Which is the Leviathan?

This is a week to ponder the role of private equity in portfolios, in what may be an early phase of a great investment and technological explosion. There seems to be no sign of higher interest rates and a stubborn refusal by Central Banks to care much about inflation. The talk of a UK raise always looked to us like a head fake which we ignored.

Spotting good and bad private equity

So first to private equity, a beast that comes in many guises, not all benign from an investor viewpoint. All liquidity fueled equity explosions come with a heavy loading of chancers; Bonnie and Clyde’s rationale for bank robbery remains valid.

Good private equity relies on management being superior to that of their targets. This can be in their analysis, their execution, their swiftness of foot or their innovation. All of this generally flourishes away from the hidebound inertia of many listed companies and their professional Boards of tame box tickers.

Bad private equity uses accounting tricks, the malleable fiction that the last price is the right price in particular, and the terrible phrase “discounted revenue multiple” which is a nice conceit for “never made a profit”. All of these share the same vice of management marking their own work.

So, we struggle with the likes of Scottish Mortgage and its little array of unquoted Chinese firms, the alphabet soup of non-voting share classes and love affair with management. Maybe they are that skilled, but nothing that looks like a real two-way market is evident to us, in many of these valuations. We have by contrast long admired Melrose Industries for their quite ruthless devotion to turning over their investments, good or bad and stapling executive pay to actual cash realizations paid to investors.

Where we stand – given our strategy

For an Absolute Return specialist there are added constraints: we want to hold under twenty positions altogether and all in ones we can sell tomorrow afternoon. And we like holdings where valuations are transparent, there is no gearing (there is usually quite enough in the private equity deals already), and you can pick them up for a fat double digit discount: oh, and we do like a yield too.

So, we are looking for big, listed options with hundreds of high-quality funds bundled together and for any yield, a bias towards management buy outs. We are certainly not at the venture capital end, with silly pricing, high fail rates, unrealistic managers, and not a decent accountant in sight and aspirations to change the world. Met those, invested in too many, and donated more shirts off my back than I care to enumerate to their serial failures and inexhaustible funding rounds.

But there are good things about Private Equity, one is that in a rising market, it can be like clipping a coupon. The accounting rules require them to be backward looking, so coming out of a trough they are typically reporting on valuations that are three or four months old, which in turn reflects business activity up to six months old. As they trade at a discount of typically 25% or so, you can buy today at a 25% discount to the value of the business they were doing in the spring. There are no guarantees, but for most, that was a lot worse than current conditions, so today’s price is simply wrong. This is a time machine that lets you buy now but pay at old prices.

Watch for built in volatility in private equity

These lags are complex, the reference points are often public market valuations, and so there is volatility built into them. While in an Absolute Return fund, not only are choices limited but the overall exposure must be too. However, in those rare purple patches of fast recovery and expansion they are excellent for performance.

What kills these bonanzas off is tight credit. In part they need debt for trade, but also their realizations rely heavily on it. A closed IPO market does them no good (just as they enjoy an exuberant one). That is a risk, as liquidity starts to tighten, that this will hurt, but as Powell and the Bank of England both showed, there is no political appetite for that just yet.

The UK and US on taming the leviathan

Indeed, Sunak’s UK budget yet again feels reckless, devoid of any discipline and with every department cashing in. Government spending is predicted to rise to 42% of GDP by 2026, a fifty year high. Healthcare alone is predicted to have grown by 40% in real terms since 2009 (both estimates from the oddly named Office for Budget Responsibility). At that level of loading, it is inching closer to hollowing out the entire budget and causing it to implode. (Leviathan was just such a creature “because by his bigness he seemes not one single creature, but a coupling of divers together; or because his scales are closed, or straitly compacted together” feels an apt description of this new giant state apparatus.)

But that gamble means there is no room to pay higher interest rates, or the economy will be reduced to a double-sided monster. The one face devoted to raising debt and levying taxes and paying interest, the other to feeding out of control public spending, with nothing left in between.

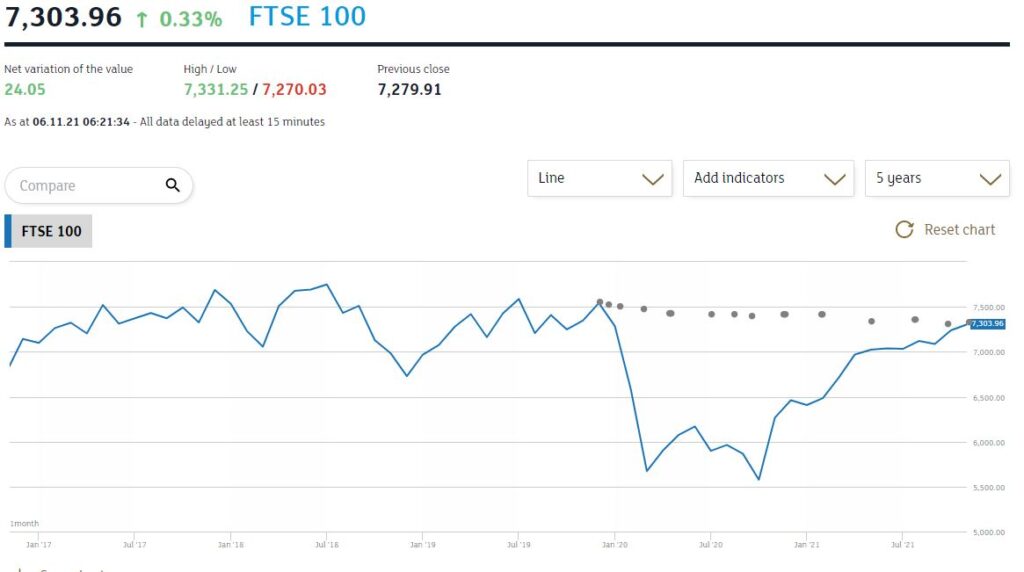

Thanks in a slightly odd way to a Democrat Senator, America has avoided throwing itself under that same bus, but with no effective political opposition the UK is now powerless to resist. Sterling’s relentless decline from the summer high and a FTSE 100 index still below its pre-COVID peak signify what markets feel about all this.

From the London Stock Exchange graph

So, while we were more bearish than we have been all year, in terms of asset allocation, at the end of October, we have yet to call time on the Private Equity cycle, that has provided such a powerful boost this year. It still feels good value to us.

Of course, we recognize too, that the populist fear is of the wealth creators and an opposing adoration for wealth consumption. Unlike politicians, however, we are tasked with producing real results not vapid dreams.

I guess we can each choose which to regard as the leviathan – the burgeoning state, or private equity.

Charles Gillams

Monogram Capital Management Ltd

Thin ice skaters or savants?

Are we drifting out further from the shore of reason, confident we can slide gracefully back to safety, or do we have insight others lack? Perhaps rates just can’t rise, whatever the inflation rate? If so, they are a paper tiger. While in a week others have pondered the failure of UK investing during this century, we look at why our biggest bank seems to hate the country.

I’m talking about the economics prognostications from HSBC, our largest bank. Following an intellectually flawed change in accounting standards (yes, another one), on top of the insanity of “mark to market” comes the “predicted loan loss model”.

Now professional bankers (unlike those in fintech) don’t make loans to lose money.

So, the politicians have instead required them to assume that they do.

Do the regulators know the industry they’re regulating?

Imagine portfolio management where you assume a certain portion of your buys always fail. Might be true, but how? And if you admit you have to buy a certain number of your holdings to instantly lose money, what do your investors feel?

But although banks advance money on the basis of their credit committee assessments, the hordes of regulators deem some of it is immediately lost. Being rational people on the whole, the banks, not great fans of predicting the future (given their record), hire economists to do this for them.

Economists, as we know, actually know little, but they do build nice econometric models. The regulators, who know even less, tweak the models, the bank Boards (see above) also tweak them. Soon every model is so tweaked that the economists wonder why they bothered.

UK shown as the riskiest of places to lend

Which leads us to page 62 of the HSBC Interim Report. We read it, so you don’t have to. There on the excitingly named, but dull as ditch water section called “Risk” it is set out.

Now HSBC lends globally: Mexico, India, Vietnam, Peoples Republic of China. So, guess where “The highest degree of uncertainty in expected credit loss estimates” relates to? Apparently, the basket case to end all wicker weaving is . . . Yes, the UK.

How?

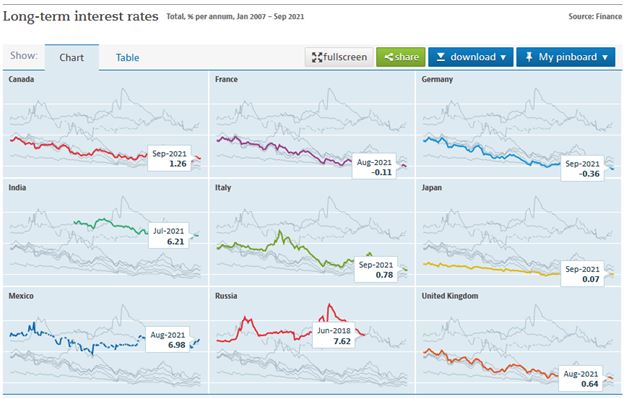

Well first up their ‘central scenario’ model sees the short-term average UK interest rates for the next five years, as 0.6%. Which at least is positive (unlike France, as they hate Macron even more), France (i.e., the Euro) rates are assumed to stay negative till after 2026.

This gloomy central scenario has a 50% chance, although for France it is a tiny bit better at 45%.

Now these are central estimates, but their “downside scenario worst case outcome” for the UK is heavily weighted, with a chunky 30% chance, and oops, France then gets a 35% chance of that disaster, neatly using up the slack just given to them, by the central scenario.

Oh, and there’s worse: house prices crater, double figure unemployment is locked in etc.

And that’s a combined 80% of outcomes sorted; for a bank, that is pretty near certain.

China compared to the UK and France

What about Mainland China, then, their biggest market, if you now include Hong Kong. Well like the US (75%), China is at a high (80%) central scenario certainty, with Hong Kong at 75%. The worst-case scenario for the PRC is ranked at just a measly 8%, the lowest of any of their major markets.

Call it impossible - a prediction that China can’t fail.

Well, if that’s what the economists believe, who are the dumb Board to argue? Well of course they can, to cover their well-appointed posteriors, they then chuck another couple of billion of extra reserves in on top of the doomsday forecasts.

So, you see the vortex, everyone, regulators, economists, non-executives are just adding to reserves, like the good old days.

Maybe they are right, but we are seeing very little sign of those incredibly low global interest rates for five years, negative in France, 0.6% in the UK, 1.1% in the US? Really? If they are right, the markets are wrong.

And it is not just technical, with a 35% chance of France hitting the worst-case scenario, no wonder the Board has shipped out their French operations to a fin tech start up, albeit one backed by private equity giants Cerberus. Not an outfit known for overpaying. With five-year rates at 1.1% the dash for cash in the US makes sense too, selling out of their retail side as well. While with a virtually nailed on, global leading, 5% five-year average GDP growth in the PRC included, surely time to expand there?

Their loan book does not bear out HSBC’s bullish estimates of Chinese infallibility

So it is with some trepidation that we look at their loan book, on Real Estate, in China. It must be massive? Certainly, markets apparently assumed so last week. But no, a paltry $6.336 billion, for HSBC that’s a rounding error. Luckily too, all rock solid, just $28m of reserves needed, although given their certainty that almost feels excessive. The Board probably slipped that bit in.

I have great admiration for HSBC, and for me personally it is a long-term hold, but I have much less regard for regulators and ‘economists’ models, about which only one thing is certain. They are wrong.

So, I try to just strip out the predicted loan loss nonsense, but it is still driving asset allocations, even when palpably false. It explains much of the last two year’s volatility in bank share prices and reported profits, it also justified the highly damaging dividend ban.

Yet the HSBC share price is still not much above 50% of its pre-COVID peak. Great investor protection that was, it hammered HMRC receipts too, for what? Based on what?

Does anyone challenge those weird scenarios internally at HSBC?

Is there really a 35% chance of France virtually collapsing in the next five years?

Or is this just part of cozying up to China? In which case as the IMF has shown, bankers accused of fiddling data for China, are not always seen as professionals and can lack credibility.

Regulators should not impose those odd fictions on real investment decisions either.

If they do real economies and yes jobs, suffer.

Charles Gillams

Monogram Capital Management Ltd

A HARD RAIN

WHEN WILL MARKETS RESPOND?

Everything is in the end politics; it just takes a long route on occasion and rather like a frog in water, markets take time to realize that the pleasant feeling of warmth is a prelude to being boiled alive. We are well into the boiling phase, but how long before it all registers and an escape is finally attempted?

The purpose of politics seems ultimately to take an individual’s wealth and the fruits of their labour and give it firstly to the friends and allies of the confiscatory state and then use the remainder to buy votes. That bit does not ever really change, whoever is in charge.

So how does that truism impact markets on each side of the pond? Well, traditionally the UK state has been far greedier and done far more harm to the economy, than the US state has, which is why both GDP per capita is far worse than the US, and the FTSE has failed to rise, even in nominal terms, in two decades. Add back inflation and investing in UK PLC has been a long-term wealth destroyer. It enjoys that characteristic with the rest of Europe. As we have long said, lift the lid on any sensible UK pension fund, and you will find a lot of Apples inside.

In general, and this too is a platitude, well run dictatorships, especially those with access to world markets, do far better still, hence the rise of China. Of course, “well run” and “dictatorship” seldom sit well together, but nor do “populist” and “well run”. In general markets are not greatly in favour of either populists or dictators, feeling the rule of law is not something either care that much about. But by implication neither are voters now too fussed about laws either.

LONDON OR WALL STREET FOR THE REST OF 21? - THE BIGGER PICTURE

So, the investing question is whether the US, despite being increasingly under the control of the populist wing of the Democratic Party, is a better bet than the UK? Or do we have the capacity to process a bigger picture?

And of course, we need to ask whether China is better than both. So far, the US is finding Biden to be no worse than the populist wing of the Republican Party, and the UK is feeling rather baffled, given Boris constantly talks right but acts left.

Put like that our current sentiment, that Biden will cause more damage than Boris, is at the least contentious. So, we should look for the good in Boris and the bad in Biden, to help justify that call. Not an easy balance, but what makes it easier is the relative valuations. In particular of tech, where the US has moved ahead massively, so a lot of the question can almost be reduced to asking if Tesla is worth it? Or if it is, what is the motivating force to make it still more overpriced?

Boris seems to be trapped by the doctors and his inability to fathom numbers, into driving us into a permanent state of fear and welfare dependency, which will keep the UK steadily in long term decline. If he can break free of that populist vice, we might have a slim chance.

The omens are mixed, banning travel to Portugal (again) looks like the familiar science trap, but of course might be a reaction to the EU also banning wider travel from the UK to the EU just before that. Given our relations with the EU, that oddly seems more likely (if childish).

By contrast the US is now operating near normally, a stark contrast, as we remain in de facto lockdown, tied up in fiddly, unpredictable, illogical restrictions.

CULTURE WARS AS INDICATORS OF INVESTOR SENTIMENT

Both the Queen’s Speech setting out the legislative agenda for the year and the visit of Viktor Orban, the Hungarian premier, may have been light on substance (they were), but boy were they heavy with Tory symbolism, coming hard on the heels of the local election wins.

Much of that proposed legislation was to placate the grass roots, I seriously doubt laws on de-platforming (of both the living and the stone hewn) will make much difference, but the Conservative base feels it is high time the left got some mild resistance, in cultural matters. There has been very little of that for the last two decades.

I suppose the brutal bashing of Bashir is in the same category, although from my own experience a BBC journalist who did not lie and cheat their way to a non-existent story, would have been the truer rarity. Although in that they differ little from the rest of their breed, but defenestrations at the National Gallery and revolt at the National Trust, have been a long time coming and indicate a new degree of solidity and confidence. This is long overdue since Blair assiduously stuffed placemen into those organisations. Neither Cameron nor May did much about them, having their focus on higher things, it transpires.

Does it matter? Well not really, to markets, but it is a counter to the reckless spending, and the chilling clarity with which Boris famously expressed his view on business during Brexit, so is a straw in the wind. Maybe other things will change.

DEFUND THE DOLLAR?

What of Biden, well so far the US markets have taken slow comfort from the slender political majority, he holds, but the view is creeping in, that he really is going for broke, he is happy to unleash inflation, almost keen to do so, that letting Wall Street blow itself up, in the meme stock nonsense, and suppressing interest rates (which is vital if you are borrowing so much) and as a result trashing the dollar, is all fine, all part of the plan. Note the recent measures by China to prevent their currency appreciating too fast and by Putin (of all people) complaining at dollar fragility. Others may not attack it yet, but it increasingly looks like US policy.

Much of that perhaps matters little to Wall Street immediately; inflation makes you own real assets, bonds are now utter rubbish and so far, very little of US individual wealth is invested abroad. So, Wall Street almost inevitably drives itself up and that’s a hard tiger to dismount.

But it maybe matters more to us Europeans, who need to both believe that US overvaluations will persist and critically that the dollar will not weaken further.

So, in the end politics do matter, not now, not today, but how these contrasting styles evolve over the rest of the year, will be very important to how currencies and markets respond.

Getting it right for the second half involves a big call, this year, as it did last.

Flat markets are not always still markets.

Charles Gillams

Monogram Capital Management Ltd

06.06.21

YELLOW BRICK ROAD

The recent elections in the UK probably result in a mildly stronger position for Boris in his Merkel persona, his Christian Democrat (CDU) disguise, so the fiscally left wing, culturally right-wing hybrid, that seems popular; but other than disasters averted, the poll achieves little more. For all the noise about the Hartlepool by-election, we are talking very small numbers, with a 40% turnout in a seat already slightly subscale due to depopulation and industrial decline. It has no resulting impact on the governing majority. Indeed, but for the Brexit Party, it would have been Tory already, so it really says nothing about the right-wing vote. The Tory Party is still miles from representing a majority view, but as long as the left is divided and the right united, that will persist.

Nor do I see much of interest in the council elections: a good result for the Tories in building on an already strong performance last time, which shifts the middle third of councils around in the quagmires of NOC or No Overall Control. This morass, like the bilges on a boat, washes left or right depending on the political tide. But with staff (and councillors) aware that only a few seats can shift them in or out of the NOC swamp, its impact is not great, particularly where they have elections three years out of four. These permanently transient councils tend to be run more for themselves than anything tedious like ideology or providing decent local services.

Neither Mayors nor Police Commissioners have any major power. Sadiq Khan, freshly back in office, faces a central government happy to call in his local plan (on housing) and impose central government representatives on his transport authority, thereby strapping one hand behind his back, in both his areas of real influence. Meanwhile London policing remains ultimately under Home Office control, so like the other areas is just for political grandstanding, not real service delivery. Policing in London also seems an enduring disaster: where it is needed, it is not wanted, where it is wanted, it is not needed.

Reading the Party Runes

So, what of Kier Starmer? Well, it also tells us little about his Cameron-lite policy of avoiding controversy, avoiding spending on fights he can neither win nor cares about, and ensuring he controls everything in the party. That policy is seemingly intact. The Corbyn wing will continue to spout for the microphones on demand, but matter little. The key issue is whether the big funders will want to have a go at winning the 2024 election. I think they will, but should they decide it too is lost, Starmer has a problem. If the party’s money bags decide he can’t win, he won’t.

For Boris it is at the least an endorsement of his recent COVID strategy, and that higher taxation to pay for the incredible spending splurge, has yet to impinge on voters’ minds. So, it permits him to carry on, but perhaps recover more of a strategic view, after the recent wallpaper storms? Does it make exiting COVID lockdowns any easier? Well, it should, but hard to tell if it will. Does it validate the extreme turn green? Not really, the Greens still did better in terms of new seats won, than either the Labour or Lib Dems, and are still advancing (from a very low base).

I am not sure if the Lib Dems expected much, they have Keir’s problem of irrelevance tied to being pro-European, when the EU is behaving more oddly than ever. So roughly holding their ground was fine. Indeed, they polled way ahead (17%) of national election ratings (which are more like 7%), but not over the magic 20% required to hit much power.

Those Strange US Job Numbers

Which brings us to the real shock from last week, the weird US jobs numbers on Friday. We have long said that how and if labour markets clear after the great lockdown experiment, is the vital economic issue. The problem never was the banks (so last crisis) nor the ability to borrow to sling money down the giant hole dug by the virus. Both are easy. But once you have smashed the economic system, does it regrow, like a lizard’s tail or simply start to rot and decay?

Many of us would have avoided the deep wound in the first place, but now the experiment has been started it must conclude. So, what did happen to slash monthly US job creation from expectations of a million to just a quarter of that? The instant reaction that it meant inflation has gone and so bonds were fine, was as instant reactions often are, garbage.

The bull or ‘Biden’ case is that as they have the right medicine, it just needs a bigger dose, or to take it for longer. Seems credible; labour force stats are notoriously volatile, some of the job losses came from manufacturing, where supply shortages are biting, but that’s transient. Some seem to indicate a mismatch of jobs to vacancies, hopefully also transitory.

Encouragingly, a spike in wage inflation and hourly rates indicated plenty of demand for workers.

Yet, slamming the brakes on, shutting the economy down and paying millions of people not to work, might have brutally destroyed the delicate economic system. Thousands of small firms, where the bulk of employment is created, have just gone. The complex prior system of sales, working capital, scheduling, delivering, inventory, payment has been eliminated. Sure, the people still exist, so do the premises, but the invisible mass, the self-directing hive, is lost: no map, no honey, no queen.

Bigger firms are also planning to work differently, perhaps needing less labour.

Once you stop working and get paid to be idle, and indeed have limited ways to spend your money, it feels easier to stay in bed, study Python, redecorate the house, or whatever, but not get back on the treadmill. Indeed, in a lot of cases, once you step off, stepping back on is hard and also downright counter intuitive. Sure, your old boss wants you back, but do you want the old boss back? Worth a look round at least? As the title song puts it, “there’s plenty like me to be found”.

Well, we still go with the bull case.

However, the bear one is not trivial. If you can’t get labour markets to clear, welfare will be embedded, as will high unemployment, deficits and unrest. It remains the most critical feature, worldwide of the recovery, and several questions about it remain as well, including the need to keep new bank lending elevated, cheap, available. Expanding needs cash, contracting creates it.

The oddity to us then remains, that if the liquidity barrage really does work, why should it work better in the US than elsewhere?

And if it works the same for all, don’t US markets then look rather expensive?

Charles Gillams

Monogram Capital Management Ltd

Rising Tides

First posted 21st March 2021

Interesting times.

Bond markets are out of the cage, off the deck, ready to rumble.

This week feels like another one of those big calls that investors have faced over the last year, and in many ways much less obvious. Forget the chatter, it is the bond markets that are now back in charge. While upsetting Californian law makers and the SEC is now small fry for Musk and Tesla, the bond markets will just roll over him. They are the gorilla in the room, for all those frothy tech valuations.

Bond holders are just dumping their holdings as fast as they can; like tectonic plates they move slow, but like any earthquake, you get the sudden shift, then the aftershocks, and then it will all settle down. But the landscape will have changed.

What has woken them up? Well inflation and the conviction that the colossal election bribes handed out by Joe Biden will cause inflation to go over 3% and perhaps, as important, possibly stay there. It is the stay there or persistency risk, we are looking at. We can all see a short-term inflation spike, from commodities and logistics snarl ups.

Now, everyone (including us) have been focused on excess capacity and deflationary forces. Indeed, as we keep being reminded, over 10 million Americans are out of work; but for some reason the nasty bond markets have decided giving those citizens jobs is not the priority.

So, the naïve equation Powell (at the Fed, who I keep reminding readers, is not an economist by training) is working on, is if you stuff circa 20% of US GDP in one end, all of course borrowed, out pops nationwide low paid jobs, focused on the low skilled workforce, by the ten million or so. Now that’s the bit which is no longer credible.

It seems more likely all that stuffing is instead creeping into asset price inflation, with virtual currencies attracting a lot of speculative flows and likewise hot stocks, be it SPACS or GameStop. None of these areas provide much of the required nationwide low skilled employment.

A Detailed Look at the UK Employment Statistics

So, what is happening? Well, a more detailed look at the labour market in the UK (not the US), provides some clues. My source is the Office for National Statistics, February Labour Market report. Not a bad date, as the year-on-year figures are clean; from the March one onwards, we will have the COVID shocks in the annual comparator.

The employment crisis is hitting the young hardest, under 25 employment is dire, of the job losses year on year, 58% were in those below 25. While we have both lower employment (so people exiting the labour market) and also higher unemployment (so not working, but available). Noting that furlough for these purposes remains classified as employed, which is a little moot.

But here is the paradox, wage inflation is also very apparent, hitting 4.7%, which is recorded as 3.8% above actual inflation, so a pretty high real rate. Now that’s not causing deflation at all.

While the furlough impact, doubled to December (from 5% to 10%) of the workforce, and no doubt has now gone up again, with the arts, entertainment and recreation industries (sic) and food service industries, each having over half their workforces on furlough.

So, while the claimant level has been stabilized quite well, we see relatively lower levels of actual employment, but with the secure workforce getting good pay rises, well over inflation, and those in less secure positions, or who are younger or in the wrong sector, hit hard.

Should Preserving Capacity be the Real Concern?

The assumption then is that the labour market is clearing, indeed faces inflation, for those in work, but for those who are not, there is a big presumption that the leisure sectors will bounce back hard and take up the slack. You wonder if just more money across the board, is the right way to tackle this specific problem. Oddly if this was in banking or steel, a targeted approach aimed at preserving capacity would now follow. Time to rethink that? Although if everyone gets a “gift”, then fewer people will complain they missed out, given how politically charged both steel and banks became, you can see why; but it is poor economic policy.

This two-speed position is also apparent in other Government statistics, tax gathering is going well, the annual self-assessment returns were higher than a year ago, and total tax returns only marginally lower due to reduced VAT income from the leisure sector. The strain on Government finances is on the other side, excessive spending, not reduced tax. On tax receipts, inflation via fiscal drag, is already working its magic.

What the Bond Market is Afraid of?

So, the bond market fear is that more of the stimulus will go to the “wrong” places, than the “right” places, creating inflation in areas that are already running hot. While Central Banks have apparently decided they no longer think about money, just the jobs market. Which is also odd, because they have so little control over it.

Indeed, the heavy political pressure in the US to sharply raise the minimum wage, must work in the opposite way, as must the surge in automation and home working. It is noticeable that when Trump tried to turbocharge labour markets with a tax cut, we had a pre-emptive rate rise from the Federal Reserve. Clearly this time round Janet Yellen has told Powell that if he tries that stunt again, he is out.

So, What do Investors do?

We did not expect this rise in rates so soon, but nor do we see it automatically stopping at this level, as Powell has clearly said he won’t intervene more to hold rates down, nor will he acquiesce by raising overnight rates.

Broadly rising rates, with rising inflation is good for equities, but the end of free money is less good for the out and out speculators, who can gamble on trivial things, without a great deal of care.

It is these periods of cross currents, short sharp movements, that are toughest to navigate. While the first order effects will be in falling bond prices and the badly overvalued tech markets globally deflating; so, all of that stuff with inflated multiples or no real sales. But the second order impact will be on equity markets overall and on currencies.

At some point if you can get a nice return in bonds, even better a real return for holding them, there will be a lot of money heading that way. It is a finely judged switchback, taken at speed, if they raise rates and then find inflation (and employment) actually starts to fall, the Fed can again wreak havoc by going too fast.

While elsewhere boring may in the end be best, especially in well run financials. There is an old market saying that a rising tide lifts all boats, but perhaps not the electric ones this time?

Our own Performance

Our own VT Global Total Return Fund has now had three distinct patches of outperformance, in the last year, as against behemoths in the Absolute Return space. All, as it happens, since Monogram joined the team, as investment advisors, although that really is co-incidence.

One such good patch would be fine for us. It is of course partly good timing (for whatever reason), but it may also be that small, focused funds like ours, can simply turn that much faster and make the needed adjustments more quickly.

Which then generates patches of outperformance, three in a row is starting to make a real difference compared to just “buying IBM”.

While we are now running unusually high cash levels, we know markets don’t stay this kind for long.

Charles Gillams

Monogram Capital Management Ltd