Small Earthquake

Full year corporate accounts have now all been published, in several cases even read, so it is time to look at the raw data beneath all those clever funds and derivatives, at the underlying companies.

There are two themes emerging: one is the extraordinary scale of movements last year in defined benefit pension assets and liabilities, and the other is how we should evaluate the size of the Scottish discount.

Pension Asteroids Collide

Enormous numbers are shifting on defined benefit pension schemes, nearly all the big ones seeing asset losses of several billion, but with matched declines in liabilities of the same scale, leaving almost no apparent change, all stitched back together. This impacts in particular the big banks, utilities, resource majors and of course life companies.

It is a source of some nervousness, when large numbers crash about the balance sheet, dwarfing the trivial numbers in the profit and loss account. But they are also quite different items, the asset declines (from long dated gilts) are real money, stuff you could have woken up at the start of the year, picked up a phone and sold.

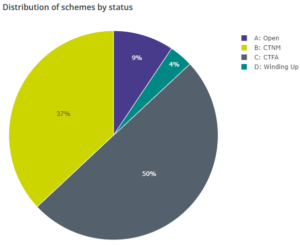

Yet the liabilities in terms of actual money to retirees hardly shifted, it was just discounted differently. While nearly all (91%) of the 5,000 odd UK schemes are either Closed To new members (CTNM) or to future accruals (CTFA). So, of little current relevance to operations.

From: This page on the UK Regulator’s website – the key to the abbreviations is also there.

What is relevant is the sudden loss of tens of billions of pounds ny these pension funds. But that is ignored, because of the liability offset, but it was lost and is gone. This came along with dramatic changes in the value of the gilts they hold, in cases by more than the unit value decline, as gilts were actually being sold quite hard too - a big chunk of assets that no longer exists.

Scottish Exceptionalism

So, to the Scottish discount. What is it? In our valuation models we discount earnings for political and operational risks, including for governance, including the location of the auditors. It is an internal assessment, so matters not a jot, unless others do the same.

We know the discount exists, the reversing tide of “swimmers” or companies raising money outside their domestic market, tells you the entire UK is already at a fair old discount to the US, even for companies with mainly US earnings. Should the same apply to Scotland? And by how much more? 20%? Whatever it is, it is getting bigger for us.

In my view if you are a FTSE100 Company, you have big four auditors, London office. Regional offices and smaller firms will be more dependent on a single big client and in enough cases to matter, that disproportionate power will swing it, for the Board, against the investors. Not that London based Big 4 is perfect (we know they are not).

So, to Scotland, there is a long-standing assumption they will use Scottish audit offices, and a drift to using Scottish firms too. This used to mean high quality, but I now sense they lack experience. Boards have also increasingly become reliant on a smaller pool of candidates, and two recent high-profile cases leave me wondering about their governance.

1. Scottish Mortgage Investment Trust

We sounded the alarm on the peculiarities of this popular fund two years or so ago, in their glory days. Like some other troubled funds, they took on more and more unquoted holdings. All disclosed and approved, but in the end clearly linking private and public markets, indeed boasting of how many of their quoted holdings started out as private ones. Well, a closed IPO market knocks that bet pretty hard. When a lot of them are also Chinese, that renders that pipeline even more suspect.

While disclosed, yes, but adequately disclosed? In one case they hold G, I, H, A, C, B Prefs and A Common Stock, with greatly varying valuations by class. We were nervous, when the share price failed to discount these holdings, at a time when other equity trusts, indeed private equity specialists, were facing growing discounts on their holdings.

That has now corrected, the Board has finally stood up to the manager and questioned the existence of the in-house skills to back up these valuations. But in the process our Scottish discount opened up.

From a three year high of over £14 per share, SMIT has fallen hard to just over £6, wiping out half the value or the thick end of £10bn, from presumably mainly UK retail holders. It has kept falling. I think it will need to list those unquoteds separately, and give holders a share in each asset pool, to regain its once illustrious crown.

2. John Wood Group

The John Wood Group, which operates in natural resource consulting and contracting, has been a disastrous investment. A well-respected consulting firm, its Board decided to merge with another well-respected quoted consulting firm, Amec: outcome? Hugely negative. Five years ago, its shares were over £5 and even quite recently shareholders were hoping a private equity bid would rescue them after only a 50% loss.

But having overseen that catastrophe, the Board seemed not to be listening. They only very reluctantly agreed to bid talks, and somewhere in those talks something persuaded the bidder to back off. From the bid inspired high of £2.55, it has now virtually halved again. The Board feels old style, out of date, insular. I particularly enjoyed (it is one of the few pleasures of reading so much verbiage) their illustration for the diversity report, (see below).

Extracted via screenshot from the Annual Report and Accounts of the John Wood Group

This reminded me of sitting on a School Curriculum Committee (see the fun I have). We had to cover multiculturism, and the teacher (in the high pale Cotswolds) chose India; intrigued I asked why? The answer was that allowed the topic to be covered for our forthcoming Ofsted inspection, by having a takeaway meal in class. That was it. No map, no history, no people, just an affiliated consumable.

But nice money for the executives, look at last year’s bonus structure. That odd picture served them well. For an original business that is now itself worth nothing and half of what it paid for Amec !

Now, but for that Board, or that history, Wood looks a nice business, cleaned up, $5 billion of apparently profitable sales, with a market cap of £1 billion, not a lot of debt, all three divisions profitable at least at the EBITDA line. Heavily exposed to renewables, including in North America, it even reports in dollars. You could argue the bid was low - no doubt the Board did - but if the price then halves, after the bid vanishes, how credible are they?

So, in comes the Scottish discount – because this pattern of behaviour speaks of a particular culture and leaves me feeling the need for a bigger safety margin, to buy a business from that region.

All Clear? REITs and Private Equity

When do we go back to property (REITs) and private equity (PE)? We look closely at these two areas, as there appears to be nothing new to see or say on interest rates or inflation.

Macro is dull just now

Neither the Fed nor the Bank of England, nor indeed the ECB meet this month. So, the default is to assume a half point rise all round. Which should mean Western central banks are broadly aligned for a while, so by implication are currencies.

Clipped from this site – downloadable from source.

Recessions lag rate rises, so are not due yet either, although clearly one is coming.

Inflation will probably drift lower, but the employment markets stay strong, as the shuddering readjustment out of COVID continues to keep churn elevated. In person service hires roughly balance stay-at-home sector losses for now.

Basic food commodities, which have driven much of the recent inflation surge, will stay elevated until the current crops/stock are harvested and replanted late in the spring. Energy is possibly oversupplied for this winter. So not that much change in those two inflation drivers yet.

REITs

So, when is it safe to go back into risky assets? We look at two contrasting stories, firstly REITS which are seen as bond proxies, so cannot properly bounce until rates top out. This seems to need a couple of months at “no change” from the Central Banks. We are less sure about quantitative tightening ending, but most of the market gets spooked by that too. We think it matters little, because masses of global liquidity make what US banks hold somewhat irrelevant.

Nor do we see why REIT assets held on 7–8-year leases with typical debt fixed for half that term, should oscillate so violently over a few months, but that’s life, they just do.

Does property matter?

Institutional interest is not high, we know that, and most institutions need daily liquidity before all else, which lumpy property can’t give. Plus, for boring old REITS a lot has changed for the worse.

Who knows where retail space settles? It remains over supplied (and overtaxed), likewise probably office space, with the added wrinkle of retrofitting for carbon neutrality. COVID created an excess of new storage and warehousing, which also needs to be worked through, so that’s not safe either. While no institution wants the grief (or bad publicity) of dealing with individual tenants and homeowners, so we have long thought if you want to play the residential market, buy high street banks, as a kind of proxy. Mortgage lending is about all they do now.

It is private investors who still love property as a tangible asset; most are over invested in property and have been over rewarded for being so. Habit really. But if they had that habit before, they are still keen to know when to step back in, at bargain basement prices.

Private equity

Now PE, is a bit different. Yes, private investors like it (like hedge funds) but trust it about as much. Never sure why you would buy a car with just an accelerator pedal, and only forward gear, but most investors buy just that: no shorting, long only for ever. Must be nice to have a mind wedded to constantly rising prices (which long only implies).

PE is just that, so you are buying for management endlessly improving, but adding into the mix a belief in high gearing. You also believe that the managers will constantly be selling and buying investments at a profit. So, you must endlessly mark up your stock, to shift it too.

Can it really work like that?

Markets do not agree.

So, while there are many eye-wateringly deep discounts in PE, markets expect debt to blow a few things up and prices to sell stock to be cut back hard. With some reason, big banks have a shed-load of deal related debt stuck on their balance sheets, probably a fair bit of equity too, and no one is underwriting an IPO, if there is a scintilla of risk left involved. So, unless it is marked down, we have a stand-off, a buyers’ strike.

And in tech, the flaky stuff (AIM etc) is back down below pre-COVID levels, and possibly still falling, which is logical. The better stuff, but with an FX impact, bottomed out a while back, possibly in June? The big “portfolio” quoted holders did so in October, when discounts maxed out around 50% and the FX (i.e., dollar) tailwind was keeping asset values rising.

NASDAQ - a proxy for private equity

However, the NASDAQ hit a new low on 28th December, and that looks much less like a clear bottom, more a long base from October. It is a tough call; NASDAQ multiples drive PE valuations, so that is not helping. Investments with three year’s money a year ago, now have two year’s cash and judging by the speed of layoffs, know that when that drops to one year, funding lines either dry up, or get super pricey. And I don’t see FX helping much this year.

So yes, massive discounts, but also yes, huge lags and the normal discount implied for firms that mark their own homework on the valuation side. Audit firms may also be growing more supine (or getting sacked if they ask the real questions).

So, on a five-year view the sector is fine, even cheap, but on a five month or five-day view? The jury is still out.

While the PE sector is still looking better than REITS in terms of recent prices, it is still, in our view, the one that has yet to base out. If the reason for revival is a flourishing IPO market, that feels more like three years away; by contrast the stability in interest rates that REITs need will probably arrive this year.

So, we stay in touch with both areas, but by no means all in - not just yet anyway. But nor given the performance and yield they give, can they be ignored for ever.

Welcome to 2023.

Charles Gillams

WHAT DO THEY KNOW OF ENGLAND?

Let us look at tech, private equity and this seeming market bounce, driven by those sectors. The NASDAQ is up almost 10% at 11,320 after a trio of twelve-month lows in the mid 10,300’s, the latest of those lows just this week. Meanwhile it looks like the US Elections have delivered both gridlock and a rebuff for Trump, which some see as a perfect mix.

Today’s post title is derived from Rudyard Kipling at his most sanguine and reflective.

I HAVE FLUNG YOUR STOUTEST STEAMERS TO ROOST

The true horror of the tech wreck has also been concealed for UK investors, by the climb in the dollar, a move that seems to be going into reverse. In terms of closing prices sterling has rallied hard from 1.08 to 1.18 in a little over a month. This has left the NASDAQ collapse, from touching 16,000 - brutally exposed, now without much of the concealing currency appreciation.

Where is the Nasdaq headed?

We suspect that the NASDAQ is heading lower still, but accept that is a big call.

From this page on Tradingeconomics

It remains a crowded space for a lot of unprofitable companies to jostle, as they build market share. This disguises the possibility that in some spaces, even owning the entire market will still be loss making.

However, market sentiment has perhaps turned, the tech rubbish generally got chucked out early. The subsequent switching out of the tech majors probably had to be into Treasuries, where their recent price rises suggest some demand, or into cash.

It remains a crowded space for a lot of unprofitable companies to jostle, as they build market share. This disguises the possibility that in some spaces, even owning the entire market will still be loss making. Bumping up against that is the second phase of the market collapse, as the multiples on profitable tech giants returned to earth.

And cash (and oddly apparently the S&P) has also been seeing inflows from China and crypto, as those areas have sold down hard. There is also the unpleasant negative impact of holding cash, on returns. Put this together with sentiment, and this may well help the NASDAQ bounce into the year end. However, many fund managers cite the dotcom bust as meaning this is now starting a multi-year sideways recovery phase, not a quick bounce at all.

LONG BACKED BREAKERS CROON

A concurrent look at Private Equity is important. NASDAQ multiples drive much of their values and are falling, and with such a recent twelve-month low, Q3 valuations (private equity valuations are always lagged) have further losses built in. And a sprinkling of those will now also be based on a significantly higher dollar too. That won’t be pretty either.

Plus, as we know there are some spectacular blow ups lurking in there, the insolvent FTX was a big investor in, and investee company for, some well-known PE names. Overall, despite solid reports, I am still expecting some fair-sized holes in quoted private equity, as either the NASDAQ rises and the dollar falls, causing currency losses, or the NASDAQ falls and the dollar rises and the one again masks the other.

Access to distress financing, has it seems largely vanished, as it does at times like this, making the chance of highly damaging wipe outs, not just down rounds, much greater.

A possible dollar sterling parity?

But those talking of dollar sterling parity are surely way off now. So, regardless of future disasters, I want more information before seeing UK Quoted Private Equity Investment Trusts as a buy. About six months after the NASDAQ bottom, will be a good valuation point, and that likely means Q3 2023. At that point we will know what the current large discounts really refer to; I don’t expect them to look anything like as generous.

THE UK - UNDER A SHRIEKING SKY

There is a lot of market optimism about the next UK budget, based on Hunt being really nasty. That may overstate his hand, as the Government has long abandoned reform, it can only support out of control spending by harsh tax rises, which will certainly kill jobs, but probably the wrong ones.

Nor can it do much to enhance investment and has foresworn labour market reforms, so both of those, with existing policies and more rate rises, must encourage the persistence of poor productivity.

Although of course the real budget numbers will be barely mentioned; energy, rate rises, and inflation are largely out of Hunt’s hands. He is lucky all three do look a lot better than when he was installed. So, the need for harsh medicine is rather reduced, and may even disappoint.

But just as the rally helped US risk assets, so it helped others, like property, come off a deeply oversold floor. TR Property Investment Trust has jumped 30% in a month, for example, and still yields over 4%.

Post Mid-term elections for the US

And coming full circle, although slowing inflation took a lot of the credit, at least some of the post Mid Term bounce came from realising that the Federal Reserve now has an ally in the legislature. It can be less vigorous in steering the economy, just relying on the brake pedal, as Biden and Congress are no longer able to simultaneously hammer the accelerator.

Overall, however we still remain cautious, we expect this pre-Christmas rally to fade, rate rises to persist into at least Q2 2023 and rate cuts to be a 2024 feature. And peak gloom lies ahead as those rate rises conclude and then start to actually bite.

Looking ahead

In general markets have had a solid look at the worst case this year, from famine to invasion and nuclear war, to out-of-control Central Banks and deluded politicians, and nothing terribly dramatic has transpired. So even with bad things still happening, we don’t see a repeat of this year’s dramatic falls either.

Charles Gillams

- The Kipling Society meets on November 16th, at the Royal Overseas League.

Which is the Leviathan?

This is a week to ponder the role of private equity in portfolios, in what may be an early phase of a great investment and technological explosion. There seems to be no sign of higher interest rates and a stubborn refusal by Central Banks to care much about inflation. The talk of a UK raise always looked to us like a head fake which we ignored.

Spotting good and bad private equity

So first to private equity, a beast that comes in many guises, not all benign from an investor viewpoint. All liquidity fueled equity explosions come with a heavy loading of chancers; Bonnie and Clyde’s rationale for bank robbery remains valid.

Good private equity relies on management being superior to that of their targets. This can be in their analysis, their execution, their swiftness of foot or their innovation. All of this generally flourishes away from the hidebound inertia of many listed companies and their professional Boards of tame box tickers.

Bad private equity uses accounting tricks, the malleable fiction that the last price is the right price in particular, and the terrible phrase “discounted revenue multiple” which is a nice conceit for “never made a profit”. All of these share the same vice of management marking their own work.

So, we struggle with the likes of Scottish Mortgage and its little array of unquoted Chinese firms, the alphabet soup of non-voting share classes and love affair with management. Maybe they are that skilled, but nothing that looks like a real two-way market is evident to us, in many of these valuations. We have by contrast long admired Melrose Industries for their quite ruthless devotion to turning over their investments, good or bad and stapling executive pay to actual cash realizations paid to investors.

Where we stand – given our strategy

For an Absolute Return specialist there are added constraints: we want to hold under twenty positions altogether and all in ones we can sell tomorrow afternoon. And we like holdings where valuations are transparent, there is no gearing (there is usually quite enough in the private equity deals already), and you can pick them up for a fat double digit discount: oh, and we do like a yield too.

So, we are looking for big, listed options with hundreds of high-quality funds bundled together and for any yield, a bias towards management buy outs. We are certainly not at the venture capital end, with silly pricing, high fail rates, unrealistic managers, and not a decent accountant in sight and aspirations to change the world. Met those, invested in too many, and donated more shirts off my back than I care to enumerate to their serial failures and inexhaustible funding rounds.

But there are good things about Private Equity, one is that in a rising market, it can be like clipping a coupon. The accounting rules require them to be backward looking, so coming out of a trough they are typically reporting on valuations that are three or four months old, which in turn reflects business activity up to six months old. As they trade at a discount of typically 25% or so, you can buy today at a 25% discount to the value of the business they were doing in the spring. There are no guarantees, but for most, that was a lot worse than current conditions, so today’s price is simply wrong. This is a time machine that lets you buy now but pay at old prices.

Watch for built in volatility in private equity

These lags are complex, the reference points are often public market valuations, and so there is volatility built into them. While in an Absolute Return fund, not only are choices limited but the overall exposure must be too. However, in those rare purple patches of fast recovery and expansion they are excellent for performance.

What kills these bonanzas off is tight credit. In part they need debt for trade, but also their realizations rely heavily on it. A closed IPO market does them no good (just as they enjoy an exuberant one). That is a risk, as liquidity starts to tighten, that this will hurt, but as Powell and the Bank of England both showed, there is no political appetite for that just yet.

The UK and US on taming the leviathan

Indeed, Sunak’s UK budget yet again feels reckless, devoid of any discipline and with every department cashing in. Government spending is predicted to rise to 42% of GDP by 2026, a fifty year high. Healthcare alone is predicted to have grown by 40% in real terms since 2009 (both estimates from the oddly named Office for Budget Responsibility). At that level of loading, it is inching closer to hollowing out the entire budget and causing it to implode. (Leviathan was just such a creature “because by his bigness he seemes not one single creature, but a coupling of divers together; or because his scales are closed, or straitly compacted together” feels an apt description of this new giant state apparatus.)

But that gamble means there is no room to pay higher interest rates, or the economy will be reduced to a double-sided monster. The one face devoted to raising debt and levying taxes and paying interest, the other to feeding out of control public spending, with nothing left in between.

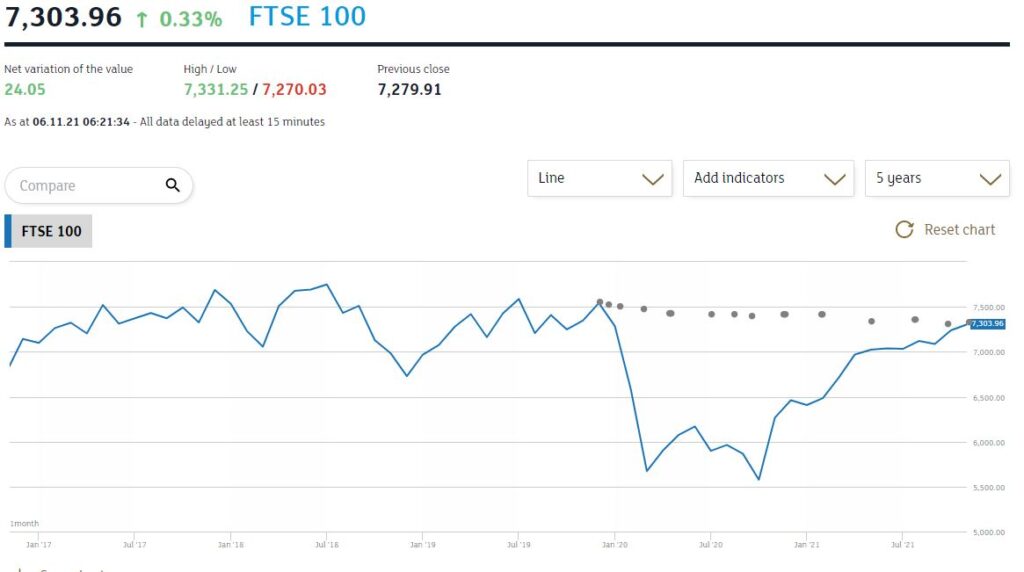

Thanks in a slightly odd way to a Democrat Senator, America has avoided throwing itself under that same bus, but with no effective political opposition the UK is now powerless to resist. Sterling’s relentless decline from the summer high and a FTSE 100 index still below its pre-COVID peak signify what markets feel about all this.

From the London Stock Exchange graph

So, while we were more bearish than we have been all year, in terms of asset allocation, at the end of October, we have yet to call time on the Private Equity cycle, that has provided such a powerful boost this year. It still feels good value to us.

Of course, we recognize too, that the populist fear is of the wealth creators and an opposing adoration for wealth consumption. Unlike politicians, however, we are tasked with producing real results not vapid dreams.

I guess we can each choose which to regard as the leviathan – the burgeoning state, or private equity.

Charles Gillams

Monogram Capital Management Ltd