All mimsy were the ‘borrowgoves’

Away from all the shenanigans with base rates and currencies, earnings seem to be showing a pattern. We look at the possibility of an unshackled NatWest and India’s renaissance after the Hindenburg disaster.

START OF EARNINGS SEASON

In so far as reported earnings have a pattern, it reflects the actual position, not the fears of a hidebound analyst community imprisoned by useless economic models. Statistics are not predictive.

There is no recession, whatever all those clever models predicted, never could be one with the extreme fiscal stimulus (quite unlike the private sector fuelled inflationary blow outs of previous downturns), high employment and plenty of liquidity. So, real life earnings are in a purple patch, high and in cases rising demand, with falling or stable costs.

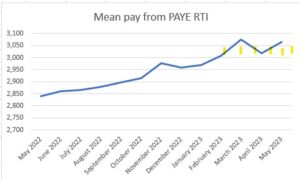

Meanwhile wage costs are perhaps stabilising and the labour supply position seems less frenetic.

In-house graph from published UK Government statistics – real time statistics

But dividends are generally ticking up, a nice bonus to collect when interest rates do start to fall next year, and valuations based on yields look low again.

FLAVEL OF THE MONTH

Nat West really is a sorry tale. The government stupidly sold off the crown jewels at give-away prices, and it now seems to be clinging on to the chaff for no good reason. The dead hand of the state permeates the place, and given the huge interest being paid on the vast national debt, surely a sale of all the government holding is long overdue.

You read the voluminous annual accounts and somewhere about page 180 the PR guff gives way to the reality of declining business lending, a worsening net promoter score and that ultimate civil service fudge, of combining two corporate departments to obfuscate.

Does NatWest actually dislike its customers?

I speak from experience – NatWest seems to dislike small business: we moved the last of our corporate accounts from there this year. Why? In striking contrast to the PR flim-flam that dominates the annual accounts, it seems that making life easy for us, is nowhere on their agenda.

At some point, it was just easier to go than fight – somewhere around the twentieth demand for the same details, and the endless Orwellian (“does not agree with other data”), even after the written confirmation that they were now content; so we quit. Always there was that threat to close the account, but not release our funds, for some arcane procedural reason.

I found the bloated pay packet for the CEO (and CFO) pretty hard to swallow for that performance. It just seems that they don’t attract good staff, and like the slow pacing of caged animals wearing their lives away, those that remain pick away at the residue of their customers.

As for valuation? Nat West would still be cheap, but I felt if it broke above £3.00 (as it did earlier this year) again, on present form – that’s not a terrible exit.

Let’s hope this starts a basic rethink and some real value creation.

RISING IN THE EAST

We noted when the Hindenburg short-selling started in India, and we doubted that it was much more than a clever speculator, despite the sad sight of the neo-colonial British press (and a few Americans) lining up to say “I told you so”.

Friday’s FT was discussing India and still called it “low-growth… dependent on commodities… hampered by political dysfunction and corruption”. Extraordinary – stale, lazy, stereotypical.

The reality is as we predicted: after a pause while stock markets looked for a systemic problem, and the short sellers booked their profits, the Indian market strode on to a new height.

From Tradingeconomics

Not that the biased UK financial press would ever mention that story. Far from the mud hut image they seemingly seek to portray, plenty of IPO (and deal making activity) is showing that India, not Europe is becoming the true challenger in high tech.

The SENSEX started this century at 5,209, the FTSE 100 started at 6,540. The FTSE 100 has made it to 7,694, and the SENSEX? It has powered past to 66,160. One is up some 18% in 23 years, (not enough to even cover advisor and custody costs), the other 1250% in the same time.

No sensible portfolio can have omitted India this century, but the UK press will have worked hard to ensure most UK ones still do.

Well, that’s the half year done, we will resume on the 10th September, expecting markets to be drifting sideways, but that gives plenty of time for the traditional summer bursts of excess or despair.

Although if it is performance you want, getting the big moves right, and the right markets, is far superior to the timing of most individual stocks.

Skipping along

Skipping is the week’s theme, following the inadvertent use of the term by the Fed Chairman, along with the rather weird behaviour of Jeremy Hunt.

Although any skipping seems unlikely soon, on this side of the Atlantic.

The dear old ‘recession’ still lingers, unseen but feared, like an ex Prime Minister. We are convinced it will arrive, but as a ‘technical’ recession only. It should be hard for anyone to be surprised. Labour markets are much stickier and far more fragmented. Supply is short, so any systemic shock feels unlikely. While as old hands keep noting, single figure mortgage rates, well below inflation rates, are hardly restrictive.

Chair Powell (almost) mentions ‘skipping’.

Jerome Powell was bowling along contentedly, when he suddenly described the Reserve Board’s June inactivity as ‘skipping’. Although it actually was just a ‘skip’, before he realised the error and with a guilty look speedily reverted to the far more passive ‘pausing’. But we knew how he was thinking. He was going to keep his foot on the neck of borrowers for a bit longer – interestingly, he refers to real rates of interest, as somehow unjust and injurious. Odd that when asked anything about fiscal policy he instantly plays the neutral, technical banker, no good and evil there.

Moves in the real economy.

So, what has really happened?

Not a lot, energy prices have climbed all the way up, and now slid all the way down. Aggressive fiscal stimulus continues, any chance Biden has to bribe the electorate with their own money, he still takes. Employment remains strong, although there is some tightening in hours worked, but it is still pretty hard to see how the Fed gets down to 2% inflation for a year or two.

And yet, markets by a mix of that unseen recession and faith in so called base effects, do think inflation by the autumn, will justify a real pause. No skipping.

UK Chancellor’s odd statements

Here in the UK Jeremy Hunt is in quite a different place. Inflation still looks high and embedded, but he has carefully outlined how he would keep going with substantial hand outs to offset inflation (aka fiscal stimulus).

However, inflation control was all for the Bank to sort out.

This is nonsense, of course. The UK Government is yet again stoking inflation while taking no responsibility for stopping it. He then gave a tortuous explanation as to why his policies have now produced exactly the same interest rates as the Truss typhoon, created by his reckless predecessor, but somehow, not at all the same.

Rate rises – a global feature.

Funny that, as we noted at the time, there was little odd about the October rate spike, and much that the Bank could have done (but refused to) by a prompt rate rise (matching the US) to stabilise the currency and inflation.

Rate rises are a global feature, with not a lot one small country could do about it.

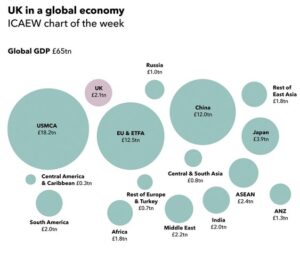

2021 chart produced by the UK Institute of Chartered Accountants

So quite where the virtue of the Truss toppling quarter point rise is now, is rather unclear.

As sterling shows, the prize for that autumnal sloth will be higher rates (and inflation) than elsewhere for longer. The thing about fire fighting is the sooner you start the less you have to do.

So how did Monogram’s methodology work?

Our in-house model switched into Japan in December 2022 and Europe in March 2023. As we only ever deal in half a dozen big global index Exchange Traded Funds, this is not a tickle, but 25% of the total equity position in (or out) at once.

Brutal and scary, but effective.

We look at the signal, kick the tyres, thump the bonnet, turn it off and on again, look for reasons to ignore it, and then six months later look back in wonder and say, “oh yes, that was right”. These signals are delicate enough to very seldom feel right at the time, but after almost a decade of running the model, we have learnt to obey.

So, our Momentum performance discussion, yet again, is about how much we made, not about in which direction the money went. While the GBP version, seeing similar signals, has also never come out of the S&P 500, which for a good while also felt wrong, but it seems was right, taking a long view. The USD model was more skittish but is back in both (S&P and NASDAQ) US indices now.

So, we do know where momentum has been, and it is quite strong.

Markets in the political timeline

The rational thinkers say the market is (still) too expensive, but the trend followers don’t agree, who is right?

We tend to feel just as Central Bankers were very slow to spot inflation, they are possibly being too slow to see it has now been contained, and the US skip may be a pause and then a snooze. Which would be very convenient for the Fed during the US Primaries, allowing for cuts into the US election?

Related to that, we watch with amusement a dialogue about the attractiveness of stock exchanges, in particular in London, couched entirely in terms of what potential listing companies say they want. Not a mention of what investors want, as if they just don’t matter. Quite absurd, as what all listings need is a deep market, good liquidity, stable tax regimes, and an attractive base currency.

Is London aiming to provide these? We seem to favour founders – so, tweaks to voting rights, smaller free floats, fewer shareholder rights. But then oops! No buyers.

This is worse than nonsense, it damages what little is left of London’s reputation. In this market you start with the buyers. The price performance of many a recent IPO spells out the problem, the sellers are finding it too easy to deceive people – a call is needed for greater transparency, longer lock-ins, and less pandering to insiders and their advisers (not more).

Small Earthquake

Full year corporate accounts have now all been published, in several cases even read, so it is time to look at the raw data beneath all those clever funds and derivatives, at the underlying companies.

There are two themes emerging: one is the extraordinary scale of movements last year in defined benefit pension assets and liabilities, and the other is how we should evaluate the size of the Scottish discount.

Pension Asteroids Collide

Enormous numbers are shifting on defined benefit pension schemes, nearly all the big ones seeing asset losses of several billion, but with matched declines in liabilities of the same scale, leaving almost no apparent change, all stitched back together. This impacts in particular the big banks, utilities, resource majors and of course life companies.

It is a source of some nervousness, when large numbers crash about the balance sheet, dwarfing the trivial numbers in the profit and loss account. But they are also quite different items, the asset declines (from long dated gilts) are real money, stuff you could have woken up at the start of the year, picked up a phone and sold.

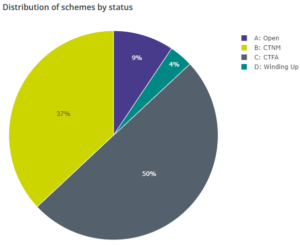

Yet the liabilities in terms of actual money to retirees hardly shifted, it was just discounted differently. While nearly all (91%) of the 5,000 odd UK schemes are either Closed To new members (CTNM) or to future accruals (CTFA). So, of little current relevance to operations.

From: This page on the UK Regulator’s website – the key to the abbreviations is also there.

What is relevant is the sudden loss of tens of billions of pounds ny these pension funds. But that is ignored, because of the liability offset, but it was lost and is gone. This came along with dramatic changes in the value of the gilts they hold, in cases by more than the unit value decline, as gilts were actually being sold quite hard too - a big chunk of assets that no longer exists.

Scottish Exceptionalism

So, to the Scottish discount. What is it? In our valuation models we discount earnings for political and operational risks, including for governance, including the location of the auditors. It is an internal assessment, so matters not a jot, unless others do the same.

We know the discount exists, the reversing tide of “swimmers” or companies raising money outside their domestic market, tells you the entire UK is already at a fair old discount to the US, even for companies with mainly US earnings. Should the same apply to Scotland? And by how much more? 20%? Whatever it is, it is getting bigger for us.

In my view if you are a FTSE100 Company, you have big four auditors, London office. Regional offices and smaller firms will be more dependent on a single big client and in enough cases to matter, that disproportionate power will swing it, for the Board, against the investors. Not that London based Big 4 is perfect (we know they are not).

So, to Scotland, there is a long-standing assumption they will use Scottish audit offices, and a drift to using Scottish firms too. This used to mean high quality, but I now sense they lack experience. Boards have also increasingly become reliant on a smaller pool of candidates, and two recent high-profile cases leave me wondering about their governance.

1. Scottish Mortgage Investment Trust

We sounded the alarm on the peculiarities of this popular fund two years or so ago, in their glory days. Like some other troubled funds, they took on more and more unquoted holdings. All disclosed and approved, but in the end clearly linking private and public markets, indeed boasting of how many of their quoted holdings started out as private ones. Well, a closed IPO market knocks that bet pretty hard. When a lot of them are also Chinese, that renders that pipeline even more suspect.

While disclosed, yes, but adequately disclosed? In one case they hold G, I, H, A, C, B Prefs and A Common Stock, with greatly varying valuations by class. We were nervous, when the share price failed to discount these holdings, at a time when other equity trusts, indeed private equity specialists, were facing growing discounts on their holdings.

That has now corrected, the Board has finally stood up to the manager and questioned the existence of the in-house skills to back up these valuations. But in the process our Scottish discount opened up.

From a three year high of over £14 per share, SMIT has fallen hard to just over £6, wiping out half the value or the thick end of £10bn, from presumably mainly UK retail holders. It has kept falling. I think it will need to list those unquoteds separately, and give holders a share in each asset pool, to regain its once illustrious crown.

2. John Wood Group

The John Wood Group, which operates in natural resource consulting and contracting, has been a disastrous investment. A well-respected consulting firm, its Board decided to merge with another well-respected quoted consulting firm, Amec: outcome? Hugely negative. Five years ago, its shares were over £5 and even quite recently shareholders were hoping a private equity bid would rescue them after only a 50% loss.

But having overseen that catastrophe, the Board seemed not to be listening. They only very reluctantly agreed to bid talks, and somewhere in those talks something persuaded the bidder to back off. From the bid inspired high of £2.55, it has now virtually halved again. The Board feels old style, out of date, insular. I particularly enjoyed (it is one of the few pleasures of reading so much verbiage) their illustration for the diversity report, (see below).

Extracted via screenshot from the Annual Report and Accounts of the John Wood Group

This reminded me of sitting on a School Curriculum Committee (see the fun I have). We had to cover multiculturism, and the teacher (in the high pale Cotswolds) chose India; intrigued I asked why? The answer was that allowed the topic to be covered for our forthcoming Ofsted inspection, by having a takeaway meal in class. That was it. No map, no history, no people, just an affiliated consumable.

But nice money for the executives, look at last year’s bonus structure. That odd picture served them well. For an original business that is now itself worth nothing and half of what it paid for Amec !

Now, but for that Board, or that history, Wood looks a nice business, cleaned up, $5 billion of apparently profitable sales, with a market cap of £1 billion, not a lot of debt, all three divisions profitable at least at the EBITDA line. Heavily exposed to renewables, including in North America, it even reports in dollars. You could argue the bid was low - no doubt the Board did - but if the price then halves, after the bid vanishes, how credible are they?

So, in comes the Scottish discount – because this pattern of behaviour speaks of a particular culture and leaves me feeling the need for a bigger safety margin, to buy a business from that region.

Wood for the trees

We have all been obsessed with rates and inflation, but we seem to be in danger of missing what looks like a widespread bull market running broadly from last October. This is widely applicable outside the main US markets, including in gold. There is a similar and at times masking trend of dollar weakness.

What are the implications of this?

We also look at the unending tragedy of the various remnants of the Tory party.

Still Rising?

With markets still fixated on the next crash, we can sometimes overlook the long momentum swings. Although the US banking crisis matters, it is of little relevance to the far more concentrated and tightly controlled Basel III banks in Europe. Many would say to excess, but they are clearly tighter rules. The few assets not marked to market are a footnote in Europe; in the Wild West of US regionals, they can be the whole story.

On a one-year basis, the France CAC 40 is up 14%, the German DAX by 12%, with both the UK large cap and Japan’s Nikkei also positive, so equity markets have been strong, almost regardless of rate rises. The US is the main home of negative twelve month returns, but the gap between the S&P and the NASDAQ declines over that period, is now quite small, after the spring bounce back in the latter.

What does that mean?

For all the media love of the disaffected trashing their own communes, doing the right thing on pensions (they were very out of step) apparently helps France.

While the splitting of power in the US Congress and the meanderings of a senile President, has perhaps hurt the US, with everything from banking regulation to the debt ceiling made into a political game.

Brazil is down too, but India and Russia are up.

Well perhaps I go too far, but maybe there is a pattern? Markets like stability.

Relative values

While comparisons are complex where accounting systems diverge, the UK still looks like the lowest rated with the highest yield, and conversely the NASDAQ still has (by some way) the highest rating and lowest yield. US earnings are it seems still much more valuable.

The savagely anti-business stance of the UK, including a brutal rise in corporation tax maybe part of it, it will create a fall in earnings (and likely dividends) next year.

While the less visible, but still onerous onslaught in the US, including a minimum tax take, won’t be good.

So, does inflation matter?

The UK perhaps is also seen as the one major European market that looks to have dithered too long on controlling inflation (which could explain sterling strength). However, I see no real appetite for more austerity in the UK, so I find that assumption slightly puzzling. Having the FX market convinced UK rates are going a lot higher (because of policy failures) is hardly comfortable, but feels a little like re-living last year now.

Oddly too, controlling inflation the US way, has hurt equity markets more, it seems, than letting it burn out in the European style. Heresy to many of us, but that’s what the numbers imply.

All the theory, all the historic data says we now must get a sharp recession, but then grandpa, pray where is your beloved recession? Still looking, since mid February. It seems we must appease the inverted yield curve and believe base rates matter, but a bit more evidence would certainly help.

And rate cuts will be a powerful tonic, when they come. The bears are now reliant on widespread recessions, and soon.

Perhaps the best of this little bull market has gone, but there is a lot of liquidity still about and being out of the market with high inflation, is not great.

A multitude of sins – local elections coming up

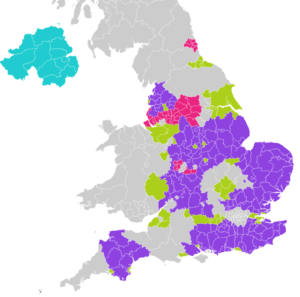

And what of the UK Tory “Party”, if such a mess can be called that. The assumption for a while has been that the imminent local elections will be bad for them. However, they are a curious mix of voting locations this time, not London, not all of the Home Counties, none of the Celtic fringe, but a good chunk (but again not all) of the Red Wall seats. See map below.

Map from Wikipedia page on 2023 local elections

But really it is heavily biased to the Tory heartland, vast swathes of Labour free wards, where they are not even bothering with candidates, so it will not tell us that much. The Lib Dems will do well, but significant conquests in many areas will now require quite substantial swings.

The assumption is also that Dominic Raab was cut down by Sunak, who has yet to learn that throwing competent colleagues under the bus may feel good, but it thins the ranks of effective ministers, and builds up the malcontents. He has handled these badly, and forgets the real target is not his ministers, but his own position.

Tory strategy

Seemingly the Tory party has run just one electoral strategy for years, based on old victories; just trash the opponent. In a two-party state, voters must then decide who they dislike least. And both Labour (and the SNP) have reliably offered something so vile, that a simple victory follows.

But no longer, Labour (despite their recent rather crude posters) still seem innocuous.

The Lib Dems are sticking to their amateur politics, which can also look strangely alluring, if the other two parties look mysterious or inept. The Tories (like the SNP) are now in danger of being judged by results, not by fear or hatred of the alternative.

The score card on that basis looks pretty bad, and Sunak’s pledges are so far, going the wrong way.

The Scottish Play: Luck or judgement?

Three topics this week: has Sunak’s luck changed? Has India’s bull run ended, and where is this much-discussed recession?