I noted at the end of our last bulletin, that markets are feeling strangely bullish, for a few reasons, which I share. Although only in some places. I still find little attractive in most debt markets. They are cheap, but given losses this year, are they good value?

And UK politics is becoming boring, which is no bad thing.

So, were we right to predict that interest rates alone cannot tame inflation?

Our original thesis for this year, that interest rates could not tame inflation alone, maybe is right. The level needed would cause too much damage. But that is applicable (we now see) to the UK, but not as yet to the US. And oddly perhaps not as yet to the EU either, although Lagarde midweek, perhaps had the same tilt. But German profligacy may wreck that.

The logic is the same for them all. You can’t tame this beast by rate rises alone, as double figure inflation needs double figure interest rates and that is just not happening.

The UK is certainly not prepared for that level of rates and fiscal restraint is therefore now required. Fiscal drag will do some of the heavy lifting, and energy price declines a fair bit more.

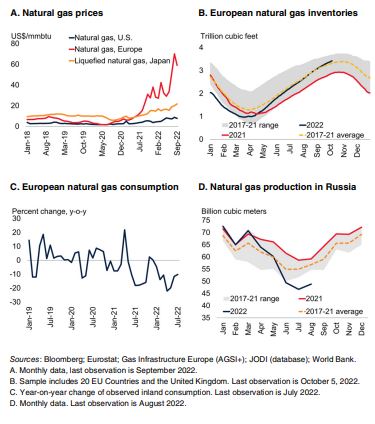

Some commodity market statistics were released by the World Bank, this quarter. The above graph is extracted from their statistical report

But tax rises and government spending cuts will still be needed to cool the UK labour market. In particular the public sector must be reined in, or service cuts made.

Earnings will fall, taxes rise, growth stall, discontent rise. But still no collapse in housing (secondary) markets or in employment.

Nor do I therefore see much rise in loan defaults. This makes the recent round of forward-looking bank provisions unusually daft. You can’t audit the future, so how can you include it in historic accounts? A weird hybrid. Best to ignore all that and focus on now, and now is still not terrible. With a pretty hefty valuation discount in situ.

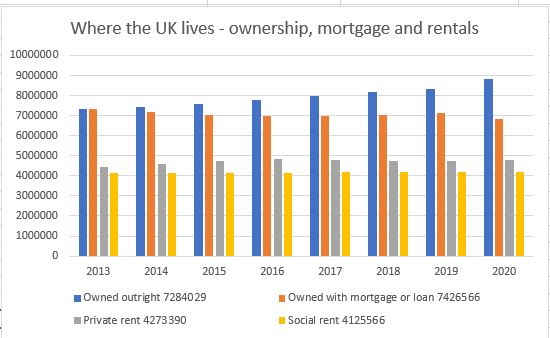

(Data downloaded from the Office of National Statistics for this in house graph).

The US political situation

In the US, The Federal Reserve have effectively said if there is no fiscal restraint, they will ramp up rates till there is, or inflation falls. That is scary, but it looks as if the Mid Terms will hobble Biden and stop some of his fiscally reckless measures. He thought the wave that toppled Kwasi missed him, but it was the same ocean, and likely will give him a rough ride too.

Biden’s approach felt good, overindulgence often does, but the pain of the untethered dollar is now starting to hurt US earnings, and in time US jobs, however much they dream of legislating against that. The impact of rate rises is also probably less than it sounds in the media, partly because most reporters are likely to have mortgages, whereas a growing number of investors don’t.

Overall US government policy remains to force up inflation and challenge the Fed to sort it out. Hence all the Fed threats are directed not at the market (which cares) but at The White House (that does not). Mid Terms (on the current path) will therefore be a big boost to US markets, as it means Congress at least, will start to work with, not against the Fed. As with Kwasi, a reckless budget will not pass unchallenged again this time. Those extremes belong to the COVID era, that is now over.

Comparison with the UK position – and where Europe maybe is headed

With that battle already won in the UK, both sterling and to a degree UK rates are reverting to the status quo ante. And as sterling rises so the FTSE falls; that link also remains. If the UK is neither chasing interest rates up, nor letting the pound fall, it gives Europe some cover to do likewise.

In truth although sounding dramatic, in the real world it is inflation that really counts not (as yet) interest rates which are still absurdly low.

The Tory Party – what can we discern?

Talking of status quo, that’s where the Tory party is now headed. Cameron drifted too far left, Boris dithered, Truss drifted right, and now the new government is a hybrid, although colloquial English perhaps has a stronger word for it.

I sense that spending decisions may correctly be back with a powerful Chancellor. There is a seeming party truce till the next election, when half the current Cabinet seats will vanish anyway, and then who knows?

Or if this coup and enforced hybridisation fails, we really will know the party is split, and a General Election could follow. Unlikely, though.

Why bullish then?

US earnings except for highly indebted outfits, will probably stay surprisingly strong for a while yet. And likewise, the dollar pivot point is being pushed further out, as no one else in the developed world is going for rates quite that high (or that fast).

There are also two market forces to look out for, rising rates and slowing growth is one, but the simultaneous loss of liquidity is another. The former will cause a patchwork of changes, both good and bad, but the latter the ending of a multi-year bubble.

It all remains cyclical – a transition, not a bounce

The difference is key, rates are possibly a two-year cycle, a bubble a ten-year one. The bubble in non-revenue companies, and in absurd multiples for even profitable tech, will take longer to deflate, be slower to re-inflate and be muddied further by all that spare capital accelerating technological change. This is still not an area we either feel confident in, or trust their valuations.

If we really are back to the status quo in the UK, about to be in the US, why would markets be going down, down, deeper and down?