THERE IS NO SANITY CLAUSE

Three big topics this week from three central banks, all of whom look to be in a muddle, with their knitting all jumbled up and highly implausible. Entirely predictable inflation meanwhile threatens to sweep them off their path, as they tinker with micro adjustments to interest rates.

Boris is diverting, but we doubt if it all matters; pre-Christmas entertainment. If he were logical or even vaguely numerate, he would change, but he’s not, and he won’t, but nor does he need to.

The Lib Dems win a by-election, that Labour fails to contest, but it makes no difference in Parliament, and it lets Boris look contrite mid-term. He will survive this with ease.

Which is not to say he should, or that he’s not making a hash of COVID, the sequel. In keeping the NHS in its current format, Boris fails to ask, as many have before him, whether it is still fit for purpose. This remains an urgent question. It can’t simply collapse every year.

Bailey - Bank Governor and historian

But perhaps Andrew Bailey, Governor of the Bank of England, understands the extraordinary risks Boris poses to the economy, and has hiked rates to show that. A Cambridge (Queens) historian, with a doctorate on the impact of the Napoleonic Wars on the cotton industry of Lancashire, he will know full well the impact of a French orchestrated trade war backed up by a dodgy pan European monetary system.

A consummate insider, via the LSE, he moved on to the ascending ladder of the Bank, which did include a slightly unfortunate move into the FCA. This turned out to have rather more real villains than he was used to. Married to the head of the Department of Government at the LSE, he will be very well aware of the political game and the current mood in Whitehall.

He’s seen enough inflation and has decided the Bank must pretend to act. Not only is the rate rise trivial, but it also coincides with a continuation of Government bond buying (QE), an odd call. That the last thing the economy needed was still more liquidity, has surely been obvious for eighteen months now.

Christine Lagarde and Jerome Powell

In Europe the same mishmash exists. We have been hearing Christine Lagarde explain why the ECB is now accelerating one asset buy back (APP) while ending another one (PEPP). She was winging it with the phrase “utterly clear” in answer to a pertinent question, when it was clearly anything but. Still, she did seem to have her ear rather closer to the ground on wage inflation, at least compared to Jerome Powell.

He by contrast has been caught with his pants on fire, trying to weasel his way out of the Fed failing to spot inflation, by saying that most market commentators agreed. Remind me, which is the canine, and which the wagging appendage?

Basic economics - why inflation arises

We called it on inflation as soon as that stock market rally took off, and for the simplest of economic reasons: the pandemic had reduced global productive capacity, so absent a change in price levels, the economy was less productive, profits were therefore lower, competition would therefore be less (unless prices rose), and total production must fall. Less output, same demand will always mean inflation.

Forget the energy issue, forget supply chains, less capacity, more demand always means trouble. True based on that one schoolboy error, the dopey measures to reduce capacity further by more regulation, hiking the minimum wage, paying people not to work and so on, plus embarking on accelerated decarbonization and a few new trade wars, was not going to help much either. But please no more “surprise” inflation, it was baked in. (See extract from my book, Smoke on the Water, blog dated July 2020, title re-appearing shortly on Amazon)

After the interest rate rise

However, we have also long felt that interest rates can’t rise enough to stop inflation, but that as governments have to back off fiscal stimulus, as they are already overborrowed, the lower productive capacity will itself shrink demand, and in the end cause inflation to fall. But we see that as taking years, not months.

Why are interest rates not rising to combat inflation? No political will for a start, and any one country that gets too far out of line will find currency appreciation itself addresses the problem. So, do we believe the US “dot plot” suggesting three rate rises in 2022, while the Euro zone does nothing? We struggle to.

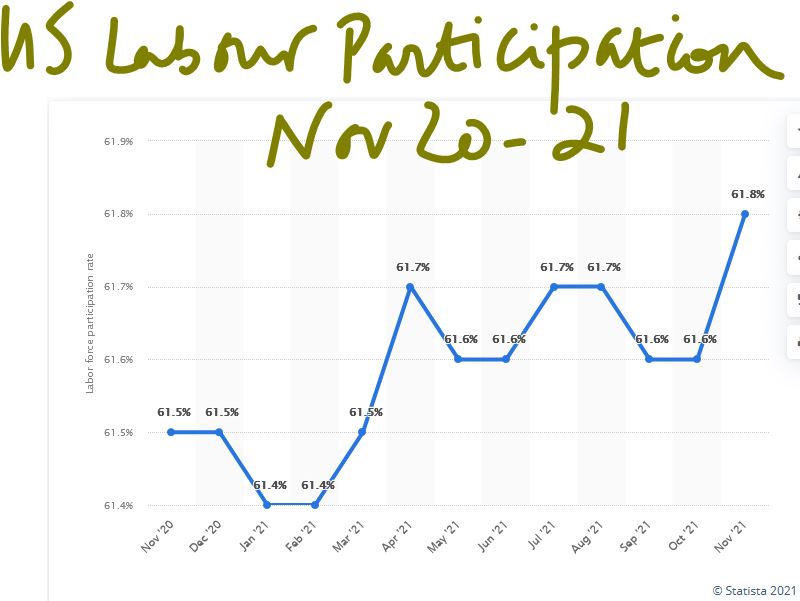

Powell is still clinging to the lower workforce participation rate (which matters) as a signal to defer rate rises and not the unemployment rate (which is more closely related to vacancies) and hence of less fundamental relevance. While employment is great, it will still be unattractive if inflation (and fiscal drag) takes off, thereby holding the participation rate low.

This does still suggest dollar strength, while sterling like other smaller currencies always needs to be wary of getting too far out of line with US rates. But also, a need to fathom out the new look economy. To us, it does not seem service industries that rely on cheap labour are operating in the same world they grew up in. Certainly not if it is onshore.

There is a forced change in government consumption patterns (and hence employment), and this will also be telling. We are heading into quite a different market, when all this shakes down.

Sitting on high cash levels over Christmas, as we are, is pretty cowardly, but if you can’t see the way ahead, slow speeds are usually safer.

We do also rather agree with Chico Marx, this year at least.

Charles Gillams

Monogram Capital Management Ltd

River Deep, Mountain High

Welcome back Mr. Powell - so what is a good response to impending inflation?

After nine months or more the newly reappointed Fed Chair conceded the blindingly obvious: we have an inflation issue, along with the equally transparent need to tighten monetary conditions to quell it. At least he’s fronted up to that, unlike the position in Europe.

What diverts us is what the right response is. Some things are perhaps obvious: gold at least in sterling terms now has positive momentum again. But there is a tremendous volume of liquidity to soak up still, while stimulus will keep being pumped in for a long time. But fixed interest just looks hopeless, credit quality is plummeting, rates are rising, and returns are poor, even in high yield.

Are we clear of COVID effects?

Nor are we really clear of COVID effects. We are yet to pass beyond all the “emergency measures”. So here in the UK, VAT is still reduced, commercial evictions banned, and government departments are still showing that odd mix of budget destroying costs and below normal productivity. So, spending pressure will stay elevated for a good while. Tax rises on corporate profits and on labour through National Insurance hikes, will therefore start to bite, well before the last variant has caused another pfennigabsatze-panik. (spike/trough related panic)

Markets have also been jittery. In general, the buying opportunities just after Thanksgiving have held, which is a good sign. The subsequent gyrations have (so far) indicated a good weight of money ready to buy the dips. But there is little doubt cash is fleeing the overhyped stocks, which are far more prevalent in the US, than in the UK. The shift out of basic commodities is also apparent. So, I would still expect enormous cash balances to build up into the year end in the banking sector, albeit maybe not always in the right places. Any Santa Claus rally will be strictly retail elf driven; the old man is self-isolating this year.

Characteristics of this inflation

Our view remains that the expected high inflation is systemic, simply because of the structural damage and inefficiency inflicted by COVID. So, it maybe transient, but multi-year transient. In this case while the seasonal moves down in energy prices will be a welcome relief, assuming Northern Hemisphere temperatures stay around seasonal norms (and that’s what mid-range forecasts are indicating) - it is not a solution to the inflationary pressures.

Nor do we see the any unwinding of the inventory super cycle caused by the holiday season and the ending of lockdowns, all at once, as having much beneficial impact on price levels.

Businesses all want inventory and will keep rebuilding it across their full ranges for a while. After all, right now holding stock has little financial cost attached.

See this article published by Markit.

Most corporates are at heart squirrels; it won’t be easy to break a new habit.

So how should we play this?

The bigger issue is how to play this - the received wisdom is pile into the US, probably the NASDAQ, while having a side bet on bitcoin or some less disreputable alternatives.

That’s where most investors knowingly or otherwise have their funds.

NASDAQ may churn as dealers try to create some volatility, but the overall (and in our view inflated) levels will most likely remain.

This Omicron variant episode at least has halted the IPO madness, and the whole SPAC nonsense is washed up. Sadly, not a big surprise to see portly old London has just tried to catch a train that left the station last year.

The longer view

But it is a bubble we think - our icf economics monthly looks in more depth at how these played out the last couple of times. Not pleasant, but oddly familiar.

NASDAQ and Bitcoin may yet scale new peaks, but the river below is very deep. Perhaps that old affection for base gold is not just nostalgia?

Time for some year end reflection.

Charles Gillams

Monogram Capital Management