By their works . . .

Well, the works this week: a pensive Jerome Powell does nothing, a reckless Andrew Bailey does nothing, Canada joins Biden in picking fights, and the bulk of most equity markets are stuck, going nowhere.

NO MORE US RISES

So, the apparently knowledgeable financial press said that Powell predicts rate rises? He said nothing of the sort of course. True the other members of the FOMC dot plots were in aggregate higher than the current rate, but by a fraction, it is like the average family being 2.4 children, meaning everyone, in the absence of King Solomon, has three children. No, it does not, it means on average there are no more rate rises.

So, Powell has stopped the runaway train, by lighting red flares in front of it and throwing railway sleepers across the track. Job done. Inflation is way below base rates. Bailey has asked nicely and tried to lasso the inflation express from half a mile down the track - won’t work. Inflation above base rates is misery, inflation below base rates is time to loosen.

Powell did start rambling, describing parts of the economy with “by their works ye shall know them” but decided that was all a bit erudite, before he had even finished the thought. He then reverted to the old saw, “forecasters are a humble lot, (with much to be humble about)”. Presumably that is unlike Central Bankers? I still think that judging them by their works makes sense.

But Powell is happy: the Q&A session threw him a litany of gloom, government shut down, students having to repay debt, auto plant shut downs, but no, all is fine.

The core US consumer and therefore the US economy, is in a good place was his verdict.

BAILEY DITHERS

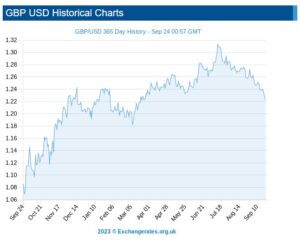

Bailey seems to like to crash the pound every October, which is not good for inflation, just as picking fights globally is not good for oil prices. And it is also bad for inflation.

And either the UK government will cave in to public sector strikes or productivity will keep falling due to said strikes. Neither are much good for the economy. Nor is it good for the markets: in performance terms, the UK remains the sick man of Europe, amongst major markets.

THE MAGNIFICENT SEVEN RIDE ON

I was at the annual Quality Growth conference in London again, a stock picker’s feast as usual. It seems that if enough stock pickers can agree on the menu, as the dominant prevailing theory of investments, they will drive the prices of their favoured stocks ever higher. Which they do, it seems. This is helped by the ‘over the long run valuations don’t matter’ line, pushed hard by Baillie Gifford (amongst others). You might recall my article on Scottish Mortgage a while back.

And of course, as we know from both index and momentum investing, once something starts to move in a flat market, it keeps moving.

But that leaves the vast bulk of quoted stocks flat or down on the year, which makes some sense. When rates rise, bonds are substituted for stocks. The last two quarters in particular have been flat to soft, and while some of these stocks may have hit a bottom, it is still very hard to tell.

The only good news for UK investors is that Andrew Bailey has ensured their overseas (especially US) stocks have a nice currency tailwind.

MADE IN JAPAN

Meanwhile from Comgest there’s a radically different view of Japan. The equity rally there has been fantastic, but it is not the typical exporter boom of a weak yen, in their view, but more about bank stocks soaring on the expectation of the end of Central Bank rate control. This allows their vast balance sheets to earn a real return, at last. This is quite a departure from the general explanations about “this is Japan’s time”. That one has caught me out far too often, but explains the horror show from respected funds like Baillie Gifford Shin Nippon - small and illiquid is just nasty everywhere.

So, although the global rally looks to be strong, it is terribly narrow, and built on different foundations in different places. Or more positively, a broad advance awaits the first rate cuts, either from triumph (US) having controlled inflation or disaster (Europe) having created a recession and left inflation out of control. Either route to rate cuts wins, it seems.

GLASSHOUSES AND THROWING STONES

Oddly, I feel the Canadian spat with India is really quite serious, the tendency of rich Northern countries to preach, in this case standing very carefully behind the only global superpower’s shoulder, really annoys the global South. It has been going on for centuries and is at heart simply the old colonial mindset.

India’s continuing reaction may well portray the accuracy (or otherwise) of the allegations, as on the face of it this is deeply insulting to the world’s largest country, and one that has tiptoed down the line between offending the West and creating starvation and destitution for millions in the South.

I don’t believe it - murdering virtuous plumbers in Canada over the Punjab, which has long ceased to be a primary source of domestic concern, is plain weird.

All things are possible, and India cares far more about Kashmiri terrorism (for instance), but if it is false, expect a sizable slap to Canadian interests, and more accommodation for Putin.

After all, if you are treated as if you are behaving like Putin, why would you ostracize him?

A RIGHT OLD TONKIN

About Influence – American and Russian, mediated by the Chinese

So, to start with what does worry us: That is the slide to a hot war with the powerful Eastern autocracies, fueled by the EU with Napoleonic tendencies, an old man in the White House and a curious sense of ‘crusades’ with no consequences.

For those with long memories of American imperialism, the latest drama even fits neatly as a modern Gulf of Tonkin, a key moment in the slide to war. In that case (south of Hanoi) the clash was naval not aerial but was still notable as one directly between the warring parties and not just their local proxies.

While elsewhere the pieces move, China can not let Russia fail, nor descend into chaos, their long-shared border must stay intact and secure. They no more want the US there than the Russians do. The first step after his confirmation as ruler for life, by Xi, was indeed to go to Moscow.

And the bitter battles in the Middle East of Persian against Arab, Sunni against Shia have cooled abruptly, under Chinese influence. The world once more understands that the US is the threat to peace and stability, not just their fractious neighbours.

For Biden it is an easy fight, the Pentagon so far has played a blinder, what can go wrong? While, for now, France is Europe, no other large state has anything like their stability, Italy is led by the unspeakable, Germany has free market liberals in a bizarre ruling alliance with Greens, Spain is wrapped in its own forthcoming general election, the UK both distinctly detached and under a caretaker government.

The UK budget said nothing, incidentally.

Main influences in France.

While the left in France, as the above photograph shows, are very alive to Macron’s ambitions, to add more territory to the EU, arrange more protectionism for French goods and to suck the labour force out of adjacent states to serve the Inner Empire. Just like Bonaparte tried (and failed) to do, with dire consequences for the French nation.

For all that, the domestic fracas in France (which makes our own strikes look rather tame) was inevitable. Raising (by not a lot) the pension age from 62 to 64, against our own 67 looks small, but it was a clear campaign pledge.

The absence of any minor party wishing to self-destruct, by supporting it in the French legislature, is no great surprise either. So, he has implemented it by decree and Macron has dared the opposition to now either remove his prime ministerial nominee, or shut up.

Banking On Nothing

So, what of markets? Well, the end of SVB is no great loss, it had several policies that had to implode if rates rose, especially on the lending side. It was painfully ‘woke’; I can tell you more about the Board Members sexual orientation, gender and ethnicity than their banking experience, the former just creeps into the end of their latest Annual Report, the latter was invisible to me.

SVB’s long list of ESG triumphs and poses (and it is long) at no point included not going bust. It did commit an extra $5billion to climate change lending, which I guess has all gone up in smoke now. Still apart from all being fired, the bank insolvent, the remnants rescued by the hated Washington mob, under investigation by the DoJ, all the rest of their “G” was superb, and so, so, cool.

I don’t see Credit Suisse as a danger, although it may be in danger. It has had an appalling run of misfortunes, with musical chairs at the top, but it remains a cornerstone of Swiss identity. To let it fold would be highly damaging and cause shockwaves in derivatives markets.

Influence on the markets

So, I do understand the Friday sell off (who wants to be weekend long with regulators on the loose). And we do understand markets needed to go down, after the big October bounce, indeed it was a key reason for our building up over 33% cash or near cash at the previous month end. We knew the winter rally was fake.

But I don’t see this as much more. Retest of the S&P 500 October low? It should not be. I take a lot of heart from bitcoin soaring (63% YTD); if liquidity was short, that would not have happened.

But for all that, I don’t like March in financial markets, too much is uncertain. So, this is more a time for cautious adding, rather than hard buying, but if we get to Easter (and hoping to be wrong on the Tonkin analogy) it does seem a better prospect.

Nor do I see how the various central banks can justify a pause in rate rises, at this point, but nor will they go in hard, that would be folly.

This Fed has made enough mistakes already.

Investment, Politics and Economic cycles

An intriguing current question is which cycle are we in now? Is it the 2000 to 2022 one, or the 2008 to 2022 version? We look at the arguments, and the politics behind it all. And who exactly are energy sanctions designed to hurt?

Hopefully, everyone has now understood it is not the 2020 + rate cycle. Why should it matter? Well, the implications for interest rates are startling. And indeed, for buying on the dip.

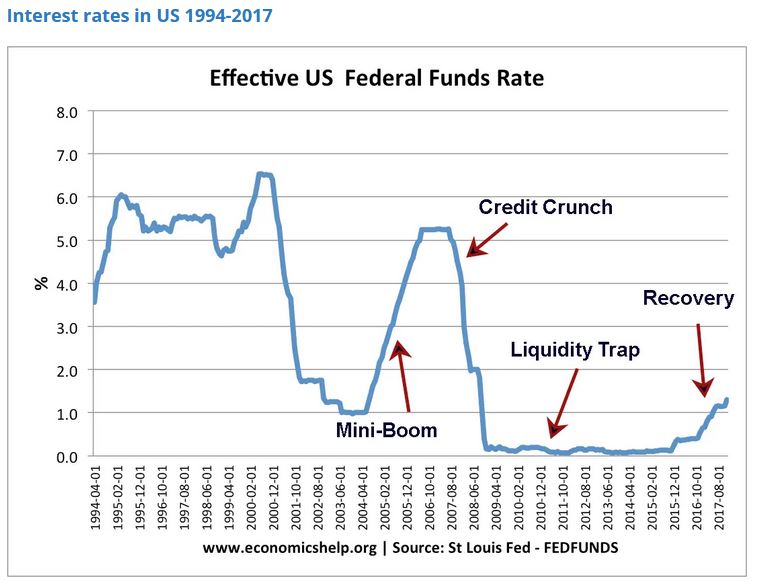

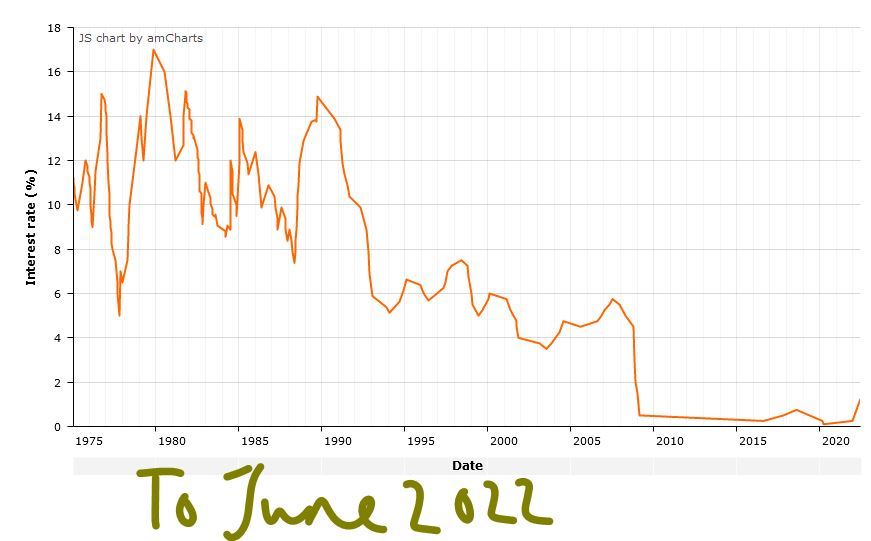

Interest rate cycles

If you consider that interest rates should be about 2% above inflation, to induce savers to defer their consumption, then this cycle really extends from 2000 onwards. The excess credit of that era, led firstly to the GFC in 2008. This in turn led to sudden a lack of credit, but ultimately exactly the same problem of excess debt has reappeared in 2022. The efforts to dampen cycles, seem to just exaggerate them. As does using the same remedy for two very different problems.

Here’s the US picture from the late 1990’s to 2017

In a similar way UK Base Rates in January 2000 were 5.5%, as they were in December 2007, before a long descent to 0.25% in August 2016 which largely held (with a few bumps) all the way to December 2021, when they were still 0.25%! That was before the recent rather modest rises. So, by our “inflation plus 2%” measure of sanity, October 2008 was the last time base rates were sensible.

Ref: this stats article

In other words, this crisis was foretold. SPACs were an early indicator which we mentioned back in 2020. So, if the GFC was caused by too much credit in the US sub-prime housing market, will the hallmark of this one be excess speculation in meme stocks and crypto currency? Clearly, we have now learnt that these “assets” are all distinctly well correlated with each other.

In which case, banking regulation was only half the answer to these vicious moves, because the regulatory perimeter is always too tight. The vandals will inevitably camp just outside the walls - wherever they are built.

Will inflation auto-correct?

It also raises the question of whether the “cure” to moderate this economic cycle is going to be a continuation of the same lax monetary policy. A rather fuzzy consensus has formed around the 3.5% level for interest rates to top out, falling back down in time.

We accept that is roughly the market belief, but feel it needs big assumptions about the auto-correction of inflation, which is presently just a fervent hope. In the real world (as distinct from asset bubbles) interest rates are too still low to matter, and we still have negative real rates on an exceptional scale. If Central Banks are really hoping to correct the laxity of 2007 to 2022, they will not stop at the current levels, but will go far beyond and cause a proper recession. But if they just want to re-establish the post 2008 consensus, they will go easy. They are talking about the former, acting like the latter with all their foot dragging and funny fixes. Is Euro fragmentation sorted? We doubt it. But if it is, they are not telling us, or really even defining what it is.

The ECB and our energy pricing policies

That partly is why markets are jittery, and why the ECB seeming to move from the cheap money forever camp (leaving Japan all alone there) to the appearance of being serious about inflation was so traumatic. We still don’t think they will tame inflation with interest rates alone, as by definition to do so breaks the Euro. This is because Italian debt in particular can’t be funded at any credible real interest rate. So, they too are just hoping for the best.

We also remain baffled by the West’s energy pricing policy that has created this sudden existential crisis. It was interesting to hear Boris telling a startled world, from Kigali, that not everyone feels creating a global food crisis is a rational approach to the Ukraine invasion. As if that was news, although it clearly was to him.

The politics behind it all

But there too we sense two underlying agendas.

Just as it is possible these interest rate rises are really to mop up the GFC policy errors, so also, a large part of the left is desperate for high energy prices. This includes the more thoughtful contingent hoping demand destruction will help sustainability goals (we ourselves have long advocated £2 per litre petrol, but gradually building to that over the last decade, not overnight), but also the more zealous, who are keen to exploit the crisis to render renewables competitive, that much sooner.

There are some big distortions in energy prices too, much of it created by the modern obsession with competition at all costs.

If this is so, then Russia is just a convenient excuse to ramp up carbon prices, blaming Putin for the resulting misery and achieving long-term goals. Certainly, Biden is acting that way, albeit, as ever talking the opposite way. Or rather his clever minders are.

There is a hint too that Boris is in the same deranged camp.

Oddly the EU led by Germany and Austria, with talk of restarting coal plants seem a little more pragmatic. Meanwhile the great beneficiary is Russia and the ever-stronger Rouble. They too have used the crisis to consolidate long term aims, not just in the war-torn rubble of Ukraine.

In short you either have inflation, or a credible short term means to create energy to replace Russian supplies, or high interest rates.

It is odd to think you would want to select just the first and last of that trio….unless your motivation was to correct another perceived policy error.