Three topics this week: has Sunak’s luck changed? Has India’s bull run ended, and where is this much-discussed recession?

from: Wikimedia commons

Where is this ‘ere Recession?

We have consistently doubted the heralded recession, for a few fundamental reasons, top of which just now would be why? I know recessions start two quarters after rate rises stop, so that suggests this summer, but we need to know more than just cranking the handle on historic data? Causation?

By historic standards although the rate rises have been dramatic, they still do not amount to a row of beans. There is no collapse in credit. No collapse either in the high yield market, nor is there a rapid rise in insolvency; it is the thinly capitalised small fry who have suffered and that debt (if any) is not traded anyway.

How about in the employment markets? No, not visible there either, and we doubt it will be. The impact of COVID and regulatory dislocations sneaked in under cover of COVID, mean supply is short and will be for years.

Drops in demand? Again, not visible, China’s re-opening will take up some slack. Relatively high US rates mean the US is again awash with dollars, as are oil producers in general.

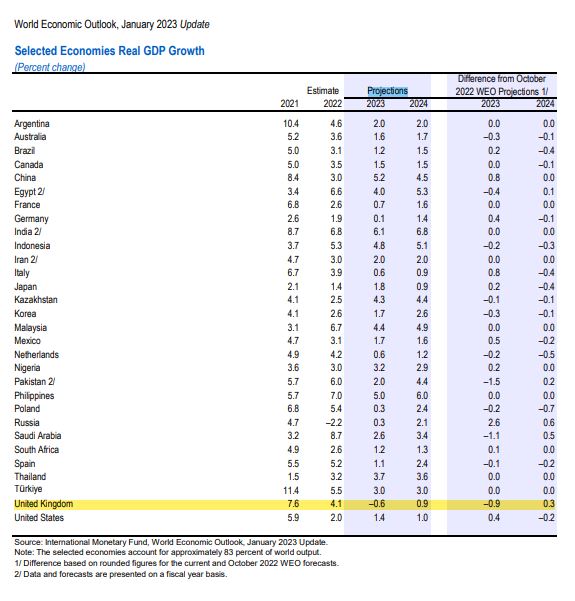

As the IMF has pointed out, only Europe and the UK, the suckers in the high-priced energy game, are facing much of a slow-down, and as more energy comes on stream, even that is muted.

And then, taxation

HM Treasury and their hair shirted desire to raise taxes, puts the UK alone in the recession camp. Indeed, Hunt’s tax increases look like self-harm. Companies will be looking to invest abroad, rather than face his punitive tax rates. Astra Zeneca will not be the last high growth, high paying project to leave for low tax, high growth, Ireland.

Taxpayers are forking out a lot more interest for state debt and Central Banks now have colossal paper losses, on the over-priced debt, held on their balance sheets. But none of that obviously matters in this era of pretend and extend.

So, we still don’t see much change, we still see inflation above target, we still see no great ability or appetite to either understand it or fight it. And yes, we think rate rises will continue longer than markets expect, but we are into the fine tuning now, no way will they double again. If that is a soft landing, we could have one. While, so far, markets albeit in some illogical ways, are still bullish. But a bit more skittish, we are now overdue one of the financial markets’ episodic mood swings.

Which Scotland? Sunak’s luck

What of Sunak? Well, he is very lucky to have a job he was never elected for, very lucky that gas prices and a mild winter mean he now has fiscal headroom, and now lucky him, Sturgeon has beached herself too. Has the Westminster government done enough to justify stopping independence? No way, because she was right on that deep seated desire. While for Sunak, her exit may just transfer parliamentary seats to Labour, so no great long-term help, but a nice win all the same.

Keir Starmer has been lucky too, we have the triumph of Corbynism, in the destructive collapse of the UK public sector into a series of politically motivated, sporadic strikes. They are co-ordinated for maximum impact and largely designed to harm the public, especially those in need. This is what the Corbynistas always wanted: anarchy with powerful unions co-ordinating the holding of vital services to ransom. Yet here is the Government’s response, the tepid internal anti rail strike legislation impact assessment. Pretty vague and low on detail.

And, who cares? It is odd, but by and large public services have become so unreliable, and so disenchanted in their episodic joyless delivery, that for most it is an inconvenient, further, delay. Starmer, by noisily taking the lead Corbynista off the ballot paper, can somehow reap all the internal benefits of far-left actions, and it seems, sustain none of the electoral damage.

India and fraud assessment

As for Modi and India, well there’s a lot of premature celebrating his downfall from the neo-colonial, white saviour, global left wing. But reality? Well reality is that over the last year the top performing major stock market remains India, although now closely followed by France and the UK.

The short seller attack on Adani’s empire has morphed into a political attack by those same ‘liberals’ on India itself, which feels like a mistake.

Some of that is inevitable, you can’t short Indian stocks in India, so you must short the index in Singapore. For that to work, you have to take down the whole index. Legitimate tactics? Yes, in the end, assuming full disclosure. The Indian market was doing well, there were clear signs of froth, manifested in areas like IPOs.

Adani had leapt on a few ‘renewables’ bandwagons, and he has high debt and indeed was trying to exploit high share prices, to issue capital. The result, yes, the few spinoffs and SPAC’s Adani had created in those areas, have seen their prices halve, but are there wider issues?

It is not obvious there are any, although waiting to see, is never a bad idea in these cases. Overall I see it as a welcome corrective to excess, and still like that market.