Away from all the shenanigans with base rates and currencies, earnings seem to be showing a pattern. We look at the possibility of an unshackled NatWest and India’s renaissance after the Hindenburg disaster.

START OF EARNINGS SEASON

In so far as reported earnings have a pattern, it reflects the actual position, not the fears of a hidebound analyst community imprisoned by useless economic models. Statistics are not predictive.

There is no recession, whatever all those clever models predicted, never could be one with the extreme fiscal stimulus (quite unlike the private sector fuelled inflationary blow outs of previous downturns), high employment and plenty of liquidity. So, real life earnings are in a purple patch, high and in cases rising demand, with falling or stable costs.

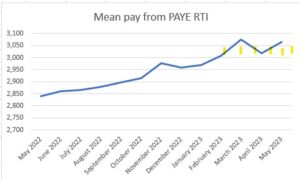

Meanwhile wage costs are perhaps stabilising and the labour supply position seems less frenetic.

In-house graph from published UK Government statistics – real time statistics

But dividends are generally ticking up, a nice bonus to collect when interest rates do start to fall next year, and valuations based on yields look low again.

FLAVEL OF THE MONTH

Nat West really is a sorry tale. The government stupidly sold off the crown jewels at give-away prices, and it now seems to be clinging on to the chaff for no good reason. The dead hand of the state permeates the place, and given the huge interest being paid on the vast national debt, surely a sale of all the government holding is long overdue.

You read the voluminous annual accounts and somewhere about page 180 the PR guff gives way to the reality of declining business lending, a worsening net promoter score and that ultimate civil service fudge, of combining two corporate departments to obfuscate.

Does NatWest actually dislike its customers?

I speak from experience – NatWest seems to dislike small business: we moved the last of our corporate accounts from there this year. Why? In striking contrast to the PR flim-flam that dominates the annual accounts, it seems that making life easy for us, is nowhere on their agenda.

At some point, it was just easier to go than fight – somewhere around the twentieth demand for the same details, and the endless Orwellian (“does not agree with other data”), even after the written confirmation that they were now content; so we quit. Always there was that threat to close the account, but not release our funds, for some arcane procedural reason.

I found the bloated pay packet for the CEO (and CFO) pretty hard to swallow for that performance. It just seems that they don’t attract good staff, and like the slow pacing of caged animals wearing their lives away, those that remain pick away at the residue of their customers.

As for valuation? Nat West would still be cheap, but I felt if it broke above £3.00 (as it did earlier this year) again, on present form – that’s not a terrible exit.

Let’s hope this starts a basic rethink and some real value creation.

RISING IN THE EAST

We noted when the Hindenburg short-selling started in India, and we doubted that it was much more than a clever speculator, despite the sad sight of the neo-colonial British press (and a few Americans) lining up to say “I told you so”.

Friday’s FT was discussing India and still called it “low-growth… dependent on commodities… hampered by political dysfunction and corruption”. Extraordinary – stale, lazy, stereotypical.

The reality is as we predicted: after a pause while stock markets looked for a systemic problem, and the short sellers booked their profits, the Indian market strode on to a new height.

From Tradingeconomics

Not that the biased UK financial press would ever mention that story. Far from the mud hut image they seemingly seek to portray, plenty of IPO (and deal making activity) is showing that India, not Europe is becoming the true challenger in high tech.

The SENSEX started this century at 5,209, the FTSE 100 started at 6,540. The FTSE 100 has made it to 7,694, and the SENSEX? It has powered past to 66,160. One is up some 18% in 23 years, (not enough to even cover advisor and custody costs), the other 1250% in the same time.

No sensible portfolio can have omitted India this century, but the UK press will have worked hard to ensure most UK ones still do.

Well, that’s the half year done, we will resume on the 10th September, expecting markets to be drifting sideways, but that gives plenty of time for the traditional summer bursts of excess or despair.

Although if it is performance you want, getting the big moves right, and the right markets, is far superior to the timing of most individual stocks.