Too chilled

Markets seem far too relaxed about world elections; we suspect from ignorance. Logically if you move from certainty to uncertainty (with a range of possible outcomes) you should adjust your level of risk. India has already shown some of the volatility of the 'wait and see' approach.

Too hot?

So, we start there, where prior confidence in an enhanced majority for Modi, was well wide of the mark, he ended down 63 seats at 240; a majority is 272. Some of that chaos is the electoral system, and some of it the ban on opinion polls - although some accurate information inevitably crept out, despite restrictions, but international investors did not pay much attention to it.

So, when the exit polls announced all was well, the market rose, only to reverse hard when the real result emerged within a few hours. Although then buyers came back in, and we ended up flat.

From this website – date published : 8th June 2024.

On a call with local managers, (and the options for investment in India are wider than you might assume) clearly something had changed, one was almost pleading with the international audience not to take money out. Very little spooks other fund managers quite like being repeatedly asked to not redeem.

The Congress Party has almost doubled its seats, from 47 to 99, a strong result. The other beneficiary was the Samajwadi party, nominally socialist, with a strong presence in Uttar Pradesh, a vast Northern state. They went from 5 to 37 seats and are very much in Modi's BJP territory.

India has always had strong states, with the more populous ones often having a local ruling party, which has been around for ages. So, this is a reversion to the long term normal.

In house collage of a state by state analysis of Indian share ownership percentages

But that is what scares investors; coalitions nearly always break down. There was also damage to the Index from the Adani group of interlocking holdings (long hounded by Congress for alleged corruption).

A weaker Modi

That allied with the long-standing fears about political corruption, uncertainty of policy and no national enforcement, is an unwelcome reminder that Modi is now in his last term. Hopes that stability will follow him, rather than a swing back to the broken past, always felt optimistic.

The commonly voiced issue is that a weaker Modi will have less ability to drive structural reforms and will find it harder to resist welfare payments, and labour demands. Historically, some of these payments and concessions reach the poor, either in higher consumption or better services, but a great part gets stuck with middlemen. That should be less of a problem now, as a result of reforms already implemented, putting in a national bio identity scheme and almost universal individual banking services.

We will see.

While generally expecting strong growth to persist, we are now more cautious about signs of the lost consensus, into the medium term.

The UK - far too chilled

Which brings us to the farce that is a UK General Election, where such discourse as there is has been about whether families are or are not facing a £2,000 tax hike (or roughly 20% more for those on average earnings). Not knowing where they live, or how they spend their money, or indeed how they will adjust to high taxes, you can never tell these things with much accuracy.

This comes with minute (and futile) attempts to list every one of the myriad ways that the assumed tax hike won't happen and extracting a "pledge" from all parties not to raise them. As if all Chancellors do not have multiple ways to raise revenue, carte blanche to create new charges, and a great ability to lie or concoct exceptional circumstances to hit us. Sunak of all people should know that.

Yet most voters are thinking, is that all? Is it enough? We know that existing service demands are not being met and that no party seeks to resist the endless demand for expanded services.

I doubt if growth will save us either: we are close to the point where those that can take investment elsewhere, have left, and no sane investor would now invest, without substantial state subsidy. So, we are simply building up to an inevitable budget crisis in the medium term.

There are a few who hope that change will be its own reward, maybe, but we can't really tell much until after the first Budget, (Labour have pledged to revert to just one a year), and a couple of Parliamentary sessions.

Just waiting and hoping is illogical. Markets do just that, though.

Frozen in the US

Which brings us finally to the USA, the Presidential election feels (to me) fairly easy to call, but how the US Congress and Senate go, does not; the resulting power (or otherwise) of the President is less easy to predict. It may be that we get a split between parties again, which markets like, and it feels unlikely (but possible) that we end up with constitutional change, which markets certainly won't like.

The current Federal Reserve Chairman will be in office for all of 2025, but almost certainly not beyond that, and who replaces him, will figure high on the consequential concerns, as unlike other Central Bankers, he sets the global tone. Powell is not popular with either of the spendthrift presidential candidates seeking office. Nor will he be trying to get reappointed. He has been an odd and erratic champion for the dollar and sound money, but he has been that.

I am not sure other elections are so consequential, the European Parliament has hopefully done its worst already, while investors in both Mexico and South Africa are starting from a low base of limited ambition.

So, to us, the question is how long to follow benign short-term themes, while such dramatic shifts may be hitting us within six months.

Inactivity from ignorance remains attractive, but is it wise? At some point in the interim, markets will probably decide not.

DREAMERS

What would Trump’s high tariff isolationist world look like? What would the mirror image be in Xi’s China? Not now, not next week, but rolling into the next decade.

And whatever portfolio theory says, and whatever the optimistic investor believes, 80% of my own portfolio is flotsam, drifting up and down on Pacific tides. Stocks I both like and which have compounded over decades are remarkably few. Oh, and a brief word on African housing.

GOING IT ALONE

But first, to give it the grand name, autarchy, or self-sufficiency. A bit of a joke - the Soviet Union tried it, Iran tries it, China famously only revived after ditching it.

But it is back in fashion, and not just in strange places. The EU industrial and agricultural policy is starting to look like a version; beyond their four walls they need carbon and chemicals, but within them they don’t, nor will they allow imports of them (or products including them). Quite fantastic.

Trump is on his 60% tariffs line. Xi clearly wants to cut off foreign capital, as it arrives infected with democracy and transparency, and the associated foreign reporting or verification.

So, could they? Yes, the US could - it is big enough, can do most things, and largely trades internally. While at least in Trump’s imagination the commercial borders are sealed, and so enforceable.

What goes wrong? Well at some, quite distant, point people stop expecting to trade with the US. So, at its most extreme, if China can’t sell to the US, it won’t buy from them either. But that is decades away, most Chinese production can probably take a 300% tariff, and still sell at a profit.

The flip side of the tariff is the huge salary for a barista, or a trucker. The latter is not so far away. Prices of domestic US production must rise, to allow the blue-collar Mid-West to rejuvenate. US consumers of course (including that barista) will pay vastly more for US goods, or will get hit with the import tariff; this of course is a tax on them.

What about Xi? Well again it is possible - that’s how China ran for much of his life, with a lot of new infrastructure, industrialization, since installed. He can do it all again. There, unlike in the US, the issue is capital. As a big net exporter, an area that will itself be under pressure, money will be harder to find; it already is.

THE NIGHTMARE

Countries that go through this closing cycle typically also do default (as the Soviets did, as US (and UK) railways did,). Folly, but it can be done.

The US has been going down this route since Obama, Trump talked a lot about it, but Biden too sees the resulting wage inflation as a good thing. So, it is the next US President’s policy either way.

Obama was keen on hitting capital markets (FATCA was and remains both a non-tariff barrier (I am being polite here) and a tariff on external capital) and I suspect a Biden administration must do the same, to balance the books.

While Xi never really left protectionism, WTO and GATT were mainly honoured in the breach.

And Europe? There is quite a strong strategic need to expand to the East, although as that goes through (and we are talking the mid 2030’s here) Ukrainian farmers, like Polish farmers today, will buckle under the rules; it barely matters about the Donbas, the EU will shut those heavy industries down too.

So, I think autarchy can work for all three, it will support a large uncompetitive labour force, and consumer choice will vanish. In many cases there will be lower quality and high prices. All three will attack (or in some cases keep attacking) capital flows.

And in the end, the entrepots will survive, those not in any such block, like the UAE or Singapore today, Amsterdam in the 17th Century, Yemen under the Romans and Victorian Britain.

The winners will be flexible, a tad amoral, assertive, in fluid alliances, but reliant on gold not steel to survive. And they will suck in entrepreneurial talent too. At a strategic level, that feels the place to be looking. Although buying uncompetitive heavy industries before their brief period of tariff induced profitability, has a short-term allure.

DOGS OR GREYHOUNDS ?

The ludicrous halving of CGT allowances, based on some fantasy “yield” number from the equally ludicrous HMRC, via the OBR, means once again the tiresome process of harvesting losses is upon us. No longer can they sit unloved at the back, snoozing; out they must come.

And what a tale of dross they reveal, and scattered amongst them so many once “good ideas” and busted yield stocks. Well, it sticks in the throat, but perhaps sticking it in a US wonder stock for six months is better?

Of course, if I knew when I acquired them that the FTSE was moribund for two decades, I would never have bothered. Seems it is time to simplify.

COLLATERAL

And lastly African housing. It was one of Gordon Brown’s (and the PRA’s) great achievements to get UK banks out of overseas assets, far too volatile, currency? foreigners?- Who needs them? Bring it all home and inflate the UK housing market with safe, cheap, mortgages.

So, Citizens went, Barclays were hounded out of South Africa, and so on – although their post-sale performance has really not been great either. Africa now just does not have proper mortgage financing for the vast bulk of the population. This is at a level I had failed to fully comprehend.

You think that despite everything, Africa must have got better. But no housing, so less health, less stability, no financial security. Safe recycling of profits in the continent is still hard. Aid can’t create institutional reform, but that’s the need.

If you look for the breakout into developed status, it starts there.

A RIGHT OLD TONKIN

About Influence – American and Russian, mediated by the Chinese

So, to start with what does worry us: That is the slide to a hot war with the powerful Eastern autocracies, fueled by the EU with Napoleonic tendencies, an old man in the White House and a curious sense of ‘crusades’ with no consequences.

For those with long memories of American imperialism, the latest drama even fits neatly as a modern Gulf of Tonkin, a key moment in the slide to war. In that case (south of Hanoi) the clash was naval not aerial but was still notable as one directly between the warring parties and not just their local proxies.

While elsewhere the pieces move, China can not let Russia fail, nor descend into chaos, their long-shared border must stay intact and secure. They no more want the US there than the Russians do. The first step after his confirmation as ruler for life, by Xi, was indeed to go to Moscow.

And the bitter battles in the Middle East of Persian against Arab, Sunni against Shia have cooled abruptly, under Chinese influence. The world once more understands that the US is the threat to peace and stability, not just their fractious neighbours.

For Biden it is an easy fight, the Pentagon so far has played a blinder, what can go wrong? While, for now, France is Europe, no other large state has anything like their stability, Italy is led by the unspeakable, Germany has free market liberals in a bizarre ruling alliance with Greens, Spain is wrapped in its own forthcoming general election, the UK both distinctly detached and under a caretaker government.

The UK budget said nothing, incidentally.

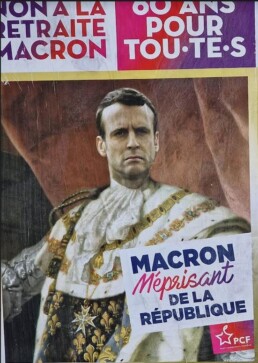

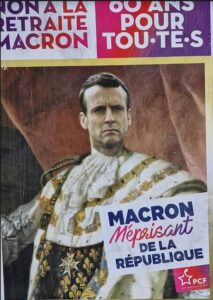

Main influences in France.

While the left in France, as the above photograph shows, are very alive to Macron’s ambitions, to add more territory to the EU, arrange more protectionism for French goods and to suck the labour force out of adjacent states to serve the Inner Empire. Just like Bonaparte tried (and failed) to do, with dire consequences for the French nation.

For all that, the domestic fracas in France (which makes our own strikes look rather tame) was inevitable. Raising (by not a lot) the pension age from 62 to 64, against our own 67 looks small, but it was a clear campaign pledge.

The absence of any minor party wishing to self-destruct, by supporting it in the French legislature, is no great surprise either. So, he has implemented it by decree and Macron has dared the opposition to now either remove his prime ministerial nominee, or shut up.

Banking On Nothing

So, what of markets? Well, the end of SVB is no great loss, it had several policies that had to implode if rates rose, especially on the lending side. It was painfully ‘woke’; I can tell you more about the Board Members sexual orientation, gender and ethnicity than their banking experience, the former just creeps into the end of their latest Annual Report, the latter was invisible to me.

SVB’s long list of ESG triumphs and poses (and it is long) at no point included not going bust. It did commit an extra $5billion to climate change lending, which I guess has all gone up in smoke now. Still apart from all being fired, the bank insolvent, the remnants rescued by the hated Washington mob, under investigation by the DoJ, all the rest of their “G” was superb, and so, so, cool.

I don’t see Credit Suisse as a danger, although it may be in danger. It has had an appalling run of misfortunes, with musical chairs at the top, but it remains a cornerstone of Swiss identity. To let it fold would be highly damaging and cause shockwaves in derivatives markets.

Influence on the markets

So, I do understand the Friday sell off (who wants to be weekend long with regulators on the loose). And we do understand markets needed to go down, after the big October bounce, indeed it was a key reason for our building up over 33% cash or near cash at the previous month end. We knew the winter rally was fake.

But I don’t see this as much more. Retest of the S&P 500 October low? It should not be. I take a lot of heart from bitcoin soaring (63% YTD); if liquidity was short, that would not have happened.

But for all that, I don’t like March in financial markets, too much is uncertain. So, this is more a time for cautious adding, rather than hard buying, but if we get to Easter (and hoping to be wrong on the Tonkin analogy) it does seem a better prospect.

Nor do I see how the various central banks can justify a pause in rate rises, at this point, but nor will they go in hard, that would be folly.

This Fed has made enough mistakes already.

Reflections & Predictions

This year won’t be last year, that much we know. Nor indeed will it be the inverse, which is inconvenient. So, starting this year as last year, but simply turned face down on the desk, is a trap.Read more