Thin ice skaters or savants?

Are we drifting out further from the shore of reason, confident we can slide gracefully back to safety, or do we have insight others lack? Perhaps rates just can’t rise, whatever the inflation rate? If so, they are a paper tiger. While in a week others have pondered the failure of UK investing during this century, we look at why our biggest bank seems to hate the country.

I’m talking about the economics prognostications from HSBC, our largest bank. Following an intellectually flawed change in accounting standards (yes, another one), on top of the insanity of “mark to market” comes the “predicted loan loss model”.

Now professional bankers (unlike those in fintech) don’t make loans to lose money.

So, the politicians have instead required them to assume that they do.

Do the regulators know the industry they’re regulating?

Imagine portfolio management where you assume a certain portion of your buys always fail. Might be true, but how? And if you admit you have to buy a certain number of your holdings to instantly lose money, what do your investors feel?

But although banks advance money on the basis of their credit committee assessments, the hordes of regulators deem some of it is immediately lost. Being rational people on the whole, the banks, not great fans of predicting the future (given their record), hire economists to do this for them.

Economists, as we know, actually know little, but they do build nice econometric models. The regulators, who know even less, tweak the models, the bank Boards (see above) also tweak them. Soon every model is so tweaked that the economists wonder why they bothered.

UK shown as the riskiest of places to lend

Which leads us to page 62 of the HSBC Interim Report. We read it, so you don’t have to. There on the excitingly named, but dull as ditch water section called “Risk” it is set out.

Now HSBC lends globally: Mexico, India, Vietnam, Peoples Republic of China. So, guess where “The highest degree of uncertainty in expected credit loss estimates” relates to? Apparently, the basket case to end all wicker weaving is . . . Yes, the UK.

How?

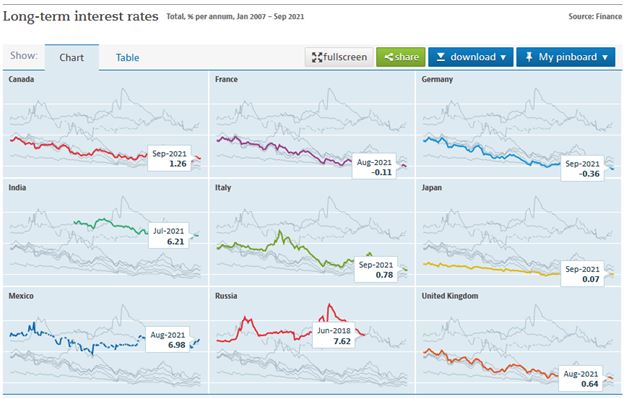

Well first up their ‘central scenario’ model sees the short-term average UK interest rates for the next five years, as 0.6%. Which at least is positive (unlike France, as they hate Macron even more), France (i.e., the Euro) rates are assumed to stay negative till after 2026.

This gloomy central scenario has a 50% chance, although for France it is a tiny bit better at 45%.

Now these are central estimates, but their “downside scenario worst case outcome” for the UK is heavily weighted, with a chunky 30% chance, and oops, France then gets a 35% chance of that disaster, neatly using up the slack just given to them, by the central scenario.

Oh, and there’s worse: house prices crater, double figure unemployment is locked in etc.

And that’s a combined 80% of outcomes sorted; for a bank, that is pretty near certain.

China compared to the UK and France

What about Mainland China, then, their biggest market, if you now include Hong Kong. Well like the US (75%), China is at a high (80%) central scenario certainty, with Hong Kong at 75%. The worst-case scenario for the PRC is ranked at just a measly 8%, the lowest of any of their major markets.

Call it impossible - a prediction that China can’t fail.

Well, if that’s what the economists believe, who are the dumb Board to argue? Well of course they can, to cover their well-appointed posteriors, they then chuck another couple of billion of extra reserves in on top of the doomsday forecasts.

So, you see the vortex, everyone, regulators, economists, non-executives are just adding to reserves, like the good old days.

Maybe they are right, but we are seeing very little sign of those incredibly low global interest rates for five years, negative in France, 0.6% in the UK, 1.1% in the US? Really? If they are right, the markets are wrong.

And it is not just technical, with a 35% chance of France hitting the worst-case scenario, no wonder the Board has shipped out their French operations to a fin tech start up, albeit one backed by private equity giants Cerberus. Not an outfit known for overpaying. With five-year rates at 1.1% the dash for cash in the US makes sense too, selling out of their retail side as well. While with a virtually nailed on, global leading, 5% five-year average GDP growth in the PRC included, surely time to expand there?

Their loan book does not bear out HSBC’s bullish estimates of Chinese infallibility

So it is with some trepidation that we look at their loan book, on Real Estate, in China. It must be massive? Certainly, markets apparently assumed so last week. But no, a paltry $6.336 billion, for HSBC that’s a rounding error. Luckily too, all rock solid, just $28m of reserves needed, although given their certainty that almost feels excessive. The Board probably slipped that bit in.

I have great admiration for HSBC, and for me personally it is a long-term hold, but I have much less regard for regulators and ‘economists’ models, about which only one thing is certain. They are wrong.

So, I try to just strip out the predicted loan loss nonsense, but it is still driving asset allocations, even when palpably false. It explains much of the last two year’s volatility in bank share prices and reported profits, it also justified the highly damaging dividend ban.

Yet the HSBC share price is still not much above 50% of its pre-COVID peak. Great investor protection that was, it hammered HMRC receipts too, for what? Based on what?

Does anyone challenge those weird scenarios internally at HSBC?

Is there really a 35% chance of France virtually collapsing in the next five years?

Or is this just part of cozying up to China? In which case as the IMF has shown, bankers accused of fiddling data for China, are not always seen as professionals and can lack credibility.

Regulators should not impose those odd fictions on real investment decisions either.

If they do real economies and yes jobs, suffer.

Charles Gillams

Monogram Capital Management Ltd