Caution: Bumpy Road ahead

Puzzle: World markets have whipsawed in the last few weeks, from high anxiety to an almost beatific calm. The VIX volatility index has dropped to pretty well a post-pandemic low. Which should mean we all agree, but on what exactly? Rising inflation, yes, but how durable, and caused by what?

And that, we all accept, will make interest rates rise, yes, but how high for how long? Markets we feel are, to say the least, fragile.

At the turn, we know that moves can be dramatic both ways, for markets.

Are we really seeing a labour shortage? The UK truck drivers’ situation

What we see now is not a labour shortage, and hence political talk of stemming migration and higher wages is well off target. What it is, in part at least, is a failure of the routine operations of an incompetent government, something politicians typically don’t want to discuss.

The government has insinuated itself into so many areas, with its complex regulations, that the market economy now lies ensnared in myriad interlocking regulations, backed up by a deeply entrenched blame culture (and its friend the compensation economy).

To take one example, there is no shortage of truck drivers, but there is a shortage of qualified, approved, signed off and regulated truck drivers, because as part of the destructive lockdown, the government just halted the conveyor belt of required testing and approvals.

Truckers’ wages have for long been too low, of course, especially for the owner drivers in the spot market. What we have is not a labour shortage, it’s a paperwork shortage. The difference is vital for how enduring inflation is. A new driver will take a couple of decades to grow, but clearing a paperwork jam, a few months. One is enduring, the other transient.

Withdrawal of older workers from the labour market

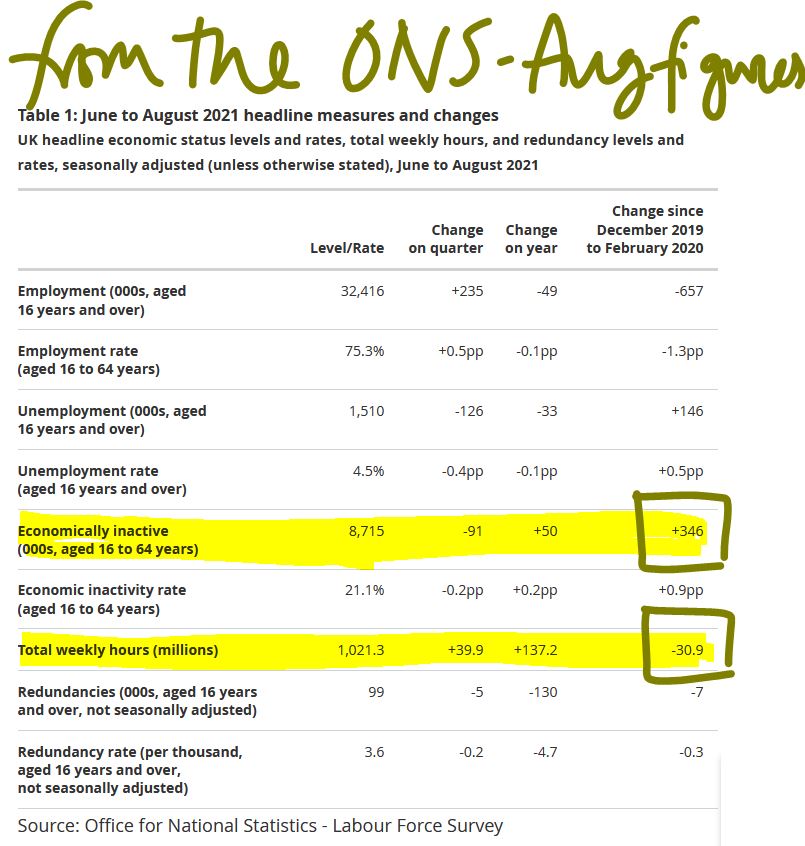

Work after all is something of a habit: once it is lost, it can be hard to understand why it existed. So, we see a marked increase in older workers in the UK who have just withdrawn from the market (Some thirty million fewer hours worked - see figure below). That too is not a labour shortage as such, they all still exist.

But if work was of marginal benefit to the worker, and the costs to resume work (actual or psychological) are high, disruption will cause the fringe or marginal job to be unfilled. Yet again more in the transient column than permanent.

Someone will waive the rules, or the government will notice, well before all drivers get paid high enough wages to cause embedded inflation. In any event articulated fuel tanker drivers tend to work for big employers, with good conditions, and are well organized. They have to be, after all they drive mobile bombs. The spot operator on a rigid rig is in a different market.

Inflation will most likely be transient

So, if it is not an actual labour shortage, it won’t cause wage inflation, and will be transient. Some other areas reliant on highly skilled older workers will continue to see standards fall, but generally younger workers will over time fill those slots and gradually acquire those skills. And it won’t be a long time.

Our view from way back was of 5% plus inflation and labour markets that struggle to clear this year. We were wrong to not foresee the failure of regulatory processes to keep up. However we still do see a permanently higher post COVID cost base and therefore in certain sectors, a large amount of marginal productive capacity are likely to be withdrawn from the market.

With a banking system that still struggles to offer commercial finance to the SME sector, because of excessive regulatory caution, there are swathes of jobs that have simply gone. So that labour will in time be redeployed. The current concern is that many of these workers show no desire, or ability under current conditions, to return to the market. But when they do, the capacity that has been destroyed will slowly return, and once more drive down prices.

Nor should we forget just how much the Exchequer loves inflation, as fiscal drag, their beloved tax on higher prices, smooths away so many budgetary blemishes. They will let it go, if they possibly can.

Commodity prices

On the input side we do still see commodity price rises as transitory, at least within the energy market. As others have noted much of that too is regulatory failure on a grand scale, not a true shortage. Price fixing by the state is a notoriously foolish concept, as we learnt in the 1970’s.

There are a number of other supply factors at play too, but while some will recur, most are temporary.

How long do we think the inflation spike will last?

So yes, inflation will spike, and yes it will stay elevated for much of next year, but no, we don’t see it as necessarily durable, once COVID restrictions and related behavioural changes vanish.

We are still pretty certain that the political costs of aggressive interest rate rises will outweigh any perceived price control benefit. As long as some Central Banks hold off rises, it will be very hard for others to do so, without sharp currency moves or bringing in formal exchange controls. That would in turn spook markets far more than rate rises.

The next phase of markets

All of this says to us that a major market dislocation, despite the benign signals, lies ahead in the next six months.

Markets shifting rapidly are more a sign of uncertainty than of a new degree of confidence, and we simply don’t trust it. We see inflation as apparently out of control, but no significant interest rate rise response is feasible. That can feel like stock nirvana, but also like investor purgatory, as you have no idea what is or is not a sustainable profit.

Charles Gillams

Monogram Capital Management Ltd

Some Big Calls

First posted on 7th February 2021

US Markets: The ‘no-Trump’ response

We may learn a little about markets from the curious absence of Trump.

We had been confidently told that without him the US stock markets would fold, and as US markets collapse, these days so do global ones. Indeed, not just relying on the US, has become the fund management challenge of the last decade.

Well, he went, admittedly in a two-stage collapse, but he and the Republicans are out of office, yet the apparent upset in Georgia passed with barely a market ripple. Markets just went on up, unconcerned. Now some of that is their appetite for short term debt fueled spending, which even if you know makes little sense, it is folly to stand in the way of.

But beyond it, higher taxes and lower growth must be the consequence, if you are buying stocks on a 6 times multiple of earning the next two years matter a lot, but when buying them on the current S&P 500 forecast of 25.35 times earnings, that implies those later high tax years must surely be in the equation too.

Has the market priced in the downside?

So, what seems to have happened, is the downside of future years has been calmly offset against the short-term gains of a stimulus package: is that logical? It seems unlikely, if nothing else a big corporate tax rise is due, to notionally pay for it all, plus a fair slice of traditional “stick it to the rich” revenge legislation.

The assumption seems to be that the winners in the higher consumption aisle will be neatly offset by those who suffer from the new regulations. We are less sure and do feel the ultimate impact will inevitably be lower US growth.

Of course, tech might solve all, but then it is very richly valued already. It might solve the growth problem, but could still be loss making for investors, at these levels.

That is not to say that Biden put on a poor show in his advocating a “go big” package, he did it lucidly and with passion, a good speech.

For all that, when a new leader arrives and confidently asserts lots of economists (but notably not including The Economist this week) think he’s doing the right thing, it means trouble ahead. While his near certainty that the US would consequently be back to full employment by Christmas was touching, but absurd. The excess stimulus might get growth back to pre-pandemic levels, but that’s really not the same as employment.

The China issue remains big.

Another really big asset allocation call:

We are hearing ever more gruesome tales about East Turkmenistan, following on from decades of horrors from Tibet, both sovereign states seized by China in the political chaos after WWII.

If you see them like the other nations seized by Mao’s fellow imperialist Stalin, at much the same time, you will understand the repression. Although as ever with China, with a big dose of racism, against the 7% of their population who are not ethnically Han Chinese, plus of Communism, which still stands against any form of religion, be it Buddhist (Tibet) or Islam.

Will Biden care more or less than Trump about human rights? Well obviously, he will care more, as something is more than nothing. But will he be more effective than Trump, indeed do the Chinese find an unpredictable enemy with a penchant for sudden tariffs, harder to deal with, than a believer in the international order and gentle fireside chats?

Well here cynicism prevails: these are nations caught between empires, like Poland was for centuries; any tension in the international order will always see a land grab by their bigger neighbours.

I also believe Biden will find the proposed attacks on American consumption through both higher taxes and the removal of cheap energy and labour, can perhaps withstand also keeping Trump’s price rising tariffs in place. As notably he has done just that, to date. Indeed, he seems to be out-Trumping Trump on Federal procurement and protectionism.

But I still don’t think cutting China out of global trade, however barbarous their actions have been, is a runner. I think the vile abuses of power can go on, just as the EU has already handed a free pass to China’s torture chambers to plough on, by agreeing a new trade deal with no human rights teeth. So, in time, realpolitik will triumph with Biden.

It was I suppose nice to see China (after a pause for thought) suggesting locking up elected politicians in Burma, after the Army grew tired of holding all the cards, but getting no thanks for it, was a poor move. But there was a long enough pause to just tell the junta they didn’t mean it and were really rather pleased. A little more discord, more repression of the ‘tribal’ areas along their shared border, more sanctions to exploit, a few less pesky journalists, all are very much in China’s interest.

So, I see a curious dichotomy, in the Han Chinese areas, Tesla car plants, Apple phone stores, Starbucks a plenty, for a sophisticated technologically advanced middle class, will all thrive. While the minority non-Han areas will be pillaged for resources and labour and if they are good, be re-settled and re-educated and polished up for tourists. A bit like California in the 19th Century. So perhaps Xi is right, only China can split China, but then history suggests, it will, one day.

But not any time soon; you can take a moral position on Chinese racism, or an economic one on Chinese dynamism, but I am fairly sure the market will easily favour the majority.

This of course does create another ESG contradiction, the US high flyers rely on selling to the Han Chinese but are keen to exploit minority Chinese labour forces and natural resources. We can look forward to a great deal of sophistication in somehow disconnecting the two.

Efficacy of the Astra Zeneca / Oxford vaccine

Finally, I should mention the battering the EU and even perhaps the Euro (at a nine month low) has taken from the principled resistance to fudging the data exhibited by German scientists. The scientists are right, the evidence base for efficacy in the over 55 age group is indeed absent. Excitable politicians, including the normally precise Macron, have said it means it is ineffective, which it does not, only that proof is lacking.

Now that is presumably in part to cover the arrogant and inflexible EU procurement process, so full of checks and balances it strangles itself.

Boris’s vaccination stance

While Boris (faced with the same data) decided to wing it, correctly seeing that to save the NHS and his own electoral chances in May, he would rather give a potentially useless but harmless jab to millions of elderly disease vectors, than talk about due process. For once his disdain for the experts paid off.

The opposition in the meantime pleaded for a longer deprivation of our liberty by a longer pointless lockdown. Thank you for that suggestion.

Call it luck, if you will, but Boris has spent a long time practicing that ex tempore talent.

Proof might have been lacking, but it looked a jolly good bet. It sure was.

Charles Gillams

Monogram Capital Management Ltd