Too chilled

Markets seem far too relaxed about world elections; we suspect from ignorance. Logically if you move from certainty to uncertainty (with a range of possible outcomes) you should adjust your level of risk. India has already shown some of the volatility of the 'wait and see' approach.

Too hot?

So, we start there, where prior confidence in an enhanced majority for Modi, was well wide of the mark, he ended down 63 seats at 240; a majority is 272. Some of that chaos is the electoral system, and some of it the ban on opinion polls - although some accurate information inevitably crept out, despite restrictions, but international investors did not pay much attention to it.

So, when the exit polls announced all was well, the market rose, only to reverse hard when the real result emerged within a few hours. Although then buyers came back in, and we ended up flat.

From this website – date published : 8th June 2024.

On a call with local managers, (and the options for investment in India are wider than you might assume) clearly something had changed, one was almost pleading with the international audience not to take money out. Very little spooks other fund managers quite like being repeatedly asked to not redeem.

The Congress Party has almost doubled its seats, from 47 to 99, a strong result. The other beneficiary was the Samajwadi party, nominally socialist, with a strong presence in Uttar Pradesh, a vast Northern state. They went from 5 to 37 seats and are very much in Modi's BJP territory.

India has always had strong states, with the more populous ones often having a local ruling party, which has been around for ages. So, this is a reversion to the long term normal.

In house collage of a state by state analysis of Indian share ownership percentages

But that is what scares investors; coalitions nearly always break down. There was also damage to the Index from the Adani group of interlocking holdings (long hounded by Congress for alleged corruption).

A weaker Modi

That allied with the long-standing fears about political corruption, uncertainty of policy and no national enforcement, is an unwelcome reminder that Modi is now in his last term. Hopes that stability will follow him, rather than a swing back to the broken past, always felt optimistic.

The commonly voiced issue is that a weaker Modi will have less ability to drive structural reforms and will find it harder to resist welfare payments, and labour demands. Historically, some of these payments and concessions reach the poor, either in higher consumption or better services, but a great part gets stuck with middlemen. That should be less of a problem now, as a result of reforms already implemented, putting in a national bio identity scheme and almost universal individual banking services.

We will see.

While generally expecting strong growth to persist, we are now more cautious about signs of the lost consensus, into the medium term.

The UK - far too chilled

Which brings us to the farce that is a UK General Election, where such discourse as there is has been about whether families are or are not facing a £2,000 tax hike (or roughly 20% more for those on average earnings). Not knowing where they live, or how they spend their money, or indeed how they will adjust to high taxes, you can never tell these things with much accuracy.

This comes with minute (and futile) attempts to list every one of the myriad ways that the assumed tax hike won't happen and extracting a "pledge" from all parties not to raise them. As if all Chancellors do not have multiple ways to raise revenue, carte blanche to create new charges, and a great ability to lie or concoct exceptional circumstances to hit us. Sunak of all people should know that.

Yet most voters are thinking, is that all? Is it enough? We know that existing service demands are not being met and that no party seeks to resist the endless demand for expanded services.

I doubt if growth will save us either: we are close to the point where those that can take investment elsewhere, have left, and no sane investor would now invest, without substantial state subsidy. So, we are simply building up to an inevitable budget crisis in the medium term.

There are a few who hope that change will be its own reward, maybe, but we can't really tell much until after the first Budget, (Labour have pledged to revert to just one a year), and a couple of Parliamentary sessions.

Just waiting and hoping is illogical. Markets do just that, though.

Frozen in the US

Which brings us finally to the USA, the Presidential election feels (to me) fairly easy to call, but how the US Congress and Senate go, does not; the resulting power (or otherwise) of the President is less easy to predict. It may be that we get a split between parties again, which markets like, and it feels unlikely (but possible) that we end up with constitutional change, which markets certainly won't like.

The current Federal Reserve Chairman will be in office for all of 2025, but almost certainly not beyond that, and who replaces him, will figure high on the consequential concerns, as unlike other Central Bankers, he sets the global tone. Powell is not popular with either of the spendthrift presidential candidates seeking office. Nor will he be trying to get reappointed. He has been an odd and erratic champion for the dollar and sound money, but he has been that.

I am not sure other elections are so consequential, the European Parliament has hopefully done its worst already, while investors in both Mexico and South Africa are starting from a low base of limited ambition.

So, to us, the question is how long to follow benign short-term themes, while such dramatic shifts may be hitting us within six months.

Inactivity from ignorance remains attractive, but is it wise? At some point in the interim, markets will probably decide not.

By their works . . .

Well, the works this week: a pensive Jerome Powell does nothing, a reckless Andrew Bailey does nothing, Canada joins Biden in picking fights, and the bulk of most equity markets are stuck, going nowhere.

NO MORE US RISES

So, the apparently knowledgeable financial press said that Powell predicts rate rises? He said nothing of the sort of course. True the other members of the FOMC dot plots were in aggregate higher than the current rate, but by a fraction, it is like the average family being 2.4 children, meaning everyone, in the absence of King Solomon, has three children. No, it does not, it means on average there are no more rate rises.

So, Powell has stopped the runaway train, by lighting red flares in front of it and throwing railway sleepers across the track. Job done. Inflation is way below base rates. Bailey has asked nicely and tried to lasso the inflation express from half a mile down the track - won’t work. Inflation above base rates is misery, inflation below base rates is time to loosen.

Powell did start rambling, describing parts of the economy with “by their works ye shall know them” but decided that was all a bit erudite, before he had even finished the thought. He then reverted to the old saw, “forecasters are a humble lot, (with much to be humble about)”. Presumably that is unlike Central Bankers? I still think that judging them by their works makes sense.

But Powell is happy: the Q&A session threw him a litany of gloom, government shut down, students having to repay debt, auto plant shut downs, but no, all is fine.

The core US consumer and therefore the US economy, is in a good place was his verdict.

BAILEY DITHERS

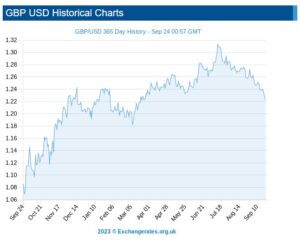

Bailey seems to like to crash the pound every October, which is not good for inflation, just as picking fights globally is not good for oil prices. And it is also bad for inflation.

And either the UK government will cave in to public sector strikes or productivity will keep falling due to said strikes. Neither are much good for the economy. Nor is it good for the markets: in performance terms, the UK remains the sick man of Europe, amongst major markets.

THE MAGNIFICENT SEVEN RIDE ON

I was at the annual Quality Growth conference in London again, a stock picker’s feast as usual. It seems that if enough stock pickers can agree on the menu, as the dominant prevailing theory of investments, they will drive the prices of their favoured stocks ever higher. Which they do, it seems. This is helped by the ‘over the long run valuations don’t matter’ line, pushed hard by Baillie Gifford (amongst others). You might recall my article on Scottish Mortgage a while back.

And of course, as we know from both index and momentum investing, once something starts to move in a flat market, it keeps moving.

But that leaves the vast bulk of quoted stocks flat or down on the year, which makes some sense. When rates rise, bonds are substituted for stocks. The last two quarters in particular have been flat to soft, and while some of these stocks may have hit a bottom, it is still very hard to tell.

The only good news for UK investors is that Andrew Bailey has ensured their overseas (especially US) stocks have a nice currency tailwind.

MADE IN JAPAN

Meanwhile from Comgest there’s a radically different view of Japan. The equity rally there has been fantastic, but it is not the typical exporter boom of a weak yen, in their view, but more about bank stocks soaring on the expectation of the end of Central Bank rate control. This allows their vast balance sheets to earn a real return, at last. This is quite a departure from the general explanations about “this is Japan’s time”. That one has caught me out far too often, but explains the horror show from respected funds like Baillie Gifford Shin Nippon - small and illiquid is just nasty everywhere.

So, although the global rally looks to be strong, it is terribly narrow, and built on different foundations in different places. Or more positively, a broad advance awaits the first rate cuts, either from triumph (US) having controlled inflation or disaster (Europe) having created a recession and left inflation out of control. Either route to rate cuts wins, it seems.

GLASSHOUSES AND THROWING STONES

Oddly, I feel the Canadian spat with India is really quite serious, the tendency of rich Northern countries to preach, in this case standing very carefully behind the only global superpower’s shoulder, really annoys the global South. It has been going on for centuries and is at heart simply the old colonial mindset.

India’s continuing reaction may well portray the accuracy (or otherwise) of the allegations, as on the face of it this is deeply insulting to the world’s largest country, and one that has tiptoed down the line between offending the West and creating starvation and destitution for millions in the South.

I don’t believe it - murdering virtuous plumbers in Canada over the Punjab, which has long ceased to be a primary source of domestic concern, is plain weird.

All things are possible, and India cares far more about Kashmiri terrorism (for instance), but if it is false, expect a sizable slap to Canadian interests, and more accommodation for Putin.

After all, if you are treated as if you are behaving like Putin, why would you ostracize him?

All mimsy were the ‘borrowgoves’

Away from all the shenanigans with base rates and currencies, earnings seem to be showing a pattern. We look at the possibility of an unshackled NatWest and India’s renaissance after the Hindenburg disaster.

START OF EARNINGS SEASON

In so far as reported earnings have a pattern, it reflects the actual position, not the fears of a hidebound analyst community imprisoned by useless economic models. Statistics are not predictive.

There is no recession, whatever all those clever models predicted, never could be one with the extreme fiscal stimulus (quite unlike the private sector fuelled inflationary blow outs of previous downturns), high employment and plenty of liquidity. So, real life earnings are in a purple patch, high and in cases rising demand, with falling or stable costs.

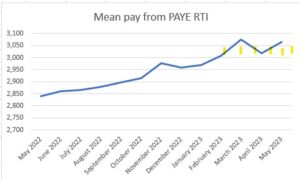

Meanwhile wage costs are perhaps stabilising and the labour supply position seems less frenetic.

In-house graph from published UK Government statistics – real time statistics

But dividends are generally ticking up, a nice bonus to collect when interest rates do start to fall next year, and valuations based on yields look low again.

FLAVEL OF THE MONTH

Nat West really is a sorry tale. The government stupidly sold off the crown jewels at give-away prices, and it now seems to be clinging on to the chaff for no good reason. The dead hand of the state permeates the place, and given the huge interest being paid on the vast national debt, surely a sale of all the government holding is long overdue.

You read the voluminous annual accounts and somewhere about page 180 the PR guff gives way to the reality of declining business lending, a worsening net promoter score and that ultimate civil service fudge, of combining two corporate departments to obfuscate.

Does NatWest actually dislike its customers?

I speak from experience – NatWest seems to dislike small business: we moved the last of our corporate accounts from there this year. Why? In striking contrast to the PR flim-flam that dominates the annual accounts, it seems that making life easy for us, is nowhere on their agenda.

At some point, it was just easier to go than fight – somewhere around the twentieth demand for the same details, and the endless Orwellian (“does not agree with other data”), even after the written confirmation that they were now content; so we quit. Always there was that threat to close the account, but not release our funds, for some arcane procedural reason.

I found the bloated pay packet for the CEO (and CFO) pretty hard to swallow for that performance. It just seems that they don’t attract good staff, and like the slow pacing of caged animals wearing their lives away, those that remain pick away at the residue of their customers.

As for valuation? Nat West would still be cheap, but I felt if it broke above £3.00 (as it did earlier this year) again, on present form – that’s not a terrible exit.

Let’s hope this starts a basic rethink and some real value creation.

RISING IN THE EAST

We noted when the Hindenburg short-selling started in India, and we doubted that it was much more than a clever speculator, despite the sad sight of the neo-colonial British press (and a few Americans) lining up to say “I told you so”.

Friday’s FT was discussing India and still called it “low-growth… dependent on commodities… hampered by political dysfunction and corruption”. Extraordinary – stale, lazy, stereotypical.

The reality is as we predicted: after a pause while stock markets looked for a systemic problem, and the short sellers booked their profits, the Indian market strode on to a new height.

From Tradingeconomics

Not that the biased UK financial press would ever mention that story. Far from the mud hut image they seemingly seek to portray, plenty of IPO (and deal making activity) is showing that India, not Europe is becoming the true challenger in high tech.

The SENSEX started this century at 5,209, the FTSE 100 started at 6,540. The FTSE 100 has made it to 7,694, and the SENSEX? It has powered past to 66,160. One is up some 18% in 23 years, (not enough to even cover advisor and custody costs), the other 1250% in the same time.

No sensible portfolio can have omitted India this century, but the UK press will have worked hard to ensure most UK ones still do.

Well, that’s the half year done, we will resume on the 10th September, expecting markets to be drifting sideways, but that gives plenty of time for the traditional summer bursts of excess or despair.

Although if it is performance you want, getting the big moves right, and the right markets, is far superior to the timing of most individual stocks.

The Scottish Play: Luck or judgement?

Three topics this week: has Sunak’s luck changed? Has India’s bull run ended, and where is this much-discussed recession?

INDIA : ‘OUTER CHINA ‘CROST THE BAY’?

Is India really rising?

For much of last year India was the top major stock market, and remains the best on a twelve-month basis, the main index up +9%: not bad, we look at why. While less exotically the lags in global markets, when the macro picture is changing rapidly, are getting tough to navigate. Too many fund managers and Wall Street analysts simply don’t change, when the facts do.

Indian Stock Market rises to 4th largest, globally

First to India, in Premier Modi’s time in office it has gone from the tenth largest global economy to knocking on fifth, which is now predicted for 2027.

If true it will have overtaken a lot of Europe on the way. It is also already the fourth largest global stock market.

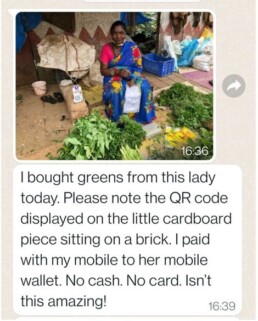

Welfare - and Highways in India

It has done it in part by two great leaps, firstly to take the millions of poor onto a national database for the direct distribution of welfare, creating the fastest monetisation of a society in history: the type of simple, big scale computerisation that works. It allows vast, complex, nimble schemes, both for welfare and tax, to be executed without a morass of red tape and civil servants milking them. The cash, meanwhile, gets right to the app of the men (or importantly as often) women who need it. Secondly it has taken a once Federal system, at least in commerce terms and unified it, creating a true single market. Neither seem that big, but both were critical steps. Remember how fond we were of the European Single Market? This one is twice the size.

While on the ground, the highway network has expanded by 50% since 2014 and in the air the number of domestic air travellers has doubled, air freight is almost as fast growing. A great deal of this is built on the IT sector, which has doubled in the last decade, and was already pretty big.

India seems to have achieved all of that while cutting oil consumption (per unit of GDP), and while racing ahead with the renewables it is so well suited for. It is also as we now know, one of the world’s big grain, especially wheat, exporters.

Some patches of India excel, others not so much

Stock market performance has been good over that time too. I went to kick the irrigation pipes in Modi’s Gujarat, before he got the top job. I liked what I saw; they were colossal and the vision to take them far inland, well away from current irrigation, spoke of a great ambition. The co-ordination and mechanisation spoke of good (and rather un-Indian) execution. It was a shock, when in Bengal at that time, I felt it was mired in politics, with too many huddled and piteous masses, inhabiting another century. But the West and South of the country were different; Bangalore was already aping Silicon Valley, albeit with traffic congestion to match.

That has kept going, tough reforms, enacted on a big scale were needed, and have been provided. But for markets, especially for the ex-colonial power, it has not been easy. Modi is a populist, he tore up the Mauritius tax treaty, introducing CGT to offshore investors, re-wrote the tax law to force Vodafone India into a billion-dollar insolvency, and had to have national assets embarrassingly repossessed, before paying Cairn back an unlawful billion-dollar tax heist.

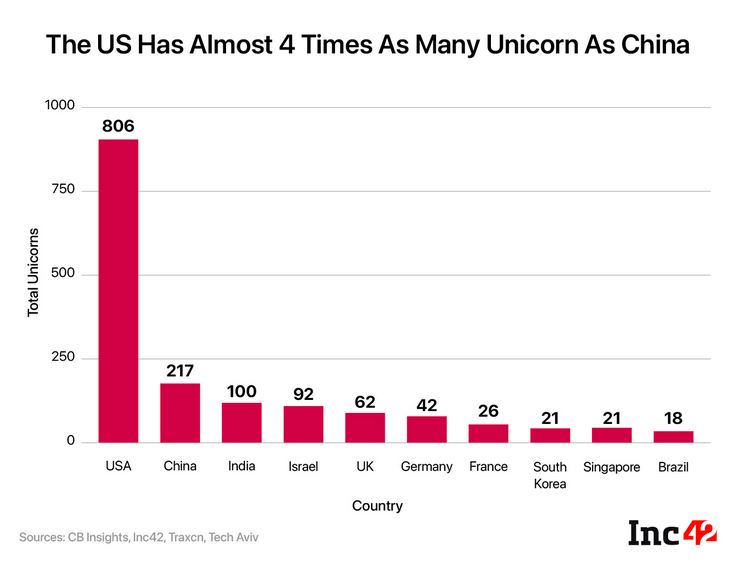

The other big risk was that the park was overrun by unicorns, and it was (and is) hard to know which will flourish, exploiting this vast unified fast-growing market (the OECD say the fastest growing large economy this year) and which will get foot rot in the monsoon floods.

While some of that was also funk money from Silicon Valley, which may now return to base, as the NASDAQ valuations fold, and indeed from China, which still remains in a different universe.

The history of jumping on (or falling under) Indian juggernauts, is not that great either. Racy IPO valuations falling to earth, have been painfully apparent.

But perhaps India will indeed come up like thunder, outer China, ‘crost the bay*.

Now to Stock Markets - in a word, Horrible.

We are having the normal churn, as a lot of vested interests and ‘long term holds’ get destroyed and no one seems to know where the lags are, in either debt or equity markets; a toxic mix. Certainly not company management, and therefore not the big lines of “analysts” often printing corporate client forecasts on fancy notepaper. Odd how so many research teams think the FD they diligently talk to has a clue. They do eventually (one hopes) but day to day, week by week, not really.

The finance team in companies

The finance team sits at the end of long and confused reporting lines, stuffed with dud AI (especially on inventory), and with no handle on returns, credits or sudden weather spikes. Knowledge? No, not much. While on top of erratic demand, their supply chains are like using a rubber band to pick a lock - all over the place and unpredictable, and remarkably elastic. Trouble is what you ordered, the currency, the freight costs and arrival dates are all plus or minus quite a lot. Fine if you can sell all you land, at any price, not so good when others have too much stock too.

Try picking a reliable single digit margin, out of that morass.

So, when rates and demand shift fast, forecasts simply melt away. Valuations don’t really change of course, but market prices do, and that’s when you need to clearly know fundamental values. The rest is froth, just crypto analysis, not the real thing.

So, markets that rely on earnings forecasts quarter by quarter, could go just about anywhere, because no one knows.

For me, now is the time to buy cheap quality, with a yield, but otherwise just watch the spectacle from the sidelines.