NO NEWS?

Staying on the sidelines till Burns Night still remains rather attractive. Christmas as ever brings thin trading, a lot of speculation and some brutal repression or natural disaster, in a far-off land. Although these days ‘far off’ could include Lille or Llandudno, both pleasantly calm and now even sounding a bit exotic.

But for all the noise, has the investing world really shifted? We did kind of have a Santa Claus rally, but with COVID about, he got shoved back up the chimney pretty fast. Meanwhile Powell was transformed into Scrooge with the terrifying thought that in a massive boom, with high inflation, perhaps he didn’t need to be reinvesting maturing state-owned bonds?

What we see is confusing data, a fair bit of economic damage from Omicron, some people not wanting to be ill, but mostly from a Pavlovian reaction to the very idea of COVID the Sequel. Fortunately like most sequels it was a pale imitation, we knew the cast, guessed the plot, will leave the show early.

Inflation - where have we got to?

Peter Sellers in The Pink Panther films asks an innkeeper if his dog bites; having been assured it did not, the dog snarled and bit him. On remonstrating he was kindly informed “that is not my dog”.

Well clearly Powell, Biden and a few other innumerate players wish to tell us the same about inflation.

Sadly, and transparently, it is their dog, and equally clearly it will bite.

There is an econometrics game of saying there is no inflation (except in; used cars, housing, fuel, take your pick really). That is like selecting the first brick to burst in a failing dam, and saying that the structure was fine, except for this one defective brick.

Therefore, the first sign that (finally) the ‘just a blip’ inflation nonsense has been retired must be good news. This comes along with some evidence that sensible Democrats (well at least one) have spotted that more money for less work in order to buy fewer goods, is probably not actually helping poor American families.

The energy question

We will sort out energy prices, if governments are sensible. So, if, like President Xi, we do bring back a bit of stand by coal capacity, for next winter’s peak. There is plenty of coal around. We have not been too short of wind around here either, of late, the UK also has a good number of salt caverns, which we can (as we used to) stuff with gas, rather than believe the idiots in the Government who felt it was too expensive to have cheap summer gas on stand buy. While at 80 USD even the Saudis will pump more, the Permian certainly will.

So that just needs a bit more planning, a bit less spurious forecasting to within three decimal places, a bit more building in a margin for error, whilst hopefully all the Whitehall types who claimed they were fostering ‘competition’ and could ‘cap’ prices of a global commodity, get moved on (or better out).

It is still next winter’s answer, none of this will help this year much. Most capacity for the next two months is sold.

So, what will Powell do next?

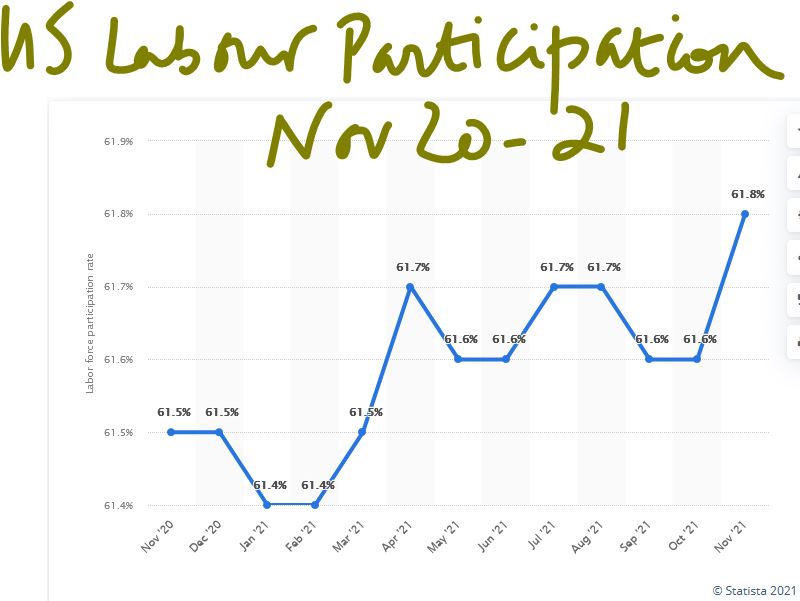

All of this leaves us with massive liquidity, poor labour market participation, excess demand and the normal reaction to all that: inflation picking up and negative real yields slowly being eradicated. What is not to like? Demand plus capacity usually equals growth.

While Powell may have failed to grasp the intricacies of inflation, I am not expecting him to suddenly declare his job done on minority employment rates, with such a poor participation level. So, I expect he will keep trying on that. Which suggests he’s not going to over-indulge in rate rises. Hence the idea the Fed will look at other ways to soak up liquidity, is quite logical.

At this stage of tightening, we don’t find most bonds attractive, but recent history suggests that if the US 10-year bond gets closer to 2%, it attracts foreign money, unless Euro base rates also rise, which still seems unlikely. More buyers will of course push the yield back down.

While China is both cutting rates and provoking some hefty defaults, which is not a great background for foreign investment, especially as they seem to be targeting offshore investors. Without knowing whether the US interest rate tops out at 2% or 4%, emerging market debt (like their equities) could be either cheap or expensive; just now it is very hard to gauge.

So cautiously we plough on - funds must be invested, the (as of now) attractive alternatives, all look pretty expensive or rather risky, while if rates really do start to rise, the dollar will itself become desirable. So, we expect something, some asset, will suddenly catch a bid and soar away. Outside the US mega cap tech stocks, value already abounds.

Overall, a return to normality. With rather fewer gifts from Lapland to be had just for asking; all of this should be quite encouraging.

While it looks like sterling has strengthened for now, the various tin pot media storms have led to the Prime Minister’s critics looking into the abyss and not liking the view very much.

It may look bad to bend some rules, but dropping a Prime Minister for disliking Theresa May’s taste in wallpaper, or treating staff like human beings, or because Liz Truss is ambitious? Not really.

MCM had a good 2021, in our global lower volatility space. The CityWire link to our subsector is here.

Charles Gillams

Monogram Capital Management Ltd

9th January 2022

(article illustration by Martin Speed, creator of the Woofle bears)

THERE IS NO SANITY CLAUSE

Three big topics this week from three central banks, all of whom look to be in a muddle, with their knitting all jumbled up and highly implausible. Entirely predictable inflation meanwhile threatens to sweep them off their path, as they tinker with micro adjustments to interest rates.

Boris is diverting, but we doubt if it all matters; pre-Christmas entertainment. If he were logical or even vaguely numerate, he would change, but he’s not, and he won’t, but nor does he need to.

The Lib Dems win a by-election, that Labour fails to contest, but it makes no difference in Parliament, and it lets Boris look contrite mid-term. He will survive this with ease.

Which is not to say he should, or that he’s not making a hash of COVID, the sequel. In keeping the NHS in its current format, Boris fails to ask, as many have before him, whether it is still fit for purpose. This remains an urgent question. It can’t simply collapse every year.

Bailey - Bank Governor and historian

But perhaps Andrew Bailey, Governor of the Bank of England, understands the extraordinary risks Boris poses to the economy, and has hiked rates to show that. A Cambridge (Queens) historian, with a doctorate on the impact of the Napoleonic Wars on the cotton industry of Lancashire, he will know full well the impact of a French orchestrated trade war backed up by a dodgy pan European monetary system.

A consummate insider, via the LSE, he moved on to the ascending ladder of the Bank, which did include a slightly unfortunate move into the FCA. This turned out to have rather more real villains than he was used to. Married to the head of the Department of Government at the LSE, he will be very well aware of the political game and the current mood in Whitehall.

He’s seen enough inflation and has decided the Bank must pretend to act. Not only is the rate rise trivial, but it also coincides with a continuation of Government bond buying (QE), an odd call. That the last thing the economy needed was still more liquidity, has surely been obvious for eighteen months now.

Christine Lagarde and Jerome Powell

In Europe the same mishmash exists. We have been hearing Christine Lagarde explain why the ECB is now accelerating one asset buy back (APP) while ending another one (PEPP). She was winging it with the phrase “utterly clear” in answer to a pertinent question, when it was clearly anything but. Still, she did seem to have her ear rather closer to the ground on wage inflation, at least compared to Jerome Powell.

He by contrast has been caught with his pants on fire, trying to weasel his way out of the Fed failing to spot inflation, by saying that most market commentators agreed. Remind me, which is the canine, and which the wagging appendage?

Basic economics - why inflation arises

We called it on inflation as soon as that stock market rally took off, and for the simplest of economic reasons: the pandemic had reduced global productive capacity, so absent a change in price levels, the economy was less productive, profits were therefore lower, competition would therefore be less (unless prices rose), and total production must fall. Less output, same demand will always mean inflation.

Forget the energy issue, forget supply chains, less capacity, more demand always means trouble. True based on that one schoolboy error, the dopey measures to reduce capacity further by more regulation, hiking the minimum wage, paying people not to work and so on, plus embarking on accelerated decarbonization and a few new trade wars, was not going to help much either. But please no more “surprise” inflation, it was baked in. (See extract from my book, Smoke on the Water, blog dated July 2020, title re-appearing shortly on Amazon)

After the interest rate rise

However, we have also long felt that interest rates can’t rise enough to stop inflation, but that as governments have to back off fiscal stimulus, as they are already overborrowed, the lower productive capacity will itself shrink demand, and in the end cause inflation to fall. But we see that as taking years, not months.

Why are interest rates not rising to combat inflation? No political will for a start, and any one country that gets too far out of line will find currency appreciation itself addresses the problem. So, do we believe the US “dot plot” suggesting three rate rises in 2022, while the Euro zone does nothing? We struggle to.

Powell is still clinging to the lower workforce participation rate (which matters) as a signal to defer rate rises and not the unemployment rate (which is more closely related to vacancies) and hence of less fundamental relevance. While employment is great, it will still be unattractive if inflation (and fiscal drag) takes off, thereby holding the participation rate low.

This does still suggest dollar strength, while sterling like other smaller currencies always needs to be wary of getting too far out of line with US rates. But also, a need to fathom out the new look economy. To us, it does not seem service industries that rely on cheap labour are operating in the same world they grew up in. Certainly not if it is onshore.

There is a forced change in government consumption patterns (and hence employment), and this will also be telling. We are heading into quite a different market, when all this shakes down.

Sitting on high cash levels over Christmas, as we are, is pretty cowardly, but if you can’t see the way ahead, slow speeds are usually safer.

We do also rather agree with Chico Marx, this year at least.

Charles Gillams

Monogram Capital Management Ltd

River Deep, Mountain High

Welcome back Mr. Powell - so what is a good response to impending inflation?

After nine months or more the newly reappointed Fed Chair conceded the blindingly obvious: we have an inflation issue, along with the equally transparent need to tighten monetary conditions to quell it. At least he’s fronted up to that, unlike the position in Europe.

What diverts us is what the right response is. Some things are perhaps obvious: gold at least in sterling terms now has positive momentum again. But there is a tremendous volume of liquidity to soak up still, while stimulus will keep being pumped in for a long time. But fixed interest just looks hopeless, credit quality is plummeting, rates are rising, and returns are poor, even in high yield.

Are we clear of COVID effects?

Nor are we really clear of COVID effects. We are yet to pass beyond all the “emergency measures”. So here in the UK, VAT is still reduced, commercial evictions banned, and government departments are still showing that odd mix of budget destroying costs and below normal productivity. So, spending pressure will stay elevated for a good while. Tax rises on corporate profits and on labour through National Insurance hikes, will therefore start to bite, well before the last variant has caused another pfennigabsatze-panik. (spike/trough related panic)

Markets have also been jittery. In general, the buying opportunities just after Thanksgiving have held, which is a good sign. The subsequent gyrations have (so far) indicated a good weight of money ready to buy the dips. But there is little doubt cash is fleeing the overhyped stocks, which are far more prevalent in the US, than in the UK. The shift out of basic commodities is also apparent. So, I would still expect enormous cash balances to build up into the year end in the banking sector, albeit maybe not always in the right places. Any Santa Claus rally will be strictly retail elf driven; the old man is self-isolating this year.

Characteristics of this inflation

Our view remains that the expected high inflation is systemic, simply because of the structural damage and inefficiency inflicted by COVID. So, it maybe transient, but multi-year transient. In this case while the seasonal moves down in energy prices will be a welcome relief, assuming Northern Hemisphere temperatures stay around seasonal norms (and that’s what mid-range forecasts are indicating) - it is not a solution to the inflationary pressures.

Nor do we see the any unwinding of the inventory super cycle caused by the holiday season and the ending of lockdowns, all at once, as having much beneficial impact on price levels.

Businesses all want inventory and will keep rebuilding it across their full ranges for a while. After all, right now holding stock has little financial cost attached.

See this article published by Markit.

Most corporates are at heart squirrels; it won’t be easy to break a new habit.

So how should we play this?

The bigger issue is how to play this - the received wisdom is pile into the US, probably the NASDAQ, while having a side bet on bitcoin or some less disreputable alternatives.

That’s where most investors knowingly or otherwise have their funds.

NASDAQ may churn as dealers try to create some volatility, but the overall (and in our view inflated) levels will most likely remain.

This Omicron variant episode at least has halted the IPO madness, and the whole SPAC nonsense is washed up. Sadly, not a big surprise to see portly old London has just tried to catch a train that left the station last year.

The longer view

But it is a bubble we think - our icf economics monthly looks in more depth at how these played out the last couple of times. Not pleasant, but oddly familiar.

NASDAQ and Bitcoin may yet scale new peaks, but the river below is very deep. Perhaps that old affection for base gold is not just nostalgia?

Time for some year end reflection.

Charles Gillams

Monogram Capital Management

Which is the Leviathan?

This is a week to ponder the role of private equity in portfolios, in what may be an early phase of a great investment and technological explosion. There seems to be no sign of higher interest rates and a stubborn refusal by Central Banks to care much about inflation. The talk of a UK raise always looked to us like a head fake which we ignored.

Spotting good and bad private equity

So first to private equity, a beast that comes in many guises, not all benign from an investor viewpoint. All liquidity fueled equity explosions come with a heavy loading of chancers; Bonnie and Clyde’s rationale for bank robbery remains valid.

Good private equity relies on management being superior to that of their targets. This can be in their analysis, their execution, their swiftness of foot or their innovation. All of this generally flourishes away from the hidebound inertia of many listed companies and their professional Boards of tame box tickers.

Bad private equity uses accounting tricks, the malleable fiction that the last price is the right price in particular, and the terrible phrase “discounted revenue multiple” which is a nice conceit for “never made a profit”. All of these share the same vice of management marking their own work.

So, we struggle with the likes of Scottish Mortgage and its little array of unquoted Chinese firms, the alphabet soup of non-voting share classes and love affair with management. Maybe they are that skilled, but nothing that looks like a real two-way market is evident to us, in many of these valuations. We have by contrast long admired Melrose Industries for their quite ruthless devotion to turning over their investments, good or bad and stapling executive pay to actual cash realizations paid to investors.

Where we stand – given our strategy

For an Absolute Return specialist there are added constraints: we want to hold under twenty positions altogether and all in ones we can sell tomorrow afternoon. And we like holdings where valuations are transparent, there is no gearing (there is usually quite enough in the private equity deals already), and you can pick them up for a fat double digit discount: oh, and we do like a yield too.

So, we are looking for big, listed options with hundreds of high-quality funds bundled together and for any yield, a bias towards management buy outs. We are certainly not at the venture capital end, with silly pricing, high fail rates, unrealistic managers, and not a decent accountant in sight and aspirations to change the world. Met those, invested in too many, and donated more shirts off my back than I care to enumerate to their serial failures and inexhaustible funding rounds.

But there are good things about Private Equity, one is that in a rising market, it can be like clipping a coupon. The accounting rules require them to be backward looking, so coming out of a trough they are typically reporting on valuations that are three or four months old, which in turn reflects business activity up to six months old. As they trade at a discount of typically 25% or so, you can buy today at a 25% discount to the value of the business they were doing in the spring. There are no guarantees, but for most, that was a lot worse than current conditions, so today’s price is simply wrong. This is a time machine that lets you buy now but pay at old prices.

Watch for built in volatility in private equity

These lags are complex, the reference points are often public market valuations, and so there is volatility built into them. While in an Absolute Return fund, not only are choices limited but the overall exposure must be too. However, in those rare purple patches of fast recovery and expansion they are excellent for performance.

What kills these bonanzas off is tight credit. In part they need debt for trade, but also their realizations rely heavily on it. A closed IPO market does them no good (just as they enjoy an exuberant one). That is a risk, as liquidity starts to tighten, that this will hurt, but as Powell and the Bank of England both showed, there is no political appetite for that just yet.

The UK and US on taming the leviathan

Indeed, Sunak’s UK budget yet again feels reckless, devoid of any discipline and with every department cashing in. Government spending is predicted to rise to 42% of GDP by 2026, a fifty year high. Healthcare alone is predicted to have grown by 40% in real terms since 2009 (both estimates from the oddly named Office for Budget Responsibility). At that level of loading, it is inching closer to hollowing out the entire budget and causing it to implode. (Leviathan was just such a creature “because by his bigness he seemes not one single creature, but a coupling of divers together; or because his scales are closed, or straitly compacted together” feels an apt description of this new giant state apparatus.)

But that gamble means there is no room to pay higher interest rates, or the economy will be reduced to a double-sided monster. The one face devoted to raising debt and levying taxes and paying interest, the other to feeding out of control public spending, with nothing left in between.

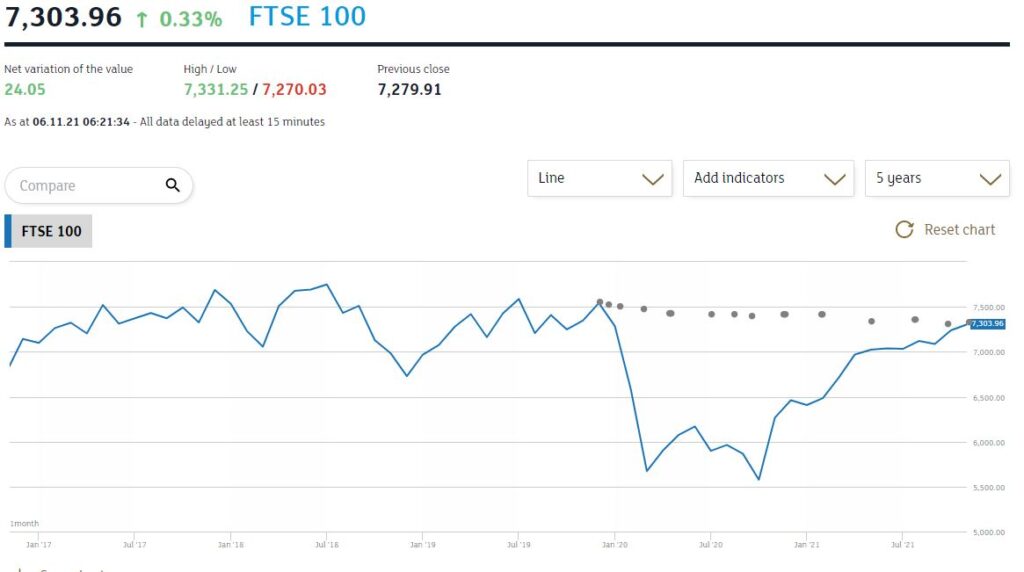

Thanks in a slightly odd way to a Democrat Senator, America has avoided throwing itself under that same bus, but with no effective political opposition the UK is now powerless to resist. Sterling’s relentless decline from the summer high and a FTSE 100 index still below its pre-COVID peak signify what markets feel about all this.

From the London Stock Exchange graph

So, while we were more bearish than we have been all year, in terms of asset allocation, at the end of October, we have yet to call time on the Private Equity cycle, that has provided such a powerful boost this year. It still feels good value to us.

Of course, we recognize too, that the populist fear is of the wealth creators and an opposing adoration for wealth consumption. Unlike politicians, however, we are tasked with producing real results not vapid dreams.

I guess we can each choose which to regard as the leviathan – the burgeoning state, or private equity.

Charles Gillams

Monogram Capital Management Ltd

Caution: Bumpy Road ahead

Puzzle: World markets have whipsawed in the last few weeks, from high anxiety to an almost beatific calm. The VIX volatility index has dropped to pretty well a post-pandemic low. Which should mean we all agree, but on what exactly? Rising inflation, yes, but how durable, and caused by what?

And that, we all accept, will make interest rates rise, yes, but how high for how long? Markets we feel are, to say the least, fragile.

At the turn, we know that moves can be dramatic both ways, for markets.

Are we really seeing a labour shortage? The UK truck drivers’ situation

What we see now is not a labour shortage, and hence political talk of stemming migration and higher wages is well off target. What it is, in part at least, is a failure of the routine operations of an incompetent government, something politicians typically don’t want to discuss.

The government has insinuated itself into so many areas, with its complex regulations, that the market economy now lies ensnared in myriad interlocking regulations, backed up by a deeply entrenched blame culture (and its friend the compensation economy).

To take one example, there is no shortage of truck drivers, but there is a shortage of qualified, approved, signed off and regulated truck drivers, because as part of the destructive lockdown, the government just halted the conveyor belt of required testing and approvals.

Truckers’ wages have for long been too low, of course, especially for the owner drivers in the spot market. What we have is not a labour shortage, it’s a paperwork shortage. The difference is vital for how enduring inflation is. A new driver will take a couple of decades to grow, but clearing a paperwork jam, a few months. One is enduring, the other transient.

Withdrawal of older workers from the labour market

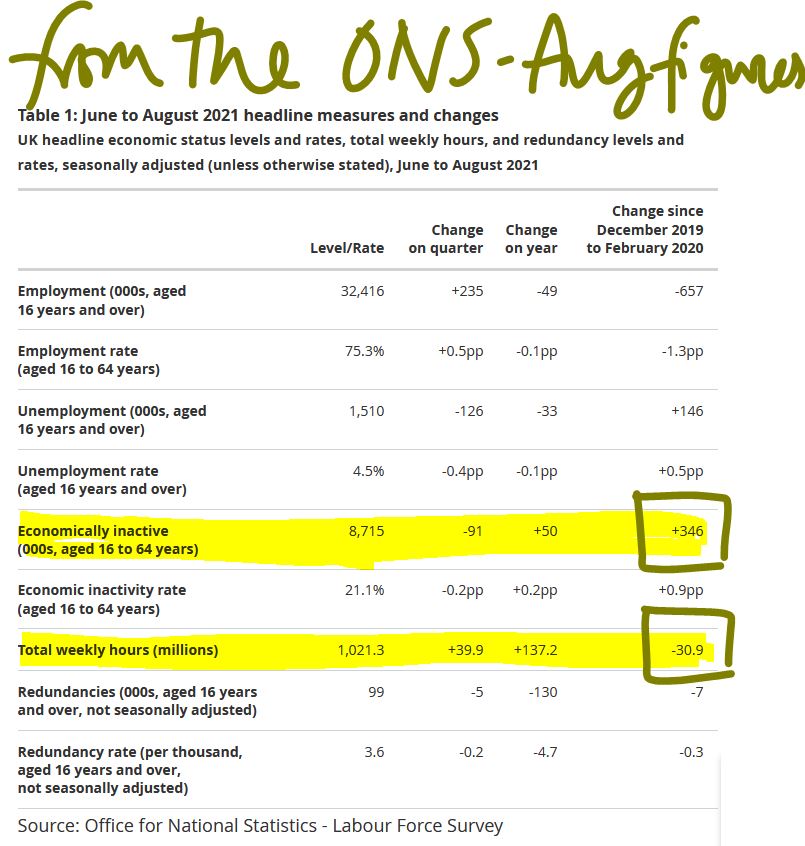

Work after all is something of a habit: once it is lost, it can be hard to understand why it existed. So, we see a marked increase in older workers in the UK who have just withdrawn from the market (Some thirty million fewer hours worked - see figure below). That too is not a labour shortage as such, they all still exist.

But if work was of marginal benefit to the worker, and the costs to resume work (actual or psychological) are high, disruption will cause the fringe or marginal job to be unfilled. Yet again more in the transient column than permanent.

Someone will waive the rules, or the government will notice, well before all drivers get paid high enough wages to cause embedded inflation. In any event articulated fuel tanker drivers tend to work for big employers, with good conditions, and are well organized. They have to be, after all they drive mobile bombs. The spot operator on a rigid rig is in a different market.

Inflation will most likely be transient

So, if it is not an actual labour shortage, it won’t cause wage inflation, and will be transient. Some other areas reliant on highly skilled older workers will continue to see standards fall, but generally younger workers will over time fill those slots and gradually acquire those skills. And it won’t be a long time.

Our view from way back was of 5% plus inflation and labour markets that struggle to clear this year. We were wrong to not foresee the failure of regulatory processes to keep up. However we still do see a permanently higher post COVID cost base and therefore in certain sectors, a large amount of marginal productive capacity are likely to be withdrawn from the market.

With a banking system that still struggles to offer commercial finance to the SME sector, because of excessive regulatory caution, there are swathes of jobs that have simply gone. So that labour will in time be redeployed. The current concern is that many of these workers show no desire, or ability under current conditions, to return to the market. But when they do, the capacity that has been destroyed will slowly return, and once more drive down prices.

Nor should we forget just how much the Exchequer loves inflation, as fiscal drag, their beloved tax on higher prices, smooths away so many budgetary blemishes. They will let it go, if they possibly can.

Commodity prices

On the input side we do still see commodity price rises as transitory, at least within the energy market. As others have noted much of that too is regulatory failure on a grand scale, not a true shortage. Price fixing by the state is a notoriously foolish concept, as we learnt in the 1970’s.

There are a number of other supply factors at play too, but while some will recur, most are temporary.

How long do we think the inflation spike will last?

So yes, inflation will spike, and yes it will stay elevated for much of next year, but no, we don’t see it as necessarily durable, once COVID restrictions and related behavioural changes vanish.

We are still pretty certain that the political costs of aggressive interest rate rises will outweigh any perceived price control benefit. As long as some Central Banks hold off rises, it will be very hard for others to do so, without sharp currency moves or bringing in formal exchange controls. That would in turn spook markets far more than rate rises.

The next phase of markets

All of this says to us that a major market dislocation, despite the benign signals, lies ahead in the next six months.

Markets shifting rapidly are more a sign of uncertainty than of a new degree of confidence, and we simply don’t trust it. We see inflation as apparently out of control, but no significant interest rate rise response is feasible. That can feel like stock nirvana, but also like investor purgatory, as you have no idea what is or is not a sustainable profit.

Charles Gillams

Monogram Capital Management Ltd