WENN DU LANGE IN EINEN ABGRUND BLICKST

We look briefly at China, not as an investment, but more an existential threat. And we finish the lessons of the Greek coup in 2015. While little else surprises? Except perhaps the pessimism apparently shown by the long bond.

But even that might have a good reason.

DIRE STRAITS

I looked idly at a certain pink paper’s New Year quiz and asked my companion for views, and on most topics, we had one, or could find one. But on one, ‘will Xi invade Taiwan?’ I had no idea.

Not because after Ukraine there is any doubt it would be mindlessly stupid to do so, and plunge China back into the dark ages. That much is obvious. There is no way China can “go it alone” - without Western markets, capital, and innovation, it heads back to where Iran, Pakistan, Congo, and Argentina have been.

But a distant echo tells me that I don’t know for certain. Perhaps my confidence that Putin would not be so stupid as to invade Ukraine, tints my view; I was wrong there.

I am also largely assuming any military contest is unpredictable, so I tend to focus on the long-term economic impacts alone. But I still don’t know that Xi won’t try, which will clearly crash world markets.

I will deliberately not gaze into that abyss, but I can’t ignore it. The best response I have is where two stocks are equally attractive, and on like valuations, I would buy the one with the lower Chinese exposure. Maybe my limited action says that I think it is possible, but really not that likely. The other option of course is adding to gold and safe haven currencies.

Looked at a Swiss Franc graph of late?

From : Google Finance currency page

Most investable firms can shed China, just as many have shed Russia, but at a much higher price. The reciprocal asset seizures will be vast.

And although it won’t cripple Starbucks, Tesla or Apple, it will be a big slice of asset destruction for them.

NO DEMOCRACY

Back to Greece - when we last wrote it was to note the ravages imposed by the EU and IMF on the Greek economy, and how the scars still remain. But completing Yanis Varoufakis and his seminal tome, other contexts are clear.

As an academic his note taking and indeed voice and video recordings were quite an exceptional contemporaneous record. Not just of Greece, but of how Europe really worked, in a crisis.

We forget now, that Ukraine also needed a big bailout in 2015, and a choice was made as to which mattered more to, in effect, Germany. The answer in 2015 was Ukraine, with the late Wolfgang Schauble wanting Greece out of the Euro, and Angela Merkel seeing that as a lesser evil, for Germany, than the collapse of the Ukrainian economy.

There is very little ‘EU’ in this incidentally, Germany was the dominant and controlling creditor. The IMF largely sat safely behind its super creditor status. As Yanis notes the IMF funds itself on interest, and that mainly comes from having plenty of distressed debt. Not an attractive feedback loop, however logical. And of course, it largely stood back from Greece – inactivity is often an action taken.

Moving on, the Greek crisis was closely followed by Brexit, at the time we thought that was chance. It is clear it was not, and both sides had learnt a lot from the prior event, to take into the next battle. The EU and Merkel in particular had no interest in rational arguments, having waded through all that guff in Greece; you can see Cameron may have been useless, but he really had no hand to play in his “re-negotiation”. Simply ‘nein’ had worked well in Greece, so Merkel pressed repeat.

The old apparatchik’s argument about “reform from the inside” was clearly flannel; popular mandates are for the birds. As a result, the Brexit faction knew it had to be a clean exit, with one shot to the head. Sadly, Theresa May failed to realise that, and when the EU subsequently realised she had thrown her majority away, they had no reason to agree any deal, or not to expect another craven capitulation.

What of Greece now?

Well, it simply lost a big chunk of its economy (circa 20%) to creditors and demolished welfare payments and entitlements, for a generation. Was that fatal? Not really, life expectancy rose through that decade, as elsewhere in Europe.

The left largely destroyed its high-water mark, one-off advantage, but remains a mid-teens political faction.

The October 2023 regional elections saw even more regional governorships fall to the centre right New Democracy. This was along with a rip-roaring stock market in 2023 as the long rebound continued.

EU

And in Europe? Well, those June Parliament elections are getting interesting, Syriza will suffer more losses, and the gains by the centre right in Italy, Holland etc. are likewise yet to show up in Strasbourg. This provides context for this week’s defenestration of the French prime minister, for a near novice (at ministerial level). It seems this was a poisoned chalice for the big guns of En Marche, as the party are well behind Le Pen in the polls.

The European Parliament is such a mash-up of parties, and with limited real power, no change can be dramatic, but for once it could be at least interesting. The super-spending high regulating internationalist left, may get a setback.

Financial markets

Markets? I don’t think they ever get going till after Martin Luther King’s birthday is celebrated on Monday. Despite the need for news, the decline in global rates is baked in, and remains positive for equities, especially rate sensitive stocks.

You can stare into the Chinese abyss, but be careful that is does not stare back at you, you will see what you most fear or least know, as Nietzsche knew.

Happy New Year.

Stop Making Sense

The benign Powell’s fireside chat has left us all very happy, while I have been pondering the Yanis Varoufakis saga from afar. So how did Greece survive the doom and gloom after the Euro crisis?

An apposite topic, as high state debt, unproductive spending, and uncertain or burdensome credit, pretty much all over the West, apparently beckons once more.

The Song of Chairman Powell

We start with Chairman Powell in his recent Q&A: he could hardly have been nicer, the equity markets loved him, the bond markets sweetly retreated, and the dollar fell away.

It was not so much the repetition of ‘data dependent’, a seemingly meaningless phrase, or the deft swerves around repeated questions about the path of rates.

It was more the extra lengths he went to, to dismiss the data outliers, particularly on much faster GDP growth (4.9%) in the US economy, for Q3 and the sharp upward shift in longer term inflation expectations. The bond markets had found both metrics spooky.

The GDP number was dismissed, rather airily, as related to strong consumption, which in turn was linked to high employment and rising real wages on the one side, but more importantly to COVID savings balances. Although he admitted no one really knew what these were, but somehow, they were still contributing.

The inflation expectations got dissed even faster: Powell thought it an outlier, more recent data was far more consistent. Suddenly the evil portents were gone.

It would be wrong to think he knows what he is talking about (why start now?) but right, to know how he is feeling; that’s it. Sure, he keeps the rate rise out in the open, like an old dog, but the chain is lax and rusted, the beast benign.

It would take a lot to make the US raise rates again and he was happy with tighter monetary policies. Even nicer for the long end, while Powell is not sure where the “neutral” funds rate was (who is?), it was certainly a lot lower than where we are now. You might even choose to quantify a gesture; I’d say his was in the 3% area.

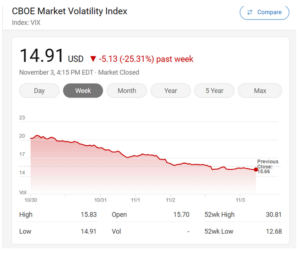

So, I feel like crisis-driven prices should not really apply. While the VIX? Down 25% in five days. Game over?

Search Results from MSN

Yanis, Right or Wrong?

Politically Yanis got lured by the old trap of supporting a party without a history, after sudden promotion, as a technocrat.

A rookie error.

But how does History see the Global Financial Crisis?

I looked at GDP from 2007 to 2022, for Bulgaria, Greece, France, Germany, UK, and the US. Here is the World Bank Chart of GDP growth rates. You can see Greece tumble out of the bundle, but it was also gathered back in, quite fast.

By 2007 the Eurozone was apparently out of control, spending was too high, it needed debt write downs, balanced budgets, selective privatisations and a war on tax evasion.

And Yanis felt Greece was being unfairly picked on to trial that medicine.

Size Counts

So, it is perhaps more instructive to look at levels, not growth rates. Here the damage is clearer, Greece has a GDP still substantially below the 2006 level. Bulgaria a neighbouring Balkan state, has doubled (and more) in the time. So Yanis has a point there.

Elsewhere France grew a shade faster than the UK, but from a slightly smaller base, so really little change.

But the US added almost twelve trillion dollars to its economy, which is like bolting on a new economy the size of the UK, France, Germany and Italy in just two decades.

We could adjust for currencies, population, different data points, calculation bases, of course and it is non-linear, inevitably. But we are looking big picture here.

Was The Left Right?

Gordon Brown was quite keen on the Yanis theory, and to some extent that adoration survived the subsequent dilettante Tory rule. Seizing big banks, attacking tax evasion at any cost, and aiming to balance budgets (Yanis was big on the primary surplus then) all crept into UK policy. The first two are oddly very non-Tory, especially when used to destroy economic growth by over-regulation. The third is quite sensible by comparison, but it was ignored.

Greece has since taken its medicine, with a steady swing to the Centre Right. Yanis finally lost his seat (for his new party) early this summer.

If the pain was indeed all inflicted to help the struggling IMF, no one told the US. If it was all done to save the Euro, I ask myself why did France go nowhere fast? It didn’t obviously hurt other Eastern European countries.

So, Greece remains an outlier, vastly reduced in wealth by the whole episode. It saved the Euro; it did not save Greece.

Where Next?

In the end, all national budgets work better with a growing economy, and in the long term that is essential. Flat or declining economies are the real crisis, especially without flat or declining state spending.

My highly selective period – (2007 being the pre-crash high) finds considerable upsides in both Trump and Biden’s expansion and in Obama’s reconstruction.

While if you need to know why the US stock market dominates in that period after the GFC, it is because GDP growth was twice that of Germany, and on course to double from 2007 quite soon.

Elephants can’t dance, they say, but when they do, the world shakes.

Insert Media here

Although Yanis, indeed has stopped making sense.

Charles Gillams

4.11.23