English local elections, and US regional banks

The English local elections saw the Tories lose 1,058 seats, dropping to 2,299 in the wards contested on Thursday, Labour gained 536 rising to 2,674, while the minor parties saw the Liberal Democrats rise by 405 to 1,626, Independents dropped by 104 to 962, Greens rose by 241 to 481.

What does all that mean for next year? Well, we called the next General Election for Labour the day after the results of the last one, and nothing has changed that view. Nor do we believe talk of falling short of an absolute majority is anything but wishful thinking by bored commentators. Rishi is largely in office, but not in government: a fairly weak cipher for the mandarins behind the throne. When they tell him to abandon core Tory principles, he obeys. This divides his party even further.

So, investors really should focus on the ‘what’; not the ‘if’. The Tories as we noted last time, had most to lose, and will take some heart at the spread of their defeats amongst the opposition parties. Although given the locations contested, both official Labour, and the Corbynite rump voting Green, did well.

This was an anti-Tory vote, rather than pro anything in particular.

We will still see a solid Labour governing majority next year. The Lib Dems will likely be back over fifty seats; as ever un-representative of their larger vote share.

So, what of Starmer?

His big offer is that he will stop party infighting and provide stable competent government. It will be Blair redux. The core five aims are currently crime, education, NHS, climate change and growth. Who would have guessed. No doubt apple pie is next.

The method it seems is Blairite targeting, with a bit of management mumbo-jumbo about breaking down silos, overarching aims etc. With the one area of large-scale Soviet style planning in the energy sector, with a state-run organisation, with what sounds like loads of money, but in truth (for the task) is not. Anyway, the big issue is not power generation but transmission.

I guess we do know from Wes Streeting, (the next health minister) that Labour knows the real problem is the public sector unions, part of why Starmer was so keen not to rely on their funding or support. But while ‘silo breaking’ is neat code for curing chronic demarcation fights, again, how does he propose to tackle it? Breaking ossified crusts needs steel. We know soft soap and water won’t do it.

But to tackle that, means splitting up some giant empires and even if Labour wanted to, I doubt if it has the means. At the same time public sector reform requires exiting vast areas where mission creep has expanded a thin film of under-funded interference and sub-par delivery. True Blair did cut loose Scotland and Wales, to wreck their own patches, raise their own taxes, maybe we will see more of that?

So, we should not hope for too much, we will get another well-meaning ambitious left-wing lawyer, but he is not Blair, and Blair despite fond memories, still gave us the GFC and Iraq.

We fear that the hostility to business and enterprise shown by Sunak will persist, it is probably embedded in the Treasury and Whitehall.

The slew of rate rises, and the slow sacrifice of the US Regional Banks

Somehow Wall Street keeps looking for rate cuts, and collapsing inflation, when it is simply not visible in the data. They are so hidebound by their models, that they see inflation as a pile of bricks. You count the bricks; you know what inflation is. But it has never been that, it is like the water table, it is a level, not discrete pieces, and like water it spreads, dampness pervades all. Sure, you can remove bricks, even big pieces of wall, but the water table needs everything to dry up for it to subside.

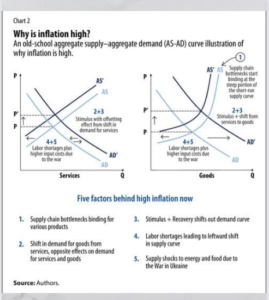

Taken from this article by IMF staff writers, Agarwal and Kimball in 2022.

You can see the flaws, factors 1, 2 and 5 look like classic bricks, or transitory bricks we should call them now. As for 4 that has been entrenched by regulations, especially on minimum wages, by tax hikes, health fears and support payments, which leaves 3 as the real solvable problem, and it endures. True they rightly noticed it, but by relying too much on the bricks falling, institutional economics just keeps getting it wrong.

You can’t lower the level, while demand remains too strong to be drained away. While the idea you can disperse inflation while piping liquidity in to offset the cost-of-living crisis, is simply daft. Until excess fiscal stimulus stops, inflation will quietly shift, steam away, reform, and then drip back on us; clammy and damp as an English spring.

It helps a bit that vacancies per job seeker are falling in the US, but it is all pretty glacial, the job market is still very tight and wage inflation still embedded. We are awfully short of swallows to be declaring summer’s arrival.

Yet, we do accept Central Banks have largely given up on rate rises, we think too soon, and their main mechanism will now be leaving rates elevated for longer. Along with quantitative tightening, which as few politicians really understand it, they can get away with. Well, it may slowly work.

Looking ahead

We (still) see inflation as higher for longer, rates likewise, and over time the big users of debt, mortgage borrowers and national Treasuries, are going to get used to paying more for it.

Although expect some other fiddle to try to stop this too, which will, naturally, embed inflation and stagnate productivity.

Markets? Well, with plenty of liquidity still and indeed (unjustified) rate cut optimism and many cash flow yields staying attractive, they remain skittish, but with no panic.

So, we are not that gloomy. Although perhaps a sideways summer is ahead.

If your base case is rapid rate cuts and mean reversion, we still have our doubts.

Charles Gillams

Monogram Capital Management Ltd

The Recessional is a great poem by Rudyard Kipling. And the Long Recessional, the title of David Gilmour’s book on RK.

While Shonibare’s trademark mannequins rely on implausible inflation to prevent disaster too.