River Deep, Mountain High

Welcome back Mr. Powell - so what is a good response to impending inflation?

After nine months or more the newly reappointed Fed Chair conceded the blindingly obvious: we have an inflation issue, along with the equally transparent need to tighten monetary conditions to quell it. At least he’s fronted up to that, unlike the position in Europe.

What diverts us is what the right response is. Some things are perhaps obvious: gold at least in sterling terms now has positive momentum again. But there is a tremendous volume of liquidity to soak up still, while stimulus will keep being pumped in for a long time. But fixed interest just looks hopeless, credit quality is plummeting, rates are rising, and returns are poor, even in high yield.

Are we clear of COVID effects?

Nor are we really clear of COVID effects. We are yet to pass beyond all the “emergency measures”. So here in the UK, VAT is still reduced, commercial evictions banned, and government departments are still showing that odd mix of budget destroying costs and below normal productivity. So, spending pressure will stay elevated for a good while. Tax rises on corporate profits and on labour through National Insurance hikes, will therefore start to bite, well before the last variant has caused another pfennigabsatze-panik. (spike/trough related panic)

Markets have also been jittery. In general, the buying opportunities just after Thanksgiving have held, which is a good sign. The subsequent gyrations have (so far) indicated a good weight of money ready to buy the dips. But there is little doubt cash is fleeing the overhyped stocks, which are far more prevalent in the US, than in the UK. The shift out of basic commodities is also apparent. So, I would still expect enormous cash balances to build up into the year end in the banking sector, albeit maybe not always in the right places. Any Santa Claus rally will be strictly retail elf driven; the old man is self-isolating this year.

Characteristics of this inflation

Our view remains that the expected high inflation is systemic, simply because of the structural damage and inefficiency inflicted by COVID. So, it maybe transient, but multi-year transient. In this case while the seasonal moves down in energy prices will be a welcome relief, assuming Northern Hemisphere temperatures stay around seasonal norms (and that’s what mid-range forecasts are indicating) - it is not a solution to the inflationary pressures.

Nor do we see the any unwinding of the inventory super cycle caused by the holiday season and the ending of lockdowns, all at once, as having much beneficial impact on price levels.

Businesses all want inventory and will keep rebuilding it across their full ranges for a while. After all, right now holding stock has little financial cost attached.

See this article published by Markit.

Most corporates are at heart squirrels; it won’t be easy to break a new habit.

So how should we play this?

The bigger issue is how to play this - the received wisdom is pile into the US, probably the NASDAQ, while having a side bet on bitcoin or some less disreputable alternatives.

That’s where most investors knowingly or otherwise have their funds.

NASDAQ may churn as dealers try to create some volatility, but the overall (and in our view inflated) levels will most likely remain.

This Omicron variant episode at least has halted the IPO madness, and the whole SPAC nonsense is washed up. Sadly, not a big surprise to see portly old London has just tried to catch a train that left the station last year.

The longer view

But it is a bubble we think - our icf economics monthly looks in more depth at how these played out the last couple of times. Not pleasant, but oddly familiar.

NASDAQ and Bitcoin may yet scale new peaks, but the river below is very deep. Perhaps that old affection for base gold is not just nostalgia?

Time for some year end reflection.

Charles Gillams

Monogram Capital Management

Which is the Leviathan?

This is a week to ponder the role of private equity in portfolios, in what may be an early phase of a great investment and technological explosion. There seems to be no sign of higher interest rates and a stubborn refusal by Central Banks to care much about inflation. The talk of a UK raise always looked to us like a head fake which we ignored.

Spotting good and bad private equity

So first to private equity, a beast that comes in many guises, not all benign from an investor viewpoint. All liquidity fueled equity explosions come with a heavy loading of chancers; Bonnie and Clyde’s rationale for bank robbery remains valid.

Good private equity relies on management being superior to that of their targets. This can be in their analysis, their execution, their swiftness of foot or their innovation. All of this generally flourishes away from the hidebound inertia of many listed companies and their professional Boards of tame box tickers.

Bad private equity uses accounting tricks, the malleable fiction that the last price is the right price in particular, and the terrible phrase “discounted revenue multiple” which is a nice conceit for “never made a profit”. All of these share the same vice of management marking their own work.

So, we struggle with the likes of Scottish Mortgage and its little array of unquoted Chinese firms, the alphabet soup of non-voting share classes and love affair with management. Maybe they are that skilled, but nothing that looks like a real two-way market is evident to us, in many of these valuations. We have by contrast long admired Melrose Industries for their quite ruthless devotion to turning over their investments, good or bad and stapling executive pay to actual cash realizations paid to investors.

Where we stand – given our strategy

For an Absolute Return specialist there are added constraints: we want to hold under twenty positions altogether and all in ones we can sell tomorrow afternoon. And we like holdings where valuations are transparent, there is no gearing (there is usually quite enough in the private equity deals already), and you can pick them up for a fat double digit discount: oh, and we do like a yield too.

So, we are looking for big, listed options with hundreds of high-quality funds bundled together and for any yield, a bias towards management buy outs. We are certainly not at the venture capital end, with silly pricing, high fail rates, unrealistic managers, and not a decent accountant in sight and aspirations to change the world. Met those, invested in too many, and donated more shirts off my back than I care to enumerate to their serial failures and inexhaustible funding rounds.

But there are good things about Private Equity, one is that in a rising market, it can be like clipping a coupon. The accounting rules require them to be backward looking, so coming out of a trough they are typically reporting on valuations that are three or four months old, which in turn reflects business activity up to six months old. As they trade at a discount of typically 25% or so, you can buy today at a 25% discount to the value of the business they were doing in the spring. There are no guarantees, but for most, that was a lot worse than current conditions, so today’s price is simply wrong. This is a time machine that lets you buy now but pay at old prices.

Watch for built in volatility in private equity

These lags are complex, the reference points are often public market valuations, and so there is volatility built into them. While in an Absolute Return fund, not only are choices limited but the overall exposure must be too. However, in those rare purple patches of fast recovery and expansion they are excellent for performance.

What kills these bonanzas off is tight credit. In part they need debt for trade, but also their realizations rely heavily on it. A closed IPO market does them no good (just as they enjoy an exuberant one). That is a risk, as liquidity starts to tighten, that this will hurt, but as Powell and the Bank of England both showed, there is no political appetite for that just yet.

The UK and US on taming the leviathan

Indeed, Sunak’s UK budget yet again feels reckless, devoid of any discipline and with every department cashing in. Government spending is predicted to rise to 42% of GDP by 2026, a fifty year high. Healthcare alone is predicted to have grown by 40% in real terms since 2009 (both estimates from the oddly named Office for Budget Responsibility). At that level of loading, it is inching closer to hollowing out the entire budget and causing it to implode. (Leviathan was just such a creature “because by his bigness he seemes not one single creature, but a coupling of divers together; or because his scales are closed, or straitly compacted together” feels an apt description of this new giant state apparatus.)

But that gamble means there is no room to pay higher interest rates, or the economy will be reduced to a double-sided monster. The one face devoted to raising debt and levying taxes and paying interest, the other to feeding out of control public spending, with nothing left in between.

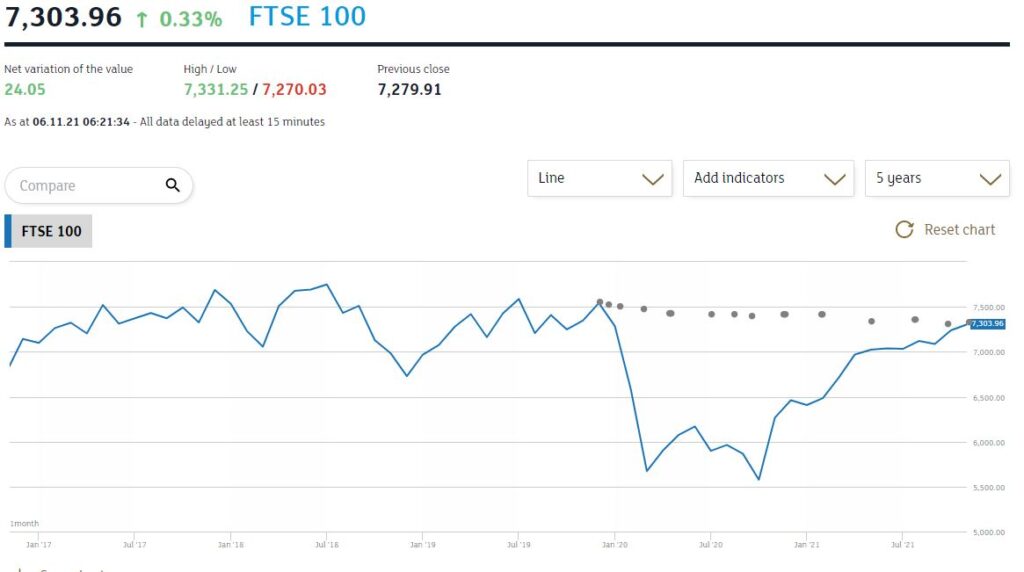

Thanks in a slightly odd way to a Democrat Senator, America has avoided throwing itself under that same bus, but with no effective political opposition the UK is now powerless to resist. Sterling’s relentless decline from the summer high and a FTSE 100 index still below its pre-COVID peak signify what markets feel about all this.

From the London Stock Exchange graph

So, while we were more bearish than we have been all year, in terms of asset allocation, at the end of October, we have yet to call time on the Private Equity cycle, that has provided such a powerful boost this year. It still feels good value to us.

Of course, we recognize too, that the populist fear is of the wealth creators and an opposing adoration for wealth consumption. Unlike politicians, however, we are tasked with producing real results not vapid dreams.

I guess we can each choose which to regard as the leviathan – the burgeoning state, or private equity.

Charles Gillams

Monogram Capital Management Ltd

Caution: Bumpy Road ahead

Puzzle: World markets have whipsawed in the last few weeks, from high anxiety to an almost beatific calm. The VIX volatility index has dropped to pretty well a post-pandemic low. Which should mean we all agree, but on what exactly? Rising inflation, yes, but how durable, and caused by what?

And that, we all accept, will make interest rates rise, yes, but how high for how long? Markets we feel are, to say the least, fragile.

At the turn, we know that moves can be dramatic both ways, for markets.

Are we really seeing a labour shortage? The UK truck drivers’ situation

What we see now is not a labour shortage, and hence political talk of stemming migration and higher wages is well off target. What it is, in part at least, is a failure of the routine operations of an incompetent government, something politicians typically don’t want to discuss.

The government has insinuated itself into so many areas, with its complex regulations, that the market economy now lies ensnared in myriad interlocking regulations, backed up by a deeply entrenched blame culture (and its friend the compensation economy).

To take one example, there is no shortage of truck drivers, but there is a shortage of qualified, approved, signed off and regulated truck drivers, because as part of the destructive lockdown, the government just halted the conveyor belt of required testing and approvals.

Truckers’ wages have for long been too low, of course, especially for the owner drivers in the spot market. What we have is not a labour shortage, it’s a paperwork shortage. The difference is vital for how enduring inflation is. A new driver will take a couple of decades to grow, but clearing a paperwork jam, a few months. One is enduring, the other transient.

Withdrawal of older workers from the labour market

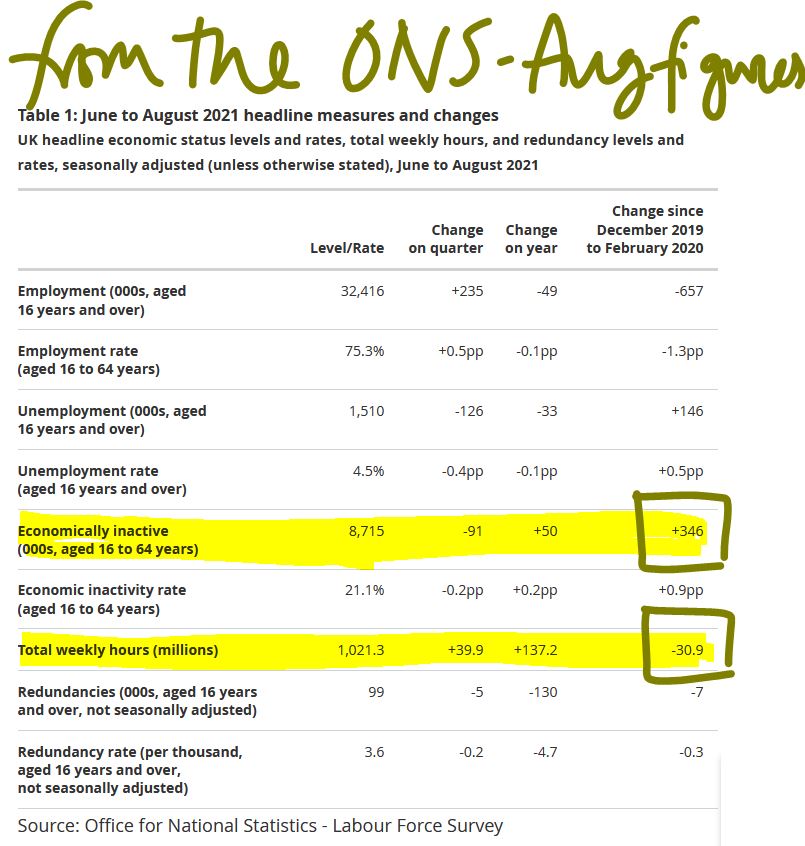

Work after all is something of a habit: once it is lost, it can be hard to understand why it existed. So, we see a marked increase in older workers in the UK who have just withdrawn from the market (Some thirty million fewer hours worked - see figure below). That too is not a labour shortage as such, they all still exist.

But if work was of marginal benefit to the worker, and the costs to resume work (actual or psychological) are high, disruption will cause the fringe or marginal job to be unfilled. Yet again more in the transient column than permanent.

Someone will waive the rules, or the government will notice, well before all drivers get paid high enough wages to cause embedded inflation. In any event articulated fuel tanker drivers tend to work for big employers, with good conditions, and are well organized. They have to be, after all they drive mobile bombs. The spot operator on a rigid rig is in a different market.

Inflation will most likely be transient

So, if it is not an actual labour shortage, it won’t cause wage inflation, and will be transient. Some other areas reliant on highly skilled older workers will continue to see standards fall, but generally younger workers will over time fill those slots and gradually acquire those skills. And it won’t be a long time.

Our view from way back was of 5% plus inflation and labour markets that struggle to clear this year. We were wrong to not foresee the failure of regulatory processes to keep up. However we still do see a permanently higher post COVID cost base and therefore in certain sectors, a large amount of marginal productive capacity are likely to be withdrawn from the market.

With a banking system that still struggles to offer commercial finance to the SME sector, because of excessive regulatory caution, there are swathes of jobs that have simply gone. So that labour will in time be redeployed. The current concern is that many of these workers show no desire, or ability under current conditions, to return to the market. But when they do, the capacity that has been destroyed will slowly return, and once more drive down prices.

Nor should we forget just how much the Exchequer loves inflation, as fiscal drag, their beloved tax on higher prices, smooths away so many budgetary blemishes. They will let it go, if they possibly can.

Commodity prices

On the input side we do still see commodity price rises as transitory, at least within the energy market. As others have noted much of that too is regulatory failure on a grand scale, not a true shortage. Price fixing by the state is a notoriously foolish concept, as we learnt in the 1970’s.

There are a number of other supply factors at play too, but while some will recur, most are temporary.

How long do we think the inflation spike will last?

So yes, inflation will spike, and yes it will stay elevated for much of next year, but no, we don’t see it as necessarily durable, once COVID restrictions and related behavioural changes vanish.

We are still pretty certain that the political costs of aggressive interest rate rises will outweigh any perceived price control benefit. As long as some Central Banks hold off rises, it will be very hard for others to do so, without sharp currency moves or bringing in formal exchange controls. That would in turn spook markets far more than rate rises.

The next phase of markets

All of this says to us that a major market dislocation, despite the benign signals, lies ahead in the next six months.

Markets shifting rapidly are more a sign of uncertainty than of a new degree of confidence, and we simply don’t trust it. We see inflation as apparently out of control, but no significant interest rate rise response is feasible. That can feel like stock nirvana, but also like investor purgatory, as you have no idea what is or is not a sustainable profit.

Charles Gillams

Monogram Capital Management Ltd

ESG : Being All Things to All Men

I have been attempting to not write about ESG all year, as passions run high, and it feels to be more about faith and politics than Environmental Social and Governance (whatever that is) itself, as they encompass an incredibly wide set of issues, now being squeezed remorselessly into a few tick boxes.

However, I have been greatly enjoying Simon Schama’s magisterial tome on the Batavian Republic, as the Netherlands were known during what we loosely call the French Revolutionary wars. The analogies to the situation today are startling.

Can you Take a Position on ESG Issues?

In the environmental universe, I personally tend to be far more a “dark green”, than a “light green”, which in very crude terms holds that sustainability is not a matter of work-rounds with the “same as before” levels of consumption, but of a reshaping to avoid the extraordinary growth in raw consumption seen over my lifetime. More Monbiot than Musk, you might say.

Yet on trade, by contrast, I would ally strongly with the ‘Social’ part of it: nothing frees a nation like free trade, and nothing builds prosperity so fast. Just ask the Chinese.

A new Form of Colonialism?

Free trade also includes the free movement of capital, so that the relentless red lining of the most impoverished third of the planet on the grounds of failing to meet our Western standards of governance, feels very much like old colonial exploitation.

Effectively you’re saying – ‘yes, do sell what you like, made by who you like, using what you like, but just not to our markets’.

How can anyone be in one place on all of these often-opposing issues? If you are, the investable universe shrinks to nothing, or indeed paradoxically becomes everything. I have seen ESG bonds where China and Qatar were the top holdings, I am sure on perfect ‘E’ box ticking, but not my idea of either the ‘S’ or the ‘G’ part of it.

Governance, the most Elastic Concept of all?

While in my experience, few things have so powerfully increased inequality as remuneration committees, festooned in ways to line the pockets of directors, and singularly toothless in their stated aim. But all it seems fine on the weird ‘G’ criteria.

There are many other fraternal and earnest slogans now hiding deceit. Several of the current entrepreneurs most carefully cloaked in greenery and its social equivalent, have a decidedly old-fashioned view of governance, a fondness for non-voting shares and other tricks, and boards stuffed with their mates, which then also leaves the substance of the ‘G’ part well short of the mark.

So, to me ESG ends up as so wide, that an investor who really cares must pick and choose where to place the emphasis. Yet even this is seldom possible, in part because so many collective instruments are already being packaged in strict tick box compliance, which massively restricts your options.

The curse of all index investing is you end up taking a set of equities typically based on their market capitalization, so “desirable” stocks by definition end up in wider and wider sets of indices. As so much is now index investing, you are then forced to acquire both sheep and goats, with little chance of avoiding one and adding to the other.

However, as a fund manager you must always play a twin game, of either allocating capital to where it is most productive or allocating capital to where it is most popular. Clients tell you they desire the former, so they want good ESG credentials, but actually want to have the best return too, in other words the latter.

Governments, as China is now clearly showing far prefer (as they must) the productive to the popular. Popularity is proving dangerous in that market, as therefore is for now, index investing. Just as you pile into owning the latest media sensation, the state starts destroying it, almost a re-run of our experience in investing in UK banking.

All of which leads me to conclude that like anything else in markets, ESG can be good value, but can also be poor value; what it can’t be is always wholesome. Investors should realize that if it is not to be all things to all men, it must also ultimately cause them losses as well as gains.

I could add a line on Jackson Hole and Jerome Powell, but that is all that it deserves, nothing new was said.

I notice that he too has become, skillfully, all things to all men.

Charles Gillams

Monogram Capital Management Ltd

Holiday reading – Simon Schama – Patriots and Liberators.

Simon Schama unpicks the eternal power and politics questions, seen through the simpler although less familiar lens of the Dutch.

I now finally understand what Camperdown was all about, so apparently it is not a racecourse, after all.

Although the Anglo Russian invasion of Holland remains mysterious, it does remind us how fleeting our alliances are.

The British showed considerable skill in repeatedly landing in Holland, looting the place, seizing much of the Dutch fleet, and then executing a negotiated evacuation, when they had clearly failed in their main mission of “liberation”, without too much embarrassment: an under rated skill it seems.

The sheer impossibility of nation building by force and myriad other democratic puzzles were exhaustively thrashed out by the Batavians, under the baffled eyes of the French invaders. Nothing changes, it seems.

While the sections on taxation and local government are rather strangely relegated to near the end, but feel to me, something of a connoisseur of both, perpetually modern. This was the period when the old inherited ways were first discarded, and our new ‘modern’ systems sketched in.

Their arguments over decades are now ours too. The clash of a European superpower and democratic freedom rings true still, the crippling burden of an overmighty, half blind and deeply corrupted centre remorselessly subverting the myth of its own creation by greed, the utter folly of war and the deep atavistic permanence of old boundaries are all visible.

Inflation: The elephant in the room?

Inflation and how persistent it is, now fascinates us although we will skip how that relates to US bond yields, as that currently makes no sense. We’re also pondering the recent high performance from non-US markets.

We signaled inflation as a forthcoming problem well over a year ago, and slightly oddly not for either of the two reasons now cited so often. The received wisdom, that it is all about freight rates and used car prices, identifies specific issues we had not spotted.

Freight and used cars – really?

The freight issue seems to be a jumble of factors, dominated by having the ‘wrong’ demand structure, so in any movement of goods (or people), one way traffic is also the worst, if you can get the return route paid for by someone else, you will always halve the cost. Hence the obsession on most mass transport with return tickets. Sudden demand shifts destroy that balanced economy. But clearly there is more to it, so poor port capacity, extra flows created (or existing flows destroyed) by COVID all matter, all that PPE displaced other goods, while grounding airlines eliminated vast amounts of high value hold space.

But all of that, the natural creation of new capacity (that is making more containers), or simply activating more shipping from lay ups, will create new supply, and we therefore recognize that whole process as a fairly short-term spike.

As for used cars, well, I can see from the congested roads that no one is using public transport, but with global over capacity, how long will that surge in demand for cars last? In general shutting car plants due to excess capacity still remains the trend. While flaws in the too tight “just in time” schedules have been apparent for a while, not helped by almost bespoke production, but that too is all probably transient.

After all, a hire car can be any colour, as long as it is black.

So, what did worry us about inflation? Capacity and competition remain the two drivers.

It was capacity, as either the number of viable business units has to decrease, if the costs per unit increase, or the price per unit sale must rise, hence inflation. This is obvious to most, although it seems not to many Central Banks. For a while any business will, it is true, keep going, even if only generating a marginal contribution, but soon it must either cease trading or lift prices. Companies just don’t sit about making losses, in the real economy.

The other part is competition, as the number of operators in a market decrease, the survivors gain greater pricing power to raise prices, while no one builds any new capacity simply to suffer losses. You can easily see these two dynamics play out in the coffee shop sector (or indeed with wine bars and public houses). COVID eliminates 50% of the capacity, by enforced social distancing. Takings must then also fall by 50%. You can prop that business up by furlough, or tax cuts, or eviction bans, but sooner or later the owner will conclude that in a fixed physical space, a 50% revenue cut just can’t work.

With operators in both those sectors and indeed many others deciding they have had enough and don’t want to face mounting debts, the capacity is then lost and the incentive to replace it is weak, so competition inevitably drops.

Looking back at the hire car sector for a moment

We are told it is price inflation caused by a temporary shortage of cars, but that sector famously is full of border line survivors, the margins are wafer thin and often come down to the residual fleet value. Several big firms have also dropped out through insolvency; of the rest many only ever survived on the twin props of residual fleet value and extended manufacturer credit.

Do you think high secondhand values are making them expand their fleets? Not that plausible. More likely they are cashing in. Nor do auto makers need to restock them on vastly extended credit terms, just to keep their own production lines running. New car sales to the sector are always at low margin to bulk buyers. So that’s not likely either.

We think it is quite possibly inflation from capacity cuts and weak competition, and that is nothing like as transitory. That is far more durable, not a brief supply side spike. Turnover is vanity, profit is sanity, as industrialists say.

In short Powell et al want to see no inflation, want to tell their political masters it is all fine, that they can keep running the engine hot, but having skimped on the engine oil, it seems rather more likely that running hot will simply seize the engine. At which point they must either coast to the hard shoulder or apply the handbrake of interest rate rises, before the economy blows a gasket.

Currency and the momentum model.

The other note of interest to us is that non-US markets are starting to flash up on momentum boards as exceeding US returns over some time periods, in particular in GBP comparatives.

In dollar terms the momentum is in the S&P 500 and NASDAQ. However, in sterling terms it is moving. We have noticed Europe shifting ahead for a while, but we were surprised to see our GBP momentum model now drawing our attention to Latin America.

Now a lot of these models (ours included) are very sensitive to the recent past (that is the momentum we care about, after all) and that means there are big moves to fall in or out of the sequence, so care is needed. But despite the headline turbulence and distress in the Latin American continent, it has forces in its favour; the index is dominated by big mining operations, closely followed by oil companies, then banks, which are seeing rates rise sooner than in the rest of the world, and then (often Mexican) consumer goods.

They will find the weaker US dollar helpful in some sectors too, but will especially enjoy the vast demand surge (and short supply line to) the US. So, all in an index with some good reasons for outperformance, despite the political noise.

Is Sajid now a factor to note? Rapid reopening will probably also continue.

Talking of politics, I don’t see the renewed ban on French holidays (or rather the absurd elongated quarantine on return, regardless of vaccine status), as anything to do with COVID. Rather it is a shock coming from the always unstable Tory politics, where the return of Sajid has created the first node of a genuine “not Boris” grouping, as a minister now too valuable to be left out in the cold.

Boris can’t bully him twice, without a major loss of face, so some of the other pretenders to the leadership want to take him down, by sabotage to his policy of an overdue full and proper re-opening.

Shapps, who dreamt up the absurd new ban, it seems wants to usurp the health portfolio, and apparently feels put out at being left in a dull and dangerous ministry, hence his attempt to claim territory and undermine a cabinet foe. However, I think his manoeuvre makes little difference to the overall thrust of government policy on rapid reopening.

We also note, that at long last the destructive and stupid attack on UK banks, by enforcing a dividend ban, when they were awash with cash, simply out of political spite, has been ditched. I suspect it is too late to reverse long term damage to the sector, but even if a year late, common sense is welcome, as is evidence that the colossal 2020 state seizure of power, is at last being pushed back, at a few points.

Last April/May I was writing about these kinds of issues, now sitting in this book, if the more regular amongst my readers would like to take a look – one of the measures has to be consistency of approach, after all. The second volume is under preparation.

Finally, we too will take a summer break, returning to this just before the August Bank Holiday, as summer draws to a close.

We wish you an enjoyable break and a well-earned rest from what has been a crazy year.

Charles Gillams

Monogram Capital Management Ltd

18.07.21