River Deep, Mountain High

Welcome back Mr. Powell - so what is a good response to impending inflation?

After nine months or more the newly reappointed Fed Chair conceded the blindingly obvious: we have an inflation issue, along with the equally transparent need to tighten monetary conditions to quell it. At least he’s fronted up to that, unlike the position in Europe.

What diverts us is what the right response is. Some things are perhaps obvious: gold at least in sterling terms now has positive momentum again. But there is a tremendous volume of liquidity to soak up still, while stimulus will keep being pumped in for a long time. But fixed interest just looks hopeless, credit quality is plummeting, rates are rising, and returns are poor, even in high yield.

Are we clear of COVID effects?

Nor are we really clear of COVID effects. We are yet to pass beyond all the “emergency measures”. So here in the UK, VAT is still reduced, commercial evictions banned, and government departments are still showing that odd mix of budget destroying costs and below normal productivity. So, spending pressure will stay elevated for a good while. Tax rises on corporate profits and on labour through National Insurance hikes, will therefore start to bite, well before the last variant has caused another pfennigabsatze-panik. (spike/trough related panic)

Markets have also been jittery. In general, the buying opportunities just after Thanksgiving have held, which is a good sign. The subsequent gyrations have (so far) indicated a good weight of money ready to buy the dips. But there is little doubt cash is fleeing the overhyped stocks, which are far more prevalent in the US, than in the UK. The shift out of basic commodities is also apparent. So, I would still expect enormous cash balances to build up into the year end in the banking sector, albeit maybe not always in the right places. Any Santa Claus rally will be strictly retail elf driven; the old man is self-isolating this year.

Characteristics of this inflation

Our view remains that the expected high inflation is systemic, simply because of the structural damage and inefficiency inflicted by COVID. So, it maybe transient, but multi-year transient. In this case while the seasonal moves down in energy prices will be a welcome relief, assuming Northern Hemisphere temperatures stay around seasonal norms (and that’s what mid-range forecasts are indicating) - it is not a solution to the inflationary pressures.

Nor do we see the any unwinding of the inventory super cycle caused by the holiday season and the ending of lockdowns, all at once, as having much beneficial impact on price levels.

Businesses all want inventory and will keep rebuilding it across their full ranges for a while. After all, right now holding stock has little financial cost attached.

See this article published by Markit.

Most corporates are at heart squirrels; it won’t be easy to break a new habit.

So how should we play this?

The bigger issue is how to play this - the received wisdom is pile into the US, probably the NASDAQ, while having a side bet on bitcoin or some less disreputable alternatives.

That’s where most investors knowingly or otherwise have their funds.

NASDAQ may churn as dealers try to create some volatility, but the overall (and in our view inflated) levels will most likely remain.

This Omicron variant episode at least has halted the IPO madness, and the whole SPAC nonsense is washed up. Sadly, not a big surprise to see portly old London has just tried to catch a train that left the station last year.

The longer view

But it is a bubble we think - our icf economics monthly looks in more depth at how these played out the last couple of times. Not pleasant, but oddly familiar.

NASDAQ and Bitcoin may yet scale new peaks, but the river below is very deep. Perhaps that old affection for base gold is not just nostalgia?

Time for some year end reflection.

Charles Gillams

Monogram Capital Management

All kinds of everything

We move towards the end of the year with a great deal of challenging uncertainty and big calls to make, on inflation, China, US Politics, whether interest rates are pegged, and a few political issues. The temptation to sit it out and come back after Burns Night, is intense.

A lot of things will be clear then: the severity of the winter, and hence fuel prices, also of the EU COVID spike, the nerve of some Central Banks and who leads the largest one, and how the Beijing Olympics will go. All are potentially significant matters for investors.

Few of these issues are surprises, which is good, indeed we see advanced economies as being in fairly stable shape, but badly damaged by populist politicians, who can’t face telling voters that ‘nothing comes from nothing, nothing ever could’.

Inflation

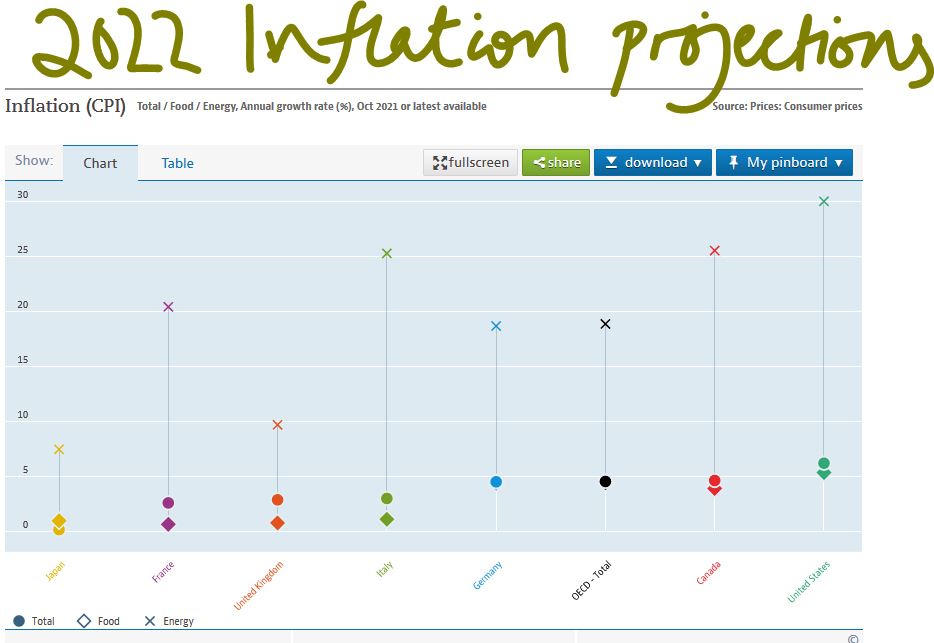

So, on inflation, we took some flak back in the Spring for talking about 5% inflation, but we regard that as pretty conservative now.

From the OECD data here.

We see it as structural too, not related solely to excess demand, supply chains or energy prices. All of these matter, but the last two are indeed transient, and excess demand is within the power of the fiscal and monetary authorities to affect. The real trouble is both the lingering and severe harm COVID is causing to productivity, especially in the service sector and in a public sector still too reliant on overmanning and allied with that, the curse of politicians trying to exploit the pandemic to pay off their chums.

Our conclusion is that we will have higher prices at least for the next two quarters and possibly all of next year. Critically Central Banks will most likely be powerless to prevent or reduce that, without bringing the house down.

Broken China?

One cannot but be envious of the performance turned in, yet again, by Scottish Mortgage. The half year gains are massively from one stock, Moderna, and then a broad raft of e-commerce and big data plays. So, really, they just continue to surf the NASDAQ run. By contrast their big cap China positions generally damaged performance but have not yet been visibly trimmed. Although China does drop from 24% to 17% of their NAV, which is significant, with North America rising from 50% to 57%. (I should also mention we don’t hold a position in this stock and have not had one this year.)

So, NASDAQ strength allows them to survive what for most fund managers has been the poison of owning anything in China this year. A decision we took, guided by our momentum models, very early.

We also note the manager’s viewpoint, which broadly aligns with a view that what Beijing is doing, is what the West should do as well, in attacking and controlling big tech platforms and their associated excesses. Telling the biggest companies to also do more to reduce inequality and cure social problems hurts profits; but they still see both as not unreasonable requests and they claim big Chinese companies are already willingly complying.

Yet for all the apparently cold rationality of the Scottish Mortgage viewpoint, we do understand it, and do see China trashing their participation in areas of global commerce and capital markets as an odd piece of self-harm, if it is really their aim, not just an ill-thought-out consequence of domestic actions.

So, we see the set back so far in China stock prices, as based on the possibility of the area being uninvestable, like Russia, but not yet on that certainty - see the how strong the trade figures are even with India, a so-called political antagonist. But tipping over to uninvestable would be a market shock and again we inch closer to that, with each diplomatic spat.

United States - and the Fed Chairman

The big US call, and again we signaled this as critical a while back, and actually well before the US Presidential Election, is about Powell. My sense is removing a competent Fed Chair for purely partisan reasons would be damaging to markets and the dollar. But the pressure on the ailing Biden to do just that feels intense, and I am struggling to see who in the White House will have the maturity to stop it, if Biden caves in.

Would a new Chair do things differently? Might markets push harder still for a rate rise and the dollar, short term at least, suffer? For now, re-appointment is still expected, but the odds on a shock are shortening.

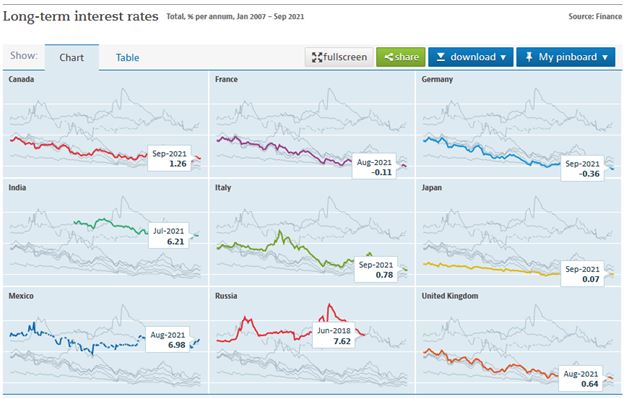

Interest rates

The Bank of England is also, quietly in the midst of a storm, it is not actually independent however hard it claims otherwise, it relies too much on Whitehall just to survive, and, in a way, can’t do anything meaningful on inflation anyway. Still a rate rise, even a notional one, would show it is still awake. It makes little sense just now, but as a symbol might yet happen. To us it simply adds emphasis to the political chaos overtaking Johnson and the ongoing shift towards an institutional alignment with a Starmer government.

Material interest rate rises (so returning us to positive real rates) during 2022 therefore still feel impossible. Indeed, German rates have once more flirted with changing the nominal sign, only to collapse back into negative territory.

To sum up - where does that leave us?

Well curiously, mildly bullish. We may not much like the position, but who cares about that, our task is to make money for investors. We also have had a think about what rescued investors from the COVID slump, on the basis that a future sharp inflexion in interest rates could look much the same.

What we see is the power of real growth, not the flotsam of cash hungry concept companies that can never pay a dividend, but fast-growing, broad-based technology – following that has been the winner for a decade. We do want to call time on that, partly for the nonsense and scams it tugs along behind it, but we still struggle to see the turn.

Charles Gillams

Monogram Capital Management Ltd

Caution: Bumpy Road ahead

Puzzle: World markets have whipsawed in the last few weeks, from high anxiety to an almost beatific calm. The VIX volatility index has dropped to pretty well a post-pandemic low. Which should mean we all agree, but on what exactly? Rising inflation, yes, but how durable, and caused by what?

And that, we all accept, will make interest rates rise, yes, but how high for how long? Markets we feel are, to say the least, fragile.

At the turn, we know that moves can be dramatic both ways, for markets.

Are we really seeing a labour shortage? The UK truck drivers’ situation

What we see now is not a labour shortage, and hence political talk of stemming migration and higher wages is well off target. What it is, in part at least, is a failure of the routine operations of an incompetent government, something politicians typically don’t want to discuss.

The government has insinuated itself into so many areas, with its complex regulations, that the market economy now lies ensnared in myriad interlocking regulations, backed up by a deeply entrenched blame culture (and its friend the compensation economy).

To take one example, there is no shortage of truck drivers, but there is a shortage of qualified, approved, signed off and regulated truck drivers, because as part of the destructive lockdown, the government just halted the conveyor belt of required testing and approvals.

Truckers’ wages have for long been too low, of course, especially for the owner drivers in the spot market. What we have is not a labour shortage, it’s a paperwork shortage. The difference is vital for how enduring inflation is. A new driver will take a couple of decades to grow, but clearing a paperwork jam, a few months. One is enduring, the other transient.

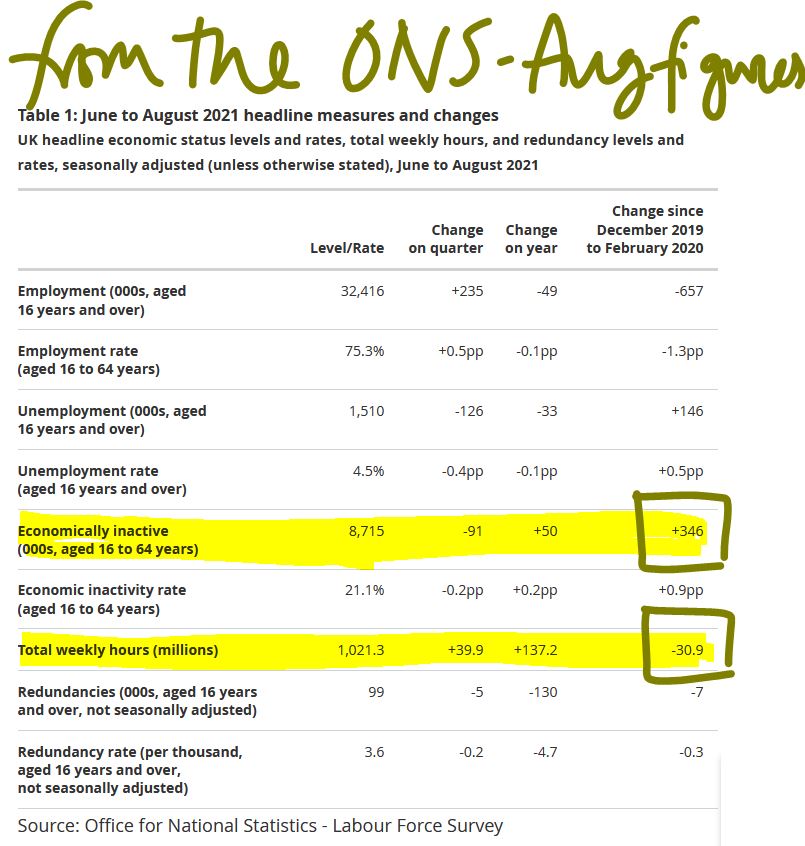

Withdrawal of older workers from the labour market

Work after all is something of a habit: once it is lost, it can be hard to understand why it existed. So, we see a marked increase in older workers in the UK who have just withdrawn from the market (Some thirty million fewer hours worked - see figure below). That too is not a labour shortage as such, they all still exist.

But if work was of marginal benefit to the worker, and the costs to resume work (actual or psychological) are high, disruption will cause the fringe or marginal job to be unfilled. Yet again more in the transient column than permanent.

Someone will waive the rules, or the government will notice, well before all drivers get paid high enough wages to cause embedded inflation. In any event articulated fuel tanker drivers tend to work for big employers, with good conditions, and are well organized. They have to be, after all they drive mobile bombs. The spot operator on a rigid rig is in a different market.

Inflation will most likely be transient

So, if it is not an actual labour shortage, it won’t cause wage inflation, and will be transient. Some other areas reliant on highly skilled older workers will continue to see standards fall, but generally younger workers will over time fill those slots and gradually acquire those skills. And it won’t be a long time.

Our view from way back was of 5% plus inflation and labour markets that struggle to clear this year. We were wrong to not foresee the failure of regulatory processes to keep up. However we still do see a permanently higher post COVID cost base and therefore in certain sectors, a large amount of marginal productive capacity are likely to be withdrawn from the market.

With a banking system that still struggles to offer commercial finance to the SME sector, because of excessive regulatory caution, there are swathes of jobs that have simply gone. So that labour will in time be redeployed. The current concern is that many of these workers show no desire, or ability under current conditions, to return to the market. But when they do, the capacity that has been destroyed will slowly return, and once more drive down prices.

Nor should we forget just how much the Exchequer loves inflation, as fiscal drag, their beloved tax on higher prices, smooths away so many budgetary blemishes. They will let it go, if they possibly can.

Commodity prices

On the input side we do still see commodity price rises as transitory, at least within the energy market. As others have noted much of that too is regulatory failure on a grand scale, not a true shortage. Price fixing by the state is a notoriously foolish concept, as we learnt in the 1970’s.

There are a number of other supply factors at play too, but while some will recur, most are temporary.

How long do we think the inflation spike will last?

So yes, inflation will spike, and yes it will stay elevated for much of next year, but no, we don’t see it as necessarily durable, once COVID restrictions and related behavioural changes vanish.

We are still pretty certain that the political costs of aggressive interest rate rises will outweigh any perceived price control benefit. As long as some Central Banks hold off rises, it will be very hard for others to do so, without sharp currency moves or bringing in formal exchange controls. That would in turn spook markets far more than rate rises.

The next phase of markets

All of this says to us that a major market dislocation, despite the benign signals, lies ahead in the next six months.

Markets shifting rapidly are more a sign of uncertainty than of a new degree of confidence, and we simply don’t trust it. We see inflation as apparently out of control, but no significant interest rate rise response is feasible. That can feel like stock nirvana, but also like investor purgatory, as you have no idea what is or is not a sustainable profit.

Charles Gillams

Monogram Capital Management Ltd

Thin ice skaters or savants?

Are we drifting out further from the shore of reason, confident we can slide gracefully back to safety, or do we have insight others lack? Perhaps rates just can’t rise, whatever the inflation rate? If so, they are a paper tiger. While in a week others have pondered the failure of UK investing during this century, we look at why our biggest bank seems to hate the country.

I’m talking about the economics prognostications from HSBC, our largest bank. Following an intellectually flawed change in accounting standards (yes, another one), on top of the insanity of “mark to market” comes the “predicted loan loss model”.

Now professional bankers (unlike those in fintech) don’t make loans to lose money.

So, the politicians have instead required them to assume that they do.

Do the regulators know the industry they’re regulating?

Imagine portfolio management where you assume a certain portion of your buys always fail. Might be true, but how? And if you admit you have to buy a certain number of your holdings to instantly lose money, what do your investors feel?

But although banks advance money on the basis of their credit committee assessments, the hordes of regulators deem some of it is immediately lost. Being rational people on the whole, the banks, not great fans of predicting the future (given their record), hire economists to do this for them.

Economists, as we know, actually know little, but they do build nice econometric models. The regulators, who know even less, tweak the models, the bank Boards (see above) also tweak them. Soon every model is so tweaked that the economists wonder why they bothered.

UK shown as the riskiest of places to lend

Which leads us to page 62 of the HSBC Interim Report. We read it, so you don’t have to. There on the excitingly named, but dull as ditch water section called “Risk” it is set out.

Now HSBC lends globally: Mexico, India, Vietnam, Peoples Republic of China. So, guess where “The highest degree of uncertainty in expected credit loss estimates” relates to? Apparently, the basket case to end all wicker weaving is . . . Yes, the UK.

How?

Well first up their ‘central scenario’ model sees the short-term average UK interest rates for the next five years, as 0.6%. Which at least is positive (unlike France, as they hate Macron even more), France (i.e., the Euro) rates are assumed to stay negative till after 2026.

This gloomy central scenario has a 50% chance, although for France it is a tiny bit better at 45%.

Now these are central estimates, but their “downside scenario worst case outcome” for the UK is heavily weighted, with a chunky 30% chance, and oops, France then gets a 35% chance of that disaster, neatly using up the slack just given to them, by the central scenario.

Oh, and there’s worse: house prices crater, double figure unemployment is locked in etc.

And that’s a combined 80% of outcomes sorted; for a bank, that is pretty near certain.

China compared to the UK and France

What about Mainland China, then, their biggest market, if you now include Hong Kong. Well like the US (75%), China is at a high (80%) central scenario certainty, with Hong Kong at 75%. The worst-case scenario for the PRC is ranked at just a measly 8%, the lowest of any of their major markets.

Call it impossible - a prediction that China can’t fail.

Well, if that’s what the economists believe, who are the dumb Board to argue? Well of course they can, to cover their well-appointed posteriors, they then chuck another couple of billion of extra reserves in on top of the doomsday forecasts.

So, you see the vortex, everyone, regulators, economists, non-executives are just adding to reserves, like the good old days.

Maybe they are right, but we are seeing very little sign of those incredibly low global interest rates for five years, negative in France, 0.6% in the UK, 1.1% in the US? Really? If they are right, the markets are wrong.

And it is not just technical, with a 35% chance of France hitting the worst-case scenario, no wonder the Board has shipped out their French operations to a fin tech start up, albeit one backed by private equity giants Cerberus. Not an outfit known for overpaying. With five-year rates at 1.1% the dash for cash in the US makes sense too, selling out of their retail side as well. While with a virtually nailed on, global leading, 5% five-year average GDP growth in the PRC included, surely time to expand there?

Their loan book does not bear out HSBC’s bullish estimates of Chinese infallibility

So it is with some trepidation that we look at their loan book, on Real Estate, in China. It must be massive? Certainly, markets apparently assumed so last week. But no, a paltry $6.336 billion, for HSBC that’s a rounding error. Luckily too, all rock solid, just $28m of reserves needed, although given their certainty that almost feels excessive. The Board probably slipped that bit in.

I have great admiration for HSBC, and for me personally it is a long-term hold, but I have much less regard for regulators and ‘economists’ models, about which only one thing is certain. They are wrong.

So, I try to just strip out the predicted loan loss nonsense, but it is still driving asset allocations, even when palpably false. It explains much of the last two year’s volatility in bank share prices and reported profits, it also justified the highly damaging dividend ban.

Yet the HSBC share price is still not much above 50% of its pre-COVID peak. Great investor protection that was, it hammered HMRC receipts too, for what? Based on what?

Does anyone challenge those weird scenarios internally at HSBC?

Is there really a 35% chance of France virtually collapsing in the next five years?

Or is this just part of cozying up to China? In which case as the IMF has shown, bankers accused of fiddling data for China, are not always seen as professionals and can lack credibility.

Regulators should not impose those odd fictions on real investment decisions either.

If they do real economies and yes jobs, suffer.

Charles Gillams

Monogram Capital Management Ltd

Fiasco

First Posted on 7th March 2021

WHY SYSTEMS FAIL, AND IT IS REALLY NOT ABOUT MONEY

A winter lockdown forces us all to examine our domestic interiors, with in my case perhaps a superfluity of paper, which led me to “Fiasco”, by Thomas E. Ricks. It is a seminal description of how complex systems create monsters and then fail, not for lack of effort, nor goodwill, nor money, but from thrashing about with no coherent strategy.

Indeed, arguably all those three inputs make matters worse. The tale simply told, in a largely deadpan tone, is of the greatest failure of American foreign policy since Pearl Harbour, and the greatest crime perpetuated by a British Prime Minister, since the Bengal Famine. It is how Bush, looking for revenge after 9/11, has spawned the disasters of the modern Middle East and locked us all into an unending cycle of terrorism and for the millions of people in the Middle East and beyond, brought poverty and despair.

Strategy matters

How? Well as Ricks tells it, they used the wrong tool for the wrong job: the strategy was hazy, mission creep endemic, the reporting system mangled everything to suit those making the reports. In the meantime, the aims kept shifting, and staff rotation and comfort swamped the original purpose of simply executing the mission.

While those they were sent to save, service and otherwise succour, were embittered and made hostile by the sacrifices they were expected to make, in return for specious, obscure propaganda.

So that led to the USA seeing the Iraqi people as the enemy, not just their crazed leader, while the entire Iraqi government was blamed for funding and concealing these non- existent weapons. Read it. Because from that flowed the failure of Phase IV (the post conflict reconstruction), the hostile occupation (not liberation) of Iraq, the idiocy of making that occupation subservient to Pentagon (not civilian) demands, the destruction of the fragile sectarian balance between Shia and Sunni, the rise of ISIS, the Syrian nightmare, Yemen, and the Iran nuclear programme.

Meanwhile, the attendant loss of money, the coming to power of the isolationist and militia based right wing in the US, the triumph of China in the emerging world, the resurgence of Russian thuggery all remorselessly followed on. Simply unbelievable. As Hicks writes it, you can hear the quiet click, as the lid of Pandora’s box was ever so gently released; beats bat breeding labs in Wuhan for the sheer laconic horror of it.

They did start the fire.

I do not know what the Pope going to Baghdad shows, beyond a startling personal courage, but it is no ordinary trip. The story also shows how in the modern world massive complex heavily manned delivery systems just can’t operate. They are dinosaurs. There was nothing inherently wrong with the US Army, but yet it created its own defeat.

WHY THIS SYSTEM WILL FAIL TOO, AND AGAIN, IT IS NOT ABOUT THE MONEY

So, to the UK budget, another set of tactical responses to poorly understood problems, hemmed in by contradictory rules, horribly distorted by politics. Sadly, the government really does believe it is the presentation that matters, not delivery. So, we had Rishi, spooling out unending largesse, and crudely claiming he was going to level with us, and level up North Yorkshire, and hand out freeport concessions to his chums and give Ulster another £5m for their paramilitaries (oh, you missed that one?).

A more extensive piece will shortly be on our website. It questions whether we are building back better. To me this looks more like ‘business as usual’, no growth, no decent jobs, London’s supremacy ploughing on, the regions thrown scraps. Green? When you freeze vehicle fuel prices for the eleventh year? Hardly. So yes, the budget was a relief, but no it should not have been. I doubt if markets will like it much, just because the publicans do.

DEBT AND EQUITY MARKETS AND INTEREST RATES

Markets Well, there is another puzzle, I thought the august President of Queens’ College Cambridge was going to self-combust into his tache, such was his thrill at seeing the bond vigilantes shooting up the US ten-year interest rate, during the week. Biden must pay his electoral base the bribe needed to win those Georgia Senate seats, at the full inflationary excess of $1.9 trillion, pumped onto an economy that is already visibly and dangerously overheating. The one Game Stop we do need, won’t happen.

So, you have $27 trillion and rising of outstanding US government debt, do the maths, if the bond vigilantes push rates up by 1% for the average duration of that debt, 65 months, that will cost you some $1.5 trillion back. So sure, you can cough up on your election pork, but it will cost the American people $3.4 trillion to do that.

Well, we don’t actually think that attempted rate increase can stick, for all the reasons it failed to stick over the last decade. Powell at the Fed then agrees with us, which on past form is perhaps an ominous sign of our approaching error (or possibly his gaining of wisdom).

Equity markets certainly felt unhinged; they started to whipsaw around in a frankly worrying fashion. On prior performance this does need sorting out, before it is safe to go back in. If (of all places) the US will lead on raising rates, it has to then pull up all other global interest rates, which we know will slow growth and take the wind out of the recovery. Indeed, it may threaten it, it has to cut (see above) how much governments can then borrow, has to start foreign exchange rates jockeying for position, has to question the whole free money basis of tech valuations.

I simply don’t think this recovery and these valuations can stand that just yet, and after a decent pause, the Fed (like many other Central Banks do already) will have to act to somehow hold down rates. Whatever Governments say, money does have a time value, and behaving as if it does not, is rather unwise. But I think extend and pretend will still persist for a while yet.

Charles Gillams

Monogram Capital Management Ltd