EVERY DOG

Boris seems slowly to be turning into the opposition to his own party, which I suppose is not new for him. Meanwhile China also seems to be hitting an identity crisis. Neither bodes well for investors.

We apparently have a real budget due soon, but this vain Prime Minister seems bent on upstaging his own team, so we had a pile of tax rises and changes to tax law bundled out in a haphazard fashion in response to the endless (and insatiable) demands of one ministry.

A likely collision course with natural Tories

That pretty well defines bad governance, and these ad hoc excursions into major spending plans are a hallmark of waste and short termism. So, to me the investor headline should be about planning ahead for the Tory government to either fail in front of an exhausted electorate, or less plausibly given the large majority, to implode. But have no doubt that No 10 and the mass of the Tory party are now set on a collision course.

The extraordinary extravagance of the blunt furlough scheme has always been the fiscal problem, and it is hard to believe, as many bosses are clamouring for new migration to solve multiple labour problems, largely in some measure of their own making, that the government has still parked up a fair chunk of two million workers, on pretty close to full pay.

I struggle to comprehend that number in a hot summer labour market, nor do I see why employers would cling onto staff until October at which point, presumably they take a decision? Are these ghost workers? Already happily in new jobs, but having done a deal with their bosses to split the loot, their fake pay for not being? Are these people HR have forgotten or are too scared to fire? Will they really try to pick up work they put down eighteen months back, in a largely different world and probably for a now quite alien organisation?

Who knows, but the whole thing cost £67 billion (so far) and that’s what Boris needs back. I challenge anyone to give a lucid explanation of how his latest proposal “fixes” social care for the elderly. Nor to explain how in parts of the country like this, with no state care home provision anyway, it can ever be called “fair”. So, to me, it is just bunce for the ever-gaping maw of the state, and the idea, with Boris in charge, that it will ever be temporary or even accounted for, is somewhat risible.

What would “fix” social care is transparent, autonomous, local provision, not bullied by a dozen state agencies, not run by money grubbing doctors, not harried by property developers and absurd land costs, nor daft HMRC grabs on stand-by staff pay, and it needs to be highly invested in simple technology, all IT integrated with the NHS; not this crippled, secretive, subscale mess.

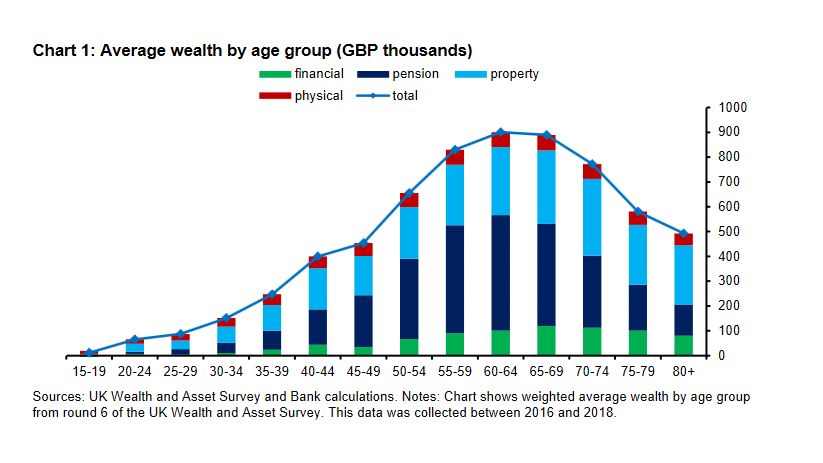

It is not that there is no problem, but it is as much operational as financial. A recent Bank of England paper looking at wealth distribution highlights how in retirement property comes to both dominate assets and also shrinks far more slowly with age.

(Sourced from this speech given at the London School of Economics, by Gertjan Vlieghe, member of the Bank of England’s Monetary Policy Committee.)

Of course, the crux here is seeing a family home as both an asset and an essential for life. That is the distortion, and this fiddling with care rules attacks the symptom, not the cause.

Can you trust a word he says?

So, now tax on income rises, a broken promise, employer tax rises, broken promise, the ‘triple lock’ on pensions is ditched, broken promise, and to top it off those working beyond normal retirement age (now 66) get a 25% tax penalty, via another broken promise. Oh, and if you are mug enough to save, then dividends will get hit too.

Again, there is a real problem but this is by no means a logical answer either: I guess the Treasury were applying heat on excess debt, and this is sand kicked back in their face, but it shows no sign of anyone solving anything. The UK has both high debt levels and no supportive currency block around it, sure France and Italy look bad, but they have Germany to help. The UK does not. Hence the anxiety.

So, Boris has had a fine Cameron-like bonfire of dozens of electoral promises; the worm turned on Cameron (and Clegg) when he couldn’t keep his word, and so it will turn on Boris. This time he won’t have Corbyn as the pantomime bete noir to bail him out. Indeed, Kier Starmer’s response linking this problem to inflated property prices is remarkably prescient, even if his typically confiscational solution is not.

These tax levels (as a % of GDP) have not been seen in fifty years, for an economy with a noticeably less effective grasp on government expenditure and a rather less globally competitive commercial base.

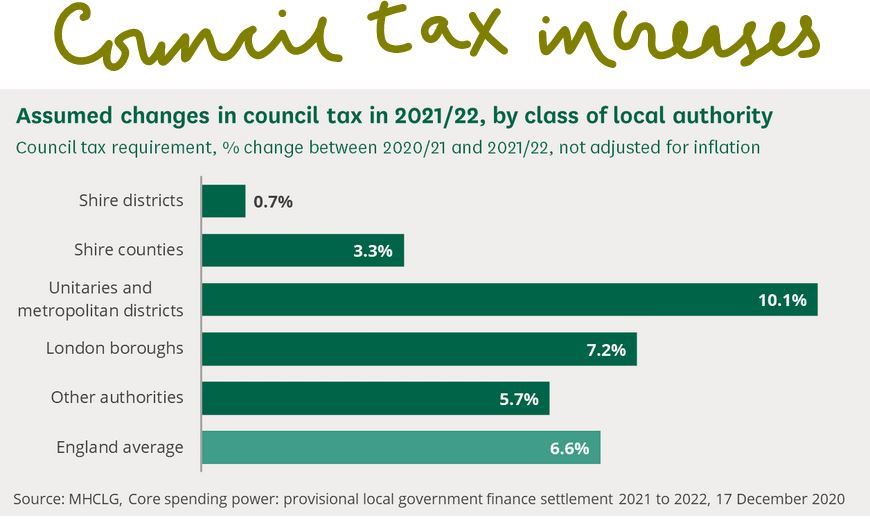

While tax rises are emerging everywhere (see below), and public service reform has become a simple money equation, need more service, spend more money, a dangerous one-way road.

Source: from this primary report

While notably, ‘buy to let’ is again left untouched. London house prices have doubled in this century, the FTSE 100 has moved from circa 6800 at its late 1999 peak to 7030 now and remains below pre-pandemic levels. So clearly this is not the time to hit the investors in jobs and business, who have had a 5% nominal gain (that is a 60% real loss) in twenty years and yet to leave the buy to let rentiers trading in second-hand hopes, with their 60% real gain in that time, untouched.

And don’t give us the dividends argument; the buy to let plutocrats get plenty of rent and all their sticky little service charges. This measure simply hits the workers and investors in business and pampers the bureaucrats and the rentiers. It makes very little sense, unless you are a senior civil servant or a retired prime minister, like Blair, of course.

Chinese insularity - the new version

Meanwhile China I feel is now detaching itself from both the rule of international law (in so far as it ever bothered) and more interestingly the world financial system. It may indeed end up better off, but for now (and this is also a change from much of the last 50 years) it does not feel it needs to attract external capital.

So much of its trade and capital markets engagement has been predicated on securing capital; this is an odd and novel twist. Although perhaps a logical response to the West, who rather than conserving capital as a scare resource, are immersing the world in torrents of surplus cash and inflation.

Much of China’s policy about their own global investment (so outside China) also used to have the same theme, driven by the desire for returns, influence and to hold their own export-based currency down.

But no more, it seems, and their inherent desire for autarchy, the hermit kingdom trope, has only been emphasized by Trump, WHO and the madness of the internet. It apparently wants to be the new Germany, (no longer the new USA), so it will be insular and conservative: cautious, not driven mad by debt and the baubles it procures.

Well, if true it will be different, whether it can really be done, without a wave of disruptive defaults is unclear, but don’t doubt the length of vision, so unlike our own government. While a theme of this century has also been where China leads, the rest must reluctantly follow.

Even a dog has its day, but for investors both the UK and China now feel significantly more canine than at the start of the summer.