WE ARE NOT NOW THAT STRENGTH

Markets are confused, as are Central Banks, and while generally indifferent to small wars, we know that’s how large wars start. And we have another month till November 5th and the US election. In the UK the Chancellor says it is all terrible, but is splashing cash around with abandon, but then cancelling dozens of projects, and claiming she is pro-growth, while taxing investment ever harder and encouraging so much capital flight even the OBR has noticed.

The colossal COVID debt burden still hovers over everything, a burden that can only be shed by growth or inflation, one an investor’s friend, the other their mortal foe.

Market confusion is more about politics than economics, no US rate cut in July, then a double cut in September, now a November (post-election) cut looks uncertain. The stated reason for a double cut was weak employment, but the real reason was political. Powell even said in his press conference that the Governors voted for the jumbo cut “in the best interests of the American people” so not economics, and I suspect those archetypal insiders will believe keeping Trump out is exactly that.

So, we get a “value” rally, as collapsing labour markets would lead to multiple rate cuts, and market interest rates, surprised at the severity, then overshoot on the downside.

Except there is little evidence of anything wrong in US labour markets, as Friday showed, they are fine, and wages, along with rigid labour markets are driving inflation. Weird. But then good labour markets, plus buoyant earnings, plus falling rates sounds pretty good for equities?

Plus, something most odd in China, which from nowhere became one of the top markets in the last year, outperforming the major UK averages. Yet no one is clear why, on fundamentals. Yes, there was a stimulus package, possibly one focused on equities, possibly bigger than expected, but no one thinks it solves anything.

So, it (and ripples into luxury and metals) seems an almighty short squeeze. China had become so unloved, even its proudest fans had bailed out. The rush back in left other emerging markets, like India, struggling.

[Culled from two pages on Yahoo finance – read more here and here]

MANNERS, CLIMATES, COUNCILS, GOVERNMENTS.

Meanwhile, the Tory Conference was oddly upbeat, with some real choices, and a fair bit of optimism. The Tory party is in theoretical retreat, but greatly energised by a real debate, with members involved, about the new leader and a new direction. The disastrous election result had focused minds nicely, and yet was still discounted. Starmer had won fewer votes than Corbyn, and his popularity was already below Sunak’s. The loss was about “three tens”; voters switching to Reform, to the Lib Dems and the Sofa, sitting it out.

None of that was the love of another party, all of it was hatred of those Tories, divided and incompetent and now gone. In so far as the rump of the party now had stars, they were all standing for leader, no big guns were left after the disaster.

It was generally agreed that it must be the fault of Central Office and candidate selection, not the Party. The conference was also largely devoid of the usual big brother manipulation, fake applause, dire autocue speeches approved by a SPAD and ministers just too busy to care.

Tugendhat was bouncy, had the youth vote and the best video, but not convincing. Cleverly had worked hard, was fun and avuncular, relaxing and the obvious unity candidate. Jenrick gave some very strong speeches, plenty of thought, but seemed off-form and weary at the closing main event. Badenoch is an enigma, slightly thrown by adding “2030” to her pitch, when everyone was suddenly thinking “2029” again. Yet she is the one who wants to reform, draw a line below the stale “what did we do last time” and start afresh. She had the best merch too.

It is still a split party, for all that. A good chunk of the younger party is very keen on Net Zero, and they were extremely visible, indeed Net Zero before all else. However the MPs know that was a Cameron fantasy, so I am not sure how that plays out.

But also, a clear understanding that talking right, governing left is finally over, and that border security is high priority, and defence is too, but not with quite the gung-ho optimism of before.

In many ways Starmer’s inability to know what sleaze and greed looks like, even if it is all innocent (a big even) bodes ill for his time; “they are all the same” is a deep-seated rallying cry of pain.

THE SCEPTRE AND THE ISLE

I am enjoying “The Sale of the Late King’s Goods”, a slightly wonkish account of Charles I’s lost trophies, but an excellent canter through the lead up to the English Civil War. It is striking how state policy was all so plausible and desirable, except for a massive inconsistency on faith, finance and Europe.

The King was desperate to be trendy, to think common decency only applied to others, had no real conviction, in restlessly appeasing various European Courts, seeking favours that never came. While funding was all about just getting to the next OBR review with enough cash to pay off friends. (Well OK, not the OBR back then, but a truly sovereign Parliament).

After finding so many conflicting aims inevitably failed to work, he then tried to drag Scotland into a standard set of beliefs and rules, and hoped blindly that the Irish would do us a favour. The desire to be liked, to look good, to look to Europe for answers, to throw money at white elephants and foreign wars, and the absurd doctrinal battles, all felt far too familiar.

If we don’t know where we are going, just buying expensive tickets won’t complete our journey. To strive, to seek.

The title of this piece comes from Ulysses, a poem by Alfred, Lord Tennyson

https://poets.org/poem/ulysses

Andrew Hunt’s piece this month, which looks at the solidity of underlying data and China may be of interest to serious investors.

Tiptoeing Through the Tulips

Is real estate safe yet? How about renewables? And an innocuous Tulip.

All three of this week’s topics are notable for what they are not, Real Estate valuations do not reflect property markets or indeed replacement cost, Renewable Energy valuations do not reflect anything much, but include plenty of hope, and the new City Minister seems to have no obvious purpose beyond being a safe and reasonably loyal supporter of all things welfare related.

Unreal Estate

As we have remarked before, somehow the RICS valuations of property assets, used to value quoted property companies, became heavily reliant on interest rates and comparable bond yields and rather less interested in the real property market. They also seem to have become a tool for bank lending, disregarding other more real-world factors. Which explains the paradox of falling valuations alongside robust occupancy levels and a level of visible new office construction, certainly in London, which remains unabated and indeed the wider market is seemingly indifferent to the slump.

There is a lot behind those paradoxes, long lead times through planning, the desire to replace older stock if (as so often) it is to be leased out, the dominance of bank funding, not equity. Even so both collapsing valuations and the discounts then applied, have been damaging. This has been exacerbated by underlying fears about vanishing bank financing, in many ways a self-fulfilling prophecy.

We had something of a buyer’s strike where vendors can’t get bank finance to stay, and their potential buyers can’t finance to buy. The impact of working from home and the inevitable changes in business models adds to this.

Some areas, notably much of Docklands and many regional and secondary offices, have become untouchable. Closed end property vehicles have been forced to sell to meet bank covenants, and several open-ended ones have simply been forced to liquidate. Something of a perfect storm.

Yet, prime real estate has in the end, come through over time, and as we have noted before the residential market has been pretty immune from falls in at least nominal value.

In both UK and Europe valuations are now becoming more stable, and I would expect for the same reason they fell so fast, they will start to recover as rates fall.

For all that, in the equity market this year we have seen reasonable returns, as discounts to stated NAVs narrow, on both sides of the Atlantic. A number of activists are also pushing through mergers or reconstructions, which helps.

And yet nerves persist, the underlying discounts maybe less, but for Investment Trusts that own REITs, there are two tiers of discount (one underlying and one at the vehicle itself) and that top level has widened in cases.

Having endured that lot, and avoided earlier temptation, I am looking to re-stablish positions in half a dozen of these stocks in the UK and Europe, to work out the two that look like long term holds into the next cycle.

Not Renewed

Renewables have somewhat of the same issue, they are valued in part, again on the discount rate, so were driven down by rate rises, but also an odd view that energy prices are destined to fall over time. However, just as I have seldom seen prime city centre values fall for long, the hope of long run falling energy prices, runs counter to my experience.

There is also a great deal of uncertainty, both about what they produce, after numerous equipment and supplier failures, when they produce, and most of all, how to get product to the consumer with a credible margin.

But overall, the two sectors, property and renewables are quite similar, you have to get land, get planning, install infrastructure, hire builders, pay banks, realise your timescales were always far too optimistic, be nice to buyers, accept a discount, move on.

Having been wary of Renewables on the way down, I do now wonder if they are a separate asset class, or just a subset of several, including utilities, construction and distribution. If so, is it not better to leave that to the big multinationals with deep pockets?

Planting Tulips

So, to the new City Minister : Reading the current incumbent’s speech to the Stock Exchange, (not high on my list) it was of course indistinguishable from the last lot. The Treasury keeps these speeches, and the newest minister trots them out – often this is just an exercise in how well the next one mimics sincerity.

Has the Treasury orthodoxy changed? No. The allocation of capital remains the point of pain at the end of staggering amounts of hopelessly outdated regulation, some of them completely failing in their objectives. That much is unchanged.

Tulip herself is deeply worthy, UCL degree in Eng Lit, King’s London Masters in Politics, Policy, Government, so she should know how it all works and be able to write a good memo. But if we think the Government’s talk of “growth” is anything more than the illusory plug to stop the welfare budget draining us dry, a most implausible appointment. The milch cow must be kept placidly tethered, while it is milked.

The City will naturally be content, as ever, as long as no one rocks the boat.

But for all the ill-mannered sneering at the nice Mr. Draghi, and the EU’s failure to grow, we are in pretty much the same place. Now if Tulip wanted to be useful, and justify her principled disloyalty over leaving the EU, she should be mapping out how to join the Euro in 2030.

No road back to Rome exists, save through that thicket of joining the Euro first, the EU got that wrong before, it will not do so this time.

While of course half of Draghi’s capital market complaints are shorthand for saying that after all, Europe needs the City of London, not vice versa.

By their works . . .

Well, the works this week: a pensive Jerome Powell does nothing, a reckless Andrew Bailey does nothing, Canada joins Biden in picking fights, and the bulk of most equity markets are stuck, going nowhere.

NO MORE US RISES

So, the apparently knowledgeable financial press said that Powell predicts rate rises? He said nothing of the sort of course. True the other members of the FOMC dot plots were in aggregate higher than the current rate, but by a fraction, it is like the average family being 2.4 children, meaning everyone, in the absence of King Solomon, has three children. No, it does not, it means on average there are no more rate rises.

So, Powell has stopped the runaway train, by lighting red flares in front of it and throwing railway sleepers across the track. Job done. Inflation is way below base rates. Bailey has asked nicely and tried to lasso the inflation express from half a mile down the track - won’t work. Inflation above base rates is misery, inflation below base rates is time to loosen.

Powell did start rambling, describing parts of the economy with “by their works ye shall know them” but decided that was all a bit erudite, before he had even finished the thought. He then reverted to the old saw, “forecasters are a humble lot, (with much to be humble about)”. Presumably that is unlike Central Bankers? I still think that judging them by their works makes sense.

But Powell is happy: the Q&A session threw him a litany of gloom, government shut down, students having to repay debt, auto plant shut downs, but no, all is fine.

The core US consumer and therefore the US economy, is in a good place was his verdict.

BAILEY DITHERS

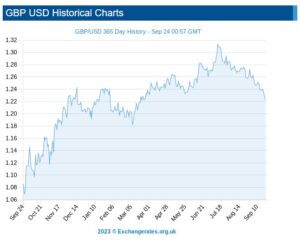

Bailey seems to like to crash the pound every October, which is not good for inflation, just as picking fights globally is not good for oil prices. And it is also bad for inflation.

And either the UK government will cave in to public sector strikes or productivity will keep falling due to said strikes. Neither are much good for the economy. Nor is it good for the markets: in performance terms, the UK remains the sick man of Europe, amongst major markets.

THE MAGNIFICENT SEVEN RIDE ON

I was at the annual Quality Growth conference in London again, a stock picker’s feast as usual. It seems that if enough stock pickers can agree on the menu, as the dominant prevailing theory of investments, they will drive the prices of their favoured stocks ever higher. Which they do, it seems. This is helped by the ‘over the long run valuations don’t matter’ line, pushed hard by Baillie Gifford (amongst others). You might recall my article on Scottish Mortgage a while back.

And of course, as we know from both index and momentum investing, once something starts to move in a flat market, it keeps moving.

But that leaves the vast bulk of quoted stocks flat or down on the year, which makes some sense. When rates rise, bonds are substituted for stocks. The last two quarters in particular have been flat to soft, and while some of these stocks may have hit a bottom, it is still very hard to tell.

The only good news for UK investors is that Andrew Bailey has ensured their overseas (especially US) stocks have a nice currency tailwind.

MADE IN JAPAN

Meanwhile from Comgest there’s a radically different view of Japan. The equity rally there has been fantastic, but it is not the typical exporter boom of a weak yen, in their view, but more about bank stocks soaring on the expectation of the end of Central Bank rate control. This allows their vast balance sheets to earn a real return, at last. This is quite a departure from the general explanations about “this is Japan’s time”. That one has caught me out far too often, but explains the horror show from respected funds like Baillie Gifford Shin Nippon - small and illiquid is just nasty everywhere.

So, although the global rally looks to be strong, it is terribly narrow, and built on different foundations in different places. Or more positively, a broad advance awaits the first rate cuts, either from triumph (US) having controlled inflation or disaster (Europe) having created a recession and left inflation out of control. Either route to rate cuts wins, it seems.

GLASSHOUSES AND THROWING STONES

Oddly, I feel the Canadian spat with India is really quite serious, the tendency of rich Northern countries to preach, in this case standing very carefully behind the only global superpower’s shoulder, really annoys the global South. It has been going on for centuries and is at heart simply the old colonial mindset.

India’s continuing reaction may well portray the accuracy (or otherwise) of the allegations, as on the face of it this is deeply insulting to the world’s largest country, and one that has tiptoed down the line between offending the West and creating starvation and destitution for millions in the South.

I don’t believe it - murdering virtuous plumbers in Canada over the Punjab, which has long ceased to be a primary source of domestic concern, is plain weird.

All things are possible, and India cares far more about Kashmiri terrorism (for instance), but if it is false, expect a sizable slap to Canadian interests, and more accommodation for Putin.

After all, if you are treated as if you are behaving like Putin, why would you ostracize him?

JENSEITS VON GUT UND BOSE

We ponder the point of the UK markets, ignore clashing BRICs, set up for the slow fall in interest rates in 2024, yes, long lags are long.

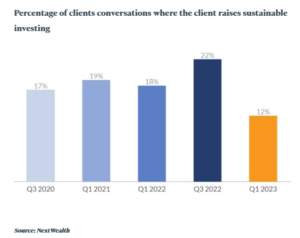

There are two investor markets, one akin to gambling and speculation, one allocating capital efficiently to invest capital or fund governments. But like weeds in a nutrient rich field, spare liquidity attracts the rankest growth of useless vegetation. There’s no clear way of knowing which is which. Money famously does not smell, and clients don’t really care much about how they earn a return, whatever they may say.

From: The FT Adviser Website

Fads and fashions in investing fuel some success at first - then they can no longer conquer new lands, and deflate, dragging down asset values as they go.

ARE INDIVIDUAL UK STOCKS WORTHWHILE?

I look back, as all investors should from time to time, at my successes and failures. Luckily out and out failures are pretty rare, and in some measure, so are successes, as I quickly milk the wins (usually from takeover bids), so they disappear from the record.

This leaves me a pretty solid mass of fairly dull UK equity holdings, I slightly favour value over growth. So, I know a simple snapshot won’t reveal the steady benefit of, at times, decades of good dividends.

But at the end of it all, for a UK investor, what remains is a mass of general mediocrity. Resource stocks have been good to me, still are, but the mass of industrials? Not really.

Or property companies?

Well big dividends from REITS, but again not really. Of financials? Again, long years of high dividends, but capital values stay scarred by the GFC. Chemicals, retailers, distributors, tech, utilities: well, all fascinating, with some good runs, often good yields. But in the end?

I could ignore such perennial plodders when their yields were far above base rate, but they are now surpassed, by a simple savings account.

So, I do wonder at times like this, why I hold them. Doubtless we will get rallies, but the tone feels a tad discouraging just now. And I sense the politicians of all hues, who seem to be eager to relieve me of anything that looks like a nominal gain, or enforce their often extreme views on my assets.

PERHAPS OTHERS DO IT BETTER

My long-term winners by and large stack up in investment companies, with specialist fund managers, and almost entirely overseas, or at the very least global. Not that is much of a surprise, we have mentioned before how the FTSE100 has not moved much in twenty, going on twenty-five years. Yet again it has flattered to deceive this year, yet again it has that slumping dinosaur feel to the graph.

The UK is not alone in that. Most of Western Europe shares that fate, and Eastern European investing has been a good way to create losses. Somehow Europe’s governments have done just enough to keep investing alive - and somehow the stock markets have had just enough liquidity to avoid collapse.

It is partly why so many investors love small companies, but they are savagely cyclical, as we are seeing just now.

I could blame management, and their apparently limitless greed, but while many quoted boards maybe have rogues or knaves, but nigh on all of them? No, I won’t accept that.

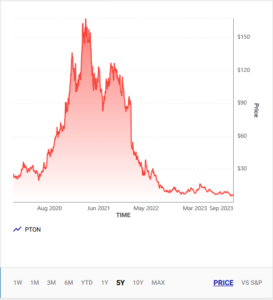

Globalization has freed capital to move easily and fast. Far faster than any real business can adjust, and in this world the ability to attract capital is vital. True many attract it, to waste it, like a meme stock, or Peloton, but it would be wrong to see that as a line of tricksters repeatedly finding ways to con the market (although many have) more about the power of liquidity to inflate prices, attract buyers, inflate prices once more, in an unending climb. That is until the last buyer has paid up, and the tipping point is reached.

Taken from this website

Then the whole thing unwinds downwards, down to a true value, or less.

WHERE NOW?

On the one hand, as interest rates fall, and they will do soon, even if that one last hike is much discussed and may well happen, the path looking forward is downwards.

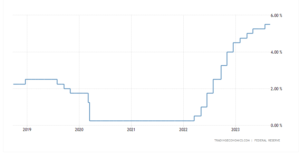

FED rates in the last 5 years

This should benefit value stocks, as more and more dividends emerge once more above the high-water line of cash deposits. Rates won’t go all the way back to zero, that is gone, but should start on the way down.

On the other hand, the liquidity trade is here to stay, money attracts money until the thermal tops out and the vultures glide along to the next spiral, or indeed back to the last one.

And looking over decades, as fund managers must, that is all that happens in most markets globally, one or two have true secular growth that also gets returned to investors (a key caveat), most seem not to. Investors become either hobbyists in love with a stock or short-term traders. It is notable how many of the new breed of big company directors spurn the shares of their own companies, bar a token few thousand.

Markets seem to have progressively been made easier for momentum, versus ‘true’ investors, allocating capital to create real jobs. The capital allocation bit is worthy but dull, and arguably governments and regulators seem to have strangled it into stasis.

The endless, joyful, mindless dance of momentum, is simpler, prettier, easier to tax, cheaper to trade; quite wonderful really. But is it much else besides that, or is it substance without meaning?

It is odd how governments moan about the lack of growth and yet cripple capital allocation. In a market system, the best capital allocator wins. It is really quite simple.

Once the tightening stops, there should be more currency stability (of sorts) as all the Central Banks realign their rate patterns again. In (to us) an unresolved month, the dollar’s strength has been notable, when not a lot else was.

Reserve in Reverse

Fallen Emperor?

With almost two thirds of global equity markets represented by the US, the fall in the dollar so far this year is quite dramatic, and for many investments, more important than the underlying asset.

UK retail investors are especially exposed to this, as although Jeremy Hunt (UK Chancellor) may not notice it, the US is where most UK investors went, when his party’s policies ensured the twenty-year stagnation in UK equity prices.

While Sunak continues to pump up wage inflation, which he claims, “won’t cause inflation, raise taxes or increase borrowings” Has he ever sounded more transparently daft? Sterling, knowing bare faced lies well enough, then simply drifts higher. Markets know such folly in wage negotiation can only lead to inflation and higher interest rates.

We noted back in the spring, in our reference to “dollar danger” that this trade (sell dollar, buy sterling) had started to matter, and we began looking for those hedged options, and to reduce dollar exposure. To a degree this turned out to be the right call, but in reality, the rate of climb of the NASDAQ, far exceeded the rate of the fall in the dollar.

While sadly the other way round, a lot of resource and energy positions fell because of weaker demand and the extra supply and stockpile drawdowns, which high prices will always produce. But that decline was then amplified by the falling dollar, as most commodities are priced in dollars. So, a lot of ‘safe’ havens (with high yields) turn out to have been unsafe again.

The impact of currency on inflation

Currency also has inflation impacts. Traditionally if the pound strengthens by 20%, then UK input prices fall 20%. The latest twelve-month range is from USD1.03 to USD1.31 now, a 28% rise in sterling.

In a lot of the inflation data, this is amplified by a similar 30% fall in energy, from $116 to $74 a barrel for crude over a year. In short, a massive reversal in the double price shock of last year. In fairness this is what Sunak had been banking on, and why the ‘greedflation’ meme is able to spread. But while that effect is indeed there, other policy errors clearly override and mask it.

A Barrier to the Fed.

In the US we expect the converse, rising inflation from the falling currency, maybe that is creeping through, but not identified as such, just yet, as price falls from supply chains clearing lead the way, but it is in there.

Finally, of course, this time, the dire performance of the FTSE is probably related to the same FX effect on overseas earnings assumptions. Plus, the odd mix of forecast data and historic numbers that we see increasingly and idiosyncratically used just in the UK. If the banks forecast a recession, regardless of that recession’s absence, they will raise loan loss reserves, and cut profits, even if the reserves never get used.

Meanwhile, UK property companies are now doing the same, valuing collapsing asset values on the basis of the expected recession, and not on actual trades. So, if you have an index with heavy exposures to stocks, that half look back, half reflect forward fears, it will usually be cheaper than the one based on reality.

Why so Insipid?

OK, so why is the dollar weak? Well, if we knew that, we would be FX traders. But funk and the Fed’s ‘front foot’ posture are the best answers we have, and both seem likely to be transient too.

If the world is saying don’t buy dollars, either from fear of the pandemic or Russian tank attacks or bank failures, that’s the funk. As confidence resumes and US equity valuations look more grotesque, the sheep venture further up the hill and out to sea. To buy in Europe or Japan, they must sell dollars.

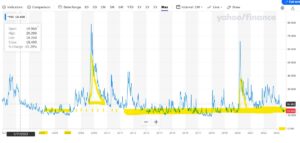

The VIX, in case you were not watching, has Smaug like, resumed its long-tailed slumber, amidst a pile of lucre.

From Yahoo Finance CBOE Volatility Index

So as the four horsemen head back to the stables, the dollar suffers a loss.

The Fed was also into inflation fighting early; it revived the moribund bond markets, enticed European savers with positive nominal rates, (a pretty low-down trick, to grab market share) and announced the end of collective regal garment denial policies. But having started and then had muscular policies, it must end sooner, and perhaps at a lower level. So that too leads to a sell off in the dollar.

Where do we go instead?

So where do investors go instead?

In general, it is either to corporate debt, or other sovereigns. Japan is not playing, the Euro maybe fun, but not so much if Germany is getting back to normal sanity and balancing the books again. So, the cluster of highly indebted Western European issuers are next.

Sterling now ticks those boxes, plenty of debt, liquid market, no fear of rate cuts for a while, irresponsible borrowing, what is not to like?

For How Long

When does that end? Well, the funk has ended. You can see how the SVB failure caused a dip in the spring, but now the curve looks upward again. Although fear can come back at any time, as could some good news for the UK on inflation. However even the sharp drop the energy/exchange rate effects will cause soon, leave UK base rates well south of UK inflation rates.

So, every bit of good news for the Fed, is bad news if you hold US stocks here.

How high and how fast does sterling go?

Well, it has a bit of a tailwind, moves like any other market in fits and starts, but could well go a bit more in our view. Oddly the FTSE would be a hedge (of sorts).