The benign Powell’s fireside chat has left us all very happy, while I have been pondering the Yanis Varoufakis saga from afar. So how did Greece survive the doom and gloom after the Euro crisis?

An apposite topic, as high state debt, unproductive spending, and uncertain or burdensome credit, pretty much all over the West, apparently beckons once more.

The Song of Chairman Powell

We start with Chairman Powell in his recent Q&A: he could hardly have been nicer, the equity markets loved him, the bond markets sweetly retreated, and the dollar fell away.

It was not so much the repetition of ‘data dependent’, a seemingly meaningless phrase, or the deft swerves around repeated questions about the path of rates.

It was more the extra lengths he went to, to dismiss the data outliers, particularly on much faster GDP growth (4.9%) in the US economy, for Q3 and the sharp upward shift in longer term inflation expectations. The bond markets had found both metrics spooky.

The GDP number was dismissed, rather airily, as related to strong consumption, which in turn was linked to high employment and rising real wages on the one side, but more importantly to COVID savings balances. Although he admitted no one really knew what these were, but somehow, they were still contributing.

The inflation expectations got dissed even faster: Powell thought it an outlier, more recent data was far more consistent. Suddenly the evil portents were gone.

It would be wrong to think he knows what he is talking about (why start now?) but right, to know how he is feeling; that’s it. Sure, he keeps the rate rise out in the open, like an old dog, but the chain is lax and rusted, the beast benign.

It would take a lot to make the US raise rates again and he was happy with tighter monetary policies. Even nicer for the long end, while Powell is not sure where the “neutral” funds rate was (who is?), it was certainly a lot lower than where we are now. You might even choose to quantify a gesture; I’d say his was in the 3% area.

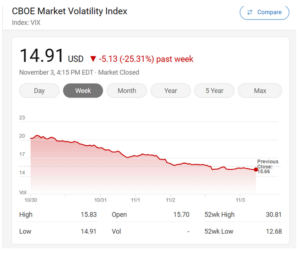

So, I feel like crisis-driven prices should not really apply. While the VIX? Down 25% in five days. Game over?

Search Results from MSN

Yanis, Right or Wrong?

Politically Yanis got lured by the old trap of supporting a party without a history, after sudden promotion, as a technocrat.

A rookie error.

But how does History see the Global Financial Crisis?

I looked at GDP from 2007 to 2022, for Bulgaria, Greece, France, Germany, UK, and the US. Here is the World Bank Chart of GDP growth rates. You can see Greece tumble out of the bundle, but it was also gathered back in, quite fast.

By 2007 the Eurozone was apparently out of control, spending was too high, it needed debt write downs, balanced budgets, selective privatisations and a war on tax evasion.

And Yanis felt Greece was being unfairly picked on to trial that medicine.

Size Counts

So, it is perhaps more instructive to look at levels, not growth rates. Here the damage is clearer, Greece has a GDP still substantially below the 2006 level. Bulgaria a neighbouring Balkan state, has doubled (and more) in the time. So Yanis has a point there.

Elsewhere France grew a shade faster than the UK, but from a slightly smaller base, so really little change.

But the US added almost twelve trillion dollars to its economy, which is like bolting on a new economy the size of the UK, France, Germany and Italy in just two decades.

We could adjust for currencies, population, different data points, calculation bases, of course and it is non-linear, inevitably. But we are looking big picture here.

Was The Left Right?

Gordon Brown was quite keen on the Yanis theory, and to some extent that adoration survived the subsequent dilettante Tory rule. Seizing big banks, attacking tax evasion at any cost, and aiming to balance budgets (Yanis was big on the primary surplus then) all crept into UK policy. The first two are oddly very non-Tory, especially when used to destroy economic growth by over-regulation. The third is quite sensible by comparison, but it was ignored.

Greece has since taken its medicine, with a steady swing to the Centre Right. Yanis finally lost his seat (for his new party) early this summer.

If the pain was indeed all inflicted to help the struggling IMF, no one told the US. If it was all done to save the Euro, I ask myself why did France go nowhere fast? It didn’t obviously hurt other Eastern European countries.

So, Greece remains an outlier, vastly reduced in wealth by the whole episode. It saved the Euro; it did not save Greece.

Where Next?

In the end, all national budgets work better with a growing economy, and in the long term that is essential. Flat or declining economies are the real crisis, especially without flat or declining state spending.

My highly selective period – (2007 being the pre-crash high) finds considerable upsides in both Trump and Biden’s expansion and in Obama’s reconstruction.

While if you need to know why the US stock market dominates in that period after the GFC, it is because GDP growth was twice that of Germany, and on course to double from 2007 quite soon.

Elephants can’t dance, they say, but when they do, the world shakes.

Insert Media here

Although Yanis, indeed has stopped making sense.

Charles Gillams

4.11.23