I come not to praise Kwasi, but to bury him. This is an explainable, predictable but probably futile coup in the UK Tory Party, along with more King Canute from Bailey of the Bank.

But in markets there is abundant good value, but with few clues on how, or at what cost, inflation is to be tamed. Or indeed what may escape this time.

Political Manoeuvres

We have long noticed the Tory party’s splits and factions, broadly between the left and the right wing. This was a chasm Boris was uniquely able to bridge, by talking right, and acting left. The puzzle, as we noted, was why the left would bring him down to replace him with a right talking right acting Prime Minister. The preference was for a Blairite Conservative, low tax, high spending, but a steady reformer, with a lethal penchant for foreign wars and illogical hatred of the Euro. After Kwarteng’s departure, the Tories now have the doomed high tax big state faction back in charge again.

Hence the need for a pretext to overrule the party members and threaten Truss with the ever-gleaming sword of Damocles, held by the 1922 committee – we are back where the plotters wanted to be after Cameron – with the neutral Hunt playing the safe stooge to hold the fort.

Unlikely to win the next election

It foretells the inevitable party split – but we had never seen another Tory term as possible, regardless of the leader. Nor have we ever seen Keir Starmer as needing to do anything but sit tight and keep a grip on his party. If he is also spared the crippling cost of a really tight General Election, he can now face down the Trade Union money men as well.

As for Kwasi, if he stays the course, his troops will yet triumph at Philippi, he is by far the best the Tories have just now and looks to be the future. He has understood that if you fail to free the supply side, in a new productivity revolution, the current national decay will just go on, as it has for twenty years or more. But he has also not torched his future, Miliband style, in the wrong leadership move.

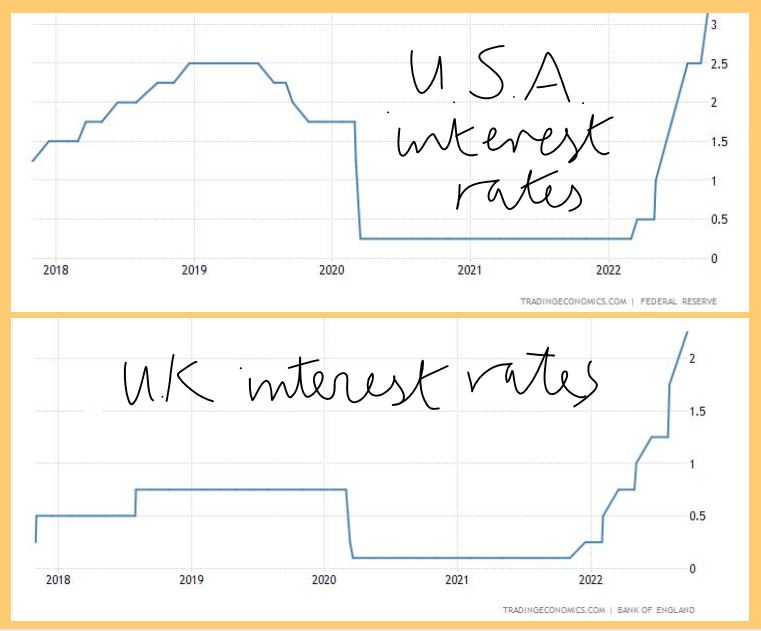

Will any of this stem the attacks by market traders? I doubt it. Will any of this forestall the inevitable sharp rise in interest rates, I doubt it. Or indeed stop ongoing sterling losses. To quell inflation requires interest rates above inflation, you can’t bear down from below. It remains daft to think UK interest rates can be effective whilst remaining underneath US ones either, as we said in our previous post.

Both clipped from this site, and set out side by side. The core data as is cited below are from the Federal Reserve and the Bank of England respectively.

So, what is the shape of this next recession?

I think we are now starting to see it. Not that much unemployment, the current tight labour market, without addressing increased workforce participation, is going nowhere. Nor is a secondary residential property crash certain. That is so last century, both areas are now far more heavily fortified sectors than they were last time. And both are now designed (and legislated) to be fiercely inflexible downwards. That is what the current labour market (and our dire productivity performance) is telling us.

House prices are propped up by a very generous market backdrop, ongoing vice like planning, high land taxation, tons of liquidity and a deep political fear of the consequences of a collapse. For all the moaning, borrowers are still able to load up at negative real rates, with a highly competitive mortgage market and generous fixed term offers.

But do expect a general slaughter of small businesses (or rather the current collapse will go on despite the various support packages). Expect weak margins for UK based firms, ever more exposed to competition, from far more generous and protectionist states.

WTO rules really are in tatters now and routinely ignored by powerful countries like the US and Germany. Expect a resulting fall in quality both in goods and services, again a continuation of current trends, as globalisation retreats.

But remember too, that so far, we do have inflation, but not a recession. The current dislocation is caused by a resource switch towards savers, who at all levels have had slim returns for a while, and we will now instead punish borrowers, who have had an absurdly easy, subsidised, inflationary decade.

The big picture, overall

Meanwhile in the energy world, a resource transfer is taking place from energy users to energy producers, who have likewise had a thin time of it. That those energy producers are places like the US, Russia, Saudi Arabia, Iran, Nigeria, Brazil, is a remarkable own goal for Europe.

But it is neutral for the world.

Indeed, much of those surplus funds will now be collected as various direct and indirect tax revenues, or to pay down debt, or as new investable funds, or distributed as dividend payments, but very little of that vast energy price transfer leaves the known universe.

For Europe, however the decline happens with the slow loss of productivity, plus the demographic torque. Meanwhile borrowing our way out, is suddenly becoming far more painful.

The political turmoil is ultimately from this change, and the longer states borrow more and pretend nothing has changed, the less effective will be their remedies. And indeed, the more the big efficient producers, like China, the US and Saudi Arabia will thrive. Neither more debt, nor protectionism will solve this, nor indeed will more global military adventurism.

Confidence is understandably damaged

Given that backdrop the mood music is damaged just now. Markets are trying to spark rallies, but with no real confidence yet.

Investors sense there is value, but with too little data to know where.

But whisper it quietly, Santa Claus is due, and the market mood is not quite as bleak as events suggest it should be.