Cheer Up, They Said

After a pleasant summer, the dampness returns, exposing a quite enormous and unbalanced level of growth among the verdant thickets of both Middle England and the NASDAQ.

Markets must climb a wall of worry, and the next two months are not short of that. Forget interest rates and non-existent recessions, that’s just the stuttering voice of old economic models, fed fouled data from the last century.

IT IS ALL POLITICS

No, the risks now all look political; the prevailing orthodoxy is the West can keep borrowing levels high, to fund bloated and protected wages and welfare weirdness, impervious to international competition, or indeed to inflation. It has worked so far, and with excess and free flowing capital, there may always be a funder, mainly of state debt or residential mortgages, as well as a buyer of a few anointed equities.

And so far, that has remained the trend and indeed, somehow, the centre has held, once exceptional debt has now become permanent. This is aided in part by centre and centre left parties collaborating to silence the right, often behind the somewhat specious argument of protecting democracy from the wrong kind of votes.

But markets are jittery, they know the sums don’t add up, as do voters.

Debt as % of GDP, US in red, Japan in purple, UK light blue, France dark blue

IMF data mapper – from this page.

The same defence of democracy continues to require the now usual never-ending wars, and divisive and punitive trade barriers and sanctions.

Both businesses and investors are quite happy to sit on the sidelines, until a few questions get answered. The UK budget is expected to finally nail the myth of growth, by heavy new taxation, although it has almost been oversold, the reality might be a relief. It is not just the severity (it won’t be that bad) that matters, but also the direction of travel. Will it hammer savers, investors wealth creators and employment or attack consumption and waste?

Labour denials of an extra £2,000 a year tax on average incomes remains to us implausible and indeed we suggested many would be relieved at only that. Well before the election we said it will need about £20bn (economics is pretty simple really) and suggested the biggest chunk of that will come from fuel duties; we will see. Indeed, we’ve always known that various fudges would be used to skirt round the creaking OBR defences too.

The main UK stock market indices are once more in slow retreat, and while sterling is strong, we attribute that to short term interest rate differentials. High government borrowing is after all good for lenders. While in the US, it remains impossible to tell where the legislature ends up. Although like Starmer, many voters are so convinced the alternative is useless, they will overlook the socialist taint.

EMBRACING THE SIDELINES

Just now, the sidelines feel a good place: hedge funds, shortish term, high quality debt. There is scant evidence that the normal run upwards for emerging markets and smaller companies, from rate cuts, with attendant dollar weakness, has started, although many areas have moved in anticipation. But why buy in September when November is so much more certain?

That switch to smaller companies and emerging markets also may not happen this time, emerging markets have a lot of china dogs that look quite fragile, and smaller company liquidity is dire, so if yields stay high and defaults low, why add risk? While the inevitable fiscal squeeze will not help the hoped for returns and dynamism of a monetary easing cycle; you need both to work.

India meanwhile still stands out long term, but both the centre and more starkly the states are showing a notable loss of fiscal discipline, unrest in Bengal does not help and the IPO market is frothier than a Bollywood musical.

ROULETTE AT THE TORY PARTY

Given the apparent penchant for gambling, how many of the six (now five) chambers hold live rounds? We should glance at these ever-fascinating trials. The party faces strategic questions. Notably when does it expect to recover the 200 odd seats it needs, and how?

Well, I suspect the group saying next time (2029) will still dominate, although it looks rather unlikely. As to how, the assumption, I assume, is by halving the Lib Dems, but that’s only 36 seats, which leaves over 150 to get from Labour.

Interestingly every leadership candidate agrees that it was all Central Office’s fault, not for instance the wrong policies or a foolish rush to the polls. Most also at least pay lip service to rebuilding from the bottom up through local councils. Indeed, they even accept associations might matter.

Although there is also quite a bit, still, of finger crossing and waiting for Labour to implode. Not such an obvious solution this time.

As for Reform, if they also fail to implode, but settle in to be a real alternative, like their French and German counterparts, they will at least deny the Tory party their votes. Who knows, David Cameron might even emerge, in twenty years’ time, like Barnier as the compromise leader, from a party of no current electoral relevance.

It is hard to get involved in the contest, which will be down to four from the original six by next week. With so few MP’s, the choice is not brilliant.

It is a very narrow electorate, just 120 survivors of the wreck, so calling it and the shifting allegiances it reveals is hard. However once decided, it will be clear if the party is going long or short and which seats it is targeting, which in time will matter a great deal. Is it still unaware that a missed target could be fatal?

SAVERS TO BORROWERS

As for markets, I tend to ignore summer and short week trading, and the switch from bonds to equities, from savers to borrowers is a powerful economic force, as rates fall, but while the direction is clear, the angle of descent is not.

I assume it could be worse, that is even more uncertain but wondering how. Roll on Guy Fawkes Day.

OUR OWN EVOLUTION

This blog is evolving - when we started Monogram was a fund manager in widely accessible products, but that’s no longer the path - we are increasingly moving towards family offices and offshore clients.

With a less domestic focus, it seems time to move this to a stand-alone blog. Which brings with it a touch more freedom. It will continue to remain fascinated by the world of economics and politics, and indeed fund management. But may be happier to poke about in the mud for sustenance, or sound a startled alarm, as we become the Campden Snipe.

Reserve in Reverse

Fallen Emperor?

With almost two thirds of global equity markets represented by the US, the fall in the dollar so far this year is quite dramatic, and for many investments, more important than the underlying asset.

UK retail investors are especially exposed to this, as although Jeremy Hunt (UK Chancellor) may not notice it, the US is where most UK investors went, when his party’s policies ensured the twenty-year stagnation in UK equity prices.

While Sunak continues to pump up wage inflation, which he claims, “won’t cause inflation, raise taxes or increase borrowings” Has he ever sounded more transparently daft? Sterling, knowing bare faced lies well enough, then simply drifts higher. Markets know such folly in wage negotiation can only lead to inflation and higher interest rates.

We noted back in the spring, in our reference to “dollar danger” that this trade (sell dollar, buy sterling) had started to matter, and we began looking for those hedged options, and to reduce dollar exposure. To a degree this turned out to be the right call, but in reality, the rate of climb of the NASDAQ, far exceeded the rate of the fall in the dollar.

While sadly the other way round, a lot of resource and energy positions fell because of weaker demand and the extra supply and stockpile drawdowns, which high prices will always produce. But that decline was then amplified by the falling dollar, as most commodities are priced in dollars. So, a lot of ‘safe’ havens (with high yields) turn out to have been unsafe again.

The impact of currency on inflation

Currency also has inflation impacts. Traditionally if the pound strengthens by 20%, then UK input prices fall 20%. The latest twelve-month range is from USD1.03 to USD1.31 now, a 28% rise in sterling.

In a lot of the inflation data, this is amplified by a similar 30% fall in energy, from $116 to $74 a barrel for crude over a year. In short, a massive reversal in the double price shock of last year. In fairness this is what Sunak had been banking on, and why the ‘greedflation’ meme is able to spread. But while that effect is indeed there, other policy errors clearly override and mask it.

A Barrier to the Fed.

In the US we expect the converse, rising inflation from the falling currency, maybe that is creeping through, but not identified as such, just yet, as price falls from supply chains clearing lead the way, but it is in there.

Finally, of course, this time, the dire performance of the FTSE is probably related to the same FX effect on overseas earnings assumptions. Plus, the odd mix of forecast data and historic numbers that we see increasingly and idiosyncratically used just in the UK. If the banks forecast a recession, regardless of that recession’s absence, they will raise loan loss reserves, and cut profits, even if the reserves never get used.

Meanwhile, UK property companies are now doing the same, valuing collapsing asset values on the basis of the expected recession, and not on actual trades. So, if you have an index with heavy exposures to stocks, that half look back, half reflect forward fears, it will usually be cheaper than the one based on reality.

Why so Insipid?

OK, so why is the dollar weak? Well, if we knew that, we would be FX traders. But funk and the Fed’s ‘front foot’ posture are the best answers we have, and both seem likely to be transient too.

If the world is saying don’t buy dollars, either from fear of the pandemic or Russian tank attacks or bank failures, that’s the funk. As confidence resumes and US equity valuations look more grotesque, the sheep venture further up the hill and out to sea. To buy in Europe or Japan, they must sell dollars.

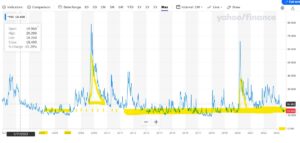

The VIX, in case you were not watching, has Smaug like, resumed its long-tailed slumber, amidst a pile of lucre.

From Yahoo Finance CBOE Volatility Index

So as the four horsemen head back to the stables, the dollar suffers a loss.

The Fed was also into inflation fighting early; it revived the moribund bond markets, enticed European savers with positive nominal rates, (a pretty low-down trick, to grab market share) and announced the end of collective regal garment denial policies. But having started and then had muscular policies, it must end sooner, and perhaps at a lower level. So that too leads to a sell off in the dollar.

Where do we go instead?

So where do investors go instead?

In general, it is either to corporate debt, or other sovereigns. Japan is not playing, the Euro maybe fun, but not so much if Germany is getting back to normal sanity and balancing the books again. So, the cluster of highly indebted Western European issuers are next.

Sterling now ticks those boxes, plenty of debt, liquid market, no fear of rate cuts for a while, irresponsible borrowing, what is not to like?

For How Long

When does that end? Well, the funk has ended. You can see how the SVB failure caused a dip in the spring, but now the curve looks upward again. Although fear can come back at any time, as could some good news for the UK on inflation. However even the sharp drop the energy/exchange rate effects will cause soon, leave UK base rates well south of UK inflation rates.

So, every bit of good news for the Fed, is bad news if you hold US stocks here.

How high and how fast does sterling go?

Well, it has a bit of a tailwind, moves like any other market in fits and starts, but could well go a bit more in our view. Oddly the FTSE would be a hedge (of sorts).

PICTURES OF MATCHSTICK MEN

I noted at the end of our last bulletin, that markets are feeling strangely bullish, for a few reasons, which I share. Although only in some places. I still find little attractive in most debt markets. They are cheap, but given losses this year, are they good value?

And UK politics is becoming boring, which is no bad thing.

So, were we right to predict that interest rates alone cannot tame inflation?

Our original thesis for this year, that interest rates could not tame inflation alone, maybe is right. The level needed would cause too much damage. But that is applicable (we now see) to the UK, but not as yet to the US. And oddly perhaps not as yet to the EU either, although Lagarde midweek, perhaps had the same tilt. But German profligacy may wreck that.

The logic is the same for them all. You can’t tame this beast by rate rises alone, as double figure inflation needs double figure interest rates and that is just not happening.

The UK is certainly not prepared for that level of rates and fiscal restraint is therefore now required. Fiscal drag will do some of the heavy lifting, and energy price declines a fair bit more.

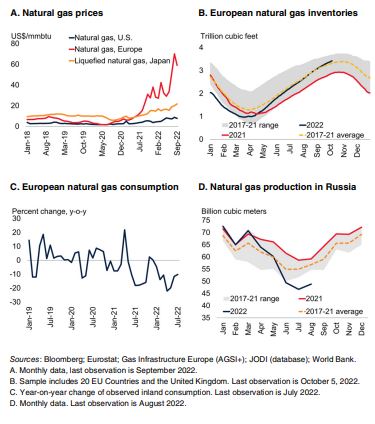

Some commodity market statistics were released by the World Bank, this quarter. The above graph is extracted from their statistical report

But tax rises and government spending cuts will still be needed to cool the UK labour market. In particular the public sector must be reined in, or service cuts made.

Earnings will fall, taxes rise, growth stall, discontent rise. But still no collapse in housing (secondary) markets or in employment.

Nor do I therefore see much rise in loan defaults. This makes the recent round of forward-looking bank provisions unusually daft. You can’t audit the future, so how can you include it in historic accounts? A weird hybrid. Best to ignore all that and focus on now, and now is still not terrible. With a pretty hefty valuation discount in situ.

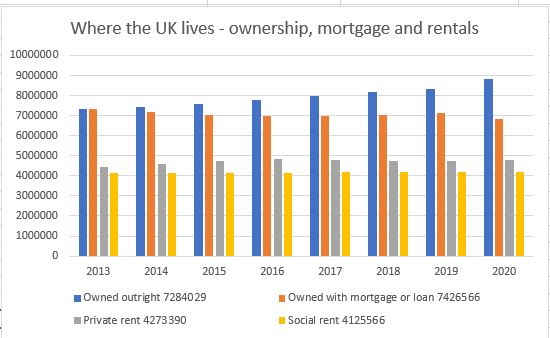

(Data downloaded from the Office of National Statistics for this in house graph).

The US political situation

In the US, The Federal Reserve have effectively said if there is no fiscal restraint, they will ramp up rates till there is, or inflation falls. That is scary, but it looks as if the Mid Terms will hobble Biden and stop some of his fiscally reckless measures. He thought the wave that toppled Kwasi missed him, but it was the same ocean, and likely will give him a rough ride too.

Biden’s approach felt good, overindulgence often does, but the pain of the untethered dollar is now starting to hurt US earnings, and in time US jobs, however much they dream of legislating against that. The impact of rate rises is also probably less than it sounds in the media, partly because most reporters are likely to have mortgages, whereas a growing number of investors don’t.

Overall US government policy remains to force up inflation and challenge the Fed to sort it out. Hence all the Fed threats are directed not at the market (which cares) but at The White House (that does not). Mid Terms (on the current path) will therefore be a big boost to US markets, as it means Congress at least, will start to work with, not against the Fed. As with Kwasi, a reckless budget will not pass unchallenged again this time. Those extremes belong to the COVID era, that is now over.

Comparison with the UK position – and where Europe maybe is headed

With that battle already won in the UK, both sterling and to a degree UK rates are reverting to the status quo ante. And as sterling rises so the FTSE falls; that link also remains. If the UK is neither chasing interest rates up, nor letting the pound fall, it gives Europe some cover to do likewise.

In truth although sounding dramatic, in the real world it is inflation that really counts not (as yet) interest rates which are still absurdly low.

The Tory Party – what can we discern?

Talking of status quo, that’s where the Tory party is now headed. Cameron drifted too far left, Boris dithered, Truss drifted right, and now the new government is a hybrid, although colloquial English perhaps has a stronger word for it.

I sense that spending decisions may correctly be back with a powerful Chancellor. There is a seeming party truce till the next election, when half the current Cabinet seats will vanish anyway, and then who knows?

Or if this coup and enforced hybridisation fails, we really will know the party is split, and a General Election could follow. Unlikely, though.

Why bullish then?

US earnings except for highly indebted outfits, will probably stay surprisingly strong for a while yet. And likewise, the dollar pivot point is being pushed further out, as no one else in the developed world is going for rates quite that high (or that fast).

There are also two market forces to look out for, rising rates and slowing growth is one, but the simultaneous loss of liquidity is another. The former will cause a patchwork of changes, both good and bad, but the latter the ending of a multi-year bubble.

It all remains cyclical – a transition, not a bounce

The difference is key, rates are possibly a two-year cycle, a bubble a ten-year one. The bubble in non-revenue companies, and in absurd multiples for even profitable tech, will take longer to deflate, be slower to re-inflate and be muddied further by all that spare capital accelerating technological change. This is still not an area we either feel confident in, or trust their valuations.

If we really are back to the status quo in the UK, about to be in the US, why would markets be going down, down, deeper and down?

The Times They are A Changin’

Rishi or Truss, can either be worse than Boris?

Also, we do seem to be decisively leaving the decade of low rates and by implication the experiment of quantitative easing. On a twelve-month basis, bar the FTSE 100, all major markets are down, although that is only just true for Europe and Japan. The Nasdaq and Aim are the big losers, and their recent recovery looks like a head fake to us.

We look at the global economy, and investment options.

So, what does the race for the next UK prime minister now look like?

It is not that important anyway, if as I assume, the next election is lost already.

These are stand in candidates, with no real grip on the party and likely to be loathed by the surviving group of Tory MP after that 2025 contest. Like a relegated football manager, they will have shaky job prospects.

Is there much to choose between them? Again, I am not sure, they have established that the party to its core hates higher taxation, whatever fantasies Boris had, and some at least understand that a smaller government or higher debt, is what the hard choices of governing are about.

I rather expect much of the ‘difficult’ stuff attempted by the last Cabinet will get ditched by new ministers. It still would be wrong to say the new team can’t achieve much, the governing majority is solid, and further bloodletting inconceivable. I would anticipate that they will still have two and a half years to run.

The two candidates compared

Sunak is admired for his high-profile experience as Chancellor, disliked for his willingness to raise taxes, loathed for wielding the knife on Boris. Truss is thought to be opportunistic, and rather unfairly for being dim and not substantial.

But I don’t expect much of a change, more fiscal conservatism, less besotted greenery, perhaps less socially liberal, but only to the extent of holding the line, not really rowing back. Short term stability, long term decline.

Preparing for another European killing field?

But you do feel Sunak would be less of a cold war warrior.

The report that the Chief of the British General Staff had called this “our 1937 moment” and launched “Operation MOBILISE” suggests the bloodlust is well and truly up, all adding to the hefty training programme. We are already deep into a proxy war ourselves.

I hear it is just as insane in the Pentagon. There is even high level gossip about this being the final great “killing field” in our centuries’ old hostility to Russia.

Economy : two questions affecting interest rates and inflation

As for the global economy, we had two great questions for the year, how long could the Fed “extend and pretend” over inflation, and how quickly everyone else would then play catch up.

Well pretty well the day Powell was re-confirmed earlier this year, he binned the Jackson Hole pretence that high employment did not have to mean high inflation.

I suspect (and so do markets) that he won’t really go after inflation, if he did so, we would have interest rates in double figures by Christmas.

Bread, job, and a roof, these three a politician must provide, and just one without the others, is a vote destroyer.

The current modest level of rate rises will let inflation creep lower, but will not control it, and we don’t see interest rates topping out for quite a while, not helped by the very low starting point. Although overall, it looks like the currency markets are forcing the rest of the world to follow in raising rates quite fast and in the end, to the same levels. Nevertheless, in Europe the response to double digit inflation, has so far only extended to ending negative rates.

As if that will matter, as the Euro collapses; they will have to move faster. Lagarde confidently delivering total guff and mysterious lawyerly threats won’t save Italy.

The economic models everyone is relying on to forecast otherwise, seem to assume no incremental rise in energy prices next year, and indeed a sizable fall. That maybe so, but there will still be a lag as this year’s rises have not been fully absorbed and will echo and bounce around the economy for a while to come. Not least through a still very tight labour market, which has several years of lost capacity due to COVID and indeed the familiar demographic time bomb.

A slackening in wage inflation needs US and Northern European unemployment to at least double; no sign of that yet. It is a muddled employment market with spatial and skill deficits, so increasing capacity where it matters, will take time. Not least because of persistent high surplus labour levels to the South and West in Europe.

So, if the Fed (and Wall Street) insists (as it does) on calling this transitory inflation, or now the new phrase, ‘peak inflation’, they are simply using dud econometric models (again).

What next?

Cash flow will again be king, capital will be well rewarded in the bond markets, dividends will have competition, non-dividend payers face a long winter. Experience of the dot com bust, and then the banking crisis, suggests it takes three or four years to retool models based on prior poor capital allocation (and boy have we had that). Not the three or four months which is being assumed.

Granted we were oversold at 3666 on the S&P 500, perhaps an auspicious low. Yields meanwhile had shot out beyond reason, but reluctantly we consider this pleasant bounce can’t survive. We accept too that earnings are OK, but they are in most cases a poor indicator of economic forces that take years to establish themselves. The extinction of even capitalist dinosaurs takes time.

And then there is the great concertina of rates: ignore what each Central Bank says, in the end they must march to one beat, that of the dollar.

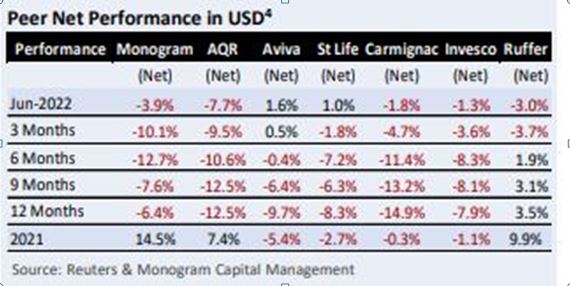

Monogram performance, compared to others in the Absolute Return sector

It is striking that our USD MonograM model now holds no equities or bonds, our GBP MonograM model is fully invested in both. While the list of storied Absolute Return managers who fail to beat our model remains embarrassing.

Download the newsletter of which this table is a section, for the full data.

There is no availability of this model, except through ourselves; perhaps it is time to talk to us about using it?

Do get in touch, an exploratory discussion is never wasted.

We wish you a pleasant summer: as good Europeans, we will fall silent for August.

I hope it all looks clearer when we return.

Charles A R Gillams

He who pays the piper

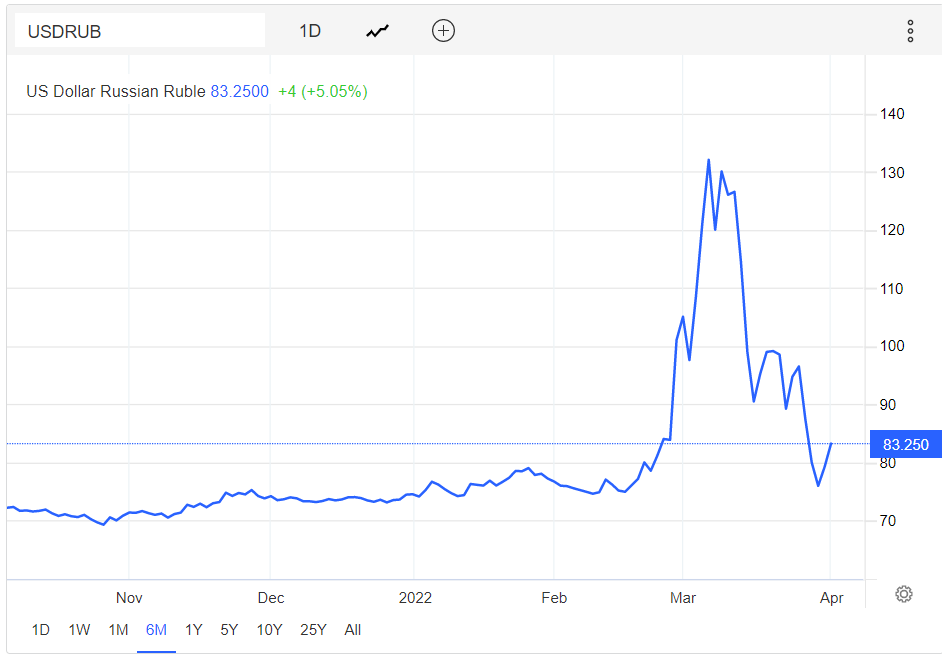

A very strange quarter: the FTSE100 was up, in sterling terms the S&P 500 was up, and the Russian Rouble ended where it was just before the Russian invasion. Short term dollar interest rates are nicely positive at last.

So where is the problem?

UK policy changes – could we finally be leading in economic policy?

Well, at long last the UK Chancellor has finally realised that just throwing money at inflation has one clear outcome: more inflation. This is tough lesson learnt back in the 1970’s and seemingly since forgotten.

If true it is a turning point and we predicted that it must always come sooner for the UK, if it persists in staying out of the Euro, than for bulkier continental currencies. Sunak also seems miraculously to be finally tackling some long overdue, multi-parliament, structural taxation issues, a rare sign of political maturity.

Whether he can hold the line against an increasingly dimwitted set of MPs and a media who constantly bay for more fuel to be added to the inflationary fire is unclear, but at least he has had the courage to step out into the unknown night, not cower by his warming bonfire of magic myths.

Nor is it clear whether he has the clout to unpick the cosy mess created by Theresa May and her childlike energy price fixing, or the ensuing nonsense from Ofgen. This fine-tuned capacity to the point of absurdity, guaranteeing a massive breakdown in the generating buffers, which had been painstakingly installed under a series of Labour governments.

Inflation policy is being taken seriously

But Rishi is trying; to cool inflation you simply must have demand destruction, there is no choice. This type of deep-seated widespread inflation will be hard to quell in any other way. True, areas of it can be contained, but it is hard to hold it all.

He is lucky to be helped by a Bank of England that seems to be serious about its brief, not regard it like Lagarde and Powell, as some kind of political inconvenience, to be wished away in double talk and evasion.

But he’s unlucky in other ways; we noted a while back that China no longer seemed to care about headlong export led growth, or more broadly about access to hard currency. It feels it can invest with and gain from its own currency and avoid importing the monetary excesses of the West. That in turn means it cares less about the endless flows of cheap goods to Europe and the US, and conversely about soaking up those surpluses in luxury goods and services. None of this is good for our inflation.

Meanwhile by eliminating the oddly divergent starting points for the two income taxes, National Insurance and Income Tax, Sunak has opened the way to many benefits. It continues to drop taxpayers out of the system, despite desperate measures by HMRC to suck more in. A key step, and a sign of, for once, a more liberal, more efficient government. Many more steps are needed to unshackle wealth creation, but it is a start. It makes much of the Universal Credit complexity around thresholds also fall away. Most of all it is a step closer to combining the two income taxes.

Politically this is highly desirable, as it strips away the pretence of a low starting rate of taxes on income.

It perhaps even gives an excuse for the otherwise inexplicable step of introducing National Insurance on employees passed retirement age. Given so much of current inflation is due to the mass withdrawal of older workers, another step in that direction looks remarkably stupid, but perhaps it has a higher purpose. It is good to see that the “Amazon” tax as Business Rates should be called, as it gives Amazon such a massive earnings boost, is also clearly still under long term review.

Why has the rouble recovered?

Source : this page on tradingeconomics.

The recovery of the rouble is of course not a market step alone, doubling interest rates, exchange controls and the mass withdrawal of exports to Russia from the West, are part of the story too. But it also shows a turning point. At first the West was so shaken by Russian military attacks, it was prepared to follow its own scorched earth policy, regardless of the harm caused to our own people and employers.

But at some point, the realisation that Ukraine’s army would hold, that Putin’s army was not that good after all, especially up against modern weapons and we start to understand that the further blowing up of our own bridges just raised the ultimate bill. Here are the sanctions we've imposed.

So, it seems it is no longer true that any price is worth paying to help Ukraine or hinder Russia. Clearly, we don’t have to jettison all our principles in dealing with other tyrants, nor one hopes do we need to alienate every piece of remaining goodwill with the rest of the world, by panicked grandstanding.

The mob is still rampant, goaded by an American president for whom no European economic sacrifice is too great.

But maybe it is also time to tell Ukraine that no NATO also means no imminent EU: Brussels has its hands full with its own struggling ex-Soviet states.

And what about Powell and his policy?

Well, we don’t expect him to hold inflation down with his trivial rate rises, nor politically can he do more than tinker. It seems too that Lagarde at the very least has to get Macron back in, before telling the bitter truth about rates.

So, we feel the bond market has rates where the market would like them to be, in the US, not where they will be set by the Fed anytime soon. And the Euro is now in a very odd place, still with monetary stimulus being applied and with an unstable gap to US interest rates.

So, we may look to be where we were late last year, but in most cases the cracks are now alarmingly wide.

Europe, quite urgently, but the US as well needs a sharp jolt upwards in rates to halt inflation.

Oddly only the UK looks to have spotted the danger, stopped the false COVID ‘economic expansion’, tightened fiscal policy, reformed taxes and raised base rates steadily, towards where they need to be. How unusual.

Long may PartyGate continue if this is the end result.

We will take a break for Easter now, and resume on the 23rd.

If the first quarter is a guide, by then everything will have changed again.