THERE IS NO SANITY CLAUSE

Three big topics this week from three central banks, all of whom look to be in a muddle, with their knitting all jumbled up and highly implausible. Entirely predictable inflation meanwhile threatens to sweep them off their path, as they tinker with micro adjustments to interest rates.

Boris is diverting, but we doubt if it all matters; pre-Christmas entertainment. If he were logical or even vaguely numerate, he would change, but he’s not, and he won’t, but nor does he need to.

The Lib Dems win a by-election, that Labour fails to contest, but it makes no difference in Parliament, and it lets Boris look contrite mid-term. He will survive this with ease.

Which is not to say he should, or that he’s not making a hash of COVID, the sequel. In keeping the NHS in its current format, Boris fails to ask, as many have before him, whether it is still fit for purpose. This remains an urgent question. It can’t simply collapse every year.

Bailey - Bank Governor and historian

But perhaps Andrew Bailey, Governor of the Bank of England, understands the extraordinary risks Boris poses to the economy, and has hiked rates to show that. A Cambridge (Queens) historian, with a doctorate on the impact of the Napoleonic Wars on the cotton industry of Lancashire, he will know full well the impact of a French orchestrated trade war backed up by a dodgy pan European monetary system.

A consummate insider, via the LSE, he moved on to the ascending ladder of the Bank, which did include a slightly unfortunate move into the FCA. This turned out to have rather more real villains than he was used to. Married to the head of the Department of Government at the LSE, he will be very well aware of the political game and the current mood in Whitehall.

He’s seen enough inflation and has decided the Bank must pretend to act. Not only is the rate rise trivial, but it also coincides with a continuation of Government bond buying (QE), an odd call. That the last thing the economy needed was still more liquidity, has surely been obvious for eighteen months now.

Christine Lagarde and Jerome Powell

In Europe the same mishmash exists. We have been hearing Christine Lagarde explain why the ECB is now accelerating one asset buy back (APP) while ending another one (PEPP). She was winging it with the phrase “utterly clear” in answer to a pertinent question, when it was clearly anything but. Still, she did seem to have her ear rather closer to the ground on wage inflation, at least compared to Jerome Powell.

He by contrast has been caught with his pants on fire, trying to weasel his way out of the Fed failing to spot inflation, by saying that most market commentators agreed. Remind me, which is the canine, and which the wagging appendage?

Basic economics - why inflation arises

We called it on inflation as soon as that stock market rally took off, and for the simplest of economic reasons: the pandemic had reduced global productive capacity, so absent a change in price levels, the economy was less productive, profits were therefore lower, competition would therefore be less (unless prices rose), and total production must fall. Less output, same demand will always mean inflation.

Forget the energy issue, forget supply chains, less capacity, more demand always means trouble. True based on that one schoolboy error, the dopey measures to reduce capacity further by more regulation, hiking the minimum wage, paying people not to work and so on, plus embarking on accelerated decarbonization and a few new trade wars, was not going to help much either. But please no more “surprise” inflation, it was baked in. (See extract from my book, Smoke on the Water, blog dated July 2020, title re-appearing shortly on Amazon)

After the interest rate rise

However, we have also long felt that interest rates can’t rise enough to stop inflation, but that as governments have to back off fiscal stimulus, as they are already overborrowed, the lower productive capacity will itself shrink demand, and in the end cause inflation to fall. But we see that as taking years, not months.

Why are interest rates not rising to combat inflation? No political will for a start, and any one country that gets too far out of line will find currency appreciation itself addresses the problem. So, do we believe the US “dot plot” suggesting three rate rises in 2022, while the Euro zone does nothing? We struggle to.

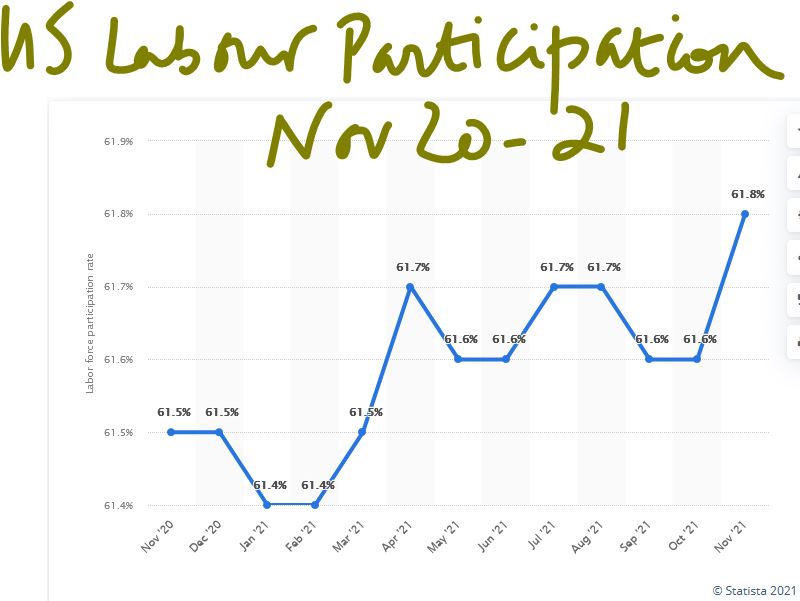

Powell is still clinging to the lower workforce participation rate (which matters) as a signal to defer rate rises and not the unemployment rate (which is more closely related to vacancies) and hence of less fundamental relevance. While employment is great, it will still be unattractive if inflation (and fiscal drag) takes off, thereby holding the participation rate low.

This does still suggest dollar strength, while sterling like other smaller currencies always needs to be wary of getting too far out of line with US rates. But also, a need to fathom out the new look economy. To us, it does not seem service industries that rely on cheap labour are operating in the same world they grew up in. Certainly not if it is onshore.

There is a forced change in government consumption patterns (and hence employment), and this will also be telling. We are heading into quite a different market, when all this shakes down.

Sitting on high cash levels over Christmas, as we are, is pretty cowardly, but if you can’t see the way ahead, slow speeds are usually safer.

We do also rather agree with Chico Marx, this year at least.

Charles Gillams

Monogram Capital Management Ltd

YELLOW BRICK ROAD

The recent elections in the UK probably result in a mildly stronger position for Boris in his Merkel persona, his Christian Democrat (CDU) disguise, so the fiscally left wing, culturally right-wing hybrid, that seems popular; but other than disasters averted, the poll achieves little more. For all the noise about the Hartlepool by-election, we are talking very small numbers, with a 40% turnout in a seat already slightly subscale due to depopulation and industrial decline. It has no resulting impact on the governing majority. Indeed, but for the Brexit Party, it would have been Tory already, so it really says nothing about the right-wing vote. The Tory Party is still miles from representing a majority view, but as long as the left is divided and the right united, that will persist.

Nor do I see much of interest in the council elections: a good result for the Tories in building on an already strong performance last time, which shifts the middle third of councils around in the quagmires of NOC or No Overall Control. This morass, like the bilges on a boat, washes left or right depending on the political tide. But with staff (and councillors) aware that only a few seats can shift them in or out of the NOC swamp, its impact is not great, particularly where they have elections three years out of four. These permanently transient councils tend to be run more for themselves than anything tedious like ideology or providing decent local services.

Neither Mayors nor Police Commissioners have any major power. Sadiq Khan, freshly back in office, faces a central government happy to call in his local plan (on housing) and impose central government representatives on his transport authority, thereby strapping one hand behind his back, in both his areas of real influence. Meanwhile London policing remains ultimately under Home Office control, so like the other areas is just for political grandstanding, not real service delivery. Policing in London also seems an enduring disaster: where it is needed, it is not wanted, where it is wanted, it is not needed.

Reading the Party Runes

So, what of Kier Starmer? Well, it also tells us little about his Cameron-lite policy of avoiding controversy, avoiding spending on fights he can neither win nor cares about, and ensuring he controls everything in the party. That policy is seemingly intact. The Corbyn wing will continue to spout for the microphones on demand, but matter little. The key issue is whether the big funders will want to have a go at winning the 2024 election. I think they will, but should they decide it too is lost, Starmer has a problem. If the party’s money bags decide he can’t win, he won’t.

For Boris it is at the least an endorsement of his recent COVID strategy, and that higher taxation to pay for the incredible spending splurge, has yet to impinge on voters’ minds. So, it permits him to carry on, but perhaps recover more of a strategic view, after the recent wallpaper storms? Does it make exiting COVID lockdowns any easier? Well, it should, but hard to tell if it will. Does it validate the extreme turn green? Not really, the Greens still did better in terms of new seats won, than either the Labour or Lib Dems, and are still advancing (from a very low base).

I am not sure if the Lib Dems expected much, they have Keir’s problem of irrelevance tied to being pro-European, when the EU is behaving more oddly than ever. So roughly holding their ground was fine. Indeed, they polled way ahead (17%) of national election ratings (which are more like 7%), but not over the magic 20% required to hit much power.

Those Strange US Job Numbers

Which brings us to the real shock from last week, the weird US jobs numbers on Friday. We have long said that how and if labour markets clear after the great lockdown experiment, is the vital economic issue. The problem never was the banks (so last crisis) nor the ability to borrow to sling money down the giant hole dug by the virus. Both are easy. But once you have smashed the economic system, does it regrow, like a lizard’s tail or simply start to rot and decay?

Many of us would have avoided the deep wound in the first place, but now the experiment has been started it must conclude. So, what did happen to slash monthly US job creation from expectations of a million to just a quarter of that? The instant reaction that it meant inflation has gone and so bonds were fine, was as instant reactions often are, garbage.

The bull or ‘Biden’ case is that as they have the right medicine, it just needs a bigger dose, or to take it for longer. Seems credible; labour force stats are notoriously volatile, some of the job losses came from manufacturing, where supply shortages are biting, but that’s transient. Some seem to indicate a mismatch of jobs to vacancies, hopefully also transitory.

Encouragingly, a spike in wage inflation and hourly rates indicated plenty of demand for workers.

Yet, slamming the brakes on, shutting the economy down and paying millions of people not to work, might have brutally destroyed the delicate economic system. Thousands of small firms, where the bulk of employment is created, have just gone. The complex prior system of sales, working capital, scheduling, delivering, inventory, payment has been eliminated. Sure, the people still exist, so do the premises, but the invisible mass, the self-directing hive, is lost: no map, no honey, no queen.

Bigger firms are also planning to work differently, perhaps needing less labour.

Once you stop working and get paid to be idle, and indeed have limited ways to spend your money, it feels easier to stay in bed, study Python, redecorate the house, or whatever, but not get back on the treadmill. Indeed, in a lot of cases, once you step off, stepping back on is hard and also downright counter intuitive. Sure, your old boss wants you back, but do you want the old boss back? Worth a look round at least? As the title song puts it, “there’s plenty like me to be found”.

Well, we still go with the bull case.

However, the bear one is not trivial. If you can’t get labour markets to clear, welfare will be embedded, as will high unemployment, deficits and unrest. It remains the most critical feature, worldwide of the recovery, and several questions about it remain as well, including the need to keep new bank lending elevated, cheap, available. Expanding needs cash, contracting creates it.

The oddity to us then remains, that if the liquidity barrage really does work, why should it work better in the US than elsewhere?

And if it works the same for all, don’t US markets then look rather expensive?

Charles Gillams

Monogram Capital Management Ltd