looking truly absurd.

Not that interest rates are off the floor yet, although the US bond market seems convinced rates over 3% are now nailed on, while oddly the UK Gilt-edged market seems unconvinced of exactly the same thing. This of course is helping an on-going collapse in Sterling.

Meanwhile the possibility of ending negative rates in Europe has caused great excitement and the Euro to strengthen, at least against sterling. The divergence is related to a belief that the Fed which raised three months after the Bank of England is now more hawkish, a belief which seems more about wishful thinking than anything the Fed has actually done so far.

We are less sure on how high interest rates go. All three Central Banks seem to be hoping something will turn up, and inflation will ease. This is a view we share, but we really doubt the trivial rate rises so far, are the “something”.

Market turmoil - how far will they fall?

This leads on to the current market turmoil: With the US feeling very exposed, partly because it went up so high (relative to other markets), it has further to fall. Nor do we see the valuations on quoted US growth stocks as offering good value at these levels. They had become so detached from reality the gap is just too big, and the repeated attempts to buy the dips, just disguises a long-term trend down. The FTSE100 over five years is down, and the NASDAQ climbed over 100% in the same time. A 25% further US fall is at the least plausible.

Other markets will then get sucked down, and in Europe and Japan they are hard hit by their reliance on imported energy (the US is an energy exporter). While for now, their rates are not moving either, the resulting devaluation makes the value gap to US growth stocks, feel even greater. Buying overvalued stock in an overvalued currency, is not always great.

What do our models say about the markets?

Our MonograM momentum models suggest a turning point for both Europe (including within that bundle the UK) and Japan is close. It is only a model, we remind ourselves, and is quite able to give a false signal. It also sees this as true in dollar terms, not sterling. So, there is plenty of noise and last week had all the elements we dislike, a month end, plus a shortened market week, plus Central Bank meetings, created a baffling miasma of signals.

However, on current policies we anticipate a crash; the only issue now is how hard the landing is.